- StocksGeniusMastery

- Posts

- 3 Stocks Poised to Hit Trillion-Dollar Valuations

3 Stocks Poised to Hit Trillion-Dollar Valuations

Invest in the next generation of market dominators

In the wake of Nvidia's historic rise to a trillion-dollar valuation, investors are eagerly seeking the next big opportunity. Several companies are inching closer to this coveted mark, and it’s not just about market cap. Analysts’ ratings play a crucial role in identifying these potential giants. By focusing on companies with strong buy ratings and impressive year-to-date gains, you can spot the frontrunners in this race.

Today, we delve into the top contenders poised to join the trillion-dollar club. These stocks have not only showcased robust market performance but also earned Wall Street’s endorsement. By scrutinizing market capitalization, recent performance, and analyst recommendations, we’ve identified the cream of the crop.

Let’s explore the three standout stocks that could be your ticket to substantial gains. These companies are not just close to reaching a trillion-dollar valuation but also exhibit the potential for significant growth, making them prime candidates for your investment portfolio.

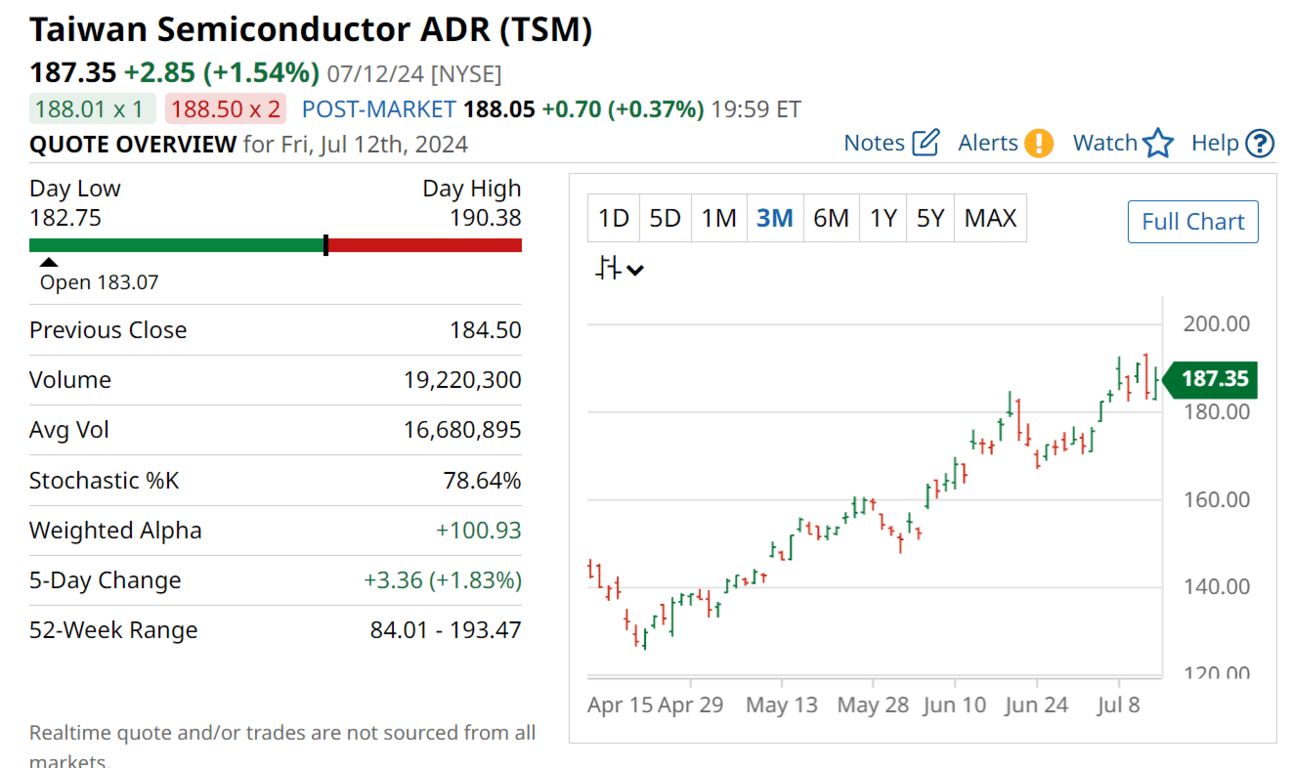

Taiwan Semiconductor (NYSE: TSM): Riding the wave of AI adoption and addressing supply constraints, TSM is poised for explosive growth, making it a top contender.

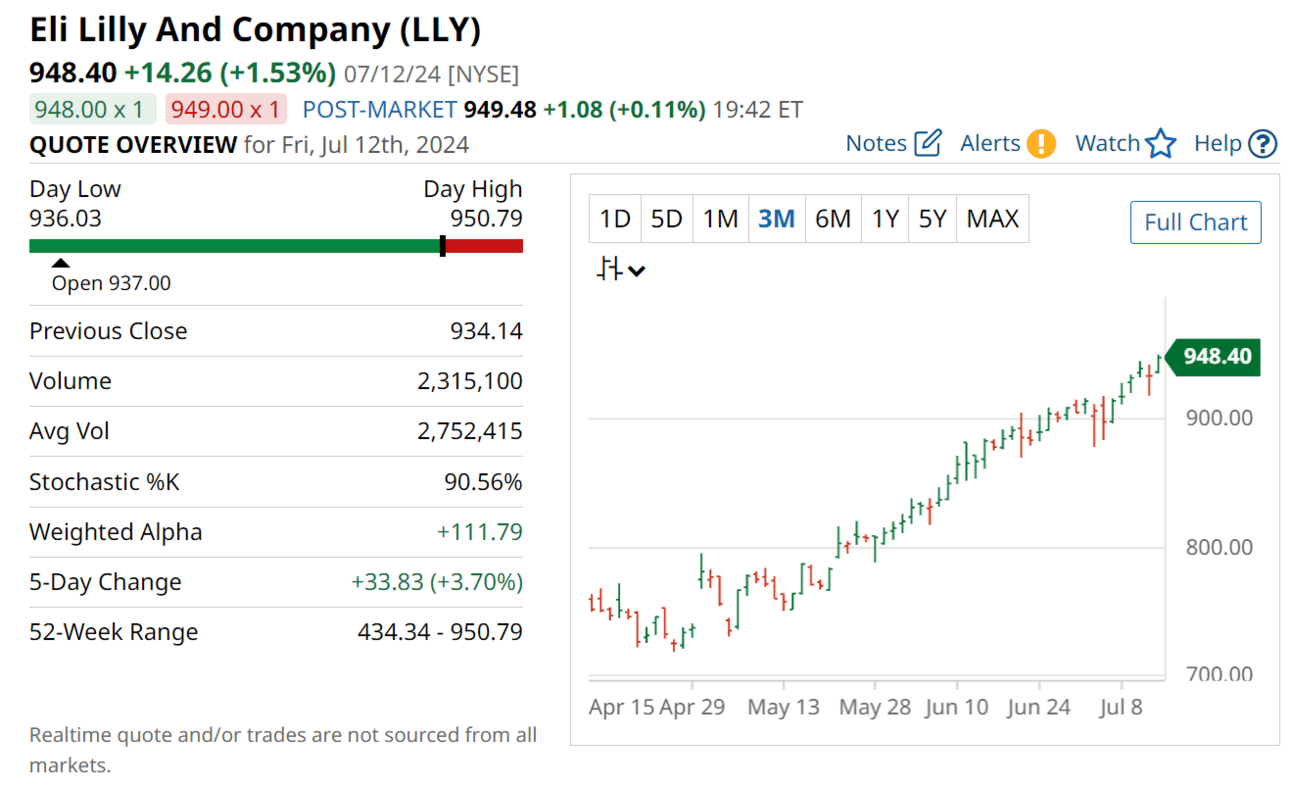

Eli Lilly and Company (NYSE: LLY): With strategic acquisitions like Morphic, Eli Lilly is expanding its drug portfolio, paving the way for a monumental rise in market value.

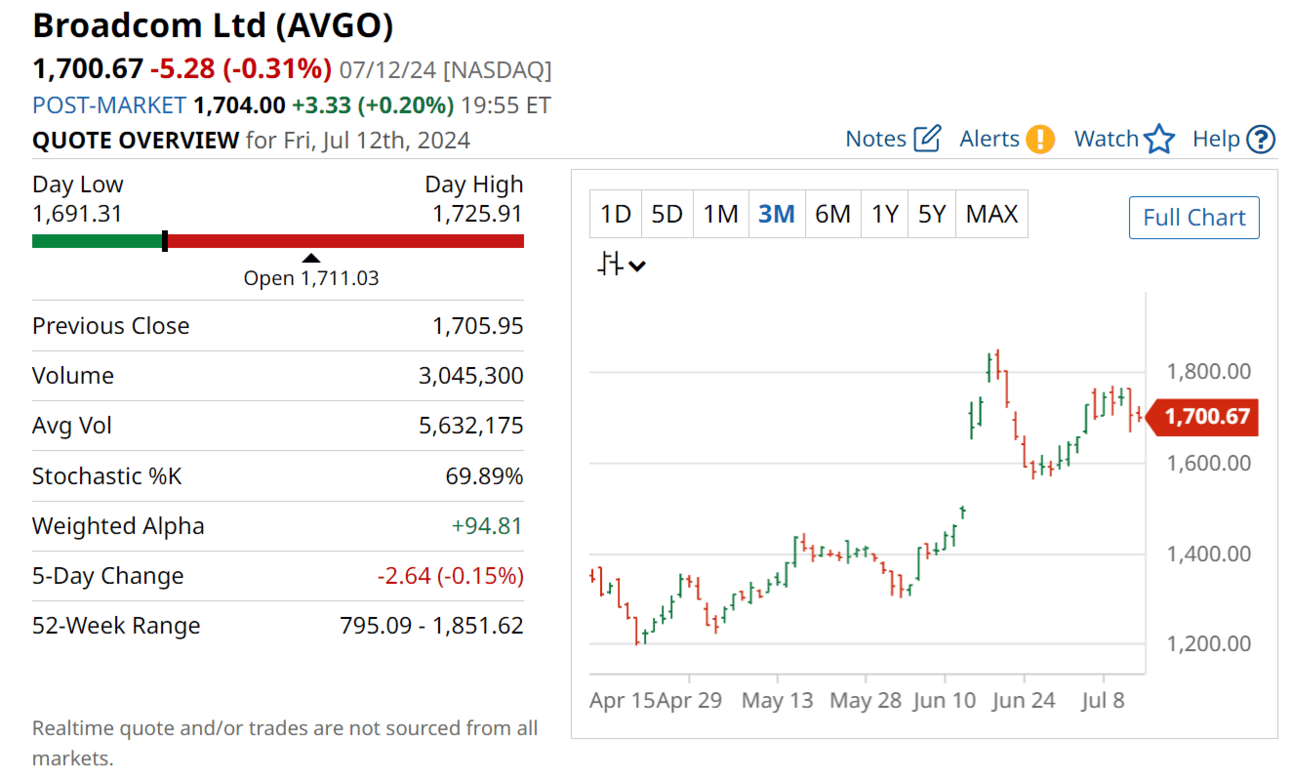

Broadcom (NASDAQ: AVGO): Broadcom's venture into hybrid cloud platforms is set to revolutionize its earnings, positioning it as a future trillion-dollar powerhouse.

Taiwan Semiconductor (NYSE: TSM):

Taiwan Semiconductor stands as the largest semiconductor foundry globally, with dedicated fabrication plants in Germany, the U.S., Japan, and China. TSMC's impressive client roster includes tech giants like Qualcomm, Broadcom, ARM, Intel, Apple, and Nvidia. The company's revenue is poised to soar as these clients ramp up AI integration across their product lines. Experts predict high demand and tight supplies for 2024 and 2025, which bodes well for TSM's growth. Despite a dip in FY'23 revenue and net income, TSM stock has surged 83.82% YTD, boasting a market cap of $974.2 billion.

Strengths:

Dominant market position in the semiconductor industry with a diverse client base.

High demand for AI-related products from major tech companies.

Robust financial performance with substantial growth during the pandemic.

Weaknesses:

Recent revenue and net income dips as reported in FY'23.

Supply chain vulnerabilities due to geopolitical tensions.

High capital expenditure required for maintaining cutting-edge technology.

Potential:

Significant growth prospects driven by increasing AI adoption.

Expansion into new markets with continued global semiconductor demand.

Strong buy ratings from analysts indicating confidence in future performance

Eli Lilly and Company (NYSE: LLY):

Eli Lilly and Company is a renowned pharmaceutical company known for its innovative drug development targeting a wide range of medical conditions. Its popular drugs include Trulicity for diabetes, Mounjaro for weight loss, Verzenio for breast cancer, Taltz for autoimmune dysfunctions, and Jardiance for diabetes. The acquisition of Morphic aims to develop an oral treatment for inflammatory bowel syndrome, further expanding its portfolio. With a market value of $877.8 billion and a 55% YTD increase, LLY is on the verge of joining the trillion-dollar stocks club.

Strengths:

Diverse and innovative drug portfolio addressing common and rare conditions.

Strategic acquisitions enhancing growth potential and market reach.

Strong financial performance with significant revenue growth.

Weaknesses:

High R&D expenses impacting the bottom line.

Regulatory risks associated with pharmaceutical approvals.

Competitive market pressures from other pharmaceutical giants.

Potential:

Expansion into new therapeutic areas through ongoing R&D and acquisitions.

Continued revenue growth driven by popular and innovative drugs.

Strong buy ratings reflecting confidence in sustained performance.

Broadcom (NASDAQ: AVGO):

Broadcom is a leading tech company specializing in semiconductor and infrastructure software products. Recently, the company launched VMware Cloud Foundation, a platform combining features of private and public clouds, designed to handle AI and machine-learning workloads at an enterprise level. Broadcom reported a record adjusted EBITDA margin of 65% in FY'23, generating $17.6 billion in free cash flow. With a market cap of $820 billion and a 60.85% YTD increase, AVGO is a strong buy.

Strengths:

Leading position in AI and semiconductor technology.

Strong financial performance with record EBITDA margins and free cash flow.

Innovative product launches like the VMware Cloud Foundation.

Weaknesses:

High competition in the semiconductor and software markets.

Dependency on tech industry cycles impacting demand.

Integration challenges with new technologies and acquisitions.

Potential:

Growth in AI and cloud computing driving future revenue.

Expansion into new markets with innovative products and solutions.

Strong buy ratings indicating market confidence in long-term growth.

Recommended Resources 📚

1. Feeling Lost in Stock Investing? Join the Super Investor Club (SIC) and Turn Confusion into Confidence! 🚀

Tired of being overwhelmed by investing jargon? You're not alone! SIC simplifies investing for everyone with dedicated coaching, expert advice, and personalized strategies.

"I went from a complete beginner to hitting my $100K Milestone Award, all thanks to SIC!".

For just $39 a month, get exclusive access to monthly and weekly live trades with our expert instructor, Sean Seah. Cancel anytime, risk-free!

Transform your financial future today. Sign up now and embark on your path to financial independence! Believe in your potential – if you think you can, you will! I'm here to support you every step of the way in your investment journey!

Summary:

This newsletter highlighted three strong stocks to consider in July 2024: Taiwan Semiconductor, Eli Lilly and Company, and Broadcom. Taiwan Semiconductor's leadership in semiconductor manufacturing and strong client base position it well for future growth. Eli Lilly's innovative drug portfolio and strategic acquisitions enhance its market potential. Broadcom's advancements in AI and cloud computing, along with its robust financial performance, make it a compelling tech investment.

Conclusion:

In uncertain markets, investing in companies with robust financials, strategic growth plans, and market-leading positions can provide stability and growth potential. Taiwan Semiconductor, Eli Lilly, and Broadcom exemplify these qualities, making them attractive options for investors seeking to navigate the current economic landscape.

Final Thought:

Are you ready to fortify your investment portfolio with these safe and promising stocks, or will you let market uncertainties steer your financial future? Make informed decisions and stay ahead in the ever-evolving market.

Are you loving the content you’re devouring right now? Spread the wealth by sharing with fellow stock investors and friends! Dive deeper into our exclusive analyses and stay ahead of the curve with our tailored content delivered directly to your Inbox. Let's forge a community of savvy, thriving investors. Let’s strive towards financial freedom together!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity, Execute Strategy, and Reap the Rewards of Investing Wisely.” 🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply