- StocksGeniusMastery

- Posts

- 💥Down 18%: Is It Time To Buy ASML Holding?

💥Down 18%: Is It Time To Buy ASML Holding?

ASML’s short-term pain may be long-term investors’ gain — here’s what the market is missing.

Hello Fellow Investors!

ASML Holding (NASDAQ: ASML) is the backbone of advanced chipmaking, producing the only machines capable of extreme ultraviolet (EUV) lithography — a technology crucial to the world's most advanced semiconductors.

From powering AI data centers to enabling the chips inside next-gen smartphones, ASML sits at the heart of the global tech supply chain.

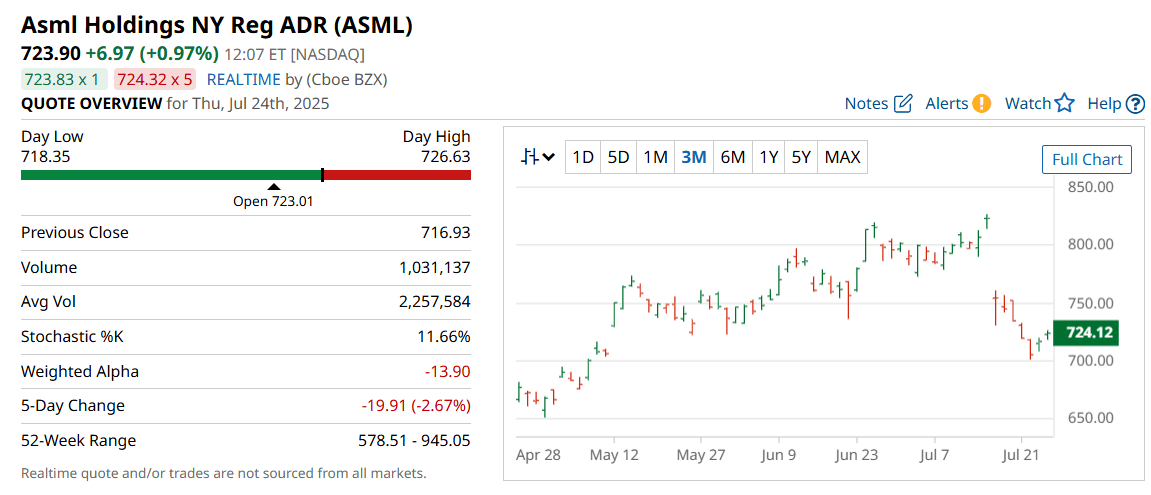

Yet, despite its dominance, ASML stock has slipped 18% over the past year, rattled by weak Q2 results and a murky 2026 demand forecast.

The market’s knee-jerk reaction shaved another 8% off the stock following its July 16 earnings report.

But when one of the world's most irreplaceable semiconductor players trades at a discount, it’s not panic time — it’s opportunity time.

Here's why savvy investors should pay attention.

Key Points:

ASML stock plunged after Q2 earnings and a cautious 2026 outlook spooked the market.

Despite short-term weakness, ASML remains an irreplaceable player in the semiconductor supply chain.

The stock now trades at a compelling valuation for long-term investors seeking exposure to advanced chipmaking.

TODAY’S SPONSOR

Find your customers on Roku this Black Friday

As with any digital ad campaign, the important thing is to reach streaming audiences who will convert. To that end, Roku’s self-service Ads Manager stands ready with powerful segmentation and targeting options. After all, you know your customers, and we know our streaming audience.

Worried it’s too late to spin up new Black Friday creative? With Roku Ads Manager, you can easily import and augment existing creative assets from your social channels. We also have AI-assisted upscaling, so every ad is primed for CTV.

Once you’ve done this, then you can easily set up A/B tests to flight different creative variants and Black Friday offers. If you’re a Shopify brand, you can even run shoppable ads directly on-screen so viewers can purchase with just a click of their Roku remote.

Bonus: we’re gifting you $5K in ad credits when you spend your first $5K on Roku Ads Manager. Just sign up and use code GET5K. Terms apply.

ASML’s Short-Term Stumble May Be the Market's Overreaction

ASML stunned with stellar Q2 results — revenue soared 24% and earnings surged 47% year-over-year, beating analyst estimates by a wide margin.

Yet despite this strong performance, shares sank after management issued cautious guidance for Q3 and flagged uncertainty around 2026.

The source of concern? A murky macroeconomic outlook, rising geopolitical tensions, and ongoing export restrictions impacting the semiconductor industry.

While quarterly bookings jumped 40%, management held off on committing to 2026 growth, which rattled investors and sent shares tumbling.

The market’s knee-jerk reaction has overshadowed ASML’s underlying strength — and savvy investors may want to take notice before the window closes.

Long-Term Growth Drivers Are Still Fully Intact

Despite its cautious tone, ASML remains laser-focused on long-term expansion — and it has the numbers to back it up.

The company reaffirmed its 2030 revenue forecast of €44 billion to €60 billion, driven by surging AI and data center demand.

With a dominant 90% share in the lithography equipment market and unmatched EUV technology, ASML is well-positioned to benefit from the expected $1 trillion semiconductor capex wave.

Gross margins are projected to climb from 52% in 2025 to as high as 60% by 2030, fueled by high-value system sales and deepening demand for next-gen chips.

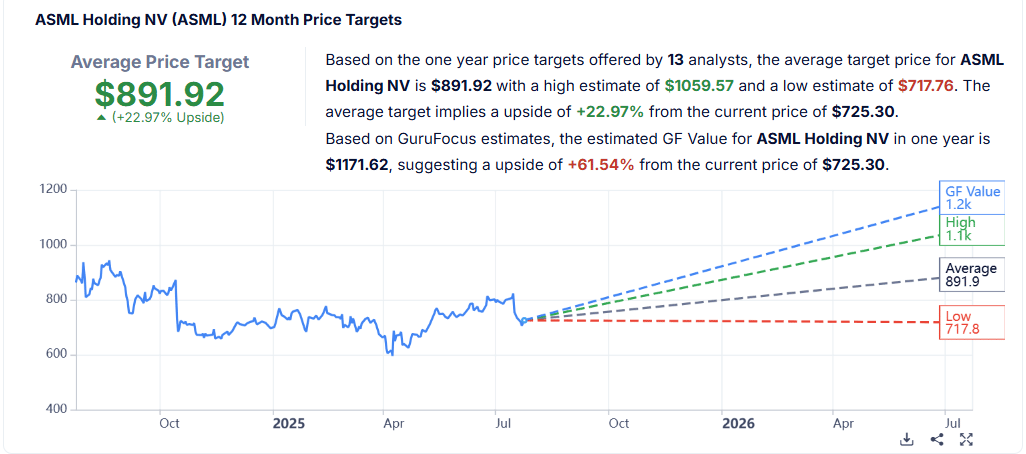

At just 26x earnings, ASML is trading well below the U.S. tech sector’s average — offering a compelling setup for long-term investors seeking growth at a reasonable price.

Strengths:

Technological Dominance: ASML is the sole supplier of EUV lithography tools, making it indispensable for the most advanced semiconductor manufacturing.

Massive Market Share: With over 90% global market share in lithography equipment, ASML is the gatekeeper of next-gen chip production.

Tailwinds from AI & Data Centers: The global explosion in AI infrastructure demand provides a multi-year growth runway for ASML’s high-margin systems.

Weaknesses:

Geopolitical Headwinds: U.S.-China tensions and export restrictions on advanced chipmaking tools could constrain short-term growth.

Cautious Management Tone: Lack of commitment to 2026 targets has eroded investor confidence despite robust near-term fundamentals.

High Customer Concentration: ASML relies heavily on a few major chipmakers, exposing it to cyclical demand swings and supplier dependency.

Potential:

2030 Growth Roadmap: Management’s €60 billion revenue target signals confidence in long-term chip industry expansion.

Valuation Opportunity: Trading below sector multiples, ASML offers rare value for a tech company of its caliber and importance.

Semiconductor Capex Boom: A projected $1 trillion global investment in new chip fabs could accelerate equipment sales and margin expansion.

TODAY’S SPONSOR

Create How-to Videos in Seconds with AI

Stop wasting time on repetitive explanations. Guidde’s AI creates stunning video guides in seconds—11x faster.

Turn boring docs into visual masterpieces

Save hours with AI-powered automation

Share or embed your guide anywhere

How it works: Click capture on the browser extension, and Guidde auto-generates step-by-step video guides with visuals, voiceover, and a call to action.

Conclusion

ASML’s recent dip isn’t a red flag — it’s a flashing green light for long-term investors.

Despite near-term uncertainties, the company remains one of the most crucial players in the global semiconductor ecosystem, powering the AI revolution from the ground up.

With dominant market positioning, breakthrough technology, and multi-decade growth catalysts, ASML is uniquely positioned to thrive in the years ahead.

Buying this world-class chip supplier on weakness could be a generational wealth-building move.

Final Thought

When a world-dominating innovator stumbles — not because of failure, but because of caution — it’s often the perfect moment to act.

Will you seize the dip or let this rare chance pass by?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply