- StocksGeniusMastery

- Posts

- 💥Apple in 2026: Will New Products and AI Innovation Fuel a Breakout?

💥Apple in 2026: Will New Products and AI Innovation Fuel a Breakout?

New product cycles and AI expansion collide with valuation headwinds in a high-stakes year.

Hi Fellow Investors,

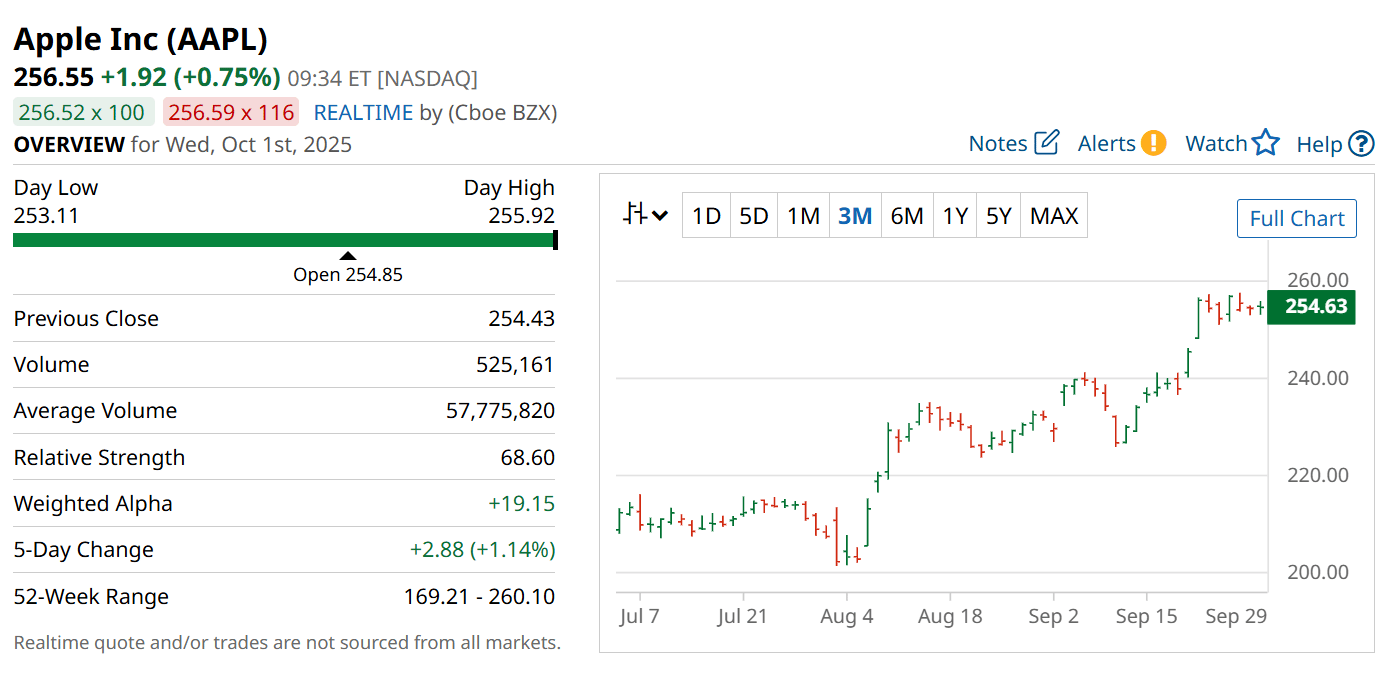

Apple (NASDAQ: AAPL) has rebounded strongly this year, with shares trading near record highs.

The launch of the iPhone 17 lineup, alongside AirPods Pro 3 and new Apple Watches, is creating buzz and boosting Wall Street confidence.

Yet with the stock still valued at a rich premium, investors are asking: where will Apple’s stock be one year from now?

Key Points:

Apple’s iPhone 17 launch is seeing stronger-than-expected demand.

Stock returns in the next year will likely hinge on valuation shifts.

Long-term strength lies in Apple’s brand dominance and consistent profits.

TODAY’S SPONSOR

The Simplest Way to Create and Launch AI Agents and Apps

You know that AI can help you automate your work, but you just don't know how to get started.

With Lindy, you can build AI agents and apps in minutes simply by describing what you want in plain English.

→ "Create a booking platform for my business."

→ "Automate my sales outreach."

→ "Create a weekly summary about each employee's performance and send it as an email."

From inbound lead qualification to AI-powered customer support and full-blown apps, Lindy has hundreds of agents that are ready to work for you 24/7/365.

Stop doing repetitive tasks manually. Let Lindy automate workflows, save time, and grow your business

iPhone 17 Demand Could Drive Near-Term Gains

Apple’s latest iPhone release has exceeded analyst expectations, with Wedbush Securities raising its price target to $310 on stronger upgrade activity.

Despite being nearly two decades old, the iPhone still accounts for almost half of Apple’s revenue, underscoring its importance to the business.

Strong iPhone 17 sales, alongside AirPods Pro 3 and new Watch models, could keep revenue momentum alive.

Integration with Apple Intelligence adds another catalyst, giving consumers more reason to upgrade.

If these launches resonate with customers, Apple could enjoy a favorable narrative on Wall Street heading into 2026.

Why Valuation Could Be the Biggest Risk

While product demand is healthy, the valuation question looms large.

Apple currently trades at a P/E ratio of 38.8, a steep 62% premium over its 10-year average.

In the short run, investor sentiment and market headlines drive stock prices more than fundamentals.

That means new launches, AI adoption, or even competitor moves could swing Apple’s valuation sharply.

If multiples contract, investors could face muted returns even with strong sales growth.

Brand Strength and Profitability Are the Long-Term Anchors

Regardless of near-term volatility, Apple’s brand remains one of the most valuable in the world.

Its ecosystem — spanning iPhones, wearables, Macs, and services — locks in customer loyalty across 3.8 billion devices.

Equally important, Apple generated $84.5 billion in net income in just nine months of fiscal 2025, proving its ability to produce massive profits.

These two factors — brand power and profitability — are the foundation of Apple’s long-term investment case.

Looking 12 months ahead, shares could track with the S&P 500 at around a 10% gain, but over five years, Apple’s fundamentals remain its biggest advantage.

Strengths

Apple’s brand is unmatched worldwide, creating a loyal customer base that keeps upgrading products across generations.

Massive profitability gives Apple flexibility, with $84.5 billion in net income in just nine months of fiscal 2025 fueling innovation and buybacks.

Integration of Apple Intelligence enhances the ecosystem, encouraging users to adopt the latest devices and strengthening switching costs.

Weaknesses

The stock trades at a hefty P/E premium, leaving little margin for error if growth slows or market sentiment shifts.

Heavy dependence on the iPhone creates concentration risk, with nearly half of revenue tied to one product line.

Competition in AI and hardware is intensifying, with rivals pushing aggressive innovation that could pressure market share.

Potential

The iPhone 17 cycle could spark stronger-than-expected revenue, driving short-term stock gains and boosting investor sentiment.

Apple Intelligence could become a major growth driver, opening new revenue streams across devices and services.

If valuation holds and profits continue to expand, Apple could see another year of market-beating performance and cement its $4 trillion-plus trajectory.

TODAY’S SPONSOR

Master ChatGPT for Work Success

ChatGPT is revolutionizing how we work, but most people barely scratch the surface. Subscribe to Mindstream for free and unlock 5 essential resources including templates, workflows, and expert strategies for 2025. Whether you're writing emails, analyzing data, or streamlining tasks, this bundle shows you exactly how to save hours every week.

Conclusion

Apple has rebounded strongly, and the iPhone 17 cycle provides a fresh catalyst heading into 2026.

But with valuations stretched, investors will need to weigh near-term risks against Apple’s unrivaled brand and profit engine.

For those with a long-term horizon, Apple remains one of the most compelling tech investments on the market.

Final Thought

Apple’s next year may hinge on valuation swings, but its brand and profitability will decide its place in the market for the decade ahead.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply