- StocksGeniusMastery

- Posts

- Finally here comes the TESLA stock for Investors to ponder over!

Finally here comes the TESLA stock for Investors to ponder over!

To buy or not to buy NOW

Finally here comes the TESLA stock for investors to ponder

Unlocking Tesla’s Full Potential

Challenging Times Amidst Weak Growth and Margin Pressure: Tesla faces adversity as evidenced by its recent 4Q23 performance, marked by sluggish growth and declining margins exacerbated by price reductions.

Impact of High Interest Rates and Growing Competition: The automotive sector, including Tesla, grapples with the ramifications of a high-interest-rate environment, intensifying competition, and slower-than-expected adoption of electric vehicles, leading to immediate obstacles.

Navigating Between Growth Waves: Positioned between significant growth phases, Tesla anticipates its next growth catalyst in the latter part of 2025 with the launch of its next-generation vehicle, while managing the current transitional phase.

Strategic Investment in Future Ventures: Tesla directs substantial resources towards future initiatives and growth prospects, emphasizing the development of next-gen vehicles, energy storage solutions, and advancing autonomous driving technology, showcasing a commitment to long-term sustainability and innovation.

Debate Over Valuation: The valuation of Tesla remains a contentious topic, with skeptics highlighting concerns over its lofty multiples amidst modest near-term growth, while proponents remain bullish on the company's enduring growth trajectory and potential.

Tesla (NASDAQ:TSLA) has encountered significant challenges over the past year.

Since mid-2023, the company has witnessed a substantial decline in its share price, plummeting nearly 45% from its peak in July of the same year.

Source: SeekingAlpha

In this discourse, we aim to provide an assessment of Tesla's current standing, evaluate whether its present valuation aligns with its market position, and articulate our perspective on the stock's attractiveness for potential investment.

How is Tesla business faring today?

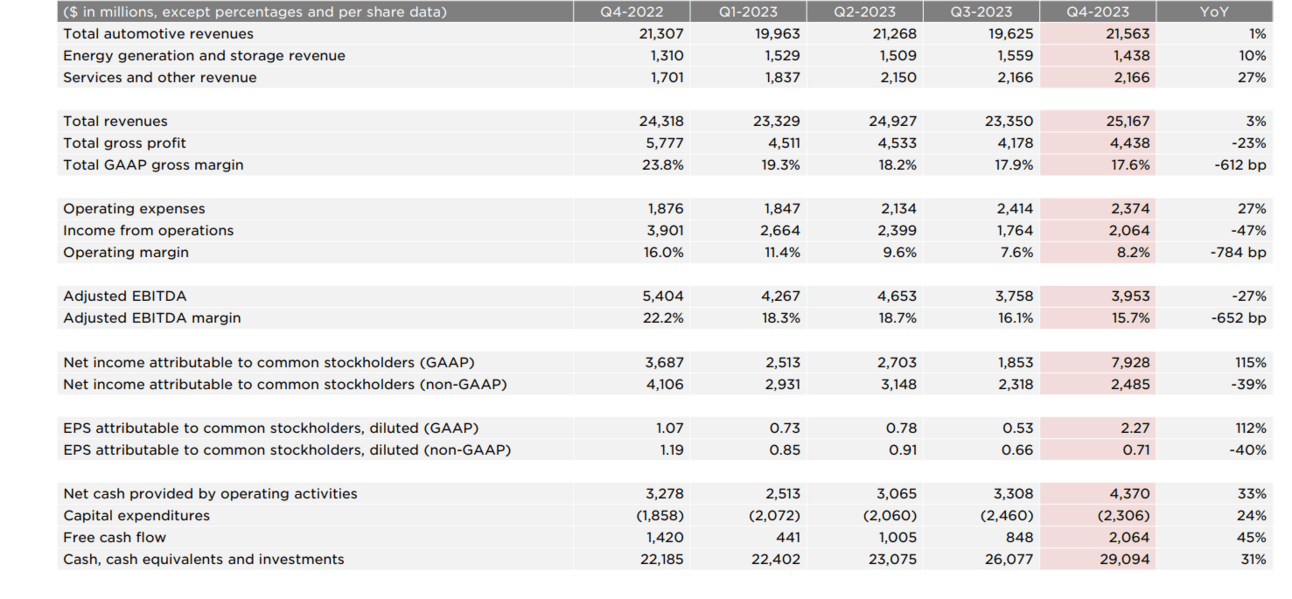

Presently, Tesla finds itself navigating through challenging waters. While the company continues to demonstrate resilience, its recent performance highlights areas of concern. In the latest quarter, Tesla witnessed softer-than-expected top-line growth, with deliveries increasing by 20% compared to the previous year but total revenues growing at a mere 3%. This discrepancy underscores the impact of price cuts on revenue generation and gross profits. Despite efforts to stimulate demand, the effectiveness of these price reductions appears limited, further exacerbating margin compression. Moreover, Tesla's struggle with maintaining robust margins is evident, with gross profit margins falling short of consensus expectations.

Checkout the Quarterly growth whereby Deliveries for the 4Q23 quarter came in at 484,507, up 20%, but growing at a slower rate after the huge growth we have seen earlier in 2021 and 2022.

Where will Tesla go from here?

Amidst these hurdles, Tesla remains subject to the influence of broader economic factors, particularly the prevailing high-interest-rate environment. This external pressure poses additional challenges for Tesla, particularly within the automotive sector where interest rates have a significant impact on consumer affordability and purchasing behavior. While the company grapples with these immediate obstacles, it continues to invest heavily in future projects and growth opportunities, emphasizing next-generation vehicles, energy storage solutions, and full self-driving technology. Despite the current headwinds, Tesla's strategic focus on innovation and expansion positions it favorably for long-term success in the dynamic automotive market.

Source: Investor Relations

Furthermore, Tesla finds itself positioned between two significant growth waves, with its management focused on executing strategic initiatives to navigate through this transitional phase. While the exact timing of the launch of its next-generation vehicle remains uncertain, Tesla aims to commence production in the second half of 2025. However, the intricacies involved in this process, such as new manufacturing procedures and technology, pose challenges to ramping up production smoothly. Despite these hurdles, the significance of this next-generation vehicle production cannot be overstated, as it solidifies Tesla's lead in manufacturing technology and innovation. Nonetheless, Tesla must contend with near-term obstacles, including increased competition in key markets like China, slowing electric vehicle adoption, and the persistently high interest rate environment, all of which may impact its performance leading up to the launch of its next-generation vehicle.

Where will Tesla’s Margin go from here?

As Tesla navigates forward, the trajectory of its margins remains a focal point of concern. Despite efforts to mitigate the impact of price cuts on the average selling price and reduce the cost of goods sold per vehicle, Tesla has struggled to arrest the decline in quarterly gross profit per unit. The 4Q23 quarter witnessed a delicate balance, with the adverse effects of lower average selling prices and the costs associated with the Cybertruck production ramp offset by reductions in vehicle costs, material costs, and logistics expenses, alongside growth in vehicle deliveries.

Looking ahead, Tesla faces a challenging near-term outlook, with the persistence of price cuts to stimulate demand and counter competition likely to continue exerting pressure on margins. However, there remains optimism that the successful execution of the Cybertruck production ramp could gradually ameliorate these margin challenges.

Tesla’s Valuation

Assessing Tesla's current valuation prompts a critical question for investors: should one consider buying Tesla stock at its present price? A comprehensive evaluation begins with a five-year financial forecast, projecting an 18% revenue compound annual growth rate (CAGR), accounting for the downturn witnessed in 2024. Anticipated enhancements in the margin profile, albeit more subdued between 2024 and 2026 due to the Cybertruck and Model 2 ramp-up, are expected to pave the way for further margin expansion opportunities in 2027 and 2028.

This forecast underscores the significance of future growth prospects in shaping Tesla's valuation. While acknowledging the prevailing uncertainties and challenges, investors must weigh the potential long-term gains against the current market sentiment. As Tesla navigates through this transitional phase, characterized by near-term headwinds and strategic investments, prudent assessment and strategic decision-making are paramount to harnessing the full potential of this innovative company in the dynamic automotive landscape.

Tesla’s Intrinsic value

Assessing Tesla's intrinsic value amidst its current P/E multiple of 54x, reflective of subdued 2024 profits, presents a nuanced evaluation. Employing a discounted cash flow model, assumptions of a 40x terminal multiple and 13% cost of equity yielded an intrinsic value of $205. Applying a prudent 20% discount, an entry price of $164 was derived, prioritizing downside protection. However, the subjectivity of terminal multiples, particularly for Tesla, underscores the intricacies of forecasting five years into the future.

Considering an alternative scenario with a 30x terminal multiple, the intrinsic value diminishes to $171, suggesting an entry price of $137 for enhanced downside protection. While securing Tesla at this level could offer attractive entry points, the feasibility of the stock reaching such levels remains uncertain. As I delve deeper into my investment decision in the conclusion, navigating these valuation intricacies will be paramount in devising a prudent and strategic approach to Tesla's evolving market dynamics.

Tesla’s Next Price Target

Setting a price target for Tesla involves forecasting future earnings, growth rates, and market sentiment to estimate its fair value. While price targets serve as reference points for investors, they are inherently subjective and subject to revision based on changing market conditions and company performance. As analysts adjust their price targets in response to new information and developments, investors should view price targets as part of a broader investment thesis rather than definitive predictions of future stock prices.

Conclusion:

The automotive sector, especially electric vehicle players like Tesla, are facing the brunt of a cyclical downturn exacerbated by price cuts and shrinking margins. Despite being caught between two growth phases, Tesla's resilient profit generation amidst heavy business investments positions it as a potential standout amid the sector's turmoil. Notably, Tesla's superior returns on equity and invested capital underscore its quality relative to competitors, showcasing its potential for long-term success.

Considering Tesla's current valuation, while it has dipped from previous highs, it remains relatively high compared to industry peers. Yet, the market seems willing to pay for Tesla's growth potential despite prevailing pessimism. While uncertainties loom, including dependency on interest rate cuts and market sentiment fluctuations, opportunities for a contrarian play emerge as sentiment hits lows. Hence, with Tesla nearing entry price thresholds, a cautious yet optimistic stance towards its stock warrants a modest position with potential for further accumulation as prices decline.

Of course, you should always do your own research and due diligence before investing in any stock. And you should also diversify your portfolio and balance your risk and reward.

Are you loving the content you’re devouring right now? Don’t miss out on our exclusive newsletter! Subscribe to our newsletter and Get my FREE bonus '7 Top AI Stocks to Buy for 2024.💰💡

~ Final Thought: "Investing: Fortune favours the patient investor, whose foresight and resilence pave the path to wealth" 🌱

Reply