- StocksGeniusMastery

- Posts

- 💥At Market Highs Again? These 3 AI Leaders Still Offer Massive Upside

💥At Market Highs Again? These 3 AI Leaders Still Offer Massive Upside

Hi Fellow Investors,

The stock market continues pushing toward record territory.

Many investors are wondering whether this is still the right moment to buy.

Yet the data shows that major artificial intelligence leaders are entering another growth phase.

And three companies—Nvidia (NASDAQ: NVDA), Taiwan Semiconductor Manufacturing (NYSE: TSM), and Alphabet (NASDAQ: GOOG)—stand out as top opportunities heading into 2026.

Key Points:

Nvidia’s massive chip backlog signals another year of explosive AI-driven revenue growth.

Taiwan Semiconductor’s new 2nm node could reshape the energy economics of global AI data centers.

Alphabet’s resurgence highlights its strengthening dominance across multiple AI verticals.

TODAY’S SPONSOR

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for HNW entrepreneurs and executives. No membership fees. What’s inside:

Self-made professionals, 30-55 years old, $5M-$100M net worth

Confidential discussions, peer advisory groups, live meetups

Institutional-grade investments, $100M+ invested annually

Nvidia: The Core Engine Behind the AI Supercycle

Nvidia has become the defining force of modern AI infrastructure.

Its GPUs continue powering the majority of global accelerated computing workloads.

A rising mix of hardware performance and unmatched software ecosystems keeps Nvidia ahead of rivals.

Revenue over the past year exceeded $187 billion, yet the company has already secured another $307 billion in contracted Blackwell and Rubin chip sales stretching through 2026.

That backlog suggests 2026 could deliver another leap in top-line growth as hyperscalers ramp spending.

If AI infrastructure investment continues at today’s trajectory, today’s price levels may look cheap in hindsight.

Why long-term investors shouldn’t wait to add these tech titans.

Strengths

Massive multiyear chip backlog underscores unmatched demand for Nvidia’s next-generation architectures.

Software leadership via CUDA and enterprise platforms creates a moat rivals struggle to penetrate.

Dominant positioning in hyperscale AI deployments provides continual growth visibility.

Weaknesses

Heavy hyperscaler concentration exposes revenue to spending cycles among a small group of megacustomers.

Intensifying competition from AMD and custom silicon increases risk of future market share erosion.

Valuation remains elevated, requiring persistent execution to maintain investor confidence.

Potential

Expansion into AI inference, robotics, and edge computing could unlock entirely new growth vectors.

Global data center power constraints may accelerate demand for Nvidia’s increasingly efficient architectures.

Continued leadership in foundational AI chips positions Nvidia to benefit from every stage of the AI boom.

Taiwan Semiconductor Manufacturing: The Power Source of the Global AI Buildout

Taiwan Semiconductor remains the premier manufacturer for cutting-edge chips used across the AI ecosystem.

As a critical partner for Nvidia and other top-tier designers, TSMC sits at the center of the semiconductor value chain.

Its new 2nm process node introduces sizable efficiency gains that directly address data centers’ energy bottlenecks.

Chips produced at equal performance to 3nm variants can reduce power consumption by roughly 25% to 30%.

With energy capacity becoming a major limiter of global AI deployment, this optimization is a game changer.

As TSMC begins charging premium pricing for next-generation nodes, long-term revenue durability appears exceptionally strong.

Strengths

Industry-leading process technology cements TSMC as the indispensable foundry for advanced AI chips.

Significant power efficiency gains in 2nm manufacturing directly support hyperscaler expansion needs.

Highly diversified customer base ensures strong and recurring demand for premium wafer production.

Weaknesses

Heavy reliance on global geopolitical stability creates inherent operational risk.

Capital-intensive manufacturing cycles can pressure margins during downturns.

Client concentration among a handful of top chip designers introduces revenue fluctuation exposure.

Potential

Expansion into 2nm and eventually 1.4nm nodes positions TSMC to dominate next-gen chip production.

Strong pricing power on advanced nodes could unlock meaningful margin expansion.

AI demand growth into 2026 and beyond should drive sustained high-capacity utilization across fabs.

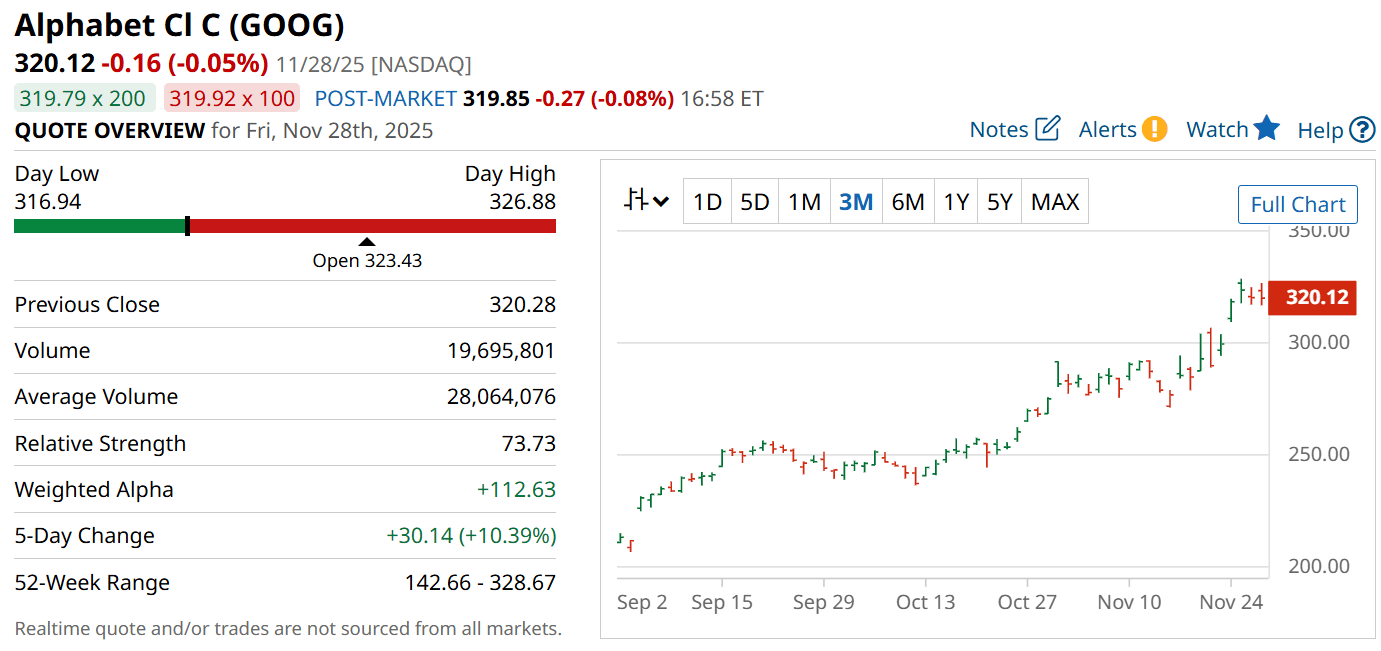

Alphabet: A Revalued AI Powerhouse Hitting Its Stride Again

Alphabet is regaining its rightful place among AI market leaders.

Despite early skepticism about its competitive position, recent financial results signal renewed momentum.

Search remains exceptionally strong, growing revenue 15% year over year despite perceived chatbot threats.

Companywide revenue increased 16% while earnings surged 35%, placing Alphabet among the fastest-growing trillion-dollar companies.

While valuation has expanded to roughly 29 times forward earnings, sentiment is shifting from caution to recognition of Alphabet’s durable advantages.

As AI initiatives scale across cloud, search, and productivity tools, the company appears well-positioned for further gains.

Strengths

Diversified AI leadership spanning cloud, software, and foundational model development.

Search revenue continues accelerating, defying expectations of generative AI disruption.

Exceptional profitability gives Alphabet massive reinvestment capacity across AI infrastructure.

Weaknesses

Higher valuation raises concern about future multiple compression if growth slows.

Legal and regulatory pressures continue to create long-term uncertainty.

Heavy cloud investments weigh on margins during early phases of infrastructure scaling.

Potential

Strengthening AI product integration across Search, YouTube, and Workspace could unlock multiyear revenue catalysts.

Cloud platform growth supported by AI infrastructure demand may accelerate margins over time.

Leadership in models, data, and compute puts Alphabet among the most leveraged winners of mainstream AI adoption.

TODAY’S SPONSOR

The Simplest Way To Create and Launch AI Agents

Imagine if ChatGPT, Zapier, and Webflow all had a baby. That's Lindy.

With Lindy, you can build AI agents and apps in minutes simply by describing what you want in plain English.

From inbound lead qualification to AI-powered customer support and full-blown apps, Lindy has hundreds of agents that are ready to work for you 24/7/365.

Stop doing repetitive tasks manually. Let Lindy automate workflows, save time, and grow your business.

Conclusion

AI spending is accelerating into 2026, and these three companies stand directly at the center of that investment wave.

Each holds a dominant competitive position with strong financial momentum behind it.

For long-term investors, these remain compelling opportunities even as markets push toward record highs.

Final Thought

Markets near all-time highs often hide some of the biggest opportunities.

The real question is whether investors will seize them while they’re still in plain sight.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply