- StocksGeniusMastery

- Posts

- 💥 3 Stock-Split Winners Built to Compound Wealth for the Next Decade

💥 3 Stock-Split Winners Built to Compound Wealth for the Next Decade

Why Amazon, Netflix, and Nvidia Could Define Long-Term Market Leadership

Hi Fellow Investors,

Stock splits often reflect management confidence following sustained performance.

These three companies combine recent splits with strengthening fundamentals and durable growth drivers.

Together, they represent long-term holdings capable of compounding value over the next decade.

Key Points:

Amazon leverages AI, advertising, and logistics scale to extend its dominance.

Netflix pairs pricing power with global content reach and expanding monetization avenues.

Nvidia anchors the AI revolution with unmatched hardware and software ecosystems.

TODAY’S SPONSOR

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

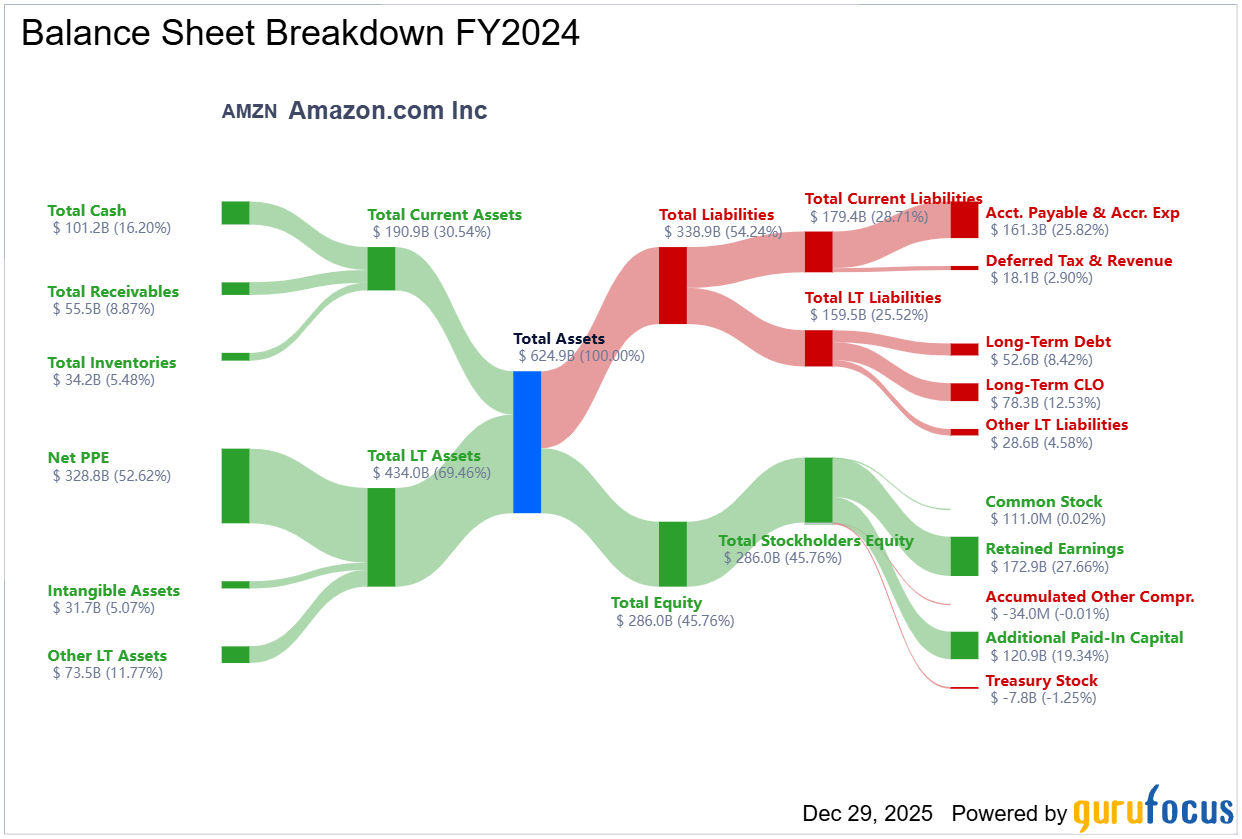

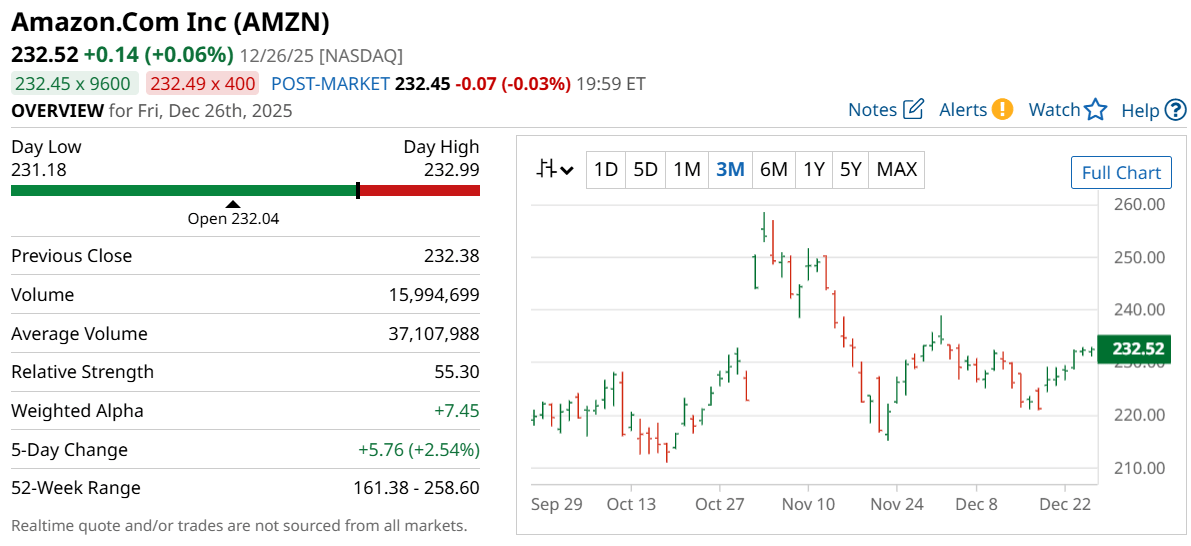

Amazon’s Growth Engine Extends Far Beyond E-Commerce

Amazon (NASDAQ: AMZN) continues to evolve into a diversified technology and services powerhouse.

Amazon Web Services remains the primary profit engine, benefiting from surging AI infrastructure demand.

Custom silicon like Trainium and Inferentia allows AWS to deliver cost-efficient AI workloads at scale.

The advertising segment is growing faster than retail, driven by high-margin, intent-based placements.

E-commerce growth is moderating, but automation and robotics investments are steadily lifting margins.

Prime’s massive global membership base reinforces loyalty across retail, media, and healthcare offerings.

Strengths

AWS leadership positions Amazon at the center of global AI infrastructure spending with resilient margins.

Advertising monetization leverages unmatched first-party data and point-of-sale dominance.

Prime creates a powerful ecosystem that drives repeat spending and cross-platform engagement.

Weaknesses

E-commerce growth is maturing, which may limit headline revenue acceleration.

Heavy capital expenditures can pressure short-term free cash flow during expansion cycles.

Regulatory scrutiny remains an ongoing overhang across multiple geographies.

Potential

AI-driven cloud demand could accelerate AWS profitability for years.

Advertising could rival AWS as a long-term profit pillar.

Logistics automation may unlock structurally higher retail margins.

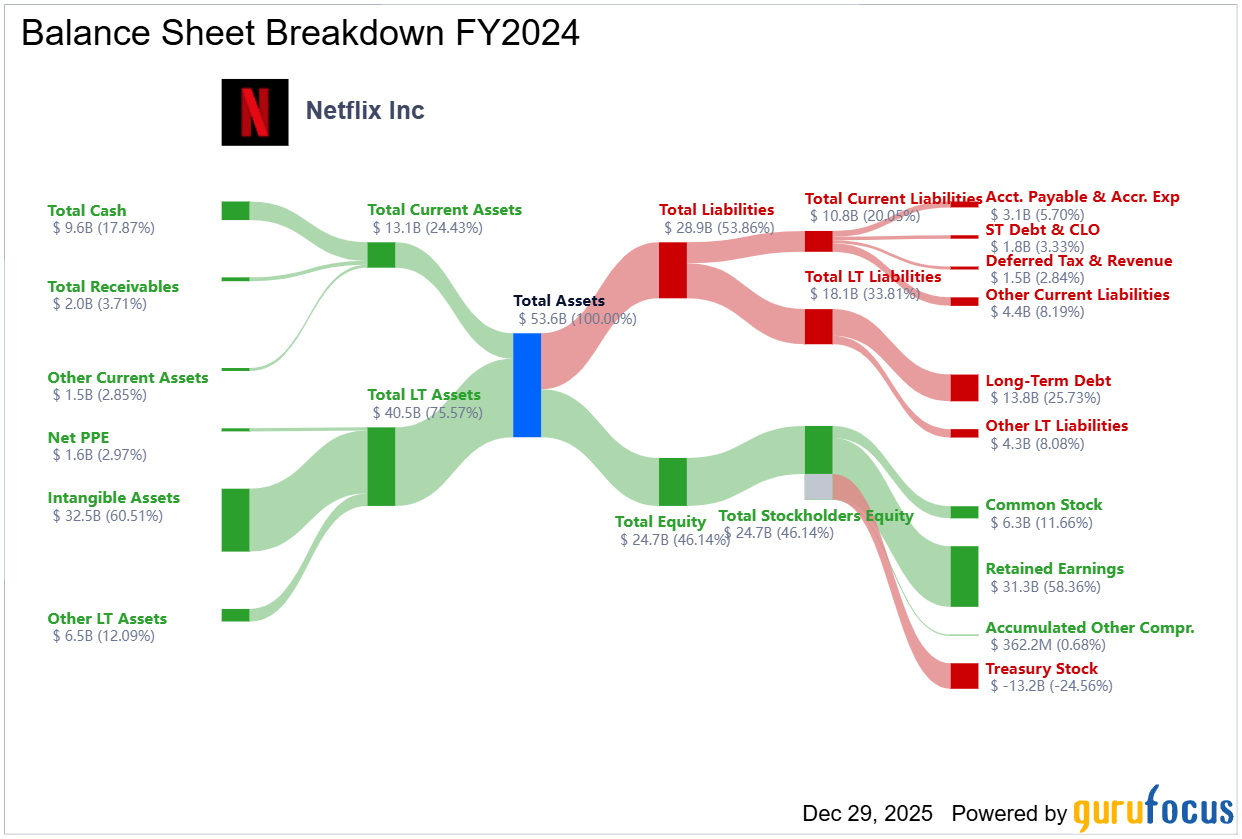

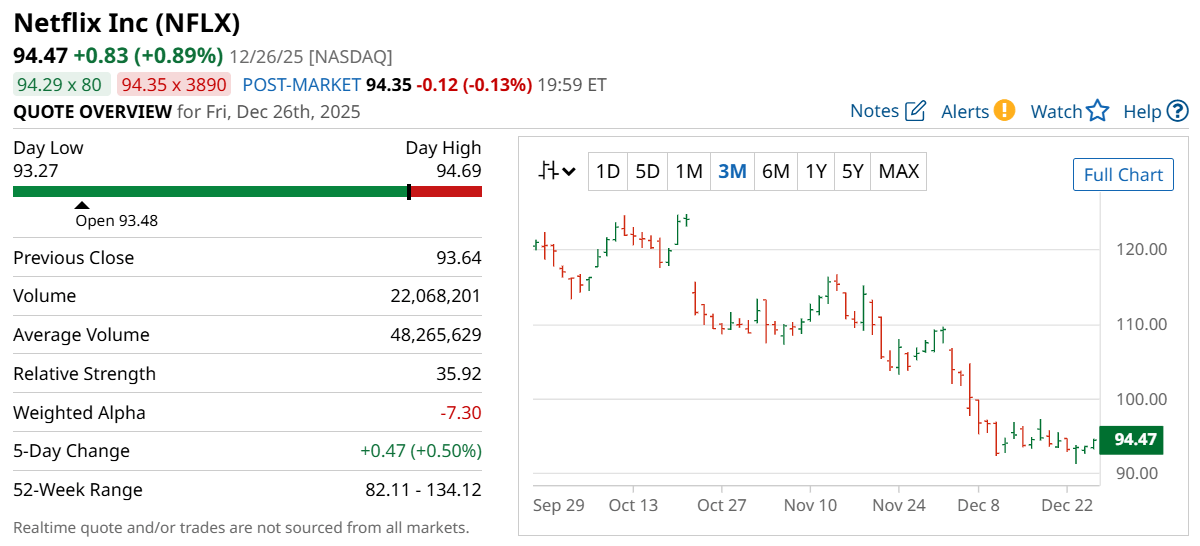

Netflix Is Quietly Becoming a Cash-Flow Powerhouse

Netflix (NASDAQ: NFLX) has transitioned from growth-at-all-costs to disciplined profitability.

Subscription revenue remains the core, supported by strong global brand recognition.

The ad-supported tier is scaling rapidly and is expected to meaningfully expand revenue contribution.

International markets still offer substantial runway through localized, high-quality content.

Operating margins continue to expand as content spending efficiency improves.

Free cash flow generation now provides flexibility for reinvestment and strategic acquisitions.

Strengths

Unmatched global streaming brand with deep consumer loyalty.

Strong pricing power demonstrated through successful subscription increases.

Expanding margins and accelerating free cash flow support long-term value creation.

Weaknesses

Content costs remain high and require consistent hit production.

Saturation in North America limits incremental subscriber growth.

Competition for premium content continues to intensify.

Potential

Advertising and live content could diversify revenue streams significantly.

International growth may offset domestic maturity.

Strategic acquisitions could deepen content moats and global reach.

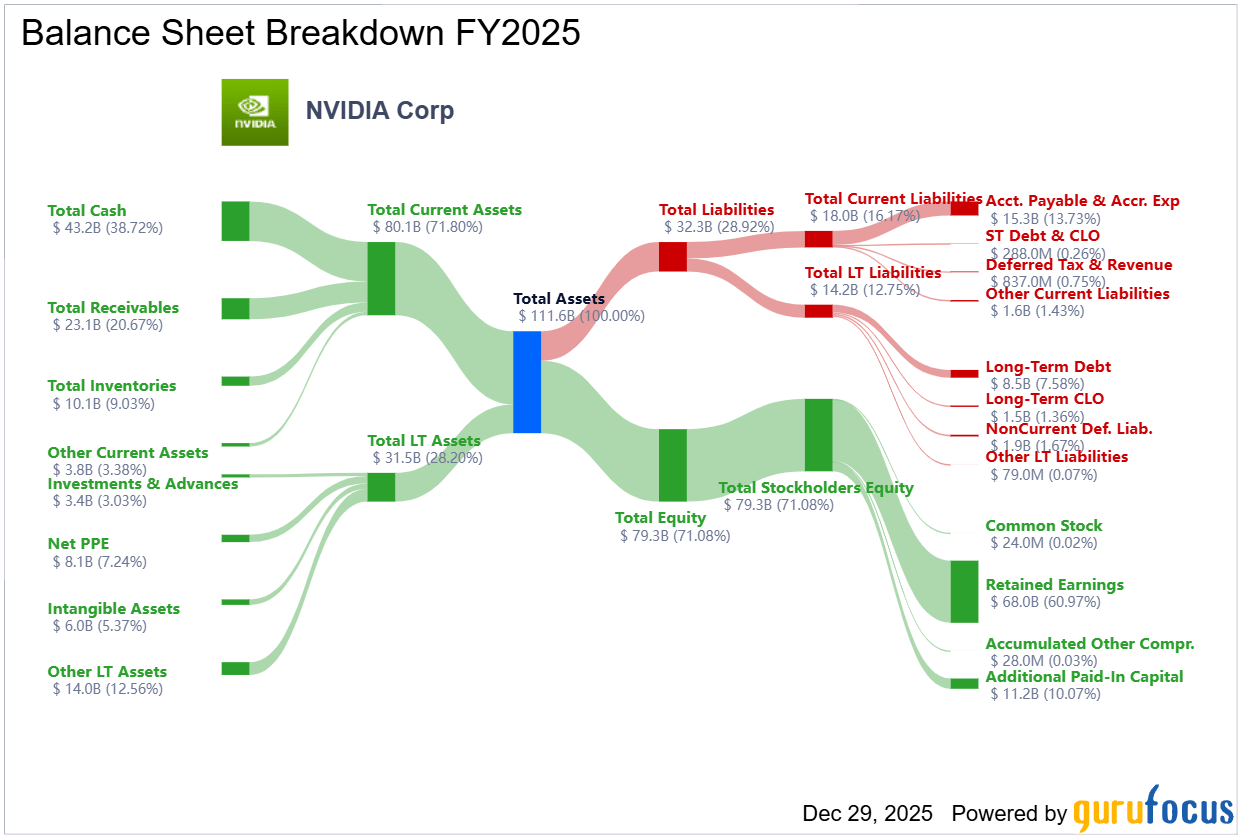

Nvidia Sits at the Core of the AI Revolution

Nvidia (NASDAQ: NVDA) remains the foundational supplier of AI computing infrastructure.

Data center revenue continues to surge on unprecedented demand for accelerated computing.

CUDA software locks developers into a powerful ecosystem with high switching costs.

Next-generation architectures like Blackwell and Rubin are driving record order backlogs.

Gross margins remain industry-leading, reflecting pricing power and technological leadership.

Expansion into robotics, autonomy, and digital twins broadens long-term opportunity.

Strengths

Dominant market share in AI data center chips with industry-leading margins.

CUDA software ecosystem creates an enduring competitive moat.

Massive backlog underscores sustained enterprise and hyperscaler demand.

Weaknesses

Revenue concentration in data centers increases cyclicality risk.

Elevated valuation leaves less room for execution missteps.

Geopolitical and export restrictions could impact certain markets.

Potential

AI infrastructure spending could persist for a decade or longer.

Software and platform monetization may enhance recurring revenue.

New markets like robotics and industrial AI expand total addressable opportunity.

TODAY’S SPONSOR

AI-native CRM

“When I first opened Attio, I instantly got the feeling this was the next generation of CRM.”

— Margaret Shen, Head of GTM at Modal

Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up.

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Conclusion

These three stock-split leaders combine scale, innovation, and durable competitive advantages.

Each business is strengthening its moat while addressing massive, long-term growth markets.

For patient investors, they represent compelling candidates for decade-long ownership.

Final Thought

Stock splits may grab headlines, but fundamentals drive wealth creation.

Which of these long-term compounders best aligns with a decade-long investment horizon?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply