- StocksGeniusMastery

- Posts

- 💥Is Microsoft Stock Still a Buy After Its OpenAI Deal?

💥Is Microsoft Stock Still a Buy After Its OpenAI Deal?

OpenAI’s new $250B Azure commitment cements Microsoft’s AI dominance heading into 2026.

Hi Fellow Investors,

Microsoft (NASDAQ: MSFT) continues to demonstrate unmatched growth momentum.

Strong cloud demand, record-breaking AI commitments, and a deepened OpenAI partnership are setting the stage for another powerful earnings cycle.

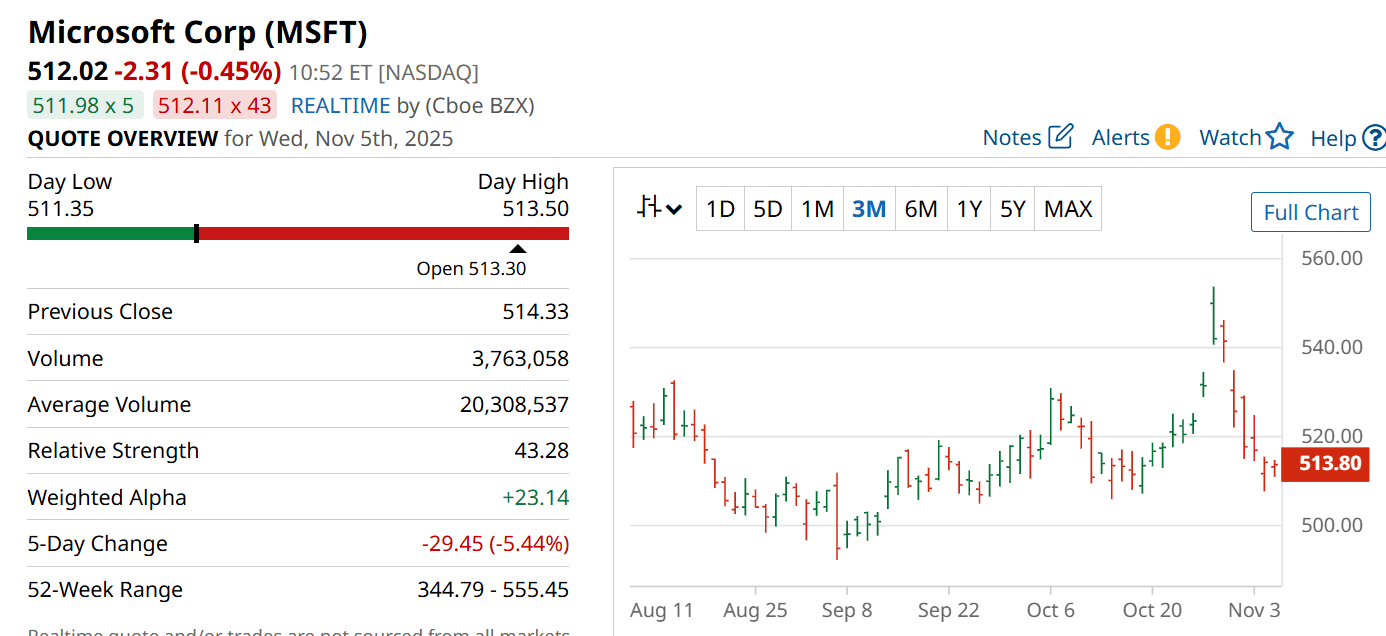

Investors are asking whether this tech titan’s current valuation still represents opportunity — or if the easy gains are already gone.

Key Points:

Microsoft reported an 18% jump in total revenue and 23% growth in adjusted EPS, beating Wall Street estimates.

Azure’s 40% growth and a $250 billion OpenAI commitment underline Microsoft’s AI leadership.

Despite a $3.8T market cap, Microsoft still looks attractively valued at a 33x forward P/E.

TODAY’S SPONSOR

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Azure’s Relentless Growth Drives the Engine

Microsoft’s cloud computing division continues to dominate the enterprise landscape.

Azure revenue surged 40% year over year — its ninth straight quarter above 30% growth.

That momentum comes largely from AI adoption, with OpenAI and other partners ramping workloads and model training on Microsoft’s infrastructure.

GitHub, another critical cloud-linked unit, saw user growth soar to 26 million developers, further embedding Microsoft across the global software ecosystem.

These numbers reaffirm that Azure is not just a growth story — it’s an AI backbone powering the next generation of enterprise computing.

The OpenAI Deal: Microsoft’s $135 Billion Bet on the Future

The company’s newly finalized OpenAI agreement could redefine its trajectory.

Microsoft now holds a 27% stake valued around $135 billion, along with exclusive intellectual property rights and API access through 2032.

OpenAI’s additional $250 billion in Azure commitments locks in multi-year cloud demand — effectively guaranteeing billions in future revenue.

This strategic tie ensures Microsoft remains central to the generative AI revolution while deepening its technological moat.

With access to the world’s most advanced LLMs, Microsoft is positioned as both a key enabler and a dominant distributor of AI innovation.

Broad-Based Strength Across Business Units

Beyond Azure, Microsoft’s other core segments continued to impress.

The productivity and business processes division — home to Microsoft 365 and LinkedIn — climbed 17% year over year to $33 billion in revenue.

Microsoft 365 Consumer revenue jumped 26%, supported by pricing power and rising subscriber growth.

Meanwhile, its “More Personal Computing” division rose 4%, driven by Windows, Xbox, and a 16% surge in search and news advertising.

Every line of business is expanding, showcasing Microsoft’s diversified growth engine.

Strengths

Azure’s ninth consecutive quarter of 30%+ revenue growth underscores unparalleled AI and cloud dominance.

The OpenAI partnership secures multi-year demand visibility and reinforces Microsoft’s AI leadership.

Strong performance across all business units demonstrates operational resilience and balanced growth.

Weaknesses

A 33x forward P/E suggests limited margin for valuation error if growth slows.

Heavy capex investments in GPUs and CPUs could pressure near-term cash flow.

Reliance on continued AI demand introduces cyclical risk if enterprise budgets tighten.

Potential

Accelerating AI adoption could expand Azure’s total addressable market exponentially.

Continued integration of OpenAI technologies into Microsoft 365 and GitHub may drive new subscription growth.

Strategic cloud spending and early leadership in AI infrastructure position Microsoft as a long-term compounding powerhouse.

TODAY’S SPONSOR

Don't get SaaD. Get Rippling.

Software sprawl is draining your team’s time, money, and sanity. Our SaaD Audit sheet helps you analyze the true cost of “Software as a Disservice” and shows you how to get that time, money, and sanity back.

Conclusion

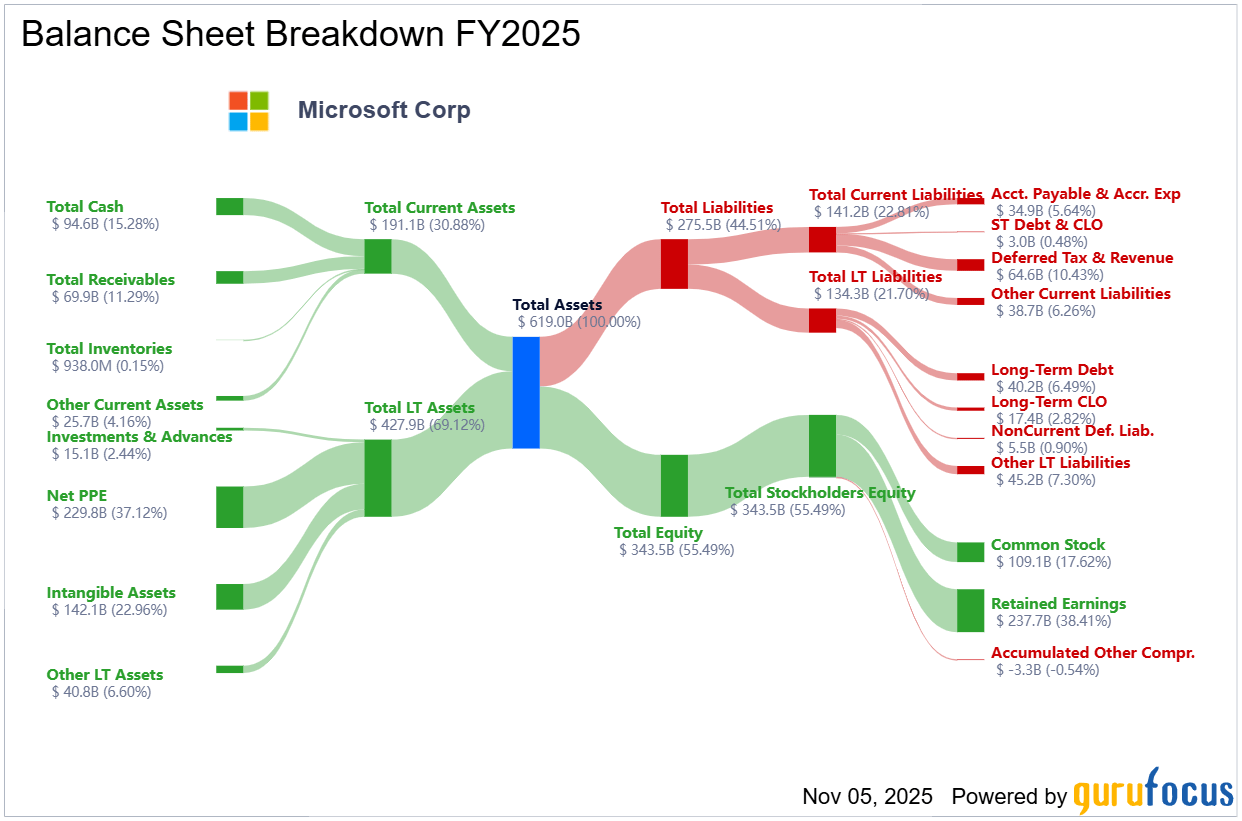

Microsoft’s combination of cloud scale, AI partnerships, and balanced financial strength presents one of the most compelling long-term opportunities in tech.

Despite its size, the company continues to grow earnings at a double-digit pace while investing aggressively for the future.

For investors seeking durable AI exposure backed by strong fundamentals, Microsoft remains a solid buy.

Final Thought

Can a $3.8 trillion company still double from here?

If AI continues to redefine global enterprise computing, Microsoft’s dominance could make that question less far-fetched than it sounds.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply