- StocksGeniusMastery

- Posts

- 💥Google’s AI Machine Is Just Getting Warmed Up — Here’s What Investors Need to Know

💥Google’s AI Machine Is Just Getting Warmed Up — Here’s What Investors Need to Know

Google Cloud’s massive AI backlog and surging Gemini adoption point to years of underestimated growth.

Hi Fellow Investors,

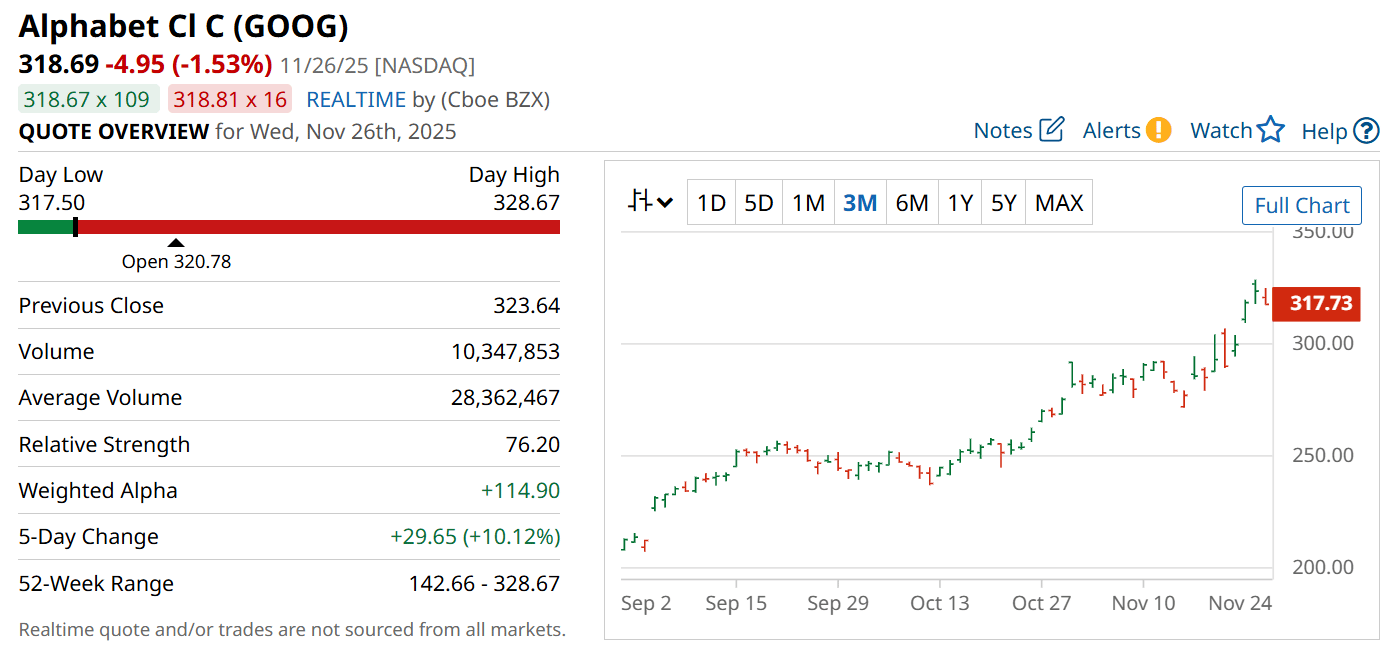

Alphabet (NASDAQ: GOOG) continues to defy expectations as its cloud momentum and AI adoption accelerate at a pace few predicted.

Google Cloud’s massive backlog surge and Gemini’s explosive user growth underline a business hitting a true inflection point.

Investors now want to know whether the stock still has room to run after a sharp rally.

Key Points:

Google Cloud’s backlog soared 79% last quarter, signaling a powerful wave of enterprise AI adoption.

Gemini’s 650 million monthly users highlight Alphabet’s strengthening position in consumer AI.

Despite a big stock rebound, Alphabet’s cloud trajectory and resilient search platform suggest further upside ahead.

TODAY’S SPONSOR

Startups who switch to Intercom can save up to $12,000/year

Startups who read beehiiv can receive a 90% discount on Intercom's AI-first customer service platform, plus Fin—the #1 AI agent for customer service—free for a full year.

That's like having a full-time human support agent at no cost.

What’s included?

6 Advanced Seats

Fin Copilot for free

300 Fin Resolutions per month

Who’s eligible?

Intercom’s program is for high-growth, high-potential companies that are:

Up to series A (including A)

Currently not an Intercom customer

Up to 15 employees

AI Demand Turns Alphabet Into a Revenue Engine

Enterprise AI spending is finally hitting scale, and Alphabet (NASDAQ: GOOG) is emerging as a key beneficiary.

The company’s third-quarter results showed revenue climbing 16% to $102 billion, signaling that AI investments are translating directly into top-line growth.

Adjusted margins expanded to 34%, proving Alphabet can spend aggressively on AI while still widening profitability.

The cloud segment is now accelerating, contributing a growing share of overall sales as enterprise clients increase AI workloads.

This shift marks the beginning of a multi-year monetization cycle driven by new AI services and infrastructure demand.

Cloud Backlog Explosion Signals a New AI Cycle

Google Cloud delivered the clearest evidence that Alphabet’s AI strategy is working.

The segment grew 34% year over year and now accounts for 15% of total revenue, reflecting strong traction in enterprise deployments.

Most striking was the 79% surge in cloud backlog — more than double last quarter’s growth rate — signaling a powerful pipeline of committed AI workload demand.

This surge demonstrates that enterprises are increasingly turning to Google’s AI-optimized infrastructure rather than relying solely on general-purpose chips.

The Anthropic partnership adds another leg of growth, bringing one of the industry’s most advanced AI labs directly onto Google’s TPU ecosystem.

With up to 1 gigawatt of new capacity coming online next year, Alphabet could unlock $8 billion to $10 billion in annual revenue from this collaboration alone.

Search Dominance Continues Despite AI Disruption Fears

Many expected AI-powered competitors to erode Google Search, but the opposite is happening.

Search grew 12% in the second quarter, maintaining more than 80% global market share despite heightened competition.

AI Overviews and AI Mode are driving incremental searches, boosting engagement rather than cannibalizing existing traffic.

Gemini’s 650 million monthly users show Alphabet’s strong consumer AI foothold and validate its cross-platform integration strategy.

A key advantage is Alphabet’s vertical AI stack, which delivers lower-cost inference thanks to custom TPUs and highly optimized models.

A technical analysis showed median Gemini prompts use just 0.24 watt-hours, making them as efficient as traditional search and more cost-effective than many competitors’ estimates.

The AI Opportunity Is Clear — and Alphabet Is Positioned to Lead

Alphabet’s resurgence reflects a market reevaluating the company’s underestimated AI capabilities.

Its cloud business is hitting scale, its search franchise remains as durable as ever, and its AI chips offer a compelling alternative to third-party hardware.

The company is not playing catch-up; it is demonstrating leadership across infrastructure, hardware, and user-facing AI applications.

For investors looking beyond short-term momentum, Alphabet offers exposure to the deep AI infrastructure buildout and high-margin advertising cash flows.

The company’s long runway in cloud, consumer AI, and emerging platforms like Waymo further strengthens its long-term investment case.

Strengths

Alphabet benefits from a massive surge in cloud backlog, signaling accelerating enterprise AI adoption and multi-year revenue visibility.

The company’s vertically integrated AI stack delivers unmatched efficiency, lowering costs and improving scalability.

Its search franchise remains dominant, supported by AI-enhanced features that deepen engagement and expand ad inventory.

Weaknesses

A premium valuation compared to the overall market may limit near-term upside for value-focused investors.

Heavy AI infrastructure spending could pressure margins if demand doesn't keep accelerating.

Regulatory scrutiny remains a persistent risk, particularly around antitrust investigations and data privacy.

Potential

The Anthropic partnership could unlock billions in high-margin cloud revenue as AI workloads shift toward Google’s TPU infrastructure.

Gemini’s rapid adoption opens the door to new monetization pathways in consumer AI, productivity, and search integration.

Long-term optionality from businesses like Waymo and DeepMind provides additional upside beyond core advertising and cloud.

TODAY’S SPONSOR

From Boring to Brilliant: Training Videos Made Simple

Say goodbye to dense, static documents. And say hello to captivating how-to videos for your team using Guidde.

1️⃣ Create in Minutes: Simplify complex tasks into step-by-step guides using AI.

2️⃣ Real-Time Updates: Keep training content fresh and accurate with instant revisions.

3️⃣ Global Accessibility: Share guides in any language effortlessly.

Make training more impactful and inclusive today.

The best part? The browser extension is 100% free.

Conclusion

Alphabet’s strengthening cloud momentum and resilient search platform suggest the company remains in the early innings of an AI-powered growth cycle.

Its financial strength, AI leadership, and expanding user engagement create a compelling setup for long-term investors.

While the stock has rallied sharply, the underlying business trajectory still supports further upside.

Final Thought

Investors often overlook opportunities hiding in plain sight, and Alphabet may be one of them.

The company’s AI ecosystem is only beginning to show its true potential.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply