- StocksGeniusMastery

- Posts

- 💥AMD’s AI Revolution Is Just Beginning — Why the Stock Could Soar Beyond $300

💥AMD’s AI Revolution Is Just Beginning — Why the Stock Could Soar Beyond $300

Wall Street is underestimating AMD’s role in the trillion-dollar AI infrastructure boom.

Hi Fellow Investors,

Advanced Micro Devices (NASDAQ: AMD) is quietly preparing for one of the most important product launches in its history — a move that could reshape the AI infrastructure market over the next five years.

Partnerships with OpenAI and Oracle have turned AMD into a legitimate contender to Nvidia’s dominance in AI compute.

With next-generation hardware, new software breakthroughs, and massive demand from data centers, AMD is setting the stage for a transformative growth cycle.

Key Points:

AMD’s expanding partnerships with OpenAI and Oracle are strengthening its position in global AI infrastructure.

The company’s ROCm 7 software stack is driving record adoption across enterprise AI workloads.

The upcoming Helios rack-scale system could redefine AMD’s growth trajectory in 2026 and beyond.

TODAY’S SPONSOR

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

AMD: From Challenger to Contender in the AI Race

The global AI infrastructure boom is creating massive demand for advanced chips, and AMD is rapidly emerging as the leading alternative to Nvidia.

Its EPYC processors and Instinct GPU lineup are now being adopted across hyperscaler data centers, sovereign AI programs, and enterprise-level AI clusters.

The company’s multiyear agreement with OpenAI — involving six gigawatts of compute capacity powered by next-gen Instinct 450 GPUs — solidifies its presence at the top of the AI supply chain.

Meanwhile, Oracle’s plans to deploy tens of thousands of AMD GPUs further validate its technological strength.

As AI workloads continue to explode globally, AMD’s strategy of combining high-performance compute with open software is proving to be a winning formula.

ROCm 7: The Secret Weapon Behind AMD’s Acceleration

AMD’s open-source ROCm 7 software stack is quietly becoming one of the company’s biggest competitive advantages.

Compared with the previous ROCm 6 version, performance on inference workloads improved by 4.6x and training speeds tripled.

This leap in efficiency has led to broader adoption among AI developers, giving AMD a much-needed ecosystem foothold once dominated by Nvidia’s CUDA platform.

By enabling developers to seamlessly optimize workloads across its GPUs, AMD is ensuring that ROCm 7 becomes a key driver of enterprise loyalty and performance gains.

This strategic bet on open software could be the cornerstone of AMD’s AI dominance over the coming decade.

Helios: AMD’s Game-Changer for 2026

Set for launch in 2026, AMD’s Helios rack-scale systems will combine EPYC CPUs, Instinct GPUs, and Pensando networking into a single, optimized architecture.

Helios is engineered for energy efficiency, high density, and scalability — precisely what hyperscalers need to handle next-generation AI clusters.

Early demand indicators suggest that large enterprises and government AI programs are already lining up for early access.

By uniting compute, networking, and cooling into one tightly integrated platform, AMD could unlock a significant share of the $6.7 trillion data center market expected by 2030.

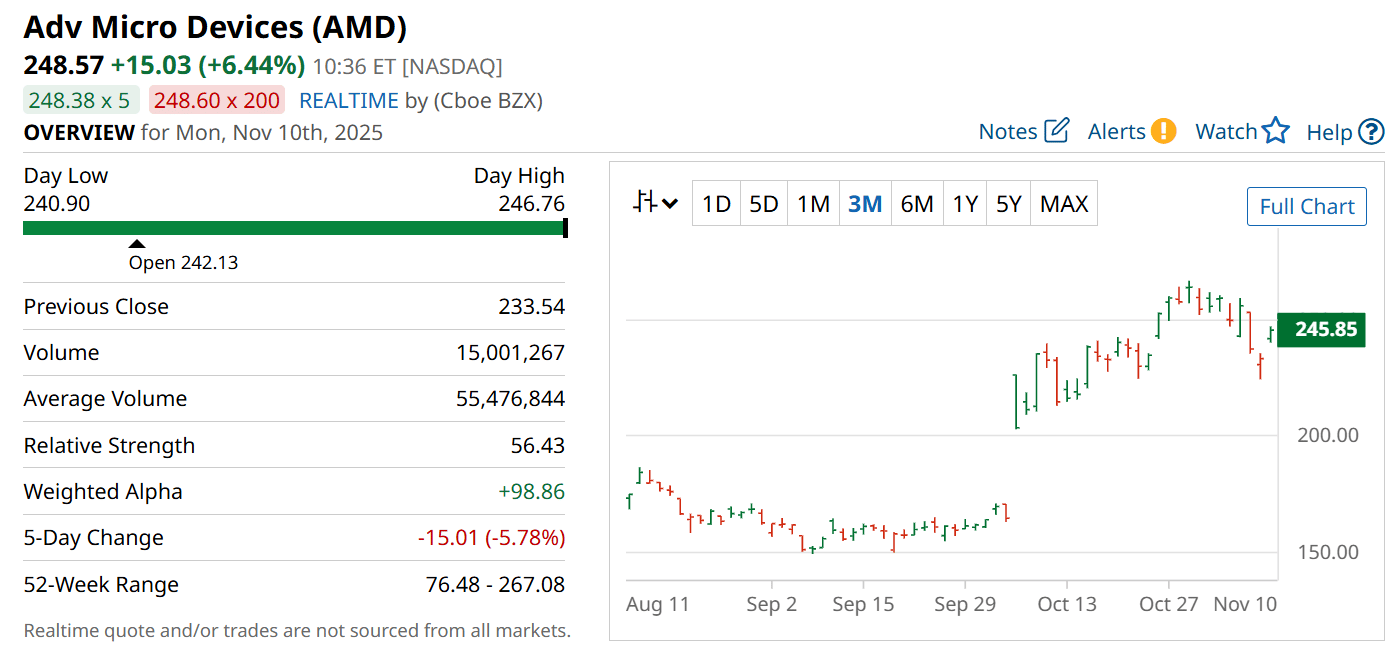

The market’s response has been enthusiastic, pushing AMD’s valuation higher despite broader tech volatility.

Strengths

Deep partnerships with OpenAI and Oracle give AMD early access to high-demand AI workloads.

ROCm 7’s massive performance leap makes AMD’s GPUs more competitive than ever.

Helios systems create an integrated ecosystem that optimizes power, cooling, and performance.

Weaknesses

AMD still trails Nvidia in developer adoption and CUDA-based ecosystem penetration.

High R&D expenses could pressure margins during the initial Helios rollout.

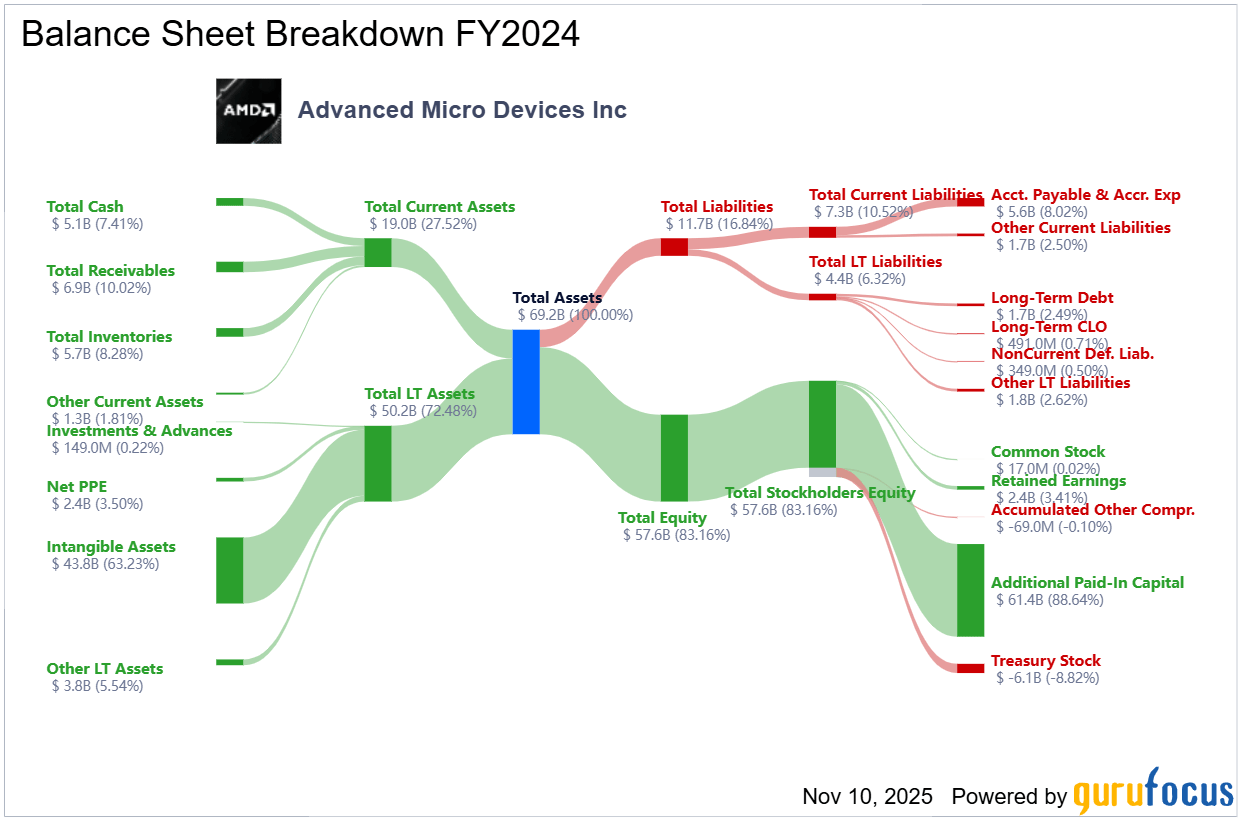

The stock trades at 13.3 times sales — a premium valuation compared to its five-year average.

Potential

Rapid AI infrastructure expansion could multiply AMD’s data center revenue by 2–3x by 2030.

ROCm 7 and Helios could position AMD as a dominant second source in the global AI chip market.

If execution remains strong, AMD’s valuation could easily climb past $300 within the next 24 months.

TODAY’S SPONSOR

An AI scheduling assistant that lives up to the hype.

Skej is an AI scheduling assistant that works just like a human. You can CC Skej on any email, and watch it book all your meetings. Skej handles scheduling, rescheduling, and event reminders. Imagine life with a 24/7 assistant who responds so naturally, you’ll forget it’s AI.

Conclusion

AMD’s Helios systems mark a bold, forward-looking step in redefining the AI hardware landscape.

With deep partnerships, breakthrough software, and unmatched integration capabilities, the company appears poised for substantial long-term growth.

Investors betting on the AI revolution should not overlook AMD’s accelerating momentum.

Final Thought

Every AI cycle creates new winners.

The real question is — when the dust settles, will AMD emerge as the true challenger to Nvidia’s crown?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply