- StocksGeniusMastery

- Posts

- 💥 Broadcom’s AI Bet Is Getting Bigger

💥 Broadcom’s AI Bet Is Getting Bigger

Why 2026 Could Be a Defining Year for AVGO Investors

Hi Fellow Investors,

Broadcom (NASDAQ: AVGO) is entering 2026 with a dramatically different business profile driven by artificial intelligence.

The company’s rapid shift toward custom AI accelerators is reshaping how the market views its long-term growth potential.

This evolution positions Broadcom as a serious contender in the escalating AI semiconductor arms race.

Key Points:

Broadcom’s custom AI accelerator revenue is growing at triple-digit rates and rapidly becoming a core business driver.

AI semiconductors could represent more than half of total company revenue by the end of 2026.

The company’s expanding role with hyperscalers may justify a valuation closer to elite AI chip peers.

TODAY’S SPONSOR

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Broadcom’s Strategic Pivot Toward AI Semiconductors

Broadcom’s historically diverse portfolio is increasingly centered on artificial intelligence infrastructure.

While the company still operates across software, networking, and enterprise solutions, capital and talent are being funneled toward AI chip development.

Custom AI accelerators are emerging as the centerpiece of this transformation.

These application-specific chips are designed around predictable AI workloads, allowing for higher efficiency and lower costs.

This specialization gives Broadcom a powerful advantage as enterprise AI adoption scales.

Why Custom AI Accelerators Are Gaining Momentum

General-purpose GPUs remain dominant for flexibility, but hyperscalers are prioritizing efficiency at scale.

Broadcom works directly with major cloud providers to design chips tailored to their proprietary AI models.

These accelerators deliver optimized performance while reducing power consumption and deployment costs.

One of the most well-known examples is Google’s Tensor Processing Unit, which highlights Broadcom’s long-standing expertise.

This collaborative design model creates sticky, long-term customer relationships.

Financial Momentum Is Accelerating Into 2026

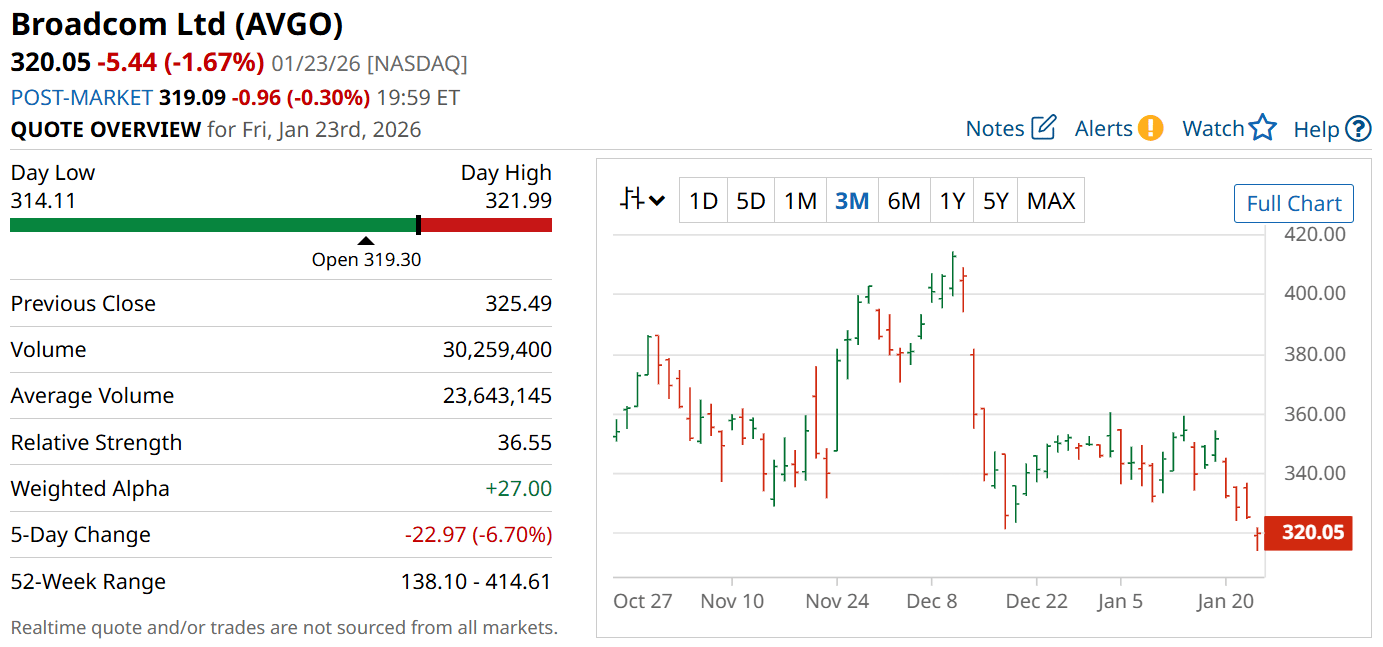

Broadcom’s AI semiconductor revenue surged 74% year over year in fiscal Q4 to $6.5 billion.

Management expects AI semiconductor revenue to reach $8.2 billion in Q1, representing 100% year-over-year growth.

This growth rate far outpaces the company’s broader revenue expansion.

AI chips already represent a substantial portion of total sales and are expanding rapidly.

This momentum suggests AI will soon dominate Broadcom’s revenue mix.

Broadcom’s Valuation Could Begin to Look More Like an AI Pure Play

As AI semiconductors approach a majority of sales, market perception may shift dramatically.

Peers such as Nvidia trade at premium multiples due to AI exposure.

Broadcom’s expanding AI footprint could support multiple expansion over time.

If AI revenue trends toward three-fourths of total sales by late 2026, the re-rating potential increases.

This transformation makes Broadcom a compelling long-term AI investment rather than a traditional diversified tech firm.

Strengths

Explosive AI accelerator revenue growth positions Broadcom at the center of hyperscaler demand.

Deep partnerships with cloud giants create recurring, high-margin chip revenue streams.

Proven ability to design application-specific chips offers efficiency advantages over general-purpose alternatives.

Weaknesses

Heavy reliance on a limited number of hyperscale customers increases concentration risk.

Reduced flexibility of ASICs compared to GPUs could limit appeal in rapidly evolving workloads.

High expectations embedded in the stock may lead to volatility if growth slows.

Potential

AI semiconductors becoming the majority of revenue could trigger valuation multiple expansion.

Broader adoption of custom accelerators may allow Broadcom to challenge GPU dominance in select workloads.

Sustained AI infrastructure spending through 2026 could support consistent market outperformance.

TODAY’S SPONSOR

Leadership Can’t Be Automated

AI can help you move faster, but real leadership still requires human judgment.

The free resource 5 Traits AI Can’t Replace explains the traits leaders must protect in an AI-driven world and why BELAY Executive Assistants are built to support them.

Conclusion

Broadcom’s rapid evolution into an AI semiconductor powerhouse is reshaping its long-term investment narrative.

Accelerating custom chip adoption positions the company for strong, durable growth into 2026.

For investors seeking AI exposure beyond traditional GPU leaders, Broadcom stands out as a compelling alternative.

Final Thought

As AI infrastructure spending intensifies, companies enabling efficiency at scale may capture the greatest value.

Could Broadcom’s quiet transformation make it one of the most important AI stocks of the next decade?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply