- StocksGeniusMastery

- Posts

- 💥AMD’s OpenAI Deal Just Changed the AI Chip Game

💥AMD’s OpenAI Deal Just Changed the AI Chip Game

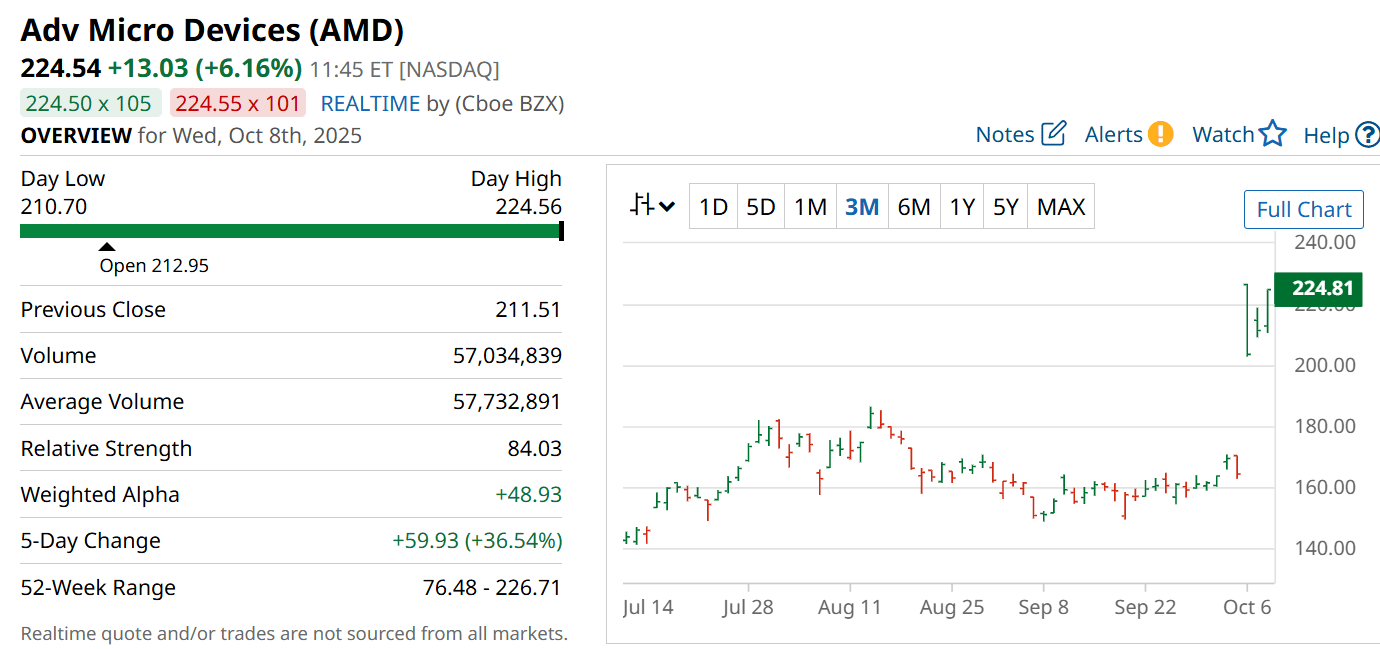

Nvidia’s biggest rival is gearing up for a delayed but massive revenue surge from its Instinct and Helios systems.

Hi Fellow Investors,

Advanced Micro Devices (NASDAQ: AMD) just landed a game-changing artificial intelligence partnership with OpenAI.

But while the market is celebrating, investors need to understand that the real windfall is still a year away.

This deal could eventually reshape the AI hardware race — if you’re patient enough to wait for it.

Key Points:

AMD’s OpenAI contract won’t generate major revenue until late 2026, with full acceleration expected in 2027.

The partnership could add more than $100 billion in new sales over the next few years.

AMD’s Instinct chips offer unique power efficiency that could lure other AI giants like Meta and Alphabet.

TODAY’S SPONSOR

How Canva, Perplexity and Notion turn feedback chaos into actionable customer intelligence

Support tickets, reviews, and survey responses pile up faster than you can read.

Enterpret unifies all feedback, auto-tags themes, and ties insights to revenue, CSAT, and NPS, helping product teams find high-impact opportunities.

→ Canva: created VoC dashboards that aligned all teams on top issues.

→ Perplexity: set up an AI agent that caught revenue‑impacting issues, cutting diagnosis time by hours.

→ Notion: generated monthly user insights reports 70% faster.

Stop manually tagging feedback in spreadsheets. Keep all customer interactions in one hub and turn them into clear priorities that drive roadmap, retention, and revenue.

The OpenAI Partnership: Big Promise, Bigger Patience

Advanced Micro Devices (NASDAQ: AMD) has finally entered the AI big leagues with its landmark partnership with OpenAI.

The agreement marks a pivotal moment in the AI hardware race, positioning AMD as a credible alternative to Nvidia (NASDAQ: NVDA).

However, investors eager for instant results may be disappointed — revenue from this collaboration won’t begin until the second half of 2026.

That’s because AMD must first build out its Instinct MI450 and Helios rack systems to gigawatt-scale capacity before shipments start rolling.

When the ramp-up begins in 2027, though, the payoff could be enormous — potentially adding double-digit billions in annual data center sales.

A $100 Billion AI Superhighway in the Making

AMD’s deal isn’t just about selling chips — it’s about constructing a 6-gigawatt AI infrastructure pipeline that rivals Nvidia’s ecosystem.

Management expects over $100 billion in incremental sales through the combined OpenAI contract and follow-on demand from other AI companies.

Each new lane of the “AI superhighway” — powered by Instinct accelerators and Helios systems — represents billions in recurring revenue potential.

OpenAI’s purchase structure even includes performance-based stock warrants, giving it up to 10% ownership in AMD if key milestones are met.

It’s an unprecedented deal that aligns incentives, locks in long-term collaboration, and validates AMD’s standing as an AI powerhouse in waiting.

A Nonexclusive Deal Opens the Floodgates

Here’s the real kicker: this OpenAI partnership is nonexclusive.

That means AMD can sell its MI450 and Helios products to anyone — and OpenAI is still free to buy from Nvidia or other suppliers.

This move signals the AI industry’s transition toward a multivendor era, where cost efficiency and power optimization matter as much as raw performance.

While Nvidia’s Blackwell GPUs still dominate benchmarks, AMD’s energy-efficient architecture could become the go-to option for companies looking to lower total AI compute costs.

If Meta, Alphabet’s Google, or Anthropic follow OpenAI’s lead, the ripple effect could accelerate AMD’s market share gains well beyond current projections.

Strengths

The OpenAI deal positions AMD as a top-tier AI player with over $100 billion in potential long-term sales.

Instinct MI450 and Helios racks deliver superior power efficiency, making them cost-effective alternatives to Nvidia GPUs.

Performance-based stock warrants with OpenAI align both companies’ growth incentives over the next five years.

Weaknesses

Revenue realization won’t begin until late 2026, testing investor patience.

Nvidia still holds a strong performance advantage in AI compute benchmarks.

Complex buildout requirements could delay AMD’s revenue ramp-up if supply chains tighten.

Potential

AMD could see explosive growth once Instinct and Helios systems reach full deployment in 2027.

The nonexclusive deal opens the door for additional billion-dollar partnerships with major tech players.

Growing AI demand could make AMD a dominant supplier in the global data center accelerator market.

TODAY’S SPONSOR

The Simplest Way to Create and Launch AI Agents and Apps

You know that AI can help you automate your work, but you just don't know how to get started.

With Lindy, you can build AI agents and apps in minutes simply by describing what you want in plain English.

From inbound lead qualification to AI-powered customer support and full-blown apps, Lindy has hundreds of agents that are ready to work for you 24/7/365.

Stop doing repetitive tasks manually. Let Lindy automate workflows, save time, and grow your business.

Conclusion

AMD’s partnership with OpenAI marks the beginning of a massive transformation in the AI chip industry.

While the payoff won’t come overnight, this alliance gives AMD the credibility, scale, and financial runway to compete head-to-head with Nvidia in the long term.

For investors willing to wait through 2026, the coming years could deliver a surge in AI-driven profitability unlike anything AMD has seen before.

Final Thought

Patience may be the hardest virtue for investors — but in AMD’s case, it could also be the most rewarding.

When the AI superhighway finally opens, the traffic could be all AMD.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply