- StocksGeniusMastery

- Posts

- 💥Could AMD Stock Skyrocket After Aug 5th Earnings?

💥Could AMD Stock Skyrocket After Aug 5th Earnings?

A high-stakes moment is coming - can AMD finally break free from Nvidia’s shadow and ignite a rally?

Hello Fellow Investors!

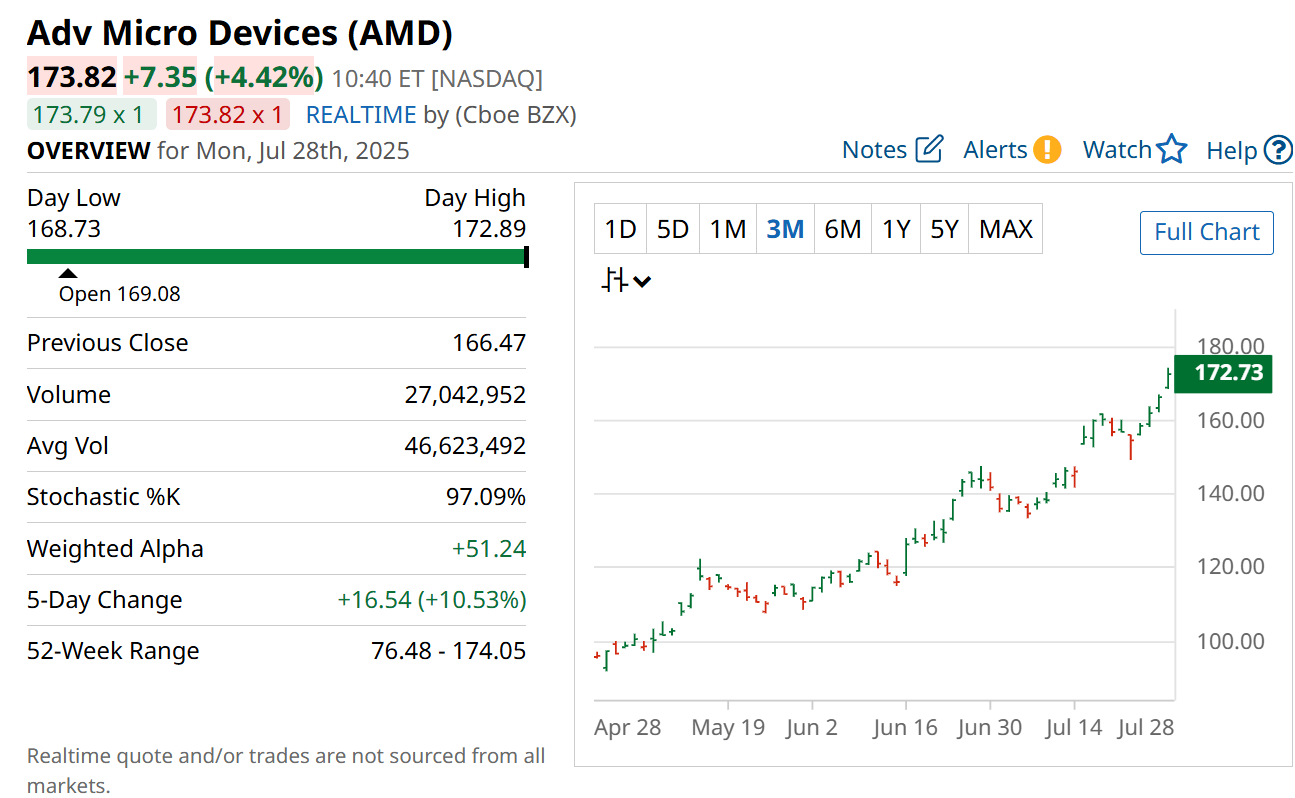

AMD (NASDAQ: AMD) has long stood in Nvidia’s shadow, but its upcoming Aug. 5 earnings release could shift the narrative dramatically. With a projected 35% jump in Q2 revenue, expectations are sky-high—and so are the risks.

Investors are watching closely to see whether AMD's AI and data center ambitions can finally deliver the kind of explosive upside that Nvidia has enjoyed. The stakes have never been higher.

If AMD surprises to the upside, the stock could go vertical. But if growth is already priced in, a harsh market reality check may follow.

Key Points:

AMD is betting big on 35% revenue growth in Q2, but it needs more than guidance to impress Wall Street.

Its data center momentum still trails far behind Nvidia, raising concerns about long-term competitiveness.

With other business segments underperforming, AMD's parabolic breakout hinges entirely on a blowout earnings report.

TODAY’S SPONSOR

Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

AMD’s Broad Portfolio Is a Double-Edged Sword

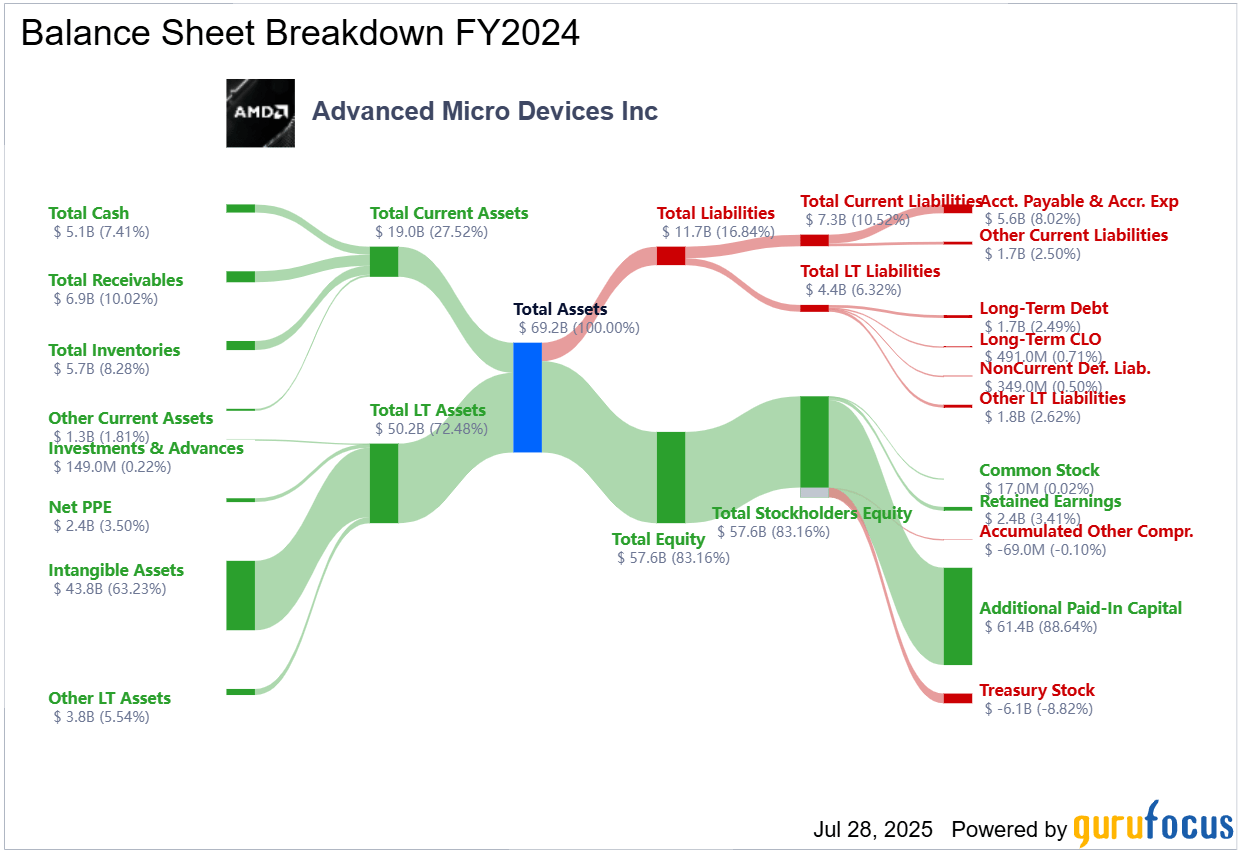

AMD’s expansive product range, spanning GPUs, CPUs, and embedded processors, sets it apart from Nvidia’s laser-focused GPU strategy.

While this diversification offers a safety net if one segment falters, it also dilutes AMD’s ability to dominate high-growth AI markets where Nvidia’s products currently lead.

With Q2 revenue projected at $7.4 billion—a robust 35% increase—the company’s growth is impressive, but still trails Nvidia’s blistering 50% surge.

In booming AI cycles, AMD risks being perceived as the runner-up rather than the leader.

However, its broader product mix could cushion the blow during downturns, making it a safer, albeit less explosive, bet.

Valuation Concerns Shadow AMD’s Second-Place Position

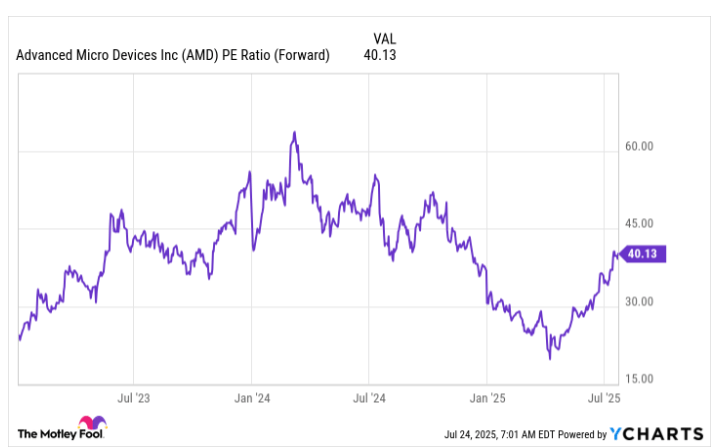

Trading at 40 times forward earnings, AMD’s stock isn’t exactly cheap—especially for a company playing catch-up to Nvidia.

Investors paying Nvidia-like premiums for slower growth may start questioning the risk-reward balance.

While AMD’s data center revenue is vital, its growth rate and market dominance still lag behind its main competitor.

If AMD delivers strong guidance on Aug. 5, it could trigger a temporary rally, but Nvidia’s momentum suggests any upside for AMD may be overshadowed by its rival’s gains.

For investors, the challenge lies in justifying AMD’s valuation when the market leader offers faster growth at the same price.

Strengths:

Diverse Product Portfolio: AMD’s mix of CPUs, GPUs, and embedded processors provides stability across multiple markets.

Strong Revenue Growth: Projected Q2 revenue surge of 35% signals resilient demand and operational momentum.

AI Opportunities: Despite trailing Nvidia, AMD is making strategic moves to capitalize on the AI infrastructure boom.

Weaknesses:

Lagging Data Center Presence: AMD’s data center offerings remain overshadowed by Nvidia’s technological leadership.

Premium Valuation: Trading at 40x forward earnings leaves little margin for error.

Cyclical Market Risks: Exposure to semiconductor cycles could amplify volatility during downturns.

Potential:

Earnings Catalysts: A strong Aug. 5 report could ignite short-term momentum and renewed investor confidence.

Expanding AI Pipeline: Further advancements in AI chips and partnerships could close the gap with Nvidia.

Diversification Hedge: Broader product lines can offset risks if AI-driven demand softens.

TODAY’S SPONSOR

Start learning AI in 2025

Keeping up with AI is hard – we get it!

That’s why over 1M professionals read Superhuman AI to stay ahead.

Get daily AI news, tools, and tutorials

Learn new AI skills you can use at work in 3 mins a day

Become 10X more productive

Conclusion

AMD stands on the brink of a defining moment as it prepares to report earnings on Aug 5th.

While its diversified portfolio offers resilience, it also limits the explosive upside potential seen with Nvidia’s hyper-focused AI strategy.

A blowout earnings report could spark a temporary rally, but the company’s valuation leaves little room for missteps.

Investors seeking long-term leadership in AI may still find Nvidia’s dominance too compelling to ignore.

Final Thought

Will AMD’s next earnings call be the catalyst that propels it out of Nvidia’s shadow—or a reminder that second place isn’t enough in the race for AI supremacy?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply