- StocksGeniusMastery

- Posts

- 💥Better Buy for AI Investors: ASML or Taiwan Semiconductor?

💥Better Buy for AI Investors: ASML or Taiwan Semiconductor?

Both are critical to artificial intelligence, but one stock is positioned to deliver superior long-term gains.subtitle

Hi Fellow Investors,

The AI revolution isn’t just about big tech companies—it's also being shaped by the hidden powerhouses that make cutting-edge processors possible.

Two of the most essential players in this ecosystem are ASML and Taiwan Semiconductor.

ASML’s (NASDAQ: ASML) extreme ultraviolet lithography machines are irreplaceable in manufacturing the world’s most advanced chips, giving the Dutch company a technological edge few can match.

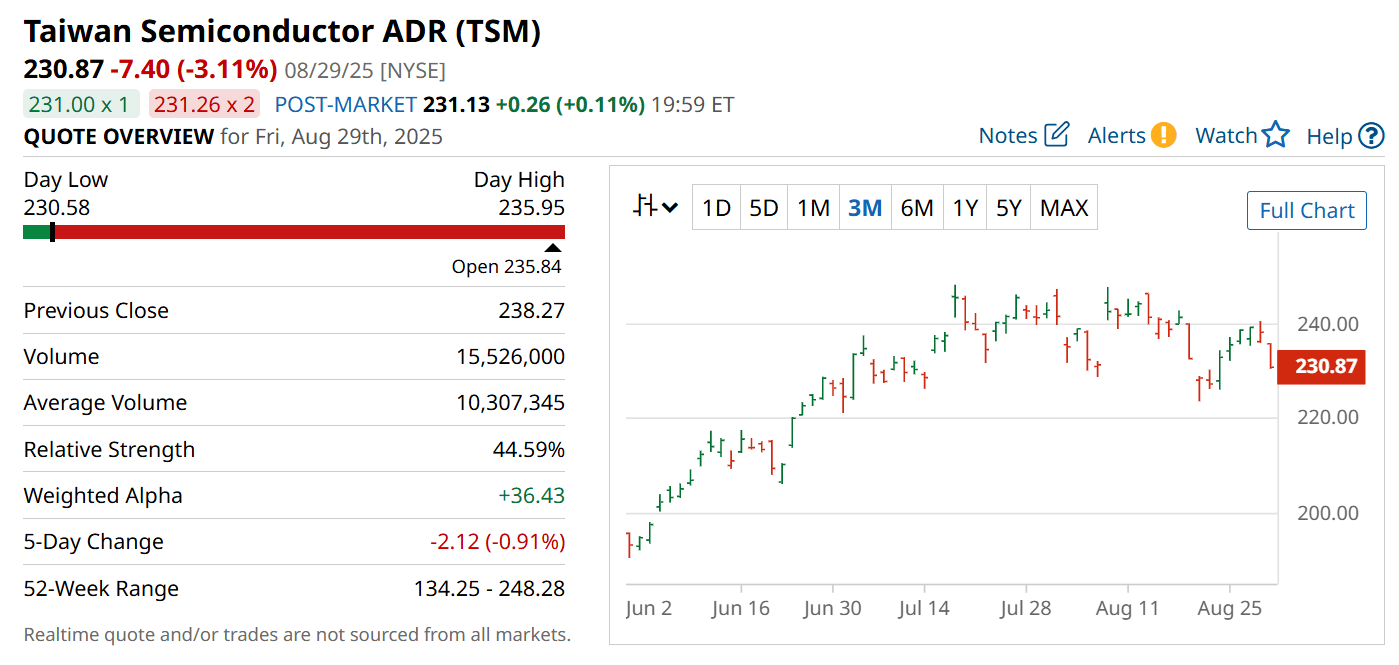

Meanwhile, Taiwan Semiconductor (NASDAQ: TSM) , better known as TSMC, dominates the global foundry space by producing processors for virtually every major AI leader.

Both companies are indispensable to the AI supply chain, but only one is delivering superior growth at this critical moment.

Investors looking to ride the AI megatrend must decide: Is ASML’s exclusivity or TSMC’s scale the better bet for the future?

Key Points:

ASML’s dominance in lithography makes it the sole supplier of extreme ultraviolet (EUV) machines, a technology critical for advanced AI chips.

Taiwan Semiconductor’s scale and leadership position it as the backbone of global AI processor production, serving giants like Apple, Nvidia, and AMD.

TSMC’s stronger revenue momentum suggests faster near-term growth, while ASML’s unique technology provides unmatched long-term leverage.

TODAY’S SPONSOR

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

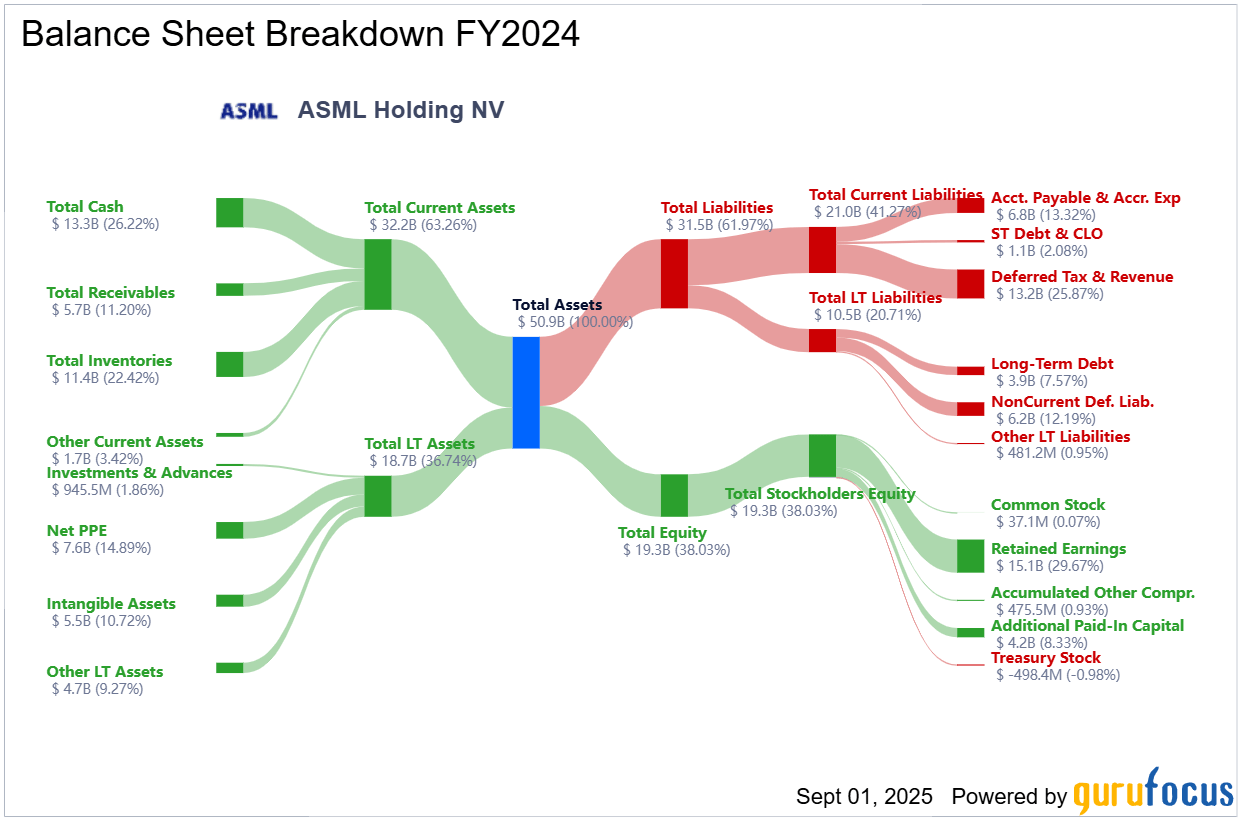

ASML: The Gatekeeper of Advanced Chipmaking

ASML holds one of the most powerful positions in the global semiconductor supply chain, thanks to its unmatched extreme ultraviolet (EUV) lithography machines.

These machines are essential for producing the world’s most advanced processors, and no chipmaker can move forward without them.

This exclusivity makes ASML a critical gatekeeper in the AI revolution.

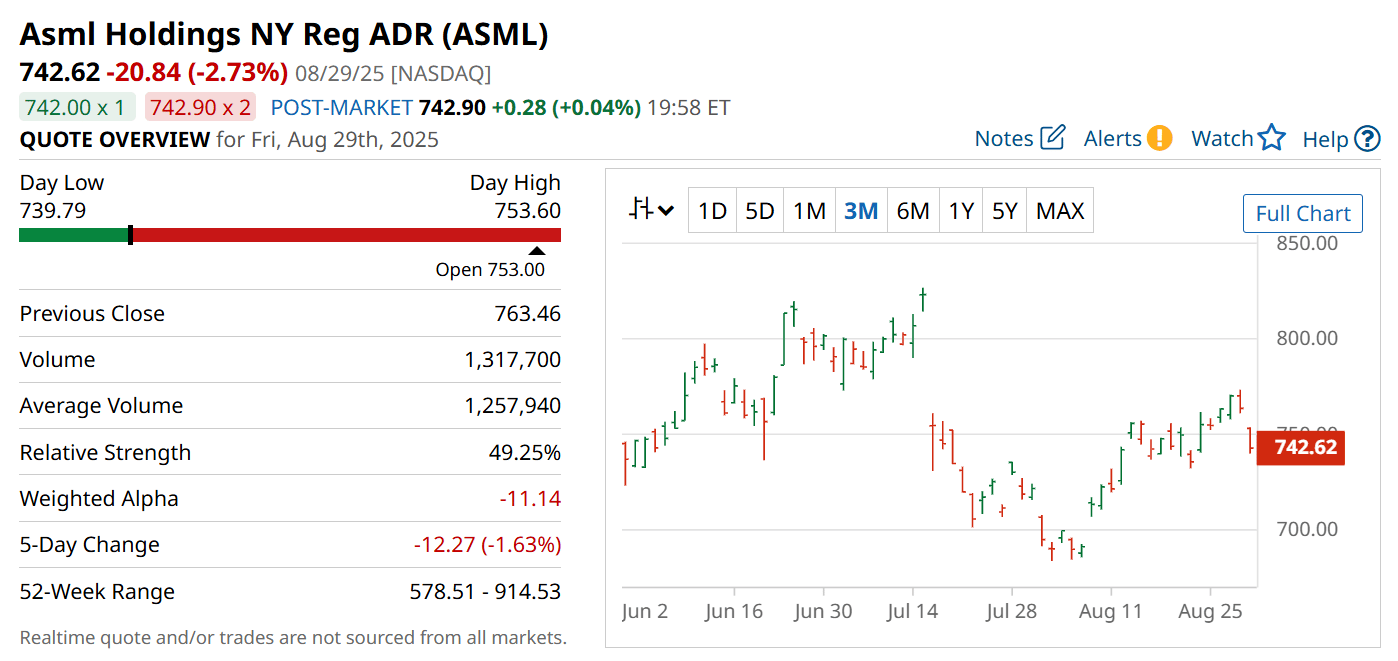

However, ASML’s growth trajectory is being tested by external pressures. Trade tensions, shifting tariffs, and macroeconomic uncertainty have cast doubt on its near-term outlook.

Management has already cut revenue guidance for the year, shaking investor confidence.

Shares have slipped over the past year as questions mount about whether the company can deliver consistent growth amid geopolitical headwinds.

Strengths

Unmatched monopoly: ASML is the only provider of EUV machines, making it indispensable to advanced chip manufacturing.

High barriers to entry: Its technology is nearly impossible for competitors to replicate, creating a durable moat.

Long-term AI leverage: Every chipmaker in the AI arms race ultimately depends on ASML’s machines.

Weaknesses

Tariff exposure: U.S.–China trade tensions threaten future growth and global demand.

Reduced sales guidance: Management has already trimmed revenue expectations, signaling near-term softness.

Stock under pressure: Shares have dropped double digits in the last year, reflecting investor skepticism.

Potential

Global AI expansion: As demand for AI processors accelerates, orders for EUV systems could surge.

Strategic indispensability: No other company can replace ASML, ensuring it remains at the center of the AI ecosystem.

Eventual recovery: Once macro and tariff headwinds ease, the company could regain strong growth momentum.

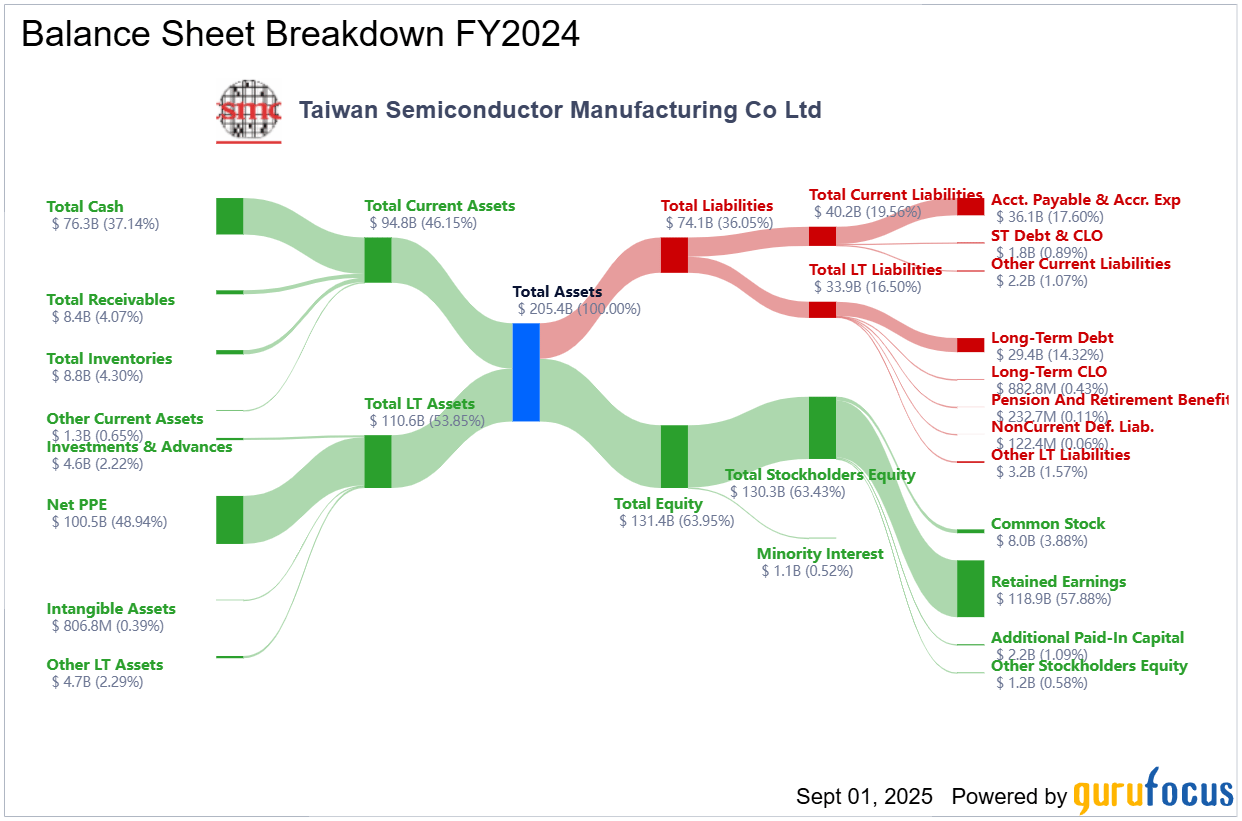

Taiwan Semiconductor: The AI Market’s Powerhouse

Taiwan Semiconductor Manufacturing Company (TSMC) dominates the global chipmaking landscape with an estimated 90% share of the advanced processor market.

This makes it the go-to partner for industry giants like Nvidia, Apple, and AMD.

Simply put, if there’s a groundbreaking AI processor powering the future, there’s a good chance TSMC made it.

The company’s results highlight its strength: double-digit revenue growth, soaring earnings, and accelerating demand from hyperscalers building out AI capacity.

Unlike ASML, which is facing uncertainty, TSMC continues to ride the wave of unprecedented processor demand.

With its stock already outperforming the S&P 500, TSMC’s momentum shows little sign of slowing.

Strengths

Market dominance: TSMC controls nearly all of the advanced AI processor market.

Explosive growth: Revenue and earnings are surging, fueled by soaring demand from AI giants.

Proven execution: The company consistently delivers on its financial targets, building investor confidence.

Weaknesses

Geopolitical risks: Taiwan’s location poses potential long-term security and stability concerns.

Heavy reliance on AI demand: Growth is heavily tied to continued AI investment cycles.

Capital intensity: Maintaining leadership requires massive, ongoing investments in new fabs.

Potential

Doubling AI sales: Management expects AI revenue to double, signaling strong demand pipelines.

Global expansion: New fabs in the U.S. and Japan could reduce geopolitical risks and expand reach.

Sustained leadership: As long as AI innovation requires cutting-edge processors, TSMC will stay in control.

The Clear Winner in the AI Race

While ASML is a technological marvel and an irreplaceable partner in chip manufacturing, its near-term growth story is clouded by tariffs and economic uncertainty.

TSMC, by contrast, is thriving in the here and now, with explosive growth, commanding market share, and unstoppable demand from the biggest names in AI.

Investors searching for the strongest play in the artificial intelligence supply chain will find TSMC better positioned to deliver superior returns over the next 12 months.

The company’s blend of scale, profitability, and dominance makes it the stock to beat in this AI showdown.

Conclusion

The AI boom is creating once-in-a-generation opportunities, but not all stocks are equal. TSMC has the sales momentum, scale, and leadership that set it apart as the superior play right now.

For investors eager to capture the next leg of AI-driven growth, Taiwan Semiconductor shines as the clear choice.

Final Thought

Artificial intelligence will reshape the global economy in the next decade—but will you own the companies powering its foundation, or just watch from the sidelines?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply