- StocksGeniusMastery

- Posts

- 💥Is CoreWeave the Next $100B AI Giant?

💥Is CoreWeave the Next $100B AI Giant?

Wall Street is betting big on compute growth — and CoreWeave sits at the center of it.

Hi Fellow Investors,

CoreWeave (NASDAQ: CRWV) has quickly become one of the most closely followed names in the AI revolution.

The company’s access to top-tier GPUs has triggered explosive revenue growth and a dramatic post-IPO surge.

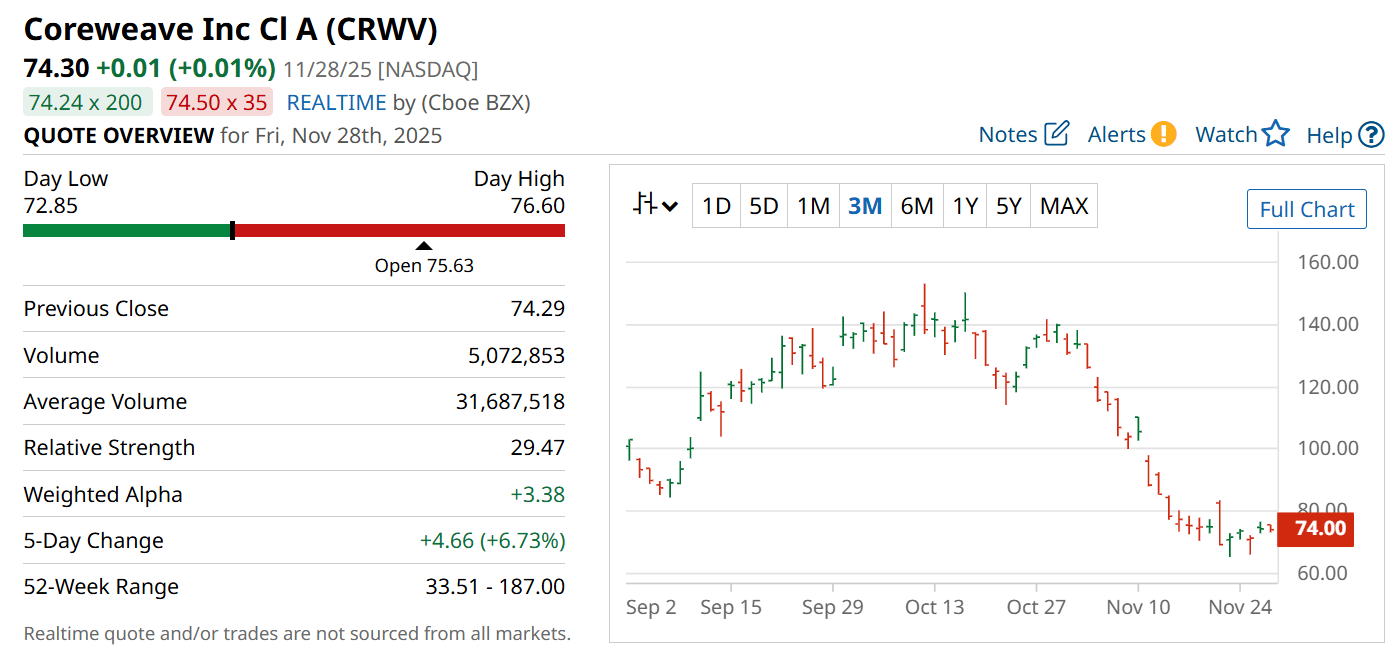

Recent pullbacks now have investors asking a critical question: Where could this AI compute leader be five years from today?

Key Points:

CoreWeave’s revenue has rapidly accelerated as AI clients rush for high-performance compute.

Demand for GPU access remains structurally high, giving CoreWeave a significant growth runway.

Long-term projections suggest meaningful upside if AI infrastructure spending continues booming.

TODAY’S SPONSOR

Startups who switch to Intercom can save up to $12,000/year

Startups who read beehiiv can receive a 90% discount on Intercom's AI-first customer service platform, plus Fin—the #1 AI agent for customer service—free for a full year.

That's like having a full-time human support agent at no cost.

What’s included?

6 Advanced Seats

Fin Copilot for free

300 Fin Resolutions per month

Who’s eligible?

Intercom’s program is for high-growth, high-potential companies that are:

Up to series A (including A)

Currently not an Intercom customer

Up to 15 employees

AI Demand Is Fueling CoreWeave’s Rise

Artificial intelligence development has reached a stage where compute is now the ultimate bottleneck.

Many companies today face a choice between building expensive data centers or renting GPU power at scale.

CoreWeave has capitalized on this moment by optimizing its cloud for AI-specific workloads.

This narrow focus allows the company to deliver specialized capabilities that general cloud giants struggle to match.

As more organizations prioritize flexibility and cost efficiency, CoreWeave’s tailored GPU offerings continue gaining traction.

A High-Demand Market Creates Room for Multiple Winners

Even with major competitors like Amazon and Microsoft dominating cloud infrastructure, demand has grown so sharply that new players can thrive.

CoreWeave benefits from this demand overflow, supplying GPU access that many AI companies cannot secure elsewhere.

The company’s timing has been near perfect, aligning its expansion directly with a global compute shortage.

Its strategy of specializing deeply in AI cloud services has produced a powerful differentiator.

This positioning gives CoreWeave a meaningful foothold in a market that is expected to expand dramatically over the next five years.

Nvidia’s Tight Relationship With CoreWeave Strengthens the Bull Case

Nvidia (NASDAQ: NVDA) owns a stake in CoreWeave, underscoring how closely tied the companies have become.

CoreWeave frequently serves as a first mover in delivering Nvidia’s most advanced architectures to customers.

This early access provides a competitive moat that is difficult for rivals to replicate.

Revenue growth has been extraordinary, fueled by major clients like OpenAI and Meta turning to CoreWeave for AI workloads.

As the company invests heavily in building out infrastructure, the focus now turns toward lowering capital costs and expanding capacity efficiently.

What CoreWeave Could Become in Five Years

Long-term forecasts indicate that continued demand for compute could substantially boost CoreWeave’s revenue trajectory.

Analysts project that by 2027, annual revenue may push toward the $18 billion mark.

If valuation multiples remain steady, this could imply a significant share-price expansion from today’s levels.

Unexpected headwinds in AI adoption or the broader economy remain risks worth monitoring.

Still, with compute needs soaring globally, CoreWeave is positioned to capture powerful tailwinds in the years ahead.

Strengths

CoreWeave delivers GPU access tailored explicitly for AI workloads, giving it an advantage over broad-based cloud providers.

Deep integration with Nvidia ensures early access to cutting-edge architectures that competitors struggle to match.

Explosive revenue growth and high-profile clients validate strong market demand for the company’s services.

Weaknesses

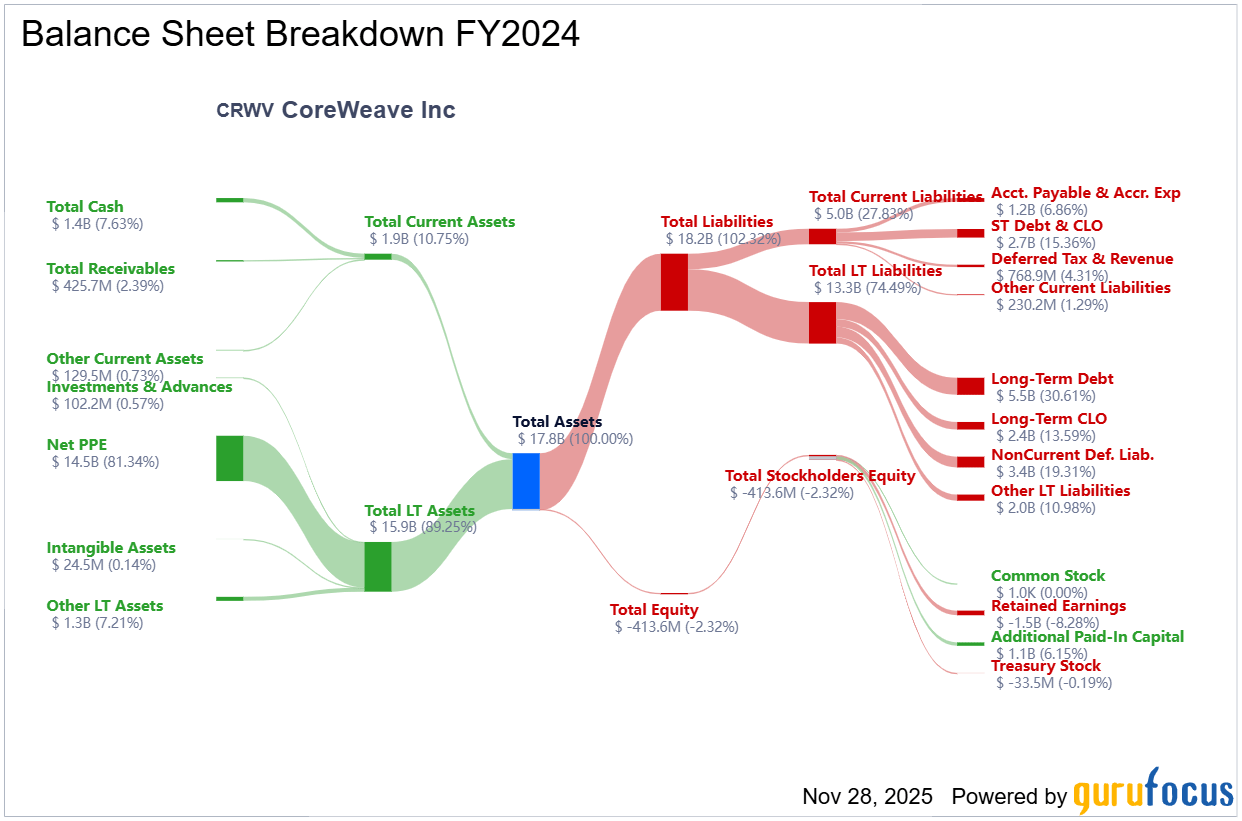

Massive capital expenditures create pressure on cash flow and increase dependence on debt financing.

Heavy reliance on Nvidia chips exposes the company to supply-chain and pricing vulnerabilities.

Its narrow focus on AI compute may limit diversification and create sensitivity to AI industry cycles.

Potential

Sustained global investment in AI infrastructure could push CoreWeave into the ranks of the largest cloud players.

The company’s strategic GPU positioning may unlock new high-margin revenue streams as AI adoption accelerates.

If CoreWeave maintains current momentum, its valuation could expand dramatically over a multi-year horizon.

TODAY’S SPONSOR

From Boring to Brilliant: Training Videos Made Simple

Say goodbye to dense, static documents. And say hello to captivating how-to videos for your team using Guidde.

1️⃣ Create in Minutes: Simplify complex tasks into step-by-step guides using AI.

2️⃣ Real-Time Updates: Keep training content fresh and accurate with instant revisions.

3️⃣ Global Accessibility: Share guides in any language effortlessly.

Make training more impactful and inclusive today.

The best part? The browser extension is 100% free.

Conclusion

CoreWeave stands at the center of one of the most powerful technology shifts in decades.

If global compute demand continues to surge, this fast-growing player could experience significant long-term upside.

Investors seeking exposure to AI infrastructure may find CoreWeave’s trajectory especially compelling in the years ahead.

Final Thought

The next five years will likely determine who dominates the AI compute landscape.

Will CoreWeave secure a place among the industry’s elite — or will competition reshape the battlefield?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply