- StocksGeniusMastery

- Posts

- 💥 Alphabet’s $4 Trillion Question: Buy Before Earnings or Wait?

💥 Alphabet’s $4 Trillion Question: Buy Before Earnings or Wait?

What Feb. 4 Earnings Could Mean for Long-Term Investors

Hi Fellow Investors,

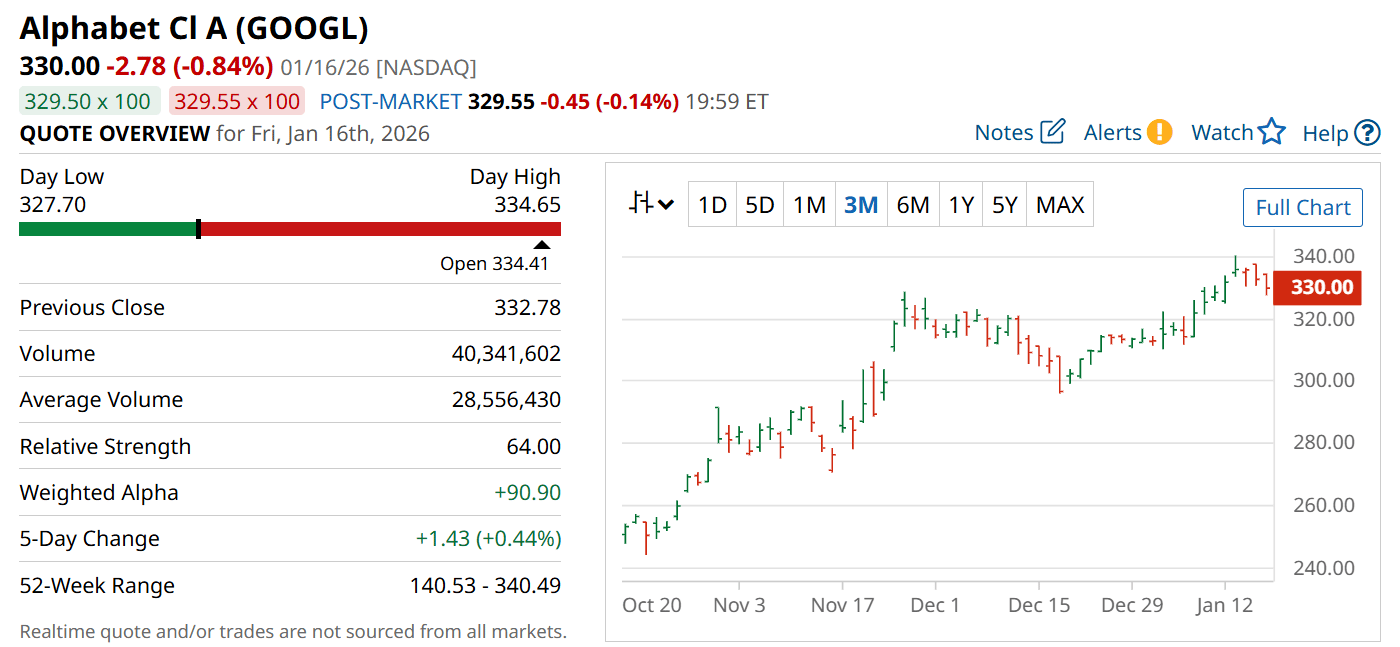

Alphabet (NASDAQ: GOOGL) enters its February earnings report after a remarkable year driven by AI execution, cloud profitability, and renewed investor confidence.

This setup has many investors questioning whether buying shares before Feb. 4 is the right strategic move.

The answer depends far more on time horizon than short-term market reactions.

Key Points:

Alphabet delivered standout revenue and earnings growth in 2025, reinforcing its dominance across search, cloud, and AI.

Major AI wins, including powering Apple’s Siri and monetizing Gemini, strengthen long-term growth visibility.

The stock remains best suited for investors willing to hold through volatility with a five-year mindset.

TODAY’S SPONSOR

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Alphabet silenced critics in 2025 after concerns that AI challengers would erode its core search business.

Google Search maintained over 90% market share, preserving its unmatched advertising engine.

Revenue grew at a double-digit pace through the first three quarters of the year.

Even more impressive, net income expanded far faster than sales, signaling operating leverage.

Google Cloud emerged as a profit engine, posting operating margins that rival mature software leaders.

This performance reaffirmed Alphabet’s ability to scale AI without sacrificing profitability.

AI Execution Is Turning Into Real Money

Gemini’s rapid adoption highlighted Alphabet’s strength in deploying AI at global scale.

Management confirmed that the majority of cloud customers now use AI-driven tools.

Monetization plans, including advertising within Gemini, align with user behavior trends favoring free access.

The agreement for Gemini to power Apple’s Siri marked a pivotal validation of Alphabet’s AI leadership.

This deal not only adds recurring revenue but embeds Alphabet’s models into a massive device ecosystem.

AI is no longer a defensive story for Alphabet but an accelerating growth catalyst.

A Conglomerate of Dominant Platforms

YouTube continues to solidify its leadership in digital entertainment by capturing a growing share of total U.S. television viewing time.

Its unmatched scale, creator ecosystem, and advertiser reach place it well ahead of traditional streaming competitors.

Meanwhile, Waymo is steadily expanding its lead in autonomous driving through rising weekly ride volumes.

Planned geographic expansion could accelerate Waymo’s transition from experimental project to meaningful revenue contributor.

Very few companies operate multiple platforms that independently dominate their respective industries.

This diversification strengthens Alphabet’s business model while compounding long-term optionality.

Why Earnings Timing Matters Less Than Patience

Short-term share price movements surrounding earnings announcements remain highly unpredictable, even for elite companies.

Alphabet’s current valuation already reflects elevated expectations following a strong multi-year rally.

Long-term performance will be driven by sustained revenue growth, margin discipline, and capital allocation decisions.

Management commentary on AI spending, cloud demand trends, and Waymo’s trajectory will shape investor confidence more than quarterly beats.

Investors with a five-year horizon need not attempt to time a single earnings release.

Alphabet’s competitive moat remains firmly intact regardless of near-term volatility.

Strengths

Dominant positions in search, digital advertising, cloud infrastructure, and online video create durable cash flows.

Proven ability to monetize AI at scale through advertising, enterprise tools, and strategic partnerships.

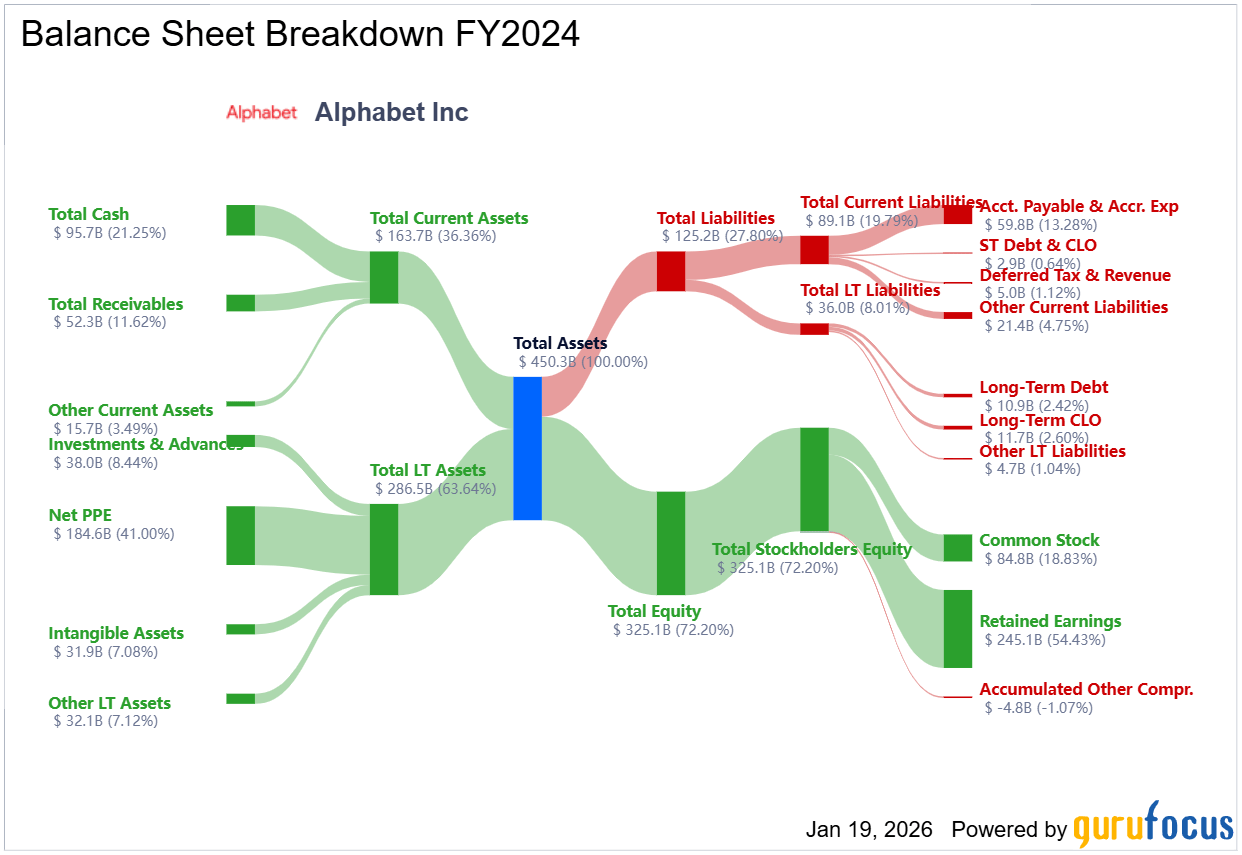

Strong balance sheet and profitability provide flexibility to invest aggressively while returning capital to shareholders.

Weaknesses

Regulatory scrutiny remains a persistent overhang across multiple jurisdictions.

Heavy capital expenditures in AI and infrastructure could pressure margins in weaker macro environments.

Earnings reactions can be volatile given the stock’s size and elevated expectations.

Potential

AI monetization through Gemini, cloud services, and enterprise solutions could unlock a new growth cycle.

Waymo’s expansion positions Alphabet as a leader in autonomous mobility over the next decade.

Continued operating leverage could drive earnings growth faster than revenue for years to come.

TODAY’S SPONSOR

Dashboards Aren’t Direction. You Still Make the Call.

Automation can generate reports, but sound financial leadership still requires human judgment.

The Future of Financial Leadership is a free guide that explores why BELAY Financial Solutions focus on human expertise to help leaders make confident, informed decisions.

Conclusion

Alphabet stands as one of the most strategically positioned companies in the global technology landscape.

Short-term earnings outcomes matter far less than its sustained leadership in AI, cloud, and digital media.

For patient investors, the stock remains a compelling long-term holding rather than a tactical trade.

Final Thought

The real question is not whether Alphabet beats expectations on Feb. 4.

The real question is whether owning a dominant AI-driven ecosystem for the next five years fits your investment strategy.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply