- StocksGeniusMastery

- Posts

- 💥2 AI Stocks Set To Explode Before 2026

💥2 AI Stocks Set To Explode Before 2026

As investors crowd into Nvidia, two stealth AI giants are quietly setting the stage for a massive second-half rally.

Hello Fellow Investors!

While the broader indexes have only eked out modest gains in 2025, the second half could reward investors who look beyond the usual mega-cap names.

Beneath the surface, artificial intelligence remains one of the market’s most explosive growth engines — and several under-the-radar stocks are quietly gaining momentum.

These AI-focused companies are perfectly positioned to capitalize on rising chip demand, expanding cloud infrastructure, and the global race toward automation.

Key Points:

Surging AI infrastructure demand is reigniting investor interest in high-performance chipmakers and cloud enablers.

AMD’s upcoming AI accelerators and competitive pricing may pressure Nvidia while capturing new hyperscaler business.

TSMC is benefiting from record AI chip tape-outs and looks to expand advanced node production to meet skyrocketing demand.

TODAY’S SPONSOR

AI Notetakers Are Quietly Leaking Risk. Audit Yours With This Checklist.

AI notetakers are becoming standard issue in meetings, but most teams haven’t vetted them properly.

✔️ Is AI trained on your data?

✔️ Where is the data stored?

✔️ Can admins control what gets recorded and shared?

This checklist from Fellow lays out the non-negotiables for secure AI in the workplace.

If your vendor can’t check all the boxes, you need to ask why.

AMD’s AI Chips Are Gearing Up for a Major Disruption

Advanced Micro Devices may have been playing catch-up in the AI race, but 2025 could mark a critical inflection point.

With the highly anticipated MI350 GPU architecture set to launch in the second half of the year — boasting faster speeds and better energy efficiency than Nvidia’s Blackwell chips — AMD is positioning itself as a serious contender for AI dominance.

Even more promising, big tech players like Meta, Oracle, OpenAI, and xAI are already building AI systems on AMD’s ecosystem.

Backed by a growing suite of AI accelerators and trading at a valuation discount to peers, AMD's underdog status may soon turn into outperformance.

The real question now is whether Wall Street is ready to re-rate this AI upstart as it captures market share in the booming data center space.

Strengths:

Next-gen chip launch: MI350 accelerators are expected to rival Nvidia’s GPUs in both performance and efficiency.

Major enterprise adoption: Big-name clients like Meta, Oracle, and OpenAI are integrating AMD’s AI infrastructure.

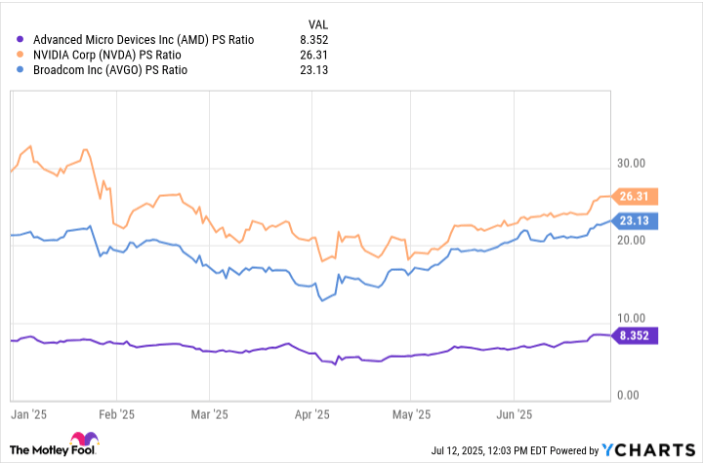

Attractive valuation: Trades at a price-to-sales ratio well below its semiconductor peers despite strong growth signals.

Weaknesses:

Overshadowed by Nvidia: Despite gains, AMD is still largely seen as a secondary player in the AI chip market.

Execution risk: The success of the MI350 and upcoming MI400 hinges on flawless rollout and supply chain execution.

Dependence on hype cycles: Share price movement still reacts strongly to macro tech sentiment and event-driven news.

Potential:

Massive upside in data centers: Demand for AI accelerators is expected to explode, giving AMD a larger slice of the pie.

Follow-up chips on the horizon: MI400 architecture in 2026 could cement AMD’s presence in the AI arena.

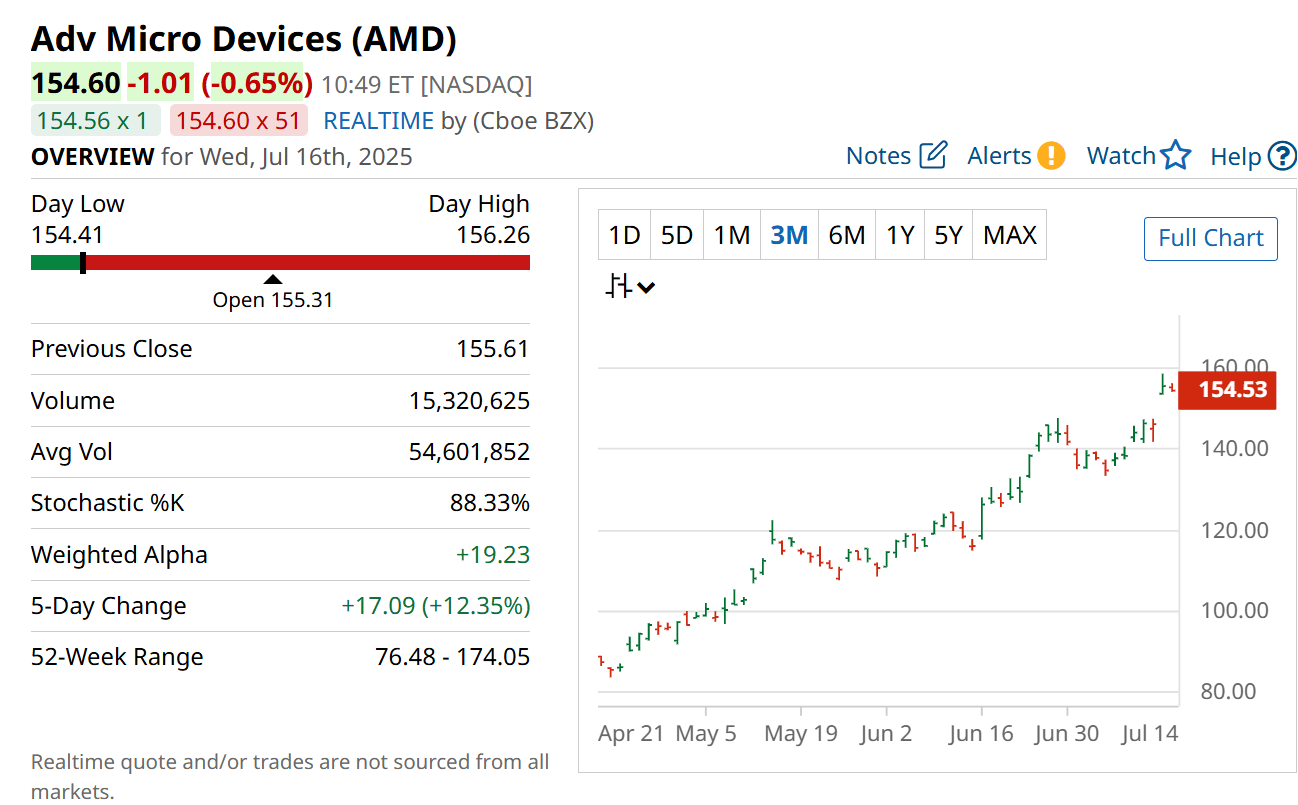

Momentum building fast: Stock surged 17% in just two months following AMD’s “Advancing AI” event, signaling strong investor conviction.

TSMC: The Silent Giant Powering the Entire AI Revolution

Taiwan Semiconductor isn’t just another chipmaker — it’s the beating heart of the AI supply chain.

As the exclusive manufacturer for Nvidia, AMD, Broadcom, and others, TSMC doesn’t need to win the GPU war — it profits from all sides.

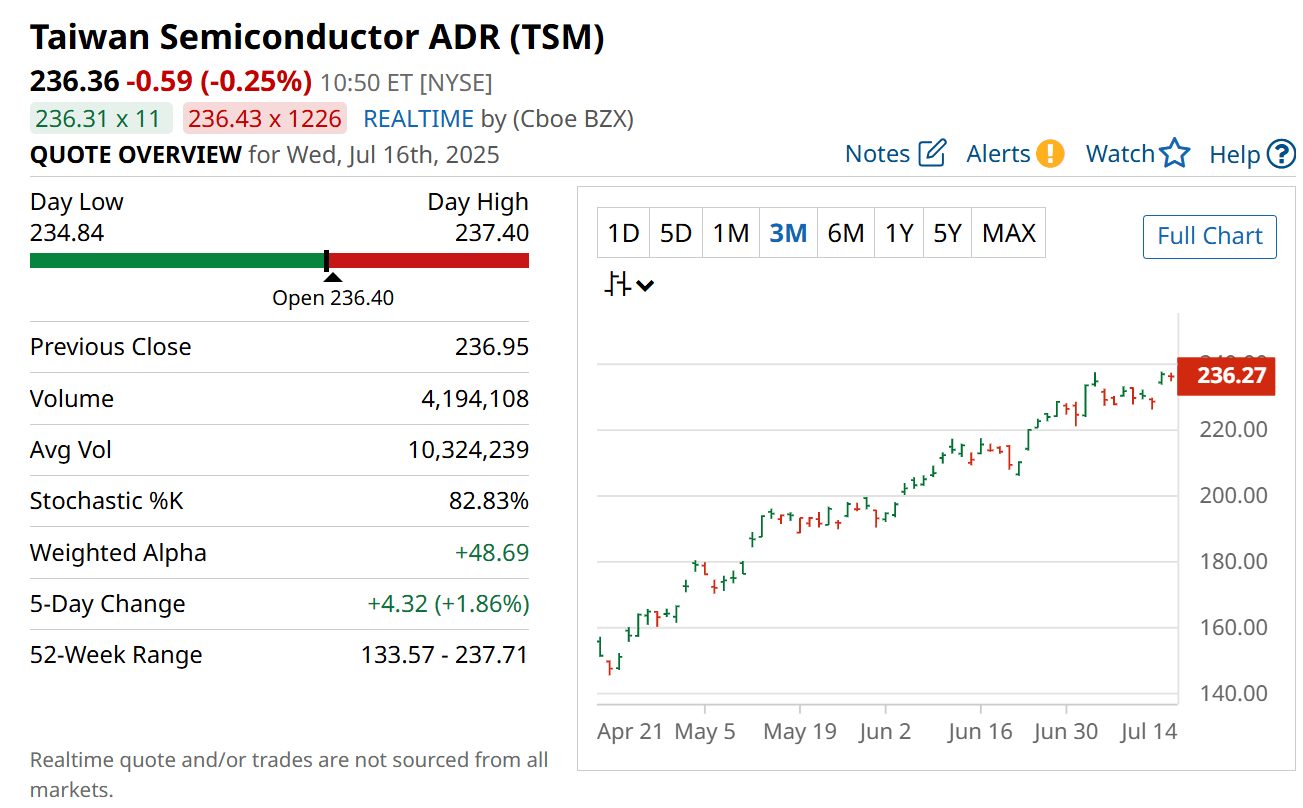

The foundry titan posted a staggering 40% revenue growth in the first half of 2025, and with AI infrastructure spending projected to hit trillions by 2030, that growth story is just beginning.

TSMC is benefiting from a global gold rush for advanced chips, custom silicon, and high-end packaging.

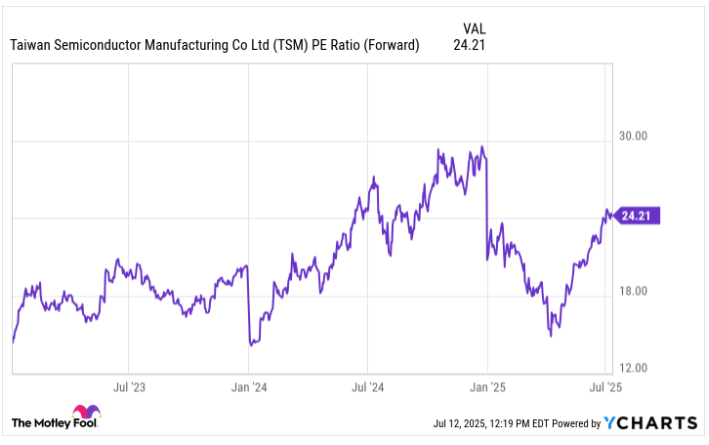

With a forward P/E of just 24 — below its historical average — this AI enabler may be the most undervalued megacap hiding in plain sight.

Strengths:

AI-agnostic winner: TSMC manufactures chips for virtually every major AI player, from Nvidia to AMD to custom hyperscaler silicon.

Explosive revenue growth: Delivered 40% YoY revenue growth in H1 2025, fueled by AI chip orders and advanced node expansion.

Massive tailwinds: Positioned to ride the $6.7 trillion AI infrastructure boom, especially in data center hardware.

Weaknesses:

Geopolitical exposure: Heavy reliance on Taiwan introduces potential geopolitical risks from China-U.S. tensions.

Customer concentration: A large portion of revenue still comes from a few major clients, including Apple and Nvidia.

Capex-intensive model: High capital expenditures for advanced nodes and packaging can weigh on margins during slowdowns.

Potential:

Secular growth engine: Rising global demand for foundry services ensures multi-year growth runway.

Valuation rerating likely: Current forward P/E of 24 suggests room for expansion as AI chip demand accelerates.

Undervalued compared to peers: Despite powering the industry, TSMC is cheaper than many customers it manufactures for.

TODAY’S SPONSOR

AI native CRM for the next generation of teams

Powerful, flexible, and intuitive to use, Attio is the CRM for the next-generation of teams.

Sync your email and calendar, and Attio instantly builds your CRM—enriching every company, contact, and interaction with actionable insights in seconds.

Join fast growing teams like Flatfile, Replicate, Modal, and more.

Conclusion

In a market obsessed with the "Magnificent Seven," investors who dig deeper may find far more explosive opportunities in the lesser-hyped but fundamentally stronger AI players.

AMD and TSMC are no longer just support acts in the AI arms race — they are emerging as center-stage contenders, poised for sustained growth and potential multiple expansion.

With strong roadmaps, key industry partnerships, and massive tailwinds from AI infrastructure, these two names could easily outperform the broader tech market through the rest of 2025 and beyond.

Final Thought

Will the next trillion-dollar AI breakout come from a household name — or a stealth contender hiding in plain sight?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply