- StocksGeniusMastery

- Posts

- 3 Warren Buffet Stocks to Buy in May 2024

3 Warren Buffet Stocks to Buy in May 2024

Discover the Fortress Stocks Warren Buffett is Loading Up on – Perfect for Your May Portfolio Surge

3 Warren Buffet Stocks to Buy in May 2024

In this edition, we delve into three stocks with immense potential for attractive returns especially when we do a rundown of three of the bigger positions held by Buffett's Berkshire Hathaway that would probably be at home in your portfolio as well. We will then discuss based on the strengths, weaknesses, and potential trajectories of these selected stocks.

Bank of America (NYSE: BAC): With a solid financial foundation and global reach, BAC stands resilient amidst industry challenges, making it a staple in Buffett's portfolio.

The Coca-Cola Company (NYSE: KO): KO's enduring brand and consistent performance make it a timeless investment choice for Buffett, reflecting his penchant for long-term value.

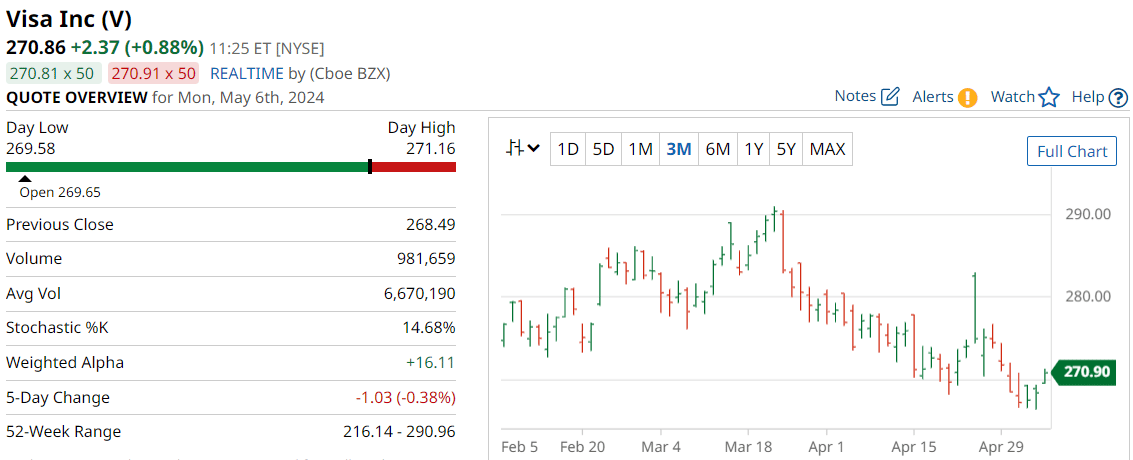

Visa (NYSE: V): As the leader in digital payments, Visa boasts unparalleled growth potential, aligning perfectly with Buffett's strategy of investing in businesses with wide economic moats.

1. Bank of America(NYSE: BAC):

In the current economic climate, owning bank stocks may seem daunting, but Bank of America (NYSE: BAC) is proving to be an exception. Despite industry challenges like rising loan defaults and tepid demand for banking services, BAC has been on an upward trajectory since its first-quarter earnings report in mid-April.

Strengths:

Resilience Amidst Adversity: Despite industry headwinds, BAC has demonstrated resilience, with its stock rallying since the release of positive quarterly numbers.

Potential M&A Rebound: With signs of a rebound in mergers and acquisitions activity, BAC stands to benefit from increased investment banking revenue, as seen in its Q1 performance.

Improving Credit Landscape: Decreasing loan delinquencies and improving credit scores indicate a positive trend for BAC's loan portfolio, suggesting a potential turnaround in its credit-related challenges.

Weaknesses:

Industry Vulnerabilities: The banking sector faces challenges such as loan defaults and subdued demand, which could continue to impact BAC's performance in the short term.

Dependence on Economic Recovery: BAC's growth prospects are closely tied to broader economic recovery, making it susceptible to macroeconomic fluctuations.

Regulatory Risks: Regulatory changes and potential shifts in consumer behavior could pose risks to BAC's operations and profitability.

Potential:

Strategic Investment by Berkshire: Berkshire Hathaway's significant stake in BAC reflects confidence in its long-term potential and suggests promising prospects for growth.

Economic Tailwinds: Anticipated growth in corporate fundraising and M&A activity, along with improving credit metrics, could fuel BAC's performance in the coming months.

Diversified Revenue Streams: BAC's diversified revenue streams, including investment banking and wealth management, position it to capitalize on emerging opportunities in a recovering economy.

2. The Coca-Cola Company(NYSE: KO):

Warren Buffett's affinity for Coca-Cola (NYSE: KO) extends beyond his reported daily consumption of the beverage. With Berkshire Hathaway holding nearly $25 billion worth of KO stock, this iconic brand has proven to be a cornerstone investment for Buffett.

Strengths:

Iconic Brand Recognition: Coca-Cola's enduring brand and marketing prowess have solidified its position as a global lifestyle choice, fostering brand loyalty and consumer trust.

Consistent Revenue Generation: Despite market fluctuations, Coca-Cola has demonstrated consistent earnings growth, supporting its track record of dividend increases for 62 consecutive years.

Stable Income Generation: As a reliable income stock, Coca-Cola offers investors a steady dividend yield of 3.1%, making it an attractive choice for income-oriented investors.

Weaknesses:

Slow Growth Potential: While Coca-Cola maintains stability, its growth prospects may be limited compared to faster-growing companies in other sectors.

Market Saturation: The beverage market faces saturation, potentially constraining Coca-Cola's ability to expand its market share and drive significant revenue growth.

Dependency on Traditional Products: Coca-Cola's reliance on traditional soda products could pose challenges amid shifting consumer preferences towards healthier alternatives.

Potential:

Long-Term Income Growth: Coca-Cola's strong cash flow generation and commitment to dividend growth make it an appealing investment for income-seeking investors looking for reliable long-term returns.

Innovation and Diversification: Continued innovation in product offerings and expansion into new beverage categories could unlock new growth opportunities for Coca-Cola, enhancing its long-term viability.

Global Expansion: Coca-Cola's global presence and distribution network provide a platform for expansion into emerging markets, tapping into growing consumer demand for beverages worldwide.

3. Visa (NYSE: VISA):

Amidst recent market turbulence, Visa (NYSE: V) presents an intriguing investment opportunity endorsed by Warren Buffett. Despite short-term concerns, Visa's market leadership and innovative payment solutions position it for long-term success.

Strengths:

Market Leadership: Visa commands a dominant market share, processing 40% of global card-based transactions, highlighting its industry-leading position and widespread acceptance.

Innovative Payment Technologies: Visa's commitment to technological innovation and payment solutions positions it at the forefront of the rapidly evolving digital payments landscape.

Global Reach: With a vast network spanning across geographies, Visa benefits from a diverse revenue base and extensive merchant acceptance, driving sustained growth.

Weaknesses:

Regulatory Uncertainty: Regulatory changes, such as new credit card regulations, and competitive pressures from emerging fintech players could impact Visa's profitability and market position.

High Valuation: Visa's current valuation may be considered relatively high compared to its peers, potentially limiting near-term upside potential for investors.

Dependency on Consumer Spending: Visa's revenue is closely tied to consumer spending patterns, making it susceptible to economic downturns and fluctuations in consumer confidence.

Potential:

Resilience Amidst Challenges: Visa has a history of navigating regulatory challenges and competitive pressures, demonstrating resilience and adaptability in evolving market conditions.

Strategic Investment by Berkshire: Berkshire Hathaway's long-term investment in Visa underscores confidence in its business model and growth prospects, signaling a vote of confidence from Warren Buffett.

Continued Innovation: Visa's focus on innovation and expanding its suite of payment solutions positions it to capitalize on emerging trends in digital payments, driving future revenue growth and shareholder value.

Summary:

In summary, Bank of America (NYSE: BAC) emerges as a resilient contender amidst industry challenges, with signs of a rebound in investment banking revenue and improving credit metrics. Despite short-term uncertainties, BAC's strategic positioning and Berkshire Hathaway's significant investment highlight its long-term growth potential.

The Coca-Cola Company (NYSE: KO) stands out for its iconic brand recognition and consistent revenue generation. With a focus on innovation and global expansion, KO remains a stalwart income stock, offering investors stability and long-term growth opportunities.

Visa Inc. (NYSE: V) showcases market leadership in digital payments and a commitment to innovation. Despite regulatory concerns and competitive pressures, V's extensive global reach and Berkshire Hathaway's endorsement position it for resilience and sustained growth in the evolving payments landscape.

Conclusion:

As investors navigate market volatility and economic uncertainty, the wisdom of Warren Buffett provides invaluable guidance. By following Buffett's lead and considering Bank of America, Coca-Cola, and Visa as cornerstone holdings in their portfolios, we can align ourselves with enduring businesses poised for long-term success. Despite short-term challenges, these companies exhibit resilience, innovation, and global reach, making them compelling choices for investors seeking stability and growth in their investments.

Final Thought:

In the ever-changing landscape of the stock market, the principles of value investing remain timeless. As Warren Buffett famously said, "Be fearful when others are greedy and greedy when others are fearful." By adopting a long-term perspective and investing in solid businesses with strong fundamentals, our fellow investors can weather market turbulence and build wealth over time.

Are you loving the content you’re devouring right now? Spread the wealth by sharing with fellow stock investors and friends! Dive deeper into our exclusive analyses and stay ahead of the curve with our tailored content delivered directly to your Inbox. Let's forge a community of savvy, thriving investors together.

Of course, you should always do your own research and due diligence before investing in any stock. And you should also diversify your portfolio and balance your risk and reward.

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.” 🌱

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply