- StocksGeniusMastery

- Posts

- 💥Buy Netflix Before the Split? Wall Street Thinks Shares Could Soar 22%

💥Buy Netflix Before the Split? Wall Street Thinks Shares Could Soar 22%

A post-earnings dip, a massive stock split, and a fast-growing ad business set the stage for a comeback.

Hi Fellow Investors,

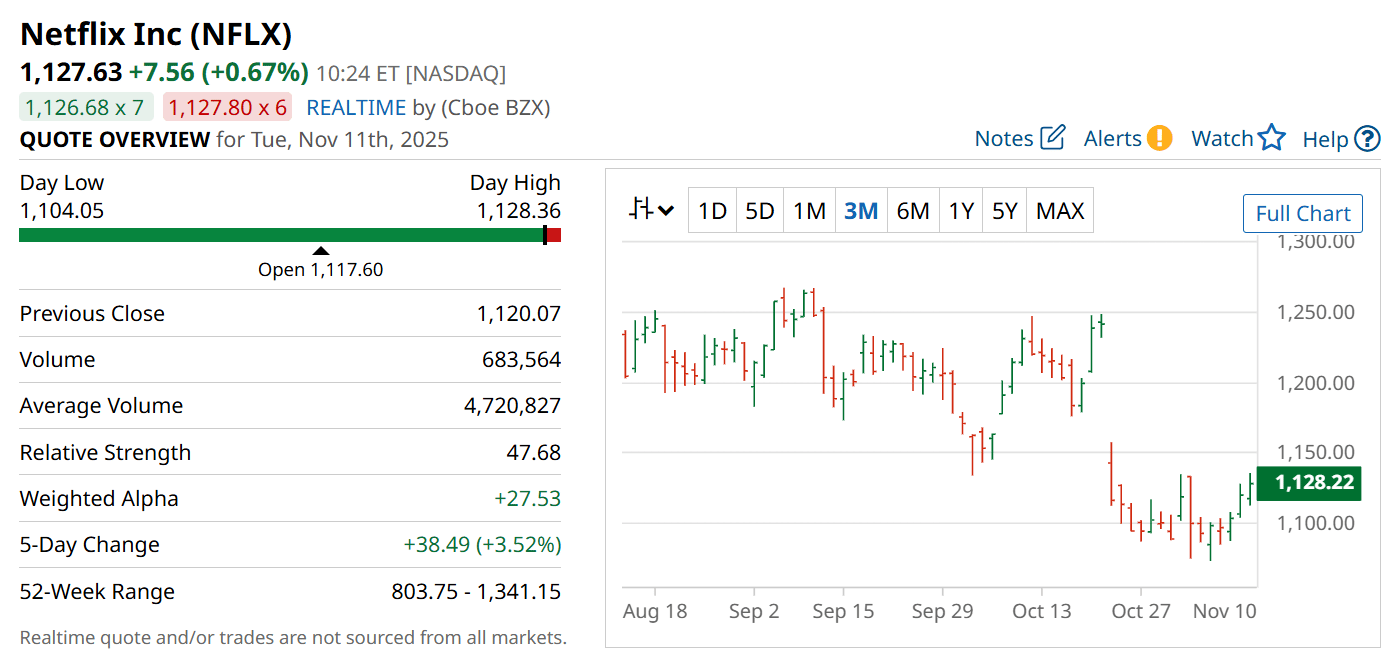

Netflix’s (NASDAQ: NFLX) stock has been on a rollercoaster.

A disappointing quarterly report triggered a sell-off.

Then came a 10-for-1 stock split announcement that reignited excitement.

Wall Street’s $1,347 price target now points to a potential 22% gain — and analysts say this could just be the beginning.

Key Points:

Netflix’s recent stock split announcement followed a turbulent Q3 earnings release.

Wall Street’s consensus price target implies a 22% upside from current levels.

Strong ad revenue growth and robust cash flow reinforce the long-term bull case.

TODAY’S SPONSOR

Don’t get SaaD. Get Rippling.

Remember when software made business simpler?

Today, the average company runs 100+ apps—each with its own logins, data, and headaches. HR can’t find employee info. IT fights security blind spots. Finance reconciles numbers instead of planning growth.

Our State of Software Sprawl report reveals the true cost of “Software as a Disservice” (SaaD)—and how much time, money, and sanity it’s draining from your teams.

The future of work is unified. Don’t get SaaD. Get Rippling.

Netflix’s Q3 Misstep Shook Investors — But Not the Long-Term Outlook

Netflix entered its third-quarter report riding high expectations after a year of strong gains.

However, the company’s bottom line took a hit from a $619 million tax dispute in Brazil.

That unexpected charge dragged profits below forecasts and sparked a sharp sell-off.

Despite this, Netflix still boasts a forward P/E ratio near 37 — a premium to the sector average of 22.

While valuation skeptics argue shares are pricey, others see this dip as a compelling buying window.

Why the 10-for-1 Split Could Reignite Momentum

Stock splits don’t alter fundamentals, but they do change perception.

Netflix’s lofty $1,100 share price limited accessibility for many investors.

Post-split, each share will trade near $110 — a psychologically appealing price point.

This move signals management’s confidence in the company’s future performance.

If history is any guide, momentum could build quickly as new investors rush in.

Still, the real driver remains Netflix’s expanding global footprint and its evolving business model.

Netflix’s Growth Story Is Far From Over

Despite short-term noise, Netflix’s business fundamentals remain exceptional.

Revenue surged 17.2% year over year to $11.5 billion last quarter.

Free cash flow climbed to $2.66 billion, up more than 21% from last year.

The company continues to dominate streaming — even amid fierce competition from Disney+, Amazon Prime, and others.

But the most promising engine for future growth could be advertising.

Netflix’s ad-tier business just delivered its strongest quarter ever and doubled upfront ad commitments in the U.S.

That success highlights new revenue streams that could lift margins in 2026 and beyond.

Strengths

Dominant market share and global brand recognition that continue to attract subscribers.

Explosive ad-tier momentum, doubling upfront ad commitments and signaling robust advertiser demand.

Strong free cash flow and double-digit revenue growth supporting reinvestment and shareholder value.

Weaknesses

Premium valuation with a forward P/E of 37, leaving limited margin for error in future quarters.

Ongoing tax disputes and regulatory challenges in key international markets.

Intensifying competition from established and emerging streaming platforms.

Potential

Expansion of the ad-supported tier could materially boost margins and subscriber growth.

Future price increases and new content partnerships may drive higher average revenue per user.

The stock split could draw in retail investors and create renewed momentum ahead of 2026.

TODAY’S SPONSOR

Here’s an un-boring way to invest that billionaires have quietly leveraged for decades

If you have enough money that you think about buckets for your capital…

Ever invest in something you know will have low returns—just for the sake of diversifying?

CDs… Bonds… REITs… :(

Sure, these “boring” investments have some merits. But you probably overlooked one historically exclusive asset class:

It’s been famously leveraged by billionaires like Bezos and Gates, but just never been widely accessible until now.

It outpaced the S&P 500 (!) overall WITH low correlation to stocks, 1995 to 2025.*

It’s not private equity or real estate. Surprisingly, it’s postwar and contemporary art.

And since 2019, over 70,000 people have started investing in SHARES of artworks featuring legends like Banksy, Basquiat, and Picasso through a platform called Masterworks.

23 exits to date

$1,245,000,000+ invested

Annualized net returns like 17.6%, 17.8%, and 21.5%

My subscribers can SKIP their waitlist and invest in blue-chip art.

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

Conclusion

Netflix’s temporary stumble offers long-term investors a rare second chance.

With ad revenue accelerating, cash flow expanding, and Wall Street backing a 22% upside, the streaming leader remains a top-tier opportunity.

Investors who stay patient through volatility could be well-positioned for the next leg higher.

Final Thought

Every market correction brings one stock that turns doubt into opportunity.

Netflix’s 10-for-1 split might just mark the start of its next blockbuster chapter.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply