- StocksGeniusMastery

- Posts

- 💥Broadcom Just Got a Big Vote of Confidence: Here’s Why the Stock Climbed

💥Broadcom Just Got a Big Vote of Confidence: Here’s Why the Stock Climbed

Analysts are betting big on Broadcom’s AI future—and investors are taking notice.

Hello Fellow Investors!

Broadcom (NASDAQ: AVGO) is quietly emerging as one of Wall Street’s favorite AI chip plays, and investors just got fresh confirmation of that momentum.

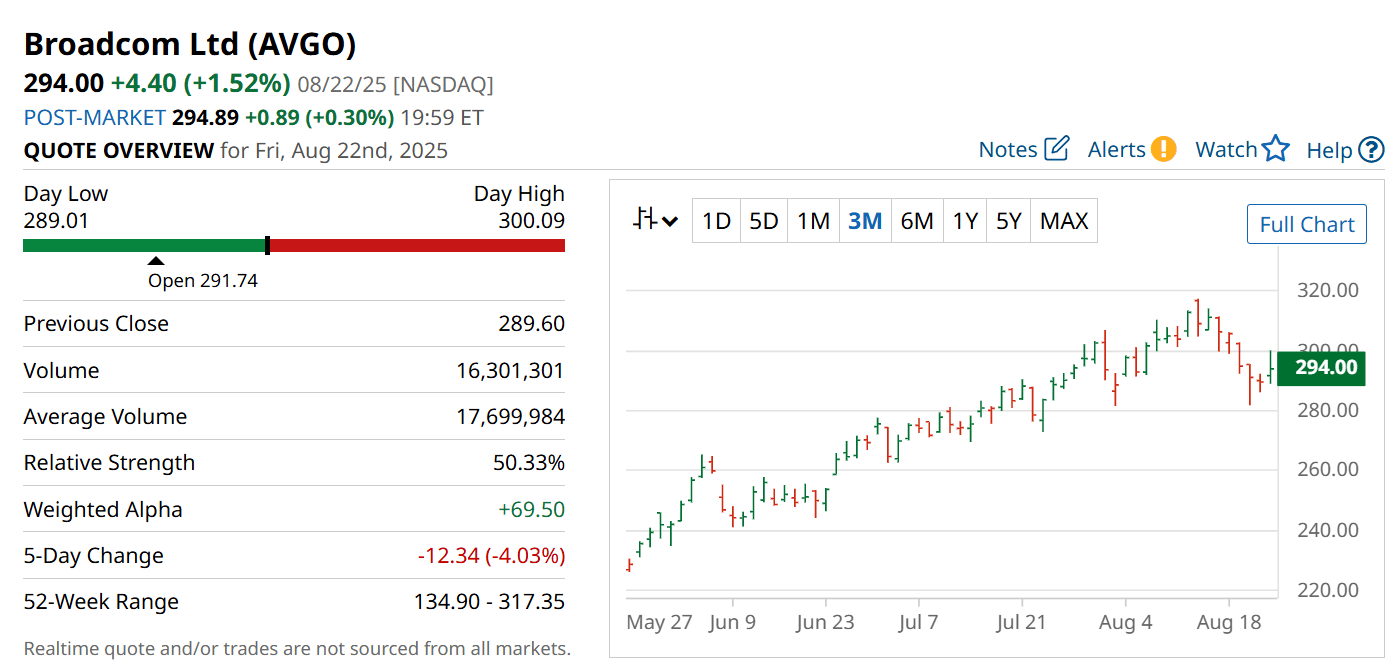

On Friday, Broadcom’s stock edged higher after an influential analyst boosted the company’s price target, signaling stronger confidence in its growth trajectory.

The upgrade adds to the bullish outlook surrounding its semiconductor lineup.

With artificial intelligence driving unprecedented demand for next-generation chips, Broadcom’s unique positioning could allow it to capture massive upside—potentially outpacing the broader market in the years ahead.

Key Points:

Broadcom shares gained 1.5% after an analyst raised the stock’s price target.

The bullish call reflects growing confidence in Broadcom’s dominance in AI-focused chips.

The move mirrors broader market strength, but Broadcom’s AI exposure makes it stand out.

TODAY’S SPONSOR

The Simplest Way To Create and Launch AI Agents

Imagine if ChatGPT and Zapier had a baby. That's Lindy.

With Lindy, you can build AI agents in minutes to automate workflows, save time, and grow your business. From inbound lead qualification to outbound sales outreach and web scraping agents, Lindy has hundreds of AI agents that are ready to work for you 24/7/365.

Stop doing repetitive tasks manually. Let Lindy's agents handle customer support, data entry, lead enrichment, appointment scheduling, and more while you focus on what matters most - growing your business.

Join thousands of businesses already saving hours every week with intelligent automation that actually works.

A Fresh Vote of Confidence Fuels Momentum

Broadcom captured Wall Street’s attention on Friday after a leading analyst raised the company’s price target from $300 to $315, while reiterating an overweight (buy) rating.

The move reflects growing optimism that Broadcom’s leadership in custom semiconductor solutions is only just beginning to pay off.

With demand for artificial intelligence (AI)-optimized chips surging globally, Broadcom stands in the right place at the right time.

Analysts now project the company’s core semiconductor business could deliver staggering year-over-year growth of 60% this quarter alone.

While its non-AI divisions remain in a holding pattern, signs of recovery are emerging, suggesting upside across multiple business segments.

The AI Gold Rush: Promise and Pitfalls

Broadcom’s surge also coincides with renewed debate about the real value of AI adoption in enterprises.

A recent MIT study revealed that most companies pursuing AI integration have yet to see measurable returns on their investments.

This highlights a gap between potential and execution—businesses may still be struggling to unlock AI’s full capabilities.

But industry veterans argue that this is a transitional phase.

As companies refine their processes and educate their workforce on deploying AI effectively, demand for Broadcom’s cutting-edge chips is only expected to climb.

For Broadcom, this means short-term skepticism may only reinforce its long-term growth narrative.

Strengths

AI Leadership: Broadcom is firmly positioned at the heart of the AI revolution with a robust pipeline of custom chips fueling unprecedented demand.

Analyst Endorsement: A raised price target and continued buy rating reinforce strong market confidence in the company’s trajectory.

Growth Acceleration: Projected 60% year-over-year growth in its semiconductor unit highlights explosive momentum in its core business.

Weaknesses

Dependence on AI: Heavy reliance on AI-driven demand may expose Broadcom to risks if enterprise adoption slows.

Flat Legacy Business: Non-AI segments remain sluggish, limiting the company’s ability to diversify growth drivers in the short term.

Execution Challenges: Delivering on aggressive growth projections will require flawless operational performance.

Potential

Market Expansion: As AI integration matures, Broadcom could cement itself as one of the defining winners in next-generation computing.

Diversification Ahead: Signs of recovery in non-AI businesses may provide an additional growth catalyst over the next year.

Investor Upside: With analyst targets climbing and sector momentum building, Broadcom stock could unlock meaningful upside for long-term investors.

TODAY’S SPONSOR

Skip the AI Learning Curve. ClickUp Brain Already Knows.

Most AI tools start from scratch every time. ClickUp Brain already knows the answers.

It has full context of all your work—docs, tasks, chats, files, and more. No uploading. No explaining. No repetitive prompting.

It's not just another AI tool. It's the first AI that actually understands your workflow because it lives where your work happens.

Join 150,000+ teams and save 1 day per week.

Conclusion

Broadcom’s story is becoming one of the most compelling in the semiconductor world: a company riding the wave of AI adoption, backed by analysts who believe the best is yet to come.

While challenges remain, Broadcom’s trajectory suggests that investors who align early could capture significant upside as the AI boom matures.

Final Thought

Will Broadcom simply follow the AI trend—or will it become one of the rare chipmakers that defines it?

The next 12 months may provide the answer.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply