- StocksGeniusMastery

- Posts

- 💥Analysts Reveal Nvidia’s Potential 2026 Valuation — and It’s Bigger Than You Think

💥Analysts Reveal Nvidia’s Potential 2026 Valuation — and It’s Bigger Than You Think

A $5.9 trillion market cap isn’t out of reach as data center spending reshapes the AI landscape.

Hi Fellow Investors,

Nvidia (NASDAQ: NVDA) has dominated the AI revolution for three straight years.

Its chips power the data centers and models driving the next generation of artificial intelligence.

Now, analysts say Nvidia’s meteoric run may just be getting started.

Key Points:

Nvidia could reach a $5.9 trillion market cap by 2026 if AI infrastructure spending continues accelerating.

Wall Street projects fiscal 2027 revenue near $294 billion — a massive leap from 2025’s expectations.

With dominant market share and unmatched demand visibility, Nvidia’s long-term growth story remains powerful.

TODAY’S SPONSOR

CTV ads made easy: Black Friday edition

As with any digital ad campaign, the important thing is to reach streaming audiences who will convert. Roku’s self-service Ads Manager stands ready with powerful segmentation and targeting — plus creative upscaling tools that transform existing assets into CTV-ready video ads. Bonus: we’re gifting you $5K in ad credits when you spend your first $5K on Roku Ads Manager. Just sign up and use code GET5K. Terms apply.

The AI Catalyst That Keeps Feeding Nvidia’s Growth

No company has benefited more from the AI spending boom than Nvidia.

Its GPUs — originally designed for gaming — now serve as the backbone for global AI computing.

From data modeling to drug discovery, Nvidia’s chips power industries once limited by computational capacity.

And AI data center demand is only accelerating.

Nvidia estimates data center capital expenditures will rise from $600 billion in 2025 to as much as $4 trillion by 2030.

That’s not just optimism — multiple tech giants have confirmed the scale of that demand.

Nvidia doesn’t just participate in the AI boom — it dominates it.

For every $50 billion spent building a data center, Nvidia captures roughly $35 billion in GPU sales.

That’s an extraordinary share of global infrastructure value.

And since data centers take years to complete, Nvidia’s sales pipeline stretches well into the future.

This means Nvidia has a real-time window into future chip demand that no rival can match.

When Nvidia forecasts growth, investors listen.

How High Could Nvidia’s Stock Go by 2026?

If data center investment grows at a 42% CAGR through 2030 — the midpoint of Nvidia’s projection — Wall Street’s forecast looks conservative.

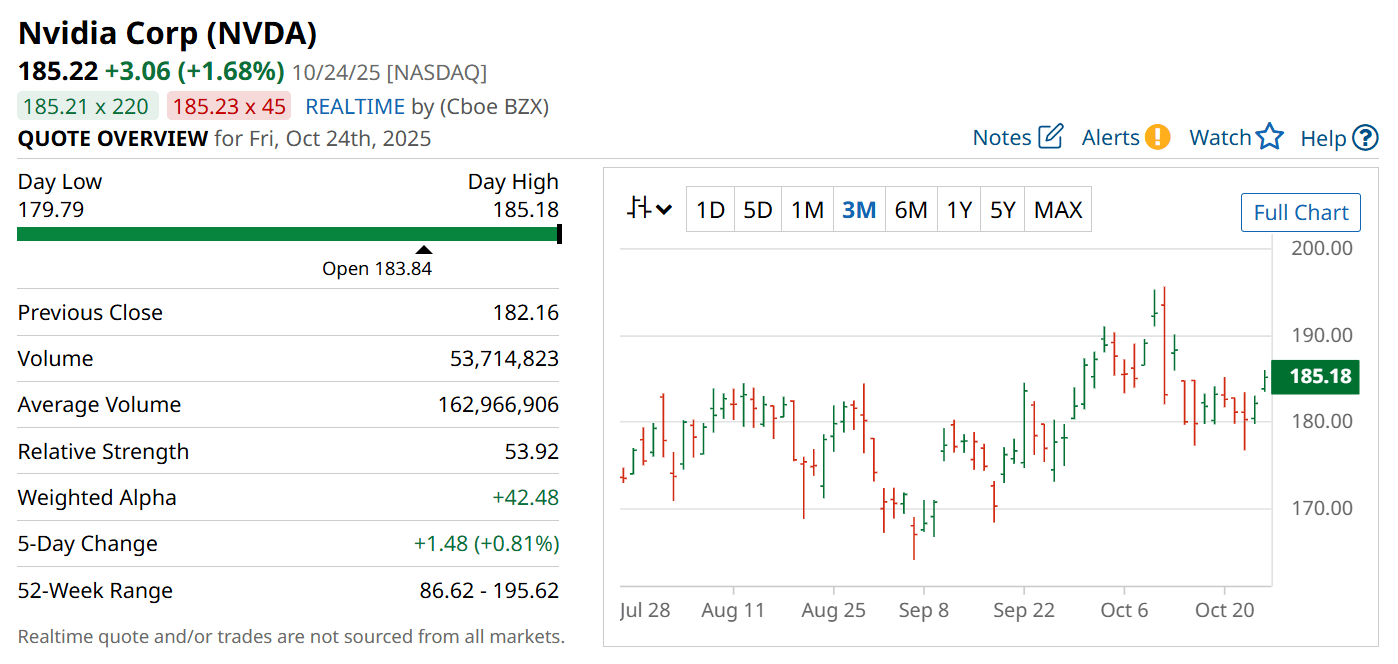

Analysts expect $207 billion in FY2026 revenue and $294 billion in FY2027, reflecting staggering momentum.

Assuming Nvidia maintains its 50% profit margin and trades at a 40x P/E, the math suggests a $5.9 trillion valuation.

That equates to roughly $241 per share, up sharply from today’s $182.

For investors seeking exposure to the AI infrastructure backbone, Nvidia’s growth path remains unmatched.

Strengths

Dominant GPU market share gives Nvidia pricing power and long-term demand visibility.

AI data center expansion through 2030 fuels continued revenue acceleration.

Best-in-class margins and brand credibility solidify its leadership in high-performance computing.

Weaknesses

Dependence on AI infrastructure spending leaves Nvidia vulnerable to macro slowdowns.

Valuation remains rich, demanding flawless execution to justify forward multiples.

Intense competition from AMD and custom AI chipmakers could pressure market share.

Potential

If AI data center investment sustains its projected CAGR, Nvidia could surpass Apple’s valuation by 2026.

Ongoing software and AI model integration may open recurring-revenue opportunities.

Strategic partnerships with hyperscalers could extend Nvidia’s lead deep into the next decade.

TODAY’S SPONSOR

How Canva, Perplexity and Notion turn feedback chaos into actionable customer intelligence

You’re sitting on a goldmine of feedback: tickets, surveys, reviews, but can’t mine it.

Manual tagging doesn’t scale, and insights fall through the cracks.

Enterpret’s AI unifies all feedback, auto‑tags themes, and ties them to revenue/CSAT, surfacing what matters to customers.

The result: faster decisions, clearer priorities, and stronger retention.

Conclusion

Nvidia’s growth trajectory continues to defy limits — and 2026 may mark another record year.

With AI spending surging and its technology at the core of that transformation, Nvidia remains one of the most strategically positioned stocks on the planet.

Long-term investors should view any volatility as opportunity, not risk.

Final Thought

If Nvidia truly captures the AI infrastructure wave it helped create, will 2026 be the year it becomes the world’s most valuable company?

Only time — and silicon — will tell.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply