- StocksGeniusMastery

- Posts

- 💥Is It Time to Invest in Amazon Before July 31?

💥Is It Time to Invest in Amazon Before July 31?

Amazon’s AI-Fueled Cloud Empire Is Gearing Up for a Major Breakout – Will You Be In Before the Next Surge?

Hello Fellow Investors!

Earnings season is heating up, and few companies draw more attention than Amazon (NASDAQ: AMZN) . As one of the major players fueling the artificial intelligence revolution, Amazon’s upcoming report could set the tone for the broader tech sector.

While e-commerce still drives the bulk of revenue, it’s Amazon Web Services (AWS) — the company’s high-margin cloud division — that holds the key to its AI ambitions. Investors and analysts alike will be laser-focused on AWS’s growth, partnerships, and AI integration efforts.

With a strong history of outperforming Wall Street’s estimates and expanding its AI infrastructure, Amazon may be preparing to surprise the market once again. The July 31 earnings release could be a pivotal moment for investors deciding whether to jump in — or wait on the sidelines.

Key Points:

Amazon is set to report Q2 2025 earnings on July 31, and the stakes couldn’t be higher.

The company has consistently beaten analyst expectations, fueling confidence in its growth momentum.

AWS and its growing portfolio of AI tools will be the spotlight of this earnings report — and a key driver for Amazon's long-term upside.

TODAY’S SPONSOR

Not All AI Notetakers Are Secure. Here’s the Checklist to Prove It.

You wouldn’t let an unknown vendor record your executive meetings, so why trust just any AI?

Most AI notetakers offer convenience. Very few offer true security.

This free checklist from Fellow breaks down the key criteria CEOs, IT teams, and privacy-conscious leaders should consider before rolling out AI meeting tools across their org.

AI-Powered Cloud Growth Could Hit Hyperdrive This Quarter

Amazon Web Services (AWS), the crown jewel of Amazon’s empire, is on the verge of another potential growth acceleration.

As the world’s largest cloud computing platform, AWS plays a central role in the global AI arms race — spanning data center infrastructure, custom-built AI chips like Trainium2, and an ever-expanding suite of large language models.

Through its Bedrock platform, AWS empowers developers with both in-house and third-party generative AI models, making it a one-stop shop for building intelligent applications.

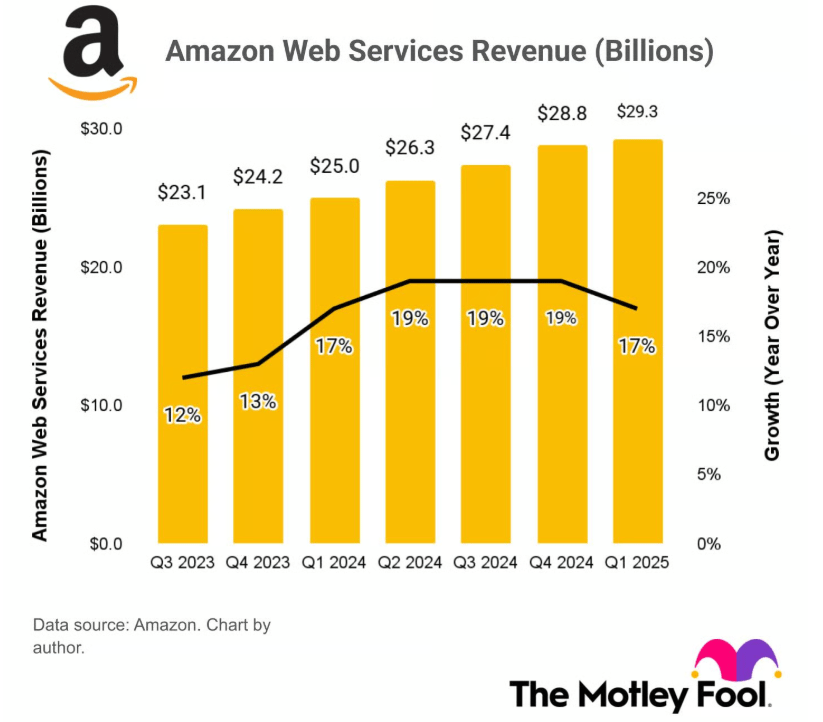

Despite a slight deceleration in revenue growth last quarter, demand for AWS's AI-driven services is now outpacing its supply.

CEO Andy Jassy recently signaled that new infrastructure capacity is coming online soon — which could clear the runway for an earnings beat and a renewed growth trajectory.

Investors watching for a reacceleration in AWS will be laser-focused on July 31, when Amazon unveils its Q2 results.

Amazon Keeps Outperforming – and the Street Can’t Keep Up

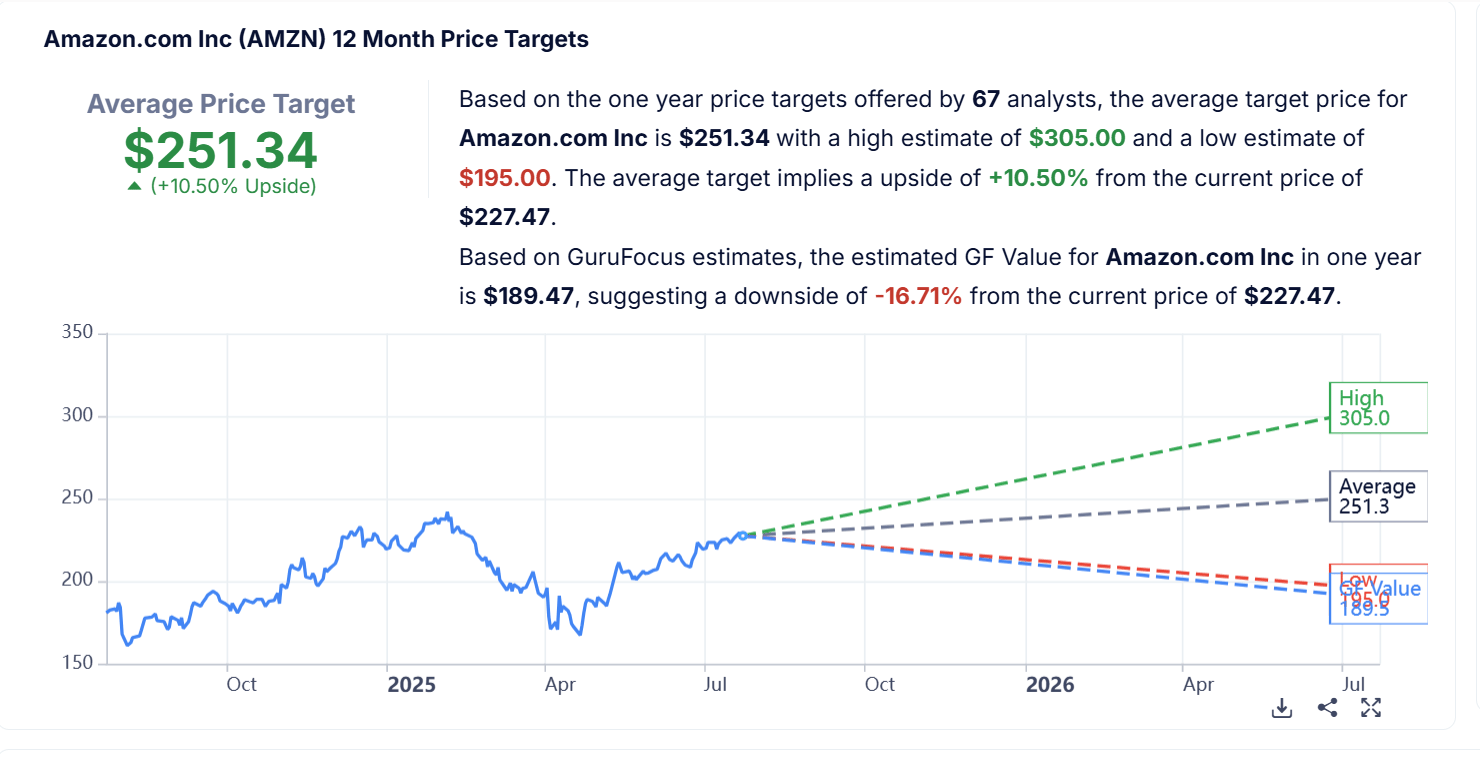

Amazon has built a reputation for exceeding expectations — and not by a small margin. Over the past year, it has delivered blowout earnings beats every single quarter, with an average surprise of 23%.

That momentum continued into 2025, as Amazon’s first-quarter EPS surged 62% year-over-year, crushing Wall Street’s forecast.

What’s driving this strength?

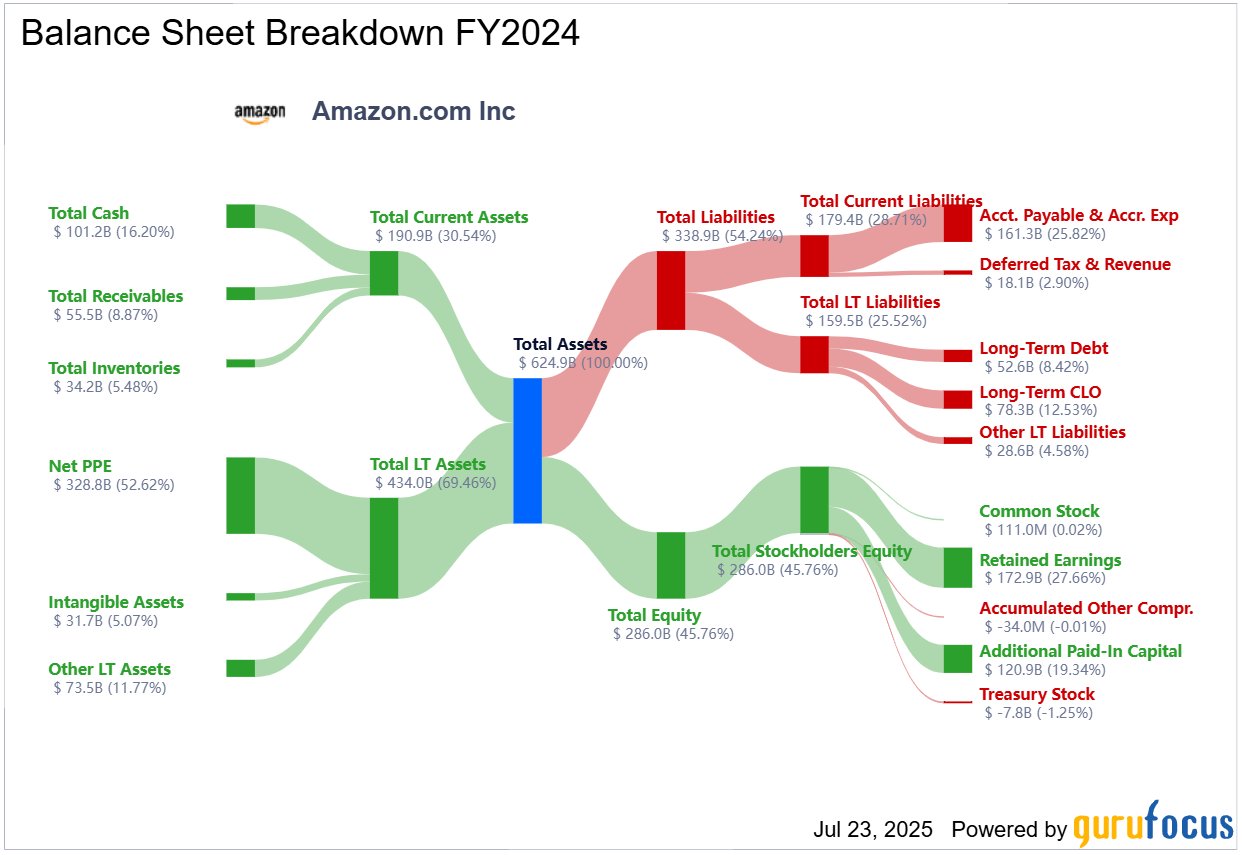

AWS remains Amazon’s profit engine, contributing 62% of operating income despite accounting for less than one-fifth of total revenue.

Meanwhile, Amazon’s e-commerce segment — long known for razor-thin margins — is becoming more efficient, thanks to smart cost-cutting and AI-powered logistics like “Project Private Investigator.”

With stronger profitability and ongoing innovation, Amazon continues to outmaneuver analyst expectations quarter after quarter.

Why Amazon Might Still Be a Smart Buy Before July 31

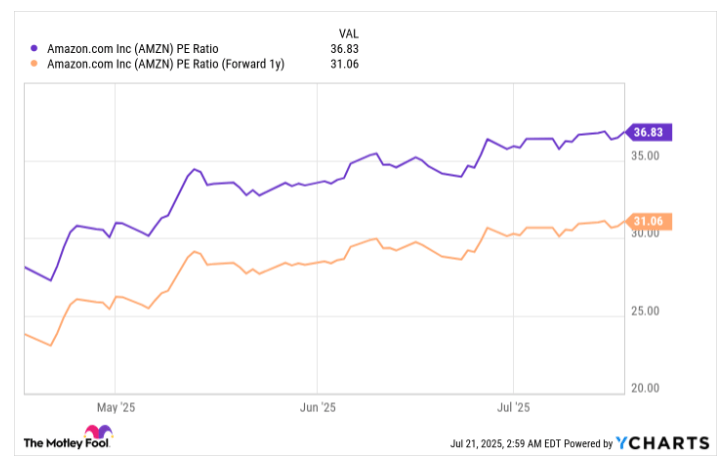

While Amazon’s current price-to-earnings ratio of 36.8 may raise eyebrows, the valuation tells a different story when you look ahead.

Based on 2026 EPS projections, its forward P/E drops to 31 — leaving room for upside, especially if earnings continue outpacing forecasts.

Short-term traders may hesitate due to high valuation, but long-term investors could see this as a golden entry point.

Amazon isn’t just about e-commerce anymore; it’s transforming into a global AI infrastructure powerhouse.

From cloud services to custom chips to fulfillment automation, Amazon is laying the foundation for exponential growth over the next decade.

Investors who look beyond the next quarter and focus on the bigger picture are more likely to be rewarded — and those who get in before July 31 may be stepping in just before the next rally.

Strengths

Dominant Cloud Presence: AWS remains the world’s leading cloud platform, with deep penetration across AI, enterprise, and developer communities.

Consistent Earnings Outperformance: Amazon has exceeded analyst EPS estimates every quarter for the past year, often by wide margins.

Efficiency-Focused Innovation: Strategic AI integration in logistics and fulfillment is driving margin expansion in core retail operations.

Weaknesses

Premium Valuation: With a trailing P/E above 36, the stock trades at a premium compared to broader tech indices.

Cloud Growth Bottlenecks: AWS demand is currently constrained by infrastructure limitations, which could cap short-term momentum.

E-commerce Margin Pressure: Despite improved efficiency, retail remains a low-margin business segment that can weigh on profitability.

Potential

Reacceleration in AWS Revenue: New data centers and AI infrastructure coming online could trigger faster growth in Q2 and beyond.

AI Infrastructure Tailwinds: Amazon’s end-to-end AI ecosystem — from chips to software — positions it for outsized gains as enterprise AI adoption scales.

Long-Term Value Creation: With projected EPS of $7.29 by 2026, Amazon offers compelling upside for investors willing to hold through short-term noise.

TODAY’S SPONSOR

Create How-to Videos in Seconds with AI

Stop wasting time on repetitive explanations. Guidde’s AI creates stunning video guides in seconds—11x faster.

Turn boring docs into visual masterpieces

Save hours with AI-powered automation

Share or embed your guide anywhere

How it works: Click capture on the browser extension, and Guidde auto-generates step-by-step video guides with visuals, voiceover, and a call to action.

Conclusion

Amazon stands at the crossroads of cloud dominance and AI transformation — two of the most powerful forces shaping the next decade of technology.

Its ability to consistently beat expectations, drive innovation across its business units, and scale profit engines like AWS makes it a compelling stock for long-term investors.

With Q2 earnings approaching, the next chapter in Amazon’s growth story may be just days away from unfolding.

For those with patience and vision, the current moment may prove to be a pivotal opportunity.

Final Thought

Will Amazon’s next earnings beat light the fuse for another breakout — or has the market already priced in perfection?

The real question is: will you be in before the momentum reignites?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply