- StocksGeniusMastery

- Posts

- 💥A New Golden Age for Tech Stocks - and Netflix Could Lead the Charge

💥A New Golden Age for Tech Stocks - and Netflix Could Lead the Charge

Netflix’s stock split and soaring profits could turn 2026 into its most profitable year yet.

Hi Fellow Investors,

History has a funny way of repeating itself — especially in the stock market.

Every major Nasdaq bull run lasting more than three years has continued to climb for years after.

And once again, history seems ready to repeat itself.

If the trend holds true, 2026 could mark another breakout year for long-term investors.

Key Points:

Historical precedent suggests the Nasdaq will surge again in 2026.

Netflix (NASDAQ: NFLX) is executing a 10-for-1 stock split, reflecting confidence in sustained growth.

Its ad-supported tier, hit content lineup, and expanding margins point to a powerful multi-year rally.

TODAY’S SPONSOR

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

The Nasdaq’s Bullish Pattern Is Back

The Nasdaq Composite (NASDAQINDEX: ^IXIC) has been on a historic run since late 2022.

Driven by AI innovation, rate cuts, and record corporate earnings, the tech index has soared past expectations.

Looking back to 1975, five bull markets that crossed the three-year mark kept climbing for an average of eight years.

That pattern suggests today’s rally could have years of fuel left.

And if history is any guide, top-performing innovators like Netflix may continue outperforming as the next phase of the bull cycle unfolds.

Netflix’s Stock Split: A Signal of Strength

Netflix recently announced a 10-for-1 stock split, a move typically reserved for companies with sustained growth and strong investor confidence.

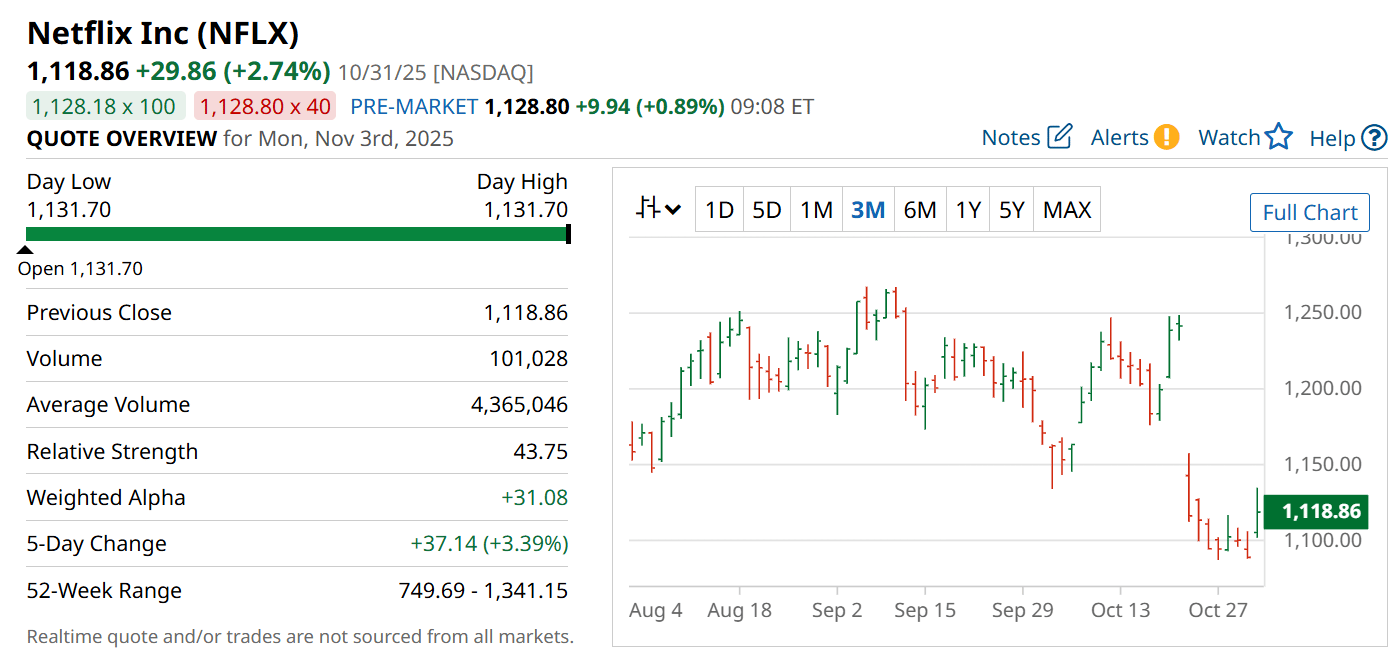

The streaming leader’s shares have already surged 48% this year, outpacing much of the Nasdaq’s rally.

Over the past decade, Netflix stock has soared 932%, cementing its status as the global streaming powerhouse.

This split will make shares more accessible to retail investors and broaden ownership just as Netflix enters another period of accelerated profitability.

That’s why analysts view this as more than a symbolic move — it’s a signal that management sees stronger days ahead.

The Comeback King of Streaming

Not long ago, Wall Street skeptics called Netflix’s best days “over.”

Competition from Disney+, Max, and Peacock threatened to erode its dominance.

But Netflix proved once again why it’s the streaming world’s benchmark.

After years of heavy investment, it built a $135 billion content empire and flipped the switch from cash-burning disruptor to cash-generating machine.

Now, as rivals retreat under profit pressure, Netflix is pulling even further ahead — with a library and subscriber base that competitors can’t match.

Growth Catalysts Point to a $1 Trillion Future

Netflix’s 2025 outlook is anything but conservative.

The company expects Q4 revenue to grow 17% to $11.96 billion, with EPS projected to rise 28% — all while expanding operating margins to nearly 30%.

Meanwhile, The Wall Street Journal reports Netflix aims to double revenue to $78 billion and triple operating income to $30 billion by 2030.

Global ad revenue is expected to grow fourfold to $9 billion, powered by the success of its ad-supported tier.

And breakout hits like KPop Demon Hunters, Wednesday, and Squid Game continue fueling subscriber growth and lucrative licensing deals.

With 410 million subscribers projected by 2030, Netflix could soon join the trillion-dollar market-cap club.

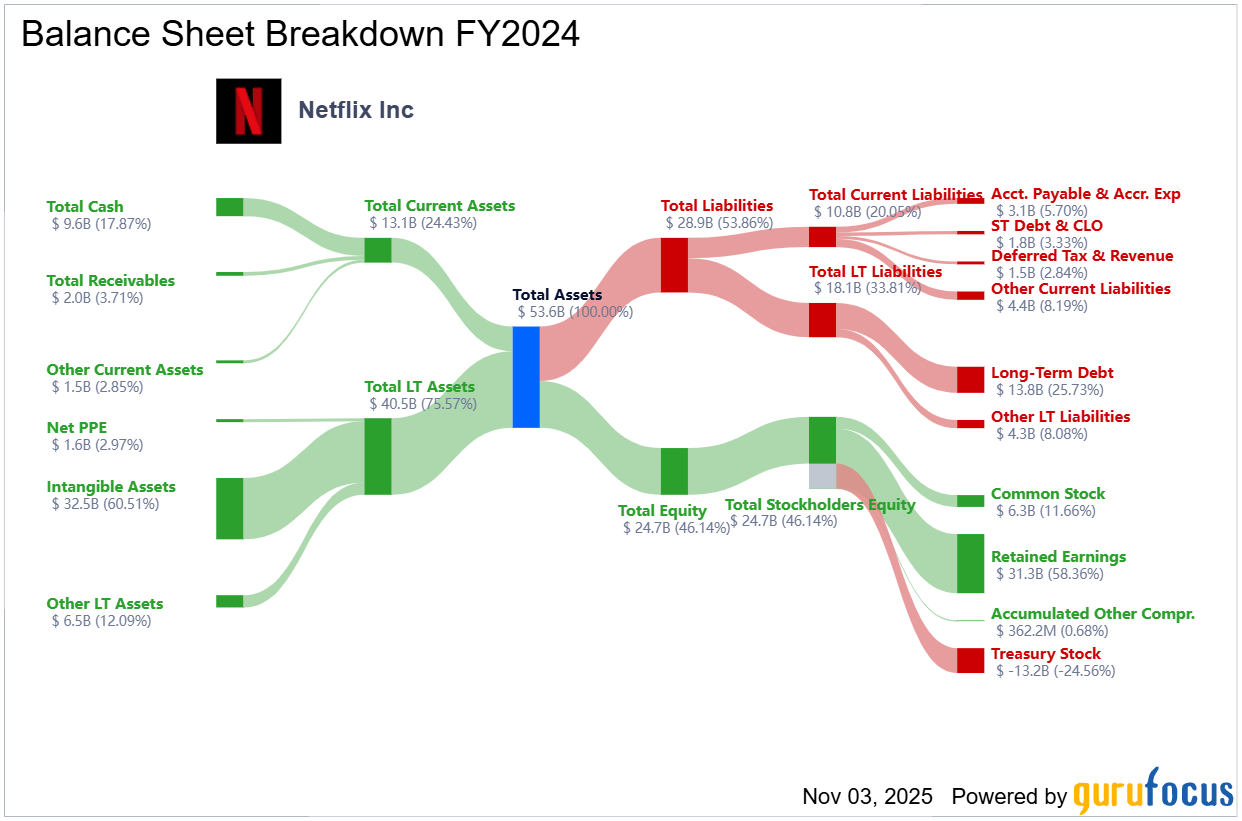

Strengths

Netflix’s stock split enhances accessibility, signaling confidence in long-term growth.

Expanding global subscriber base and strong original content pipeline drive recurring revenue.

Proven ability to turn hits into multi-channel franchises and licensing success.

Weaknesses

High valuation (34x forward earnings) leaves limited margin for error in short-term performance.

Rising content production costs and global expansion expenses could pressure margins.

Heavy dependence on hit-driven content may create volatility in quarterly results.

Potential

Ad-tier growth and emerging-market expansion could double profits within five years.

Continued margin expansion and disciplined spending could re-rate the stock even higher.

History suggests Netflix could outperform as the Nasdaq enters its next multi-year bull phase.

TODAY’S SPONSOR

Meet your new assistant (who happens to be AI).

Meet Skej — your new scheduling assistant. Whether it’s a coffee intro, a client check-in, or a last-minute reschedule, Skej is on it. Just CC Skej on your emails, and it takes care of everything: checking calendars, suggesting times, and sending out invites.

Conclusion

If history repeats itself, 2026 could be another record-setting year for tech investors.

And among the potential winners, Netflix stands tall — a proven leader combining scalability, profitability, and global brand power.

Its 10-for-1 stock split could mark the start of its next great run, as investors rediscover the value of owning the world’s top streaming platform.

Final Thought

Will Netflix’s next chapter mirror the Nasdaq’s historic surge — or surpass it entirely?

Either way, history is once again on the side of patient investors.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply