- StocksGeniusMastery

- Posts

- 💥Broadcom Stock Is Surging — But Can It Really Be the Next Nvidia?

💥Broadcom Stock Is Surging — But Can It Really Be the Next Nvidia?

With record-breaking AI revenue and massive data center growth, Broadcom is making its case as the next trillion-dollar tech titan.

Hi Fellow Investors,

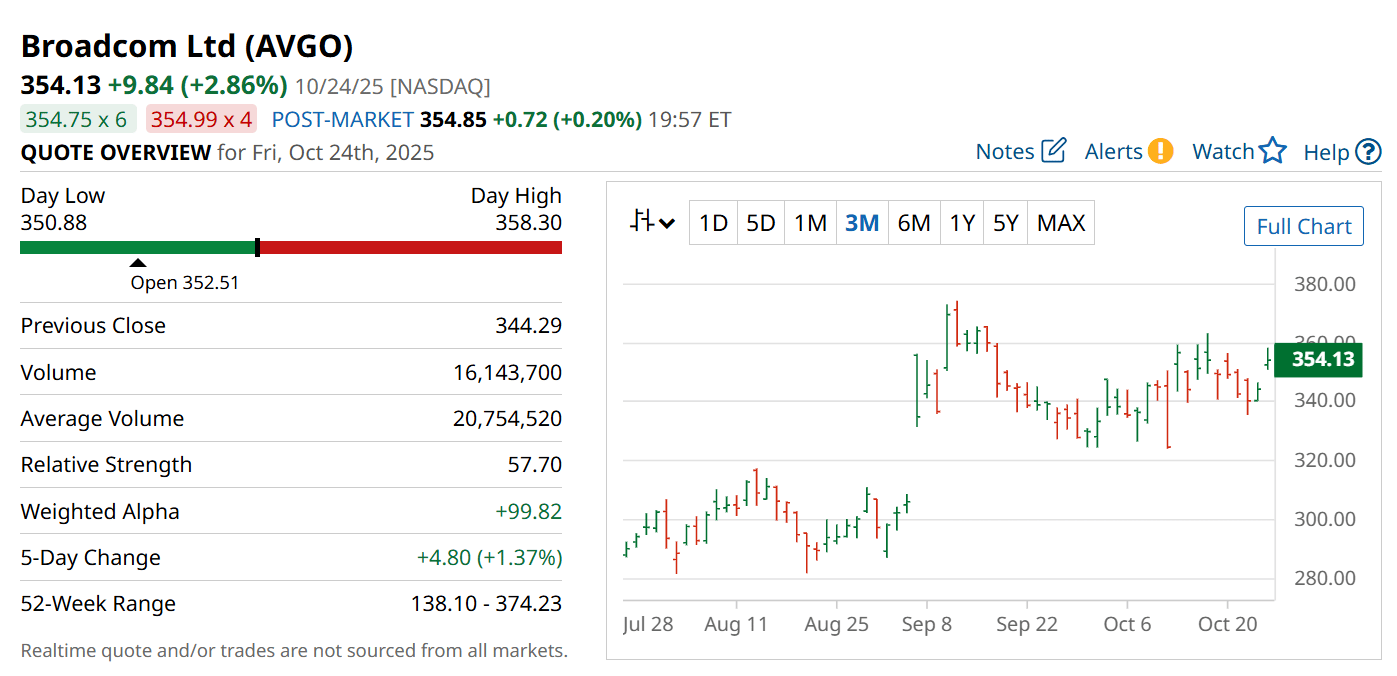

Broadcom (NASDAQ: AVGO) has quietly become one of the biggest winners of the AI revolution.

Its stock has surged 96% over the past year — nearly triple Nvidia’s (NASDAQ: NVDA) gain.

Now, with major AI deals and explosive revenue growth, investors are wondering if Broadcom might actually be the next Nvidia.

Key Points:

Broadcom’s 96% stock surge outpaced Nvidia and could accelerate further with new AI partnerships.

The company’s customizable AI chips are winning attention from hyperscalers and now, even OpenAI.

Despite its strong growth, Broadcom’s premium valuation raises questions about sustainability.

TODAY’S SPONSOR

It's not you, it’s your tax tools

Tax teams are stretched thin and spreadsheets aren’t cutting it. This guide helps you figure out what to look for in tax software that saves time, cuts risk, and keeps you ahead of reporting demands.

Broadcom’s AI Boom Is Just Getting Started

The global AI arms race shows no signs of slowing — and Broadcom is rapidly becoming one of its key suppliers.

The company’s networking and semiconductor technologies power nearly every major data center on Earth.

Management notes that 99% of all internet traffic touches Broadcom technology, highlighting its dominance in data infrastructure.

While Nvidia’s GPUs have driven the AI revolution, Broadcom’s custom-built ASICs are gaining traction as a more energy-efficient, task-specific alternative.

That distinction is critical — and could position Broadcom as a complementary, not competitive, force in the next phase of AI adoption.

The OpenAI Deal That Changes Everything

Earlier this month, Broadcom announced a landmark deal to help design and deploy 10 gigawatts of custom chips for OpenAI — the creator of ChatGPT.

Analysts estimate each gigawatt could translate to roughly $20 billion in potential revenue, a staggering figure even by Big Tech standards.

This move not only validates Broadcom’s ASIC technology as a serious GPU alternative but also expands its AI footprint far beyond its traditional hyperscale clients.

Broadcom already counts Alphabet, Meta Platforms, and ByteDance among its major AI customers.

Adding OpenAI to that roster could accelerate Broadcom’s share of the AI compute market — and rewrite its growth story entirely.

Record Revenue and Explosive Growth

In its most recent quarter, Broadcom generated $15.9 billion in revenue, up 22% year over year.

AI-related sales surged 63%, reaching $5.2 billion and fueling a 36% jump in earnings per share.

CEO Hock Tan emphasized that Broadcom is gaining market share across all three of its largest AI customers.

He also forecast continued acceleration in AI demand, well above the 50–60% growth rate originally expected for 2025.

This strong financial performance cements Broadcom’s position as a top-tier AI enabler — not just a chip supplier.

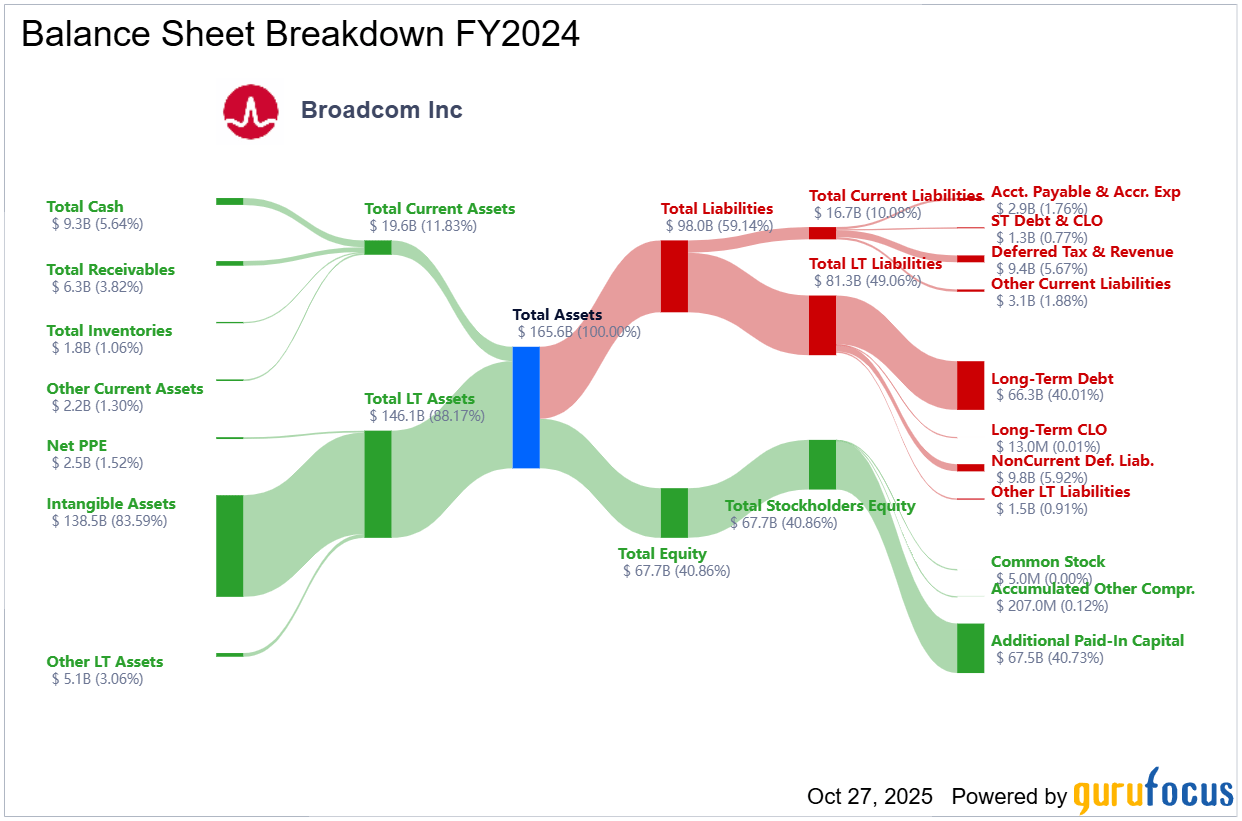

Valuation: The Price of Greatness

Broadcom’s success has not gone unnoticed on Wall Street.

The stock now trades at roughly 38 times next year’s earnings, compared to 29 for Nvidia.

That premium reflects investors’ confidence in Broadcom’s future AI potential — but also raises the bar for performance.

At a $1.7 trillion market cap, Broadcom is no longer a hidden gem, yet it continues to defy expectations through innovation and execution.

If the AI market truly grows to the $15.7 trillion level projected by PwC by 2030, Broadcom’s upside may still be only beginning.

Strengths

Explosive 63% AI revenue growth demonstrates real traction beyond hype.

Strategic partnerships with OpenAI, Alphabet, Meta, and ByteDance validate its ASIC leadership.

Record-setting quarterly revenue and earnings highlight robust demand across AI and networking.

Weaknesses

Premium valuation (38× forward earnings) could limit near-term upside if growth slows.

Heavy reliance on a small set of hyperscale customers increases concentration risk.

Nvidia remains the preferred brand among AI developers, making market share gains challenging.

Potential

OpenAI deal could add up to $200 billion in lifetime AI chip revenue over the coming decade.

Rising energy costs may accelerate demand for Broadcom’s more efficient ASIC designs.

As AI infrastructure matures, Broadcom’s dominance in networking positions it for long-term compound growth.

TODAY’S SPONSOR

Turn AI into Your Income Engine

Ready to transform artificial intelligence from a buzzword into your personal revenue generator

HubSpot’s groundbreaking guide "200+ AI-Powered Income Ideas" is your gateway to financial innovation in the digital age.

Inside you'll discover:

A curated collection of 200+ profitable opportunities spanning content creation, e-commerce, gaming, and emerging digital markets—each vetted for real-world potential

Step-by-step implementation guides designed for beginners, making AI accessible regardless of your technical background

Cutting-edge strategies aligned with current market trends, ensuring your ventures stay ahead of the curve

Download your guide today and unlock a future where artificial intelligence powers your success. Your next income stream is waiting.

Conclusion

Broadcom has all the makings of a long-term AI powerhouse — innovative products, elite partnerships, and booming financials.

While it may never fully replace Nvidia as the face of AI hardware, it’s carving out a lucrative and defensible niche in the fastest-growing tech market on Earth.

Investors seeking exposure to the next wave of AI growth should not overlook this rising semiconductor giant.

Final Thought

Is Broadcom simply Nvidia’s understudy — or the architect of AI’s next hardware revolution?

The coming year may reveal which company truly powers the brain of the future.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply