- StocksGeniusMastery

- Posts

- 💥 Why Micron’s AI Advantage May Be Just Getting Started

💥 Why Micron’s AI Advantage May Be Just Getting Started

Record revenue and a surprisingly reasonable valuation fuel upside.

Hi Fellow Investors,

Artificial intelligence infrastructure is quietly entering a supply crunch.

Memory, not compute, is becoming the limiting factor in AI expansion.

That shift puts one semiconductor company in a uniquely powerful position.

Key Points:

Micron Technology is one of just three global suppliers of high-bandwidth memory critical for AI workloads.

The company is sold out through 2026 as demand from leading AI chipmakers accelerates.

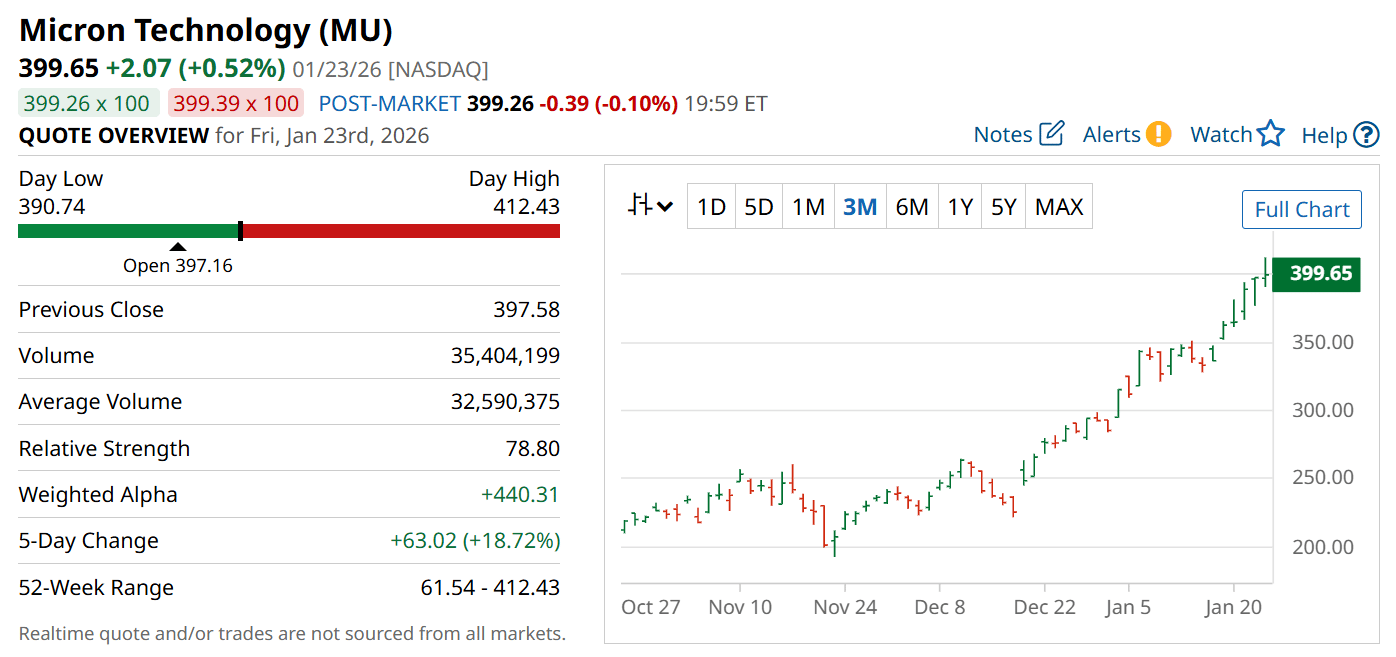

Despite a major rally, Micron still trades at a modest valuation relative to its growth outlook.

TODAY’S SPONSOR

Hiring in 8 countries shouldn't require 8 different processes

This guide from Deel breaks down how to build one global hiring system. You’ll learn about assessment frameworks that scale, how to do headcount planning across regions, and even intake processes that work everywhere. As HR pros know, hiring in one country is hard enough. So let this free global hiring guide give you the tools you need to avoid global hiring headaches.

Micron’s AI Memory Bottleneck Advantage

Micron Technology (NASDAQ: MU) has emerged as a critical beneficiary of the AI infrastructure buildout.

High-bandwidth memory has become essential for modern AI accelerators, enabling faster data movement and higher performance.

Only three companies globally can supply HBM at scale, giving Micron substantial pricing power.

That scarcity is forcing AI leaders to lock in long-term supply agreements.

Micron’s position in this narrow supplier group is translating directly into revenue momentum.

Record Financial Momentum Backed by Real Demand

Micron recently delivered record quarterly revenue of $13.6 billion.

That figure represents a 57% year-over-year increase, signaling structural demand rather than a short-term cycle.

Management has confirmed that production capacity is fully booked through 2026.

To prioritize AI workloads, Micron is even exiting parts of its consumer memory business.

This strategic shift underscores how valuable AI-driven memory demand has become.

Deep Partnerships With AI’s Biggest Names

Micron supplies memory to Nvidia, Advanced Micro Devices, and Intel.

These relationships tie Micron directly to the fastest-growing segments of the semiconductor market.

As AI models grow larger and more data-intensive, memory requirements increase exponentially.

That dynamic turns Micron from a cyclical chipmaker into a core AI infrastructure provider.

Few semiconductor companies enjoy that level of embedded demand visibility.

A Valuation That Still Leaves Room for Upside

Even after a strong rally, Micron trades at roughly 12 times forward earnings.

That multiple remains conservative given its growth rate and multi-year backlog.

AI-related demand is no longer speculative but contractually secured.

As long as earnings meet expectations, the current valuation appears sustainable.

For growth-oriented investors, that combination is increasingly rare.

Strengths

Dominant position in high-bandwidth memory as one of only three global suppliers.

Sold-out production through 2026 provides rare revenue visibility in semiconductors.

Deep partnerships with leading AI chipmakers anchor long-term demand.

Weaknesses

Semiconductor cycles remain inherently volatile despite AI-driven stability.

Heavy capital expenditure requirements could pressure free cash flow in downturns.

Customer concentration in AI increases exposure to industry-specific slowdowns.

Potential

Expanding AI model complexity could drive exponential memory demand growth.

Pricing power may improve further as HBM supply remains constrained.

A re-rating is possible if Micron is viewed as an AI infrastructure leader rather than a cyclical memory stock.

TODAY’S SPONSOR

We’re running a super short survey to see if our newsletter ads are being noticed. It takes about 20 seconds and there's just a few easy questions.

Your feedback helps us make smarter, better ads.

Conclusion

Micron Technology is benefiting from a structural shift in AI infrastructure economics.

Memory has become a bottleneck, and Micron controls one of the narrowest supply gates.

For investors seeking AI exposure with a reasonable valuation, Micron stands out.

Final Thought

When demand is locked in years ahead, valuation matters less than positioning.

The question may not be whether Micron is expensive, but whether AI can grow without it.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply