- StocksGeniusMastery

- Posts

- 💥AMD’s Stock Has Doubled — But the Smart Money Says It’s Still Cheap

💥AMD’s Stock Has Doubled — But the Smart Money Says It’s Still Cheap

The AI chipmaker’s growth, valuation, and partnerships signal that the story is only getting started.

Hi Fellow Investors,

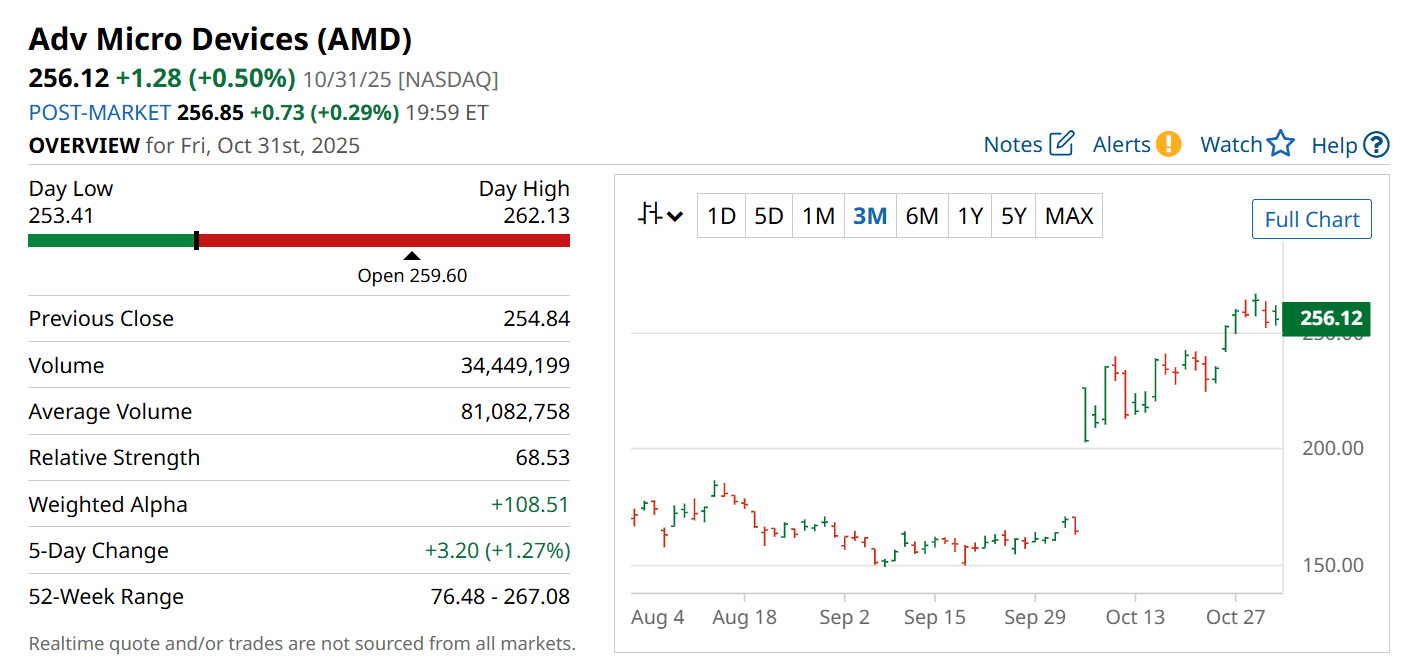

Advanced Micro Devices (NASDAQ: AMD) has more than doubled in 2025, yet analysts believe the rally is far from over.

AI has transformed the semiconductor landscape — and AMD’s position is stronger than ever.

Here’s why investors may still be early to one of the decade’s biggest tech stories.

Key Points:

AMD’s AI-driven growth is accelerating with new high-margin opportunities.

Strategic partnerships with OpenAI and IBM are fueling massive potential demand.

Despite its surge, AMD’s valuation still looks attractive for long-term investors.

TODAY’S SPONSOR

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

AMD’s AI Business Is Just Getting Started

For years, Nvidia (NASDAQ: NVDA) dominated the AI hardware narrative.

But 2025 has shifted the spotlight.

AMD’s chip business is now delivering strong double-digit revenue growth — a major reversal from its slow start in earlier AI cycles.

This isn’t just catch-up growth.

AMD’s AI chips are gaining credibility among top enterprise clients, signaling real traction in the market.

As CEO Lisa Su positions AMD to capture billions in AI-related sales, the company’s transformation is clearly underway.

Big-Name Partnerships Are Fueling AMD’s Growth Story

OpenAI — the creator of ChatGPT — has become a strategic partner and may even acquire a 10% stake in AMD.

That kind of endorsement is a credibility rocket.

IBM’s validation adds another layer, with AMD’s chips now being tested for quantum computing applications.

Each collaboration cements AMD’s reputation as a serious rival to Nvidia in the world’s fastest-growing tech sector.

With these relationships expanding, AMD’s AI momentum could only be in its first inning.

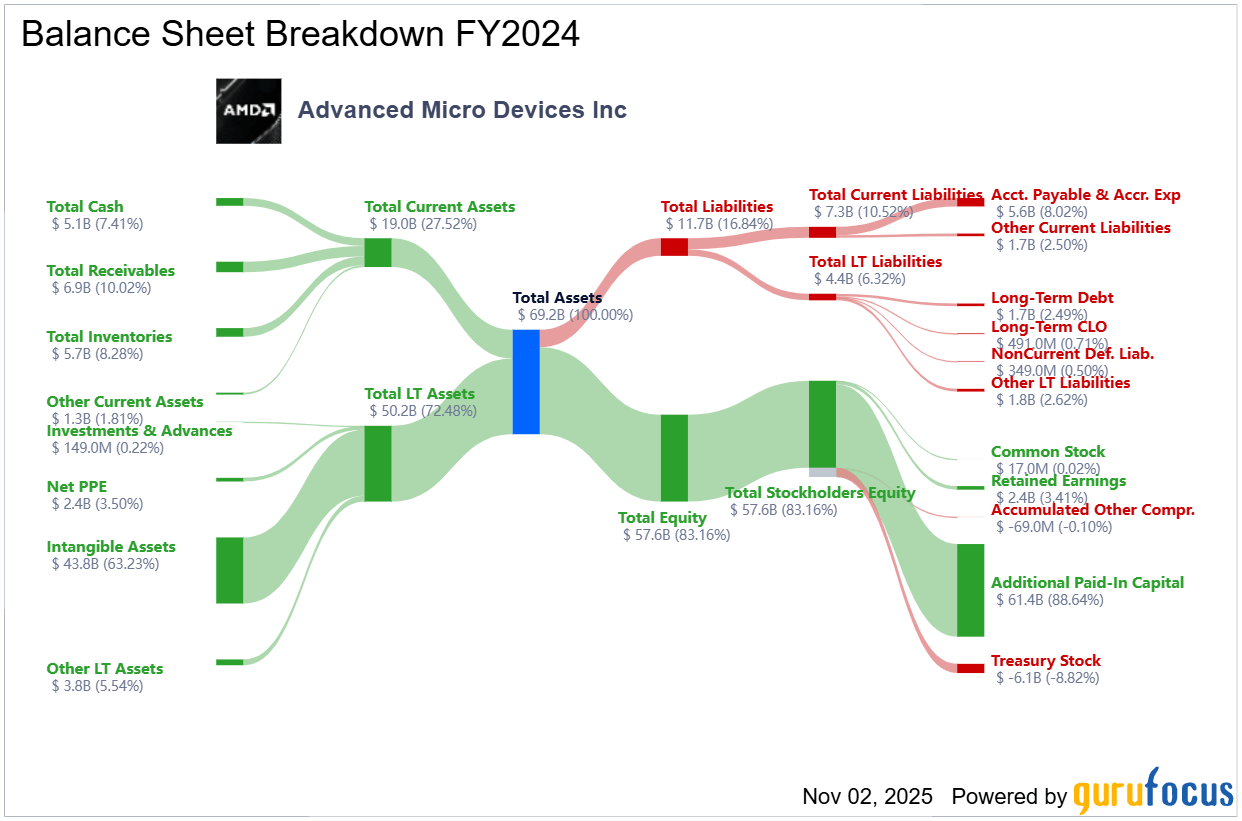

Why AMD’s Valuation Still Looks Cheap

On paper, AMD’s trailing price-to-earnings ratio of 160 looks sky-high.

But growth investors know that the forward P/E — below 29 — paints a far more realistic picture.

More importantly, AMD’s PEG ratio sits around 0.5, suggesting that the market may still be underestimating its earnings potential.

The company’s long-term earnings trajectory, powered by AI and data center demand, could make today’s price seem like a bargain in hindsight.

When Lisa Su says billions in AI revenue are coming, it’s worth paying attention.

Strengths

Explosive AI growth pipeline backed by industry-leading partnerships and innovation.

Forward P/E and PEG ratios that signal undervaluation versus peers.

CEO Lisa Su’s proven execution and visionary AI roadmap.

Weaknesses

Intense competition from Nvidia’s entrenched ecosystem.

Volatility in chip demand tied to cyclical semiconductor trends.

Premium valuation may limit short-term upside.

Potential

Potential $1 trillion market cap within years if AI adoption continues at current pace.

OpenAI and IBM partnerships could unlock multibillion-dollar new revenue streams.

Expanding AI chip production and quantum computing opportunities position AMD as a next-generation semiconductor leader.

TODAY’S SPONSOR

Turn AI into Your Income Engine

Ready to transform artificial intelligence from a buzzword into your personal revenue generator

HubSpot’s groundbreaking guide "200+ AI-Powered Income Ideas" is your gateway to financial innovation in the digital age.

Inside you'll discover:

A curated collection of 200+ profitable opportunities spanning content creation, e-commerce, gaming, and emerging digital markets—each vetted for real-world potential

Step-by-step implementation guides designed for beginners, making AI accessible regardless of your technical background

Cutting-edge strategies aligned with current market trends, ensuring your ventures stay ahead of the curve

Download your guide today and unlock a future where artificial intelligence powers your success. Your next income stream is waiting.

Conclusion

AMD has transformed from an underdog to one of AI’s most compelling investment opportunities.

Its growth story, valuation strength, and expanding partnerships suggest it could be one of the top long-term buys in the tech sector today.

For investors with patience and conviction, AMD may still be in the early stages of a remarkable multi-year run.

Final Thought

If AMD can sustain its AI growth trajectory while deepening partnerships with leaders like OpenAI, could this be the decade it surpasses Nvidia as the world’s top chipmaker?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply