- StocksGeniusMastery

- Posts

- 3 Under-the-Radar VR Stocks That You Do Not Want To Miss

3 Under-the-Radar VR Stocks That You Do Not Want To Miss

Virtual Reality Stocks Poised for Surge During Market Upswing

3 Under-the-Radar VR Stocks That You Do Not Want To Miss

In this edition, we are considering to invest in these leading Virtual Reality (VR) stocks to delve into a future where virtual and real-world experiences intertwine. These three stocks with immense potential for attractive returns, meticulously chosen by top Wall Street analysts and based on the strengths, weaknesses, and potential trajectories of these selected stocks.

Virtual reality is booming, and savvy investors are poised to cash in on the next big wave of tech innovation. With market conditions on the upswing and groundbreaking advancements on the horizon, now's the time to seize the opportunity.

Microsoft (MSFT): Get ready for a game-changing ride with Microsoft's groundbreaking VR innovations like Mesh and cutting-edge motion reprojection techniques. The future of mixed reality has never looked brighter!

Meta Platforms (META): Join the VR revolution with Meta Platforms and its impressive lineup of advanced VR products, including the highly anticipated Quest Pro. With a massive user base and unrivaled market position, Meta is primed for exponential growth.

Unity Software (U): Strap in for profitability with Unity Software and its upcoming Unity 6 game engine. With robust support for new VR devices, Unity is paving the way for unprecedented development opportunities in the VR space.

Weak forecasts have pushed top VR stocks like Microsoft, Meta Platforms, and Unity Software to trade below their 52-week highs, despite a bullish stock market amid Federal Reserve rate cut preparations.

Goldman Sachs predicts U.S. GDP growth of 1.8% from Q4 2023 to Q4 2024, with a 2.1% annual growth rate. If core PCE inflation drops below 2.5%, Goldman Sachs anticipates a significant price decrease.

The global VR market is projected to surpass $22 billion by 2025, up from under $12 billion in 2022, offering substantial growth potential for the discussed trio.

1. Microsoft(NASD: MSFT):

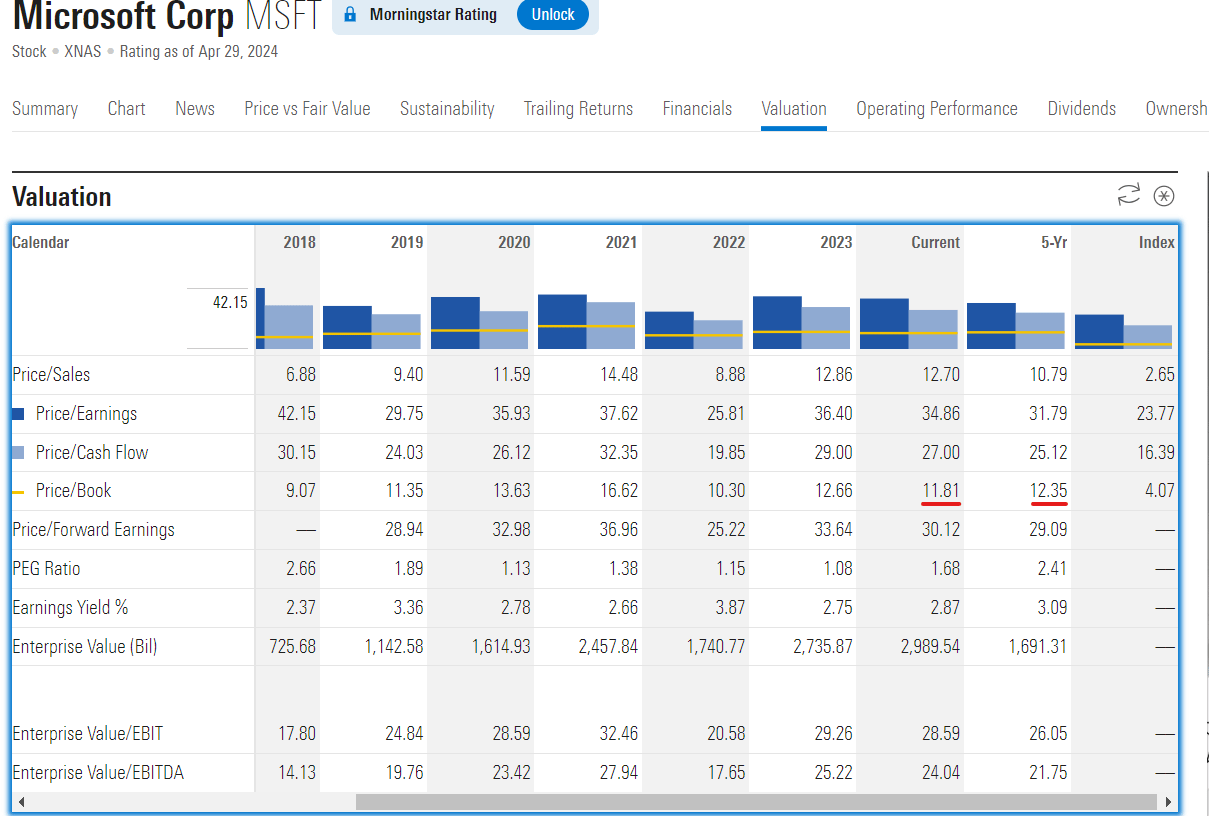

In the realm of virtual reality stocks, Microsoft stands out due to its enduring tech giant status and diversified business strategy, providing stability in the VR sector. Despite short-term sales projections, Microsoft's stock is considered undervalued, presenting an attractive investment opportunity.

Microsoft (NASDAQ:MSFT) remains a formidable player in the virtual reality (VR) arena. While weaker forecasts have led to discounted stock prices, savvy investors recognize the potential for significant gains amidst market volatility and Federal Reserve rate cut preparations.

Strengths:

Market Dominance: Microsoft's established presence and market dominance in the tech industry provide a solid foundation for its foray into virtual reality. With a diverse portfolio and extensive resources at its disposal, Microsoft is well-equipped to navigate the evolving VR landscape and capitalize on emerging opportunities.

Innovative Technologies: Microsoft's commitment to innovation is evident in its development of groundbreaking VR technologies like Microsoft Mesh and OpenXR Tools. These advancements not only showcase the company's technological prowess but also position it as a leader in shaping the future of virtual reality experiences.

Strategic Partnerships: Microsoft's strategic partnerships with key players in the VR ecosystem further bolster its position in the market. Collaborations with hardware manufacturers, content developers, and industry leaders enhance Microsoft's VR offerings and strengthen its competitive edge.

Weaknesses:

Sales Projections: Despite its strong market position, Microsoft faces challenges in meeting short-term sales projections in the VR sector. Fluctuations in demand and evolving consumer preferences contribute to uncertainties surrounding sales forecasts, potentially impacting the company's stock performance.

Competitive Pressures: Intensifying competition in the VR market poses a threat to Microsoft's market share and profitability. Rival companies are investing heavily in VR technologies, posing challenges to Microsoft's efforts to maintain its competitive edge and market leadership.

Regulatory Risks: Regulatory scrutiny and compliance requirements present additional challenges for Microsoft in the VR space. Evolving regulations and legal uncertainties could hinder the company's ability to innovate and expand its VR offerings, impacting its growth prospects.

Potential:

Expanding Market Opportunities: Despite short-term challenges, Microsoft remains well-positioned to capitalize on the growing demand for virtual reality experiences. With the global VR market projected to exceed $22 billion by 2025, Microsoft has significant growth potential and opportunities to drive revenue and profitability.

Technological Advancements: Microsoft's ongoing investments in VR research and development pave the way for future technological advancements and product innovations. As Microsoft continues to push the boundaries of VR technology, it can unlock new opportunities for growth and differentiation in the market.

Diversification Strategy: Microsoft's diversified business strategy and extensive product portfolio provide resilience and flexibility in navigating market uncertainties. By leveraging its strengths across multiple business segments, Microsoft can mitigate risks and capitalize on emerging trends in the VR industry, driving long-term value for investors.

2. Meta(NASD: META):

Meta Platforms (META) stands at the forefront of the metaverse revolution, leveraging its massive investments in VR technology and software to redefine digital interaction. Despite facing regulatory scrutiny and public skepticism, Meta's unwavering commitment to the metaverse is evident through initiatives like the 'Year of Efficiency' and AI advancements. While challenges persist, Meta's early investments and diversified growth story underscore its potential to capitalize on the trillion-dollar metaverse industry. As the digital landscape continues to evolve, Meta remains a compelling choice for investors seeking exposure to the future of virtual reality and beyond.

Meta Platforms, akin to Microsoft, is a legacy enterprise with a massive consumer base exceeding 3 billion daily active users. Despite this, its stock has faced downward pressure due to weaker-than-expected guidance, mirroring Microsoft's market trajectory.

Following Meta's first-quarter profit beat, the stock plummeted by 16% in a single day, marking its most significant drop since October 2022. The primary driver behind this decline was subdued sales predictions, reflecting broader market uncertainties.

Strengths:

Massive Consumer Base: With over 3 billion daily active users, Meta Platforms possesses an unparalleled reach and consumer base to market its VR products. This vast audience provides a solid foundation for Meta's VR initiatives and offers immense potential for growth and market penetration.

Innovative VR Products: Meta Platforms demonstrates its commitment to VR innovation through products like the Meta Quest Pro, equipped with advanced features such as flat lenses and high-resolution cameras. These cutting-edge technologies position Meta as a leader in the VR space and drive excitement among consumers and investors alike.

Forward-Thinking Approach: Meta's strategic vision for the future of VR is evident in its plans to release four new VR headsets by 2024, including the highly anticipated Project Cambria. By investing in R&D and staying ahead of industry trends, Meta Platforms showcases its forward-thinking approach and readiness to capitalize on emerging opportunities in the VR market.

Weaknesses:

Stock Volatility: Despite its innovative VR initiatives, Meta Platforms' stock has experienced significant volatility, particularly in response to weaker-than-expected guidance and subdued sales predictions. This volatility reflects market uncertainties surrounding Meta's ability to translate VR investments into sustained financial success.

Challenges in Sales Execution: Meta faces challenges in meeting sales expectations for its VR products, despite efforts to drive adoption through price reductions and new product releases. The company must address these challenges to demonstrate its ability to effectively monetize its VR investments and deliver value to shareholders.

Competitive Pressures: Intensifying competition in the VR market poses a threat to Meta's market share and profitability. Rival companies are investing heavily in VR technologies, presenting challenges to Meta's efforts to maintain its competitive edge and market leadership.

Potential:

Strong Growth Prospects: With a 24% upside potential and a 'Strong Buy' rating, Meta Platforms remains an attractive investment opportunity in the VR space. Its massive consumer base, innovative VR products, and forward-thinking approach position Meta for sustained growth and market leadership.

Continued Innovation: Meta's ongoing investments in R&D and product development initiatives underscore its commitment to innovation in the VR space. By staying at the forefront of technological advancements, Meta can capitalize on emerging trends and solidify its position as a key player in the VR industry.

Market Leadership: Despite challenges, Meta Platforms has the potential to emerge as a leader in the VR market. With its vast resources, strategic vision, and innovative products, Meta is well-equipped to navigate market uncertainties and drive long-term value for investors.

3. Unity Software: (NYSE: U)

Unity Software, similar to Microsoft and Meta Platforms, has seen its stock decline significantly following tepid financial forecasts and a restructuring strategy. Despite these challenges, experts remain optimistic about Unity's prospects in the virtual reality (VR) market, with a "Moderate Buy" consensus rating and a promising upside potential of 33%.

Unity's strategic developments in the VR space, such as the upcoming release of Unity 6 game engine in 2024, signal its commitment to driving innovation and accelerating VR and real-time 3D applications. These advancements align with the broader economic outlook for the VR market, which is poised for substantial growth in the coming years.

Strengths:

Innovative Technology: Unity's continuous advancements in VR technology, including the support for Meta Quest 3 headset and enhanced compatibility with XR devices, demonstrate its commitment to staying at the forefront of VR development. This innovative approach enables developers to create immersive experiences across multiple platforms, driving adoption and engagement.

Unique Applications: Unity's utilization of VR and AR in diverse industries, such as aviation for creating digital twins, showcases its versatility and adaptability. By leveraging VR technology in unique and practical ways, Unity expands its market reach and solidifies its position as a leader in the VR ecosystem.

Transition Strategy: Unity's strategic transition to improve its adjusted EBITDA margin from 20% in 2023 to "over 25%" in 2024 reflects its focus on enhancing profitability and operational efficiency. This transition strategy, if successful, could unlock significant value for investors and position Unity for sustainable growth in the long term.

Weaknesses:

Stock Volatility: Unity's stock has experienced notable volatility following its financial forecasts and restructuring announcements. Investor sentiment may be influenced by uncertainties surrounding Unity's ability to execute its transition strategy and deliver on its promises, leading to fluctuations in stock price.

Competitive Landscape: Unity faces competition from other players in the VR software market, requiring continuous innovation and differentiation to maintain its competitive edge. Failure to effectively differentiate its offerings or keep pace with technological advancements could pose challenges to Unity's market position and growth prospects.

Execution Risks: The success of Unity's transition strategy hinges on its ability to effectively manage expenses and improve profitability. Any missteps or delays in executing this strategy could impact Unity's financial performance and erode investor confidence.

Potential:

Robust Growth Opportunities: With a 33% upside potential and a strategic focus on driving innovation and profitability, Unity is well-positioned to capitalize on the growing demand for VR technologies. As the VR market expands and evolves, Unity's innovative solutions and transition strategy offer significant growth opportunities for investors.

Market Leadership: Unity's leadership in the VR software market, coupled with its diverse applications across industries, positions it as a key player in shaping the future of VR experiences. By leveraging its strengths in technology and strategic vision, Unity has the potential to maintain its market leadership and deliver long-term value to shareholders.

Financial Performance: If Unity successfully executes its transition strategy and achieves its target adjusted EBITDA margin, investors stand to benefit from improved financial performance and enhanced profitability. This could drive further upside for Unity's stock and unlock value for shareholders in the years to come.

Summary:

In this analysis, we've delved into the prospects of three under-the-radar virtual reality (VR) stocks: Microsoft (NASDAQ: MSFT), Meta Platforms (NASDAQ: META), and Unity Software (NYSE: U). Despite facing challenges such as weaker-than-expected forecasts and stock declines, these companies demonstrate promising opportunities in the burgeoning VR market.

Microsoft, a tech giant with a diverse business strategy, shows stability in the VR sector despite short-term sales predictions. Meta Platforms, boasting a massive consumer base and a strong interest in VR innovation, faces stock volatility amidst subdued sales projections but continues to invest in VR development. Unity Software, amidst a restructuring strategy and stock volatility, exhibits a forward-thinking approach with advancements like the Unity 6 game engine and support for new VR devices.

Looking ahead, the VR market is poised for substantial growth, with projections exceeding $22 billion by 2025. Despite economic uncertainties, these VR stocks present opportunities for investors to capitalize on the evolving landscape of immersive technology.

Conclusion:

As the VR market evolves and expands, investors have the opportunity to tap into the potential of these under-the-radar stocks. Microsoft, Meta Platforms, and Unity Software showcase resilience, innovation, and strategic vision in navigating the challenges of the VR sector. By staying informed and embracing the transformative power of VR technology, investors can position themselves for long-term growth and success in the dynamic world of immersive experiences.

Final Thought:

Step into the future of investing with Microsoft, Meta Platforms, and Unity Software – the powerhouses driving the virtual reality (VR) revolution. With the VR market projected to skyrocket to over $22 billion by 2025, these under-the-radar stocks offer unparalleled opportunities for savvy investors. From Microsoft's resilient market presence to Meta's expansive consumer base and Unity's cutting-edge innovations, these companies are poised to dominate the immersive technology landscape. Don't miss out on the chance to ride the wave of VR innovation and secure your financial future. The time to invest in the future is now – don't let this opportunity pass you by.

Are you loving the content you’re devouring right now? Spread the wealth by sharing with fellow stock investors and friends! Dive deeper into our exclusive analyses and stay ahead of the curve with our tailored content delivered directly to your Inbox. Let's forge a community of savvy, thriving investors.

Of course, you should always do your own research and due diligence before investing in any stock. And you should also diversify your portfolio and balance your risk and reward.

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.” 🌱

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply