- StocksGeniusMastery

- Posts

- 💥Can Amazon Become the Ultimate AI Stock by 2028?

💥Can Amazon Become the Ultimate AI Stock by 2028?

How AI, Cloud, and E-Commerce Could Unlock Amazon’s Next Trillion-Dollar Surge

Hello Fellow Investors!

The generative AI boom may have started with ChatGPT, but Amazon (NASD: AMZN) is quietly positioning itself to lead the next wave. From retail to cloud to advertising, Amazon is embedding AI into every layer of its operations. Over the next three years, this silent transformation could send Amazon’s stock soaring to new heights.

As businesses race to adopt AI, Amazon stands out with its unmatched scale and infrastructure. Whether it's streamlining warehouse logistics or powering enterprises through AWS, Amazon's AI integration is a game-changer in the making.

Investors looking three years ahead should consider one thing: Amazon isn’t just adapting to the AI era—it’s building it. The stock’s current levels may look like a bargain in hindsight.

Key Points:

Amazon is embedding AI across its e-commerce, logistics, and AWS platforms to supercharge growth and efficiency.

With AWS leading the cloud infrastructure race, Amazon is becoming the backbone of the AI revolution.

Amazon’s expanding advertising and retail tech businesses could be major profit drivers in the AI-powered future.

TODAY’S SPONSOR

Finally, a powerful CRM—made simple.

Attio is the AI-native CRM built to scale your company from seed stage to category leader. Powerful, flexible, and intuitive to use, Attio is the CRM for the next-generation of teams.

Sync your email and calendar, and Attio instantly builds your CRM—enriching every company, contact, and interaction with actionable insights in seconds.

With Attio, AI isn’t just a feature—it’s the foundation.

Instantly find and route leads with research agents

Get real-time AI insights during customer conversations

Build AI automations for your most complex workflows

Join fast growing teams like Flatfile, Replicate, Modal, and more.

A Tech Revolution Too Big to Ignore

What once looked like Silicon Valley hype is now proving to be one of the most transformative technological shifts of our era—generative AI.

With OpenAI pulling in $10 billion in recurring revenue and eyeing a $300 billion valuation, the AI gold rush is officially underway.

Amazon isn’t a pure AI play, but it doesn’t need to be—it sits at the crossroads of AI application, infrastructure, and monetization.

From its AWS backbone to its massive fulfillment and retail networks, Amazon is positioned to extract real value from every layer of this revolution.

As AI reshapes industries, Amazon’s multi-pronged model gives it an enviable advantage.

Amazon’s deep integration with Anthropic signals a long-term strategy: dominate AI from the inside out.

By embedding its Trainium and Inferentia chips into Anthropic’s model infrastructure and hosting it on AWS, Amazon doesn’t just sell cloud services—it sells the foundation of modern AI.

Add to that the company’s growing use of generative AI to streamline corporate operations and reduce headcount, and it becomes clear that this isn’t just about innovation—it’s about margin expansion.

With over 1 million robots already deployed across its facilities, Amazon is morphing into an AI-powered logistics empire.

The shift isn’t just about automation—it’s about transforming its labor-intensive legacy into a high-efficiency, high-margin future.

What Could the Next 36 Months Hold for Amazon?

Amazon is already reaping the rewards of its AI and cloud strategy.

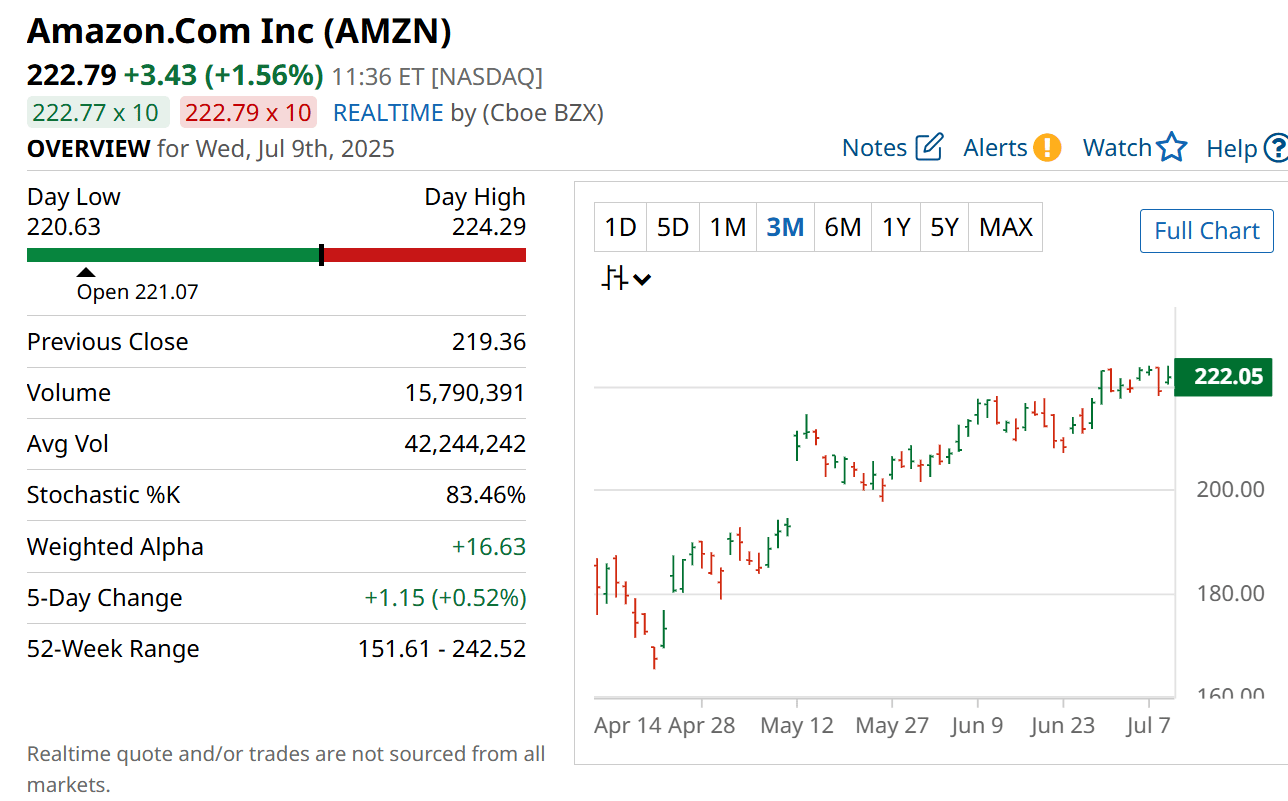

With AWS posting 17% year-over-year growth and net sales reaching $155.7 billion in Q1, the flywheel is turning fast.

Operating income surged 20%, driven by tighter cost controls and stronger operating leverage—especially in AWS, Amazon’s crown jewel.

As generative AI continues to explode in demand, AWS stands to benefit the most, thanks to its dominant market position and increasingly AI-optimized offerings.

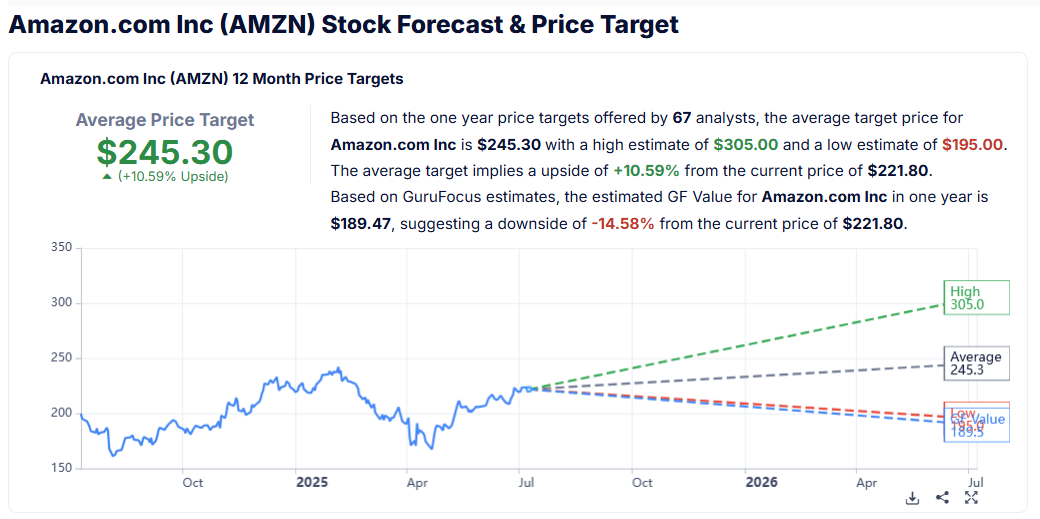

If current momentum holds, Amazon could see its stock outperform major indices and even challenge all-time highs in the next three years.

Strengths:

Dominant cloud infrastructure (AWS): Powers a large chunk of the internet and now forms the bedrock of modern AI applications.

Diverse revenue streams: E-commerce, ads, cloud, logistics, and now AI give Amazon unmatched resilience.

Operational scale and robotics: Over 1 million robots deployed, drastically improving logistics efficiency and cost structure.

Weaknesses:

Labor tensions and regulatory scrutiny: Amazon's workforce challenges continue to attract political and legal heat globally.

Thin e-commerce margins: Despite scale, Amazon’s retail segment remains low-margin and sensitive to macroeconomic shifts.

Dependence on AWS for profits: AWS is the primary profit driver, making the company vulnerable to cloud competition or slowdowns.

Potential:

AI-driven cost optimization: Automation and generative AI could lead to major margin expansion over the next few years.

Cloud dominance in AI boom: As demand for LLMs and AI compute grows, AWS stands to capture significant upside.

Expansion into new verticals: Healthcare, autonomous delivery, and global advertising present new frontiers for growth.

TODAY’S SPONSOR

The Future of AI in Marketing. Your Shortcut to Smarter, Faster Marketing.

This guide distills 10 AI strategies from industry leaders that are transforming marketing.

Learn how HubSpot's engineering team achieved 15-20% productivity gains with AI

Learn how AI-driven emails achieved 94% higher conversion rates

Discover 7 ways to enhance your marketing strategy with AI.

Conclusion

Amazon's evolution isn’t just about catching up with the AI wave—it’s about riding it to the front of the pack.

With a strategic blend of infrastructure, automation, and cloud dominance, Amazon may not just survive this AI disruption—it could lead it.

For long-term investors, this is an opportunity hiding in plain sight.

Final Thought

If Amazon is already this powerful without fully unleashing AI, imagine what it becomes once that potential is fully realized.

Will you be watching from the sidelines—or positioned to ride the wave?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply