- StocksGeniusMastery

- Posts

- 💥 Is Netflix’s 40% Slide the Setup for a Massive Comeback?

💥 Is Netflix’s 40% Slide the Setup for a Massive Comeback?

A fallen streaming giant faces its most important valuation test in years.

Hi Fellow Investors,

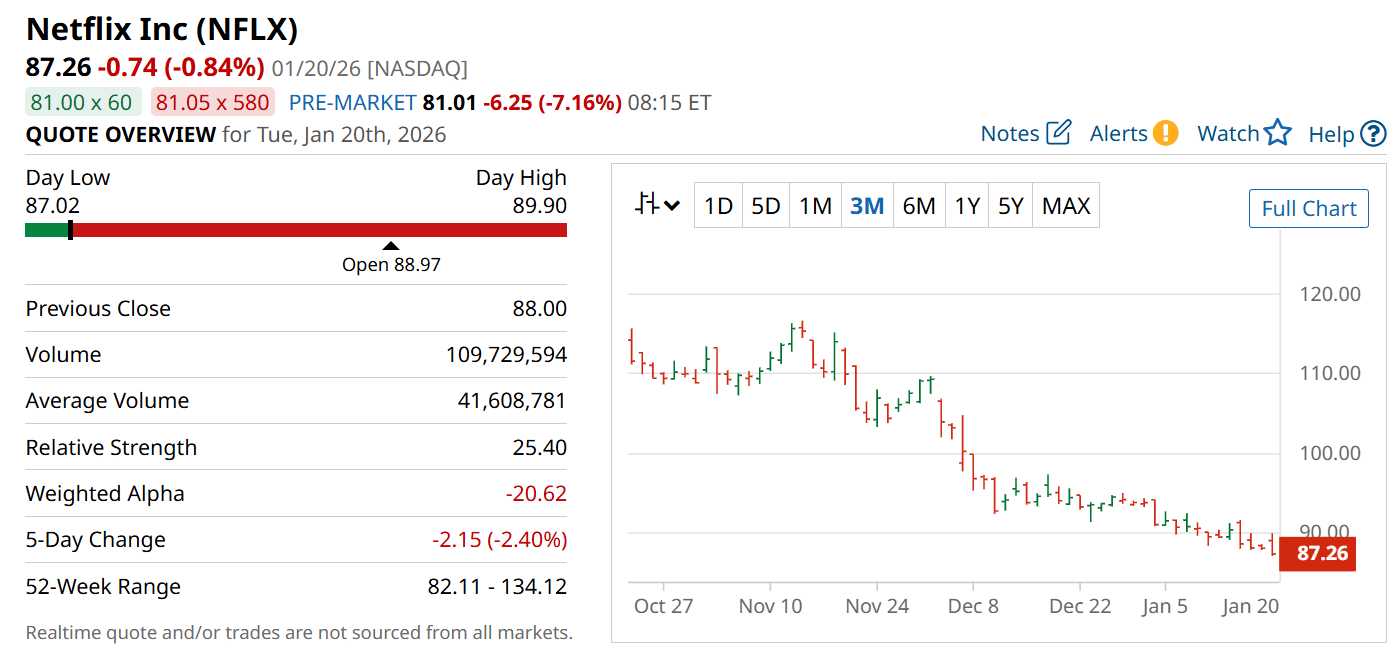

Netflix (NASDAQ: NFLX) has delivered some of its strongest financial results in years, yet the stock has suffered a sharp and unsettling sell-off.

The disconnect between operating performance and share price action is forcing investors to reassess whether this pullback is an opportunity or a warning.

With growth slowing and a major acquisition looming, the next chapter for the streaming leader is being written right now.

Key Points:

Netflix posted strong fourth-quarter growth and expanding margins, but forward guidance raised concerns.

Investor skepticism around the Warner Bros. Discovery acquisition has pressured the stock.

Valuation has fallen to levels not seen in years, despite continued profitability and scale advantages.

TODAY’S SPONSOR

Payroll errors cost more than you think

While many businesses are solving problems at lightspeed, their payroll systems seem to stay stuck in the past. Deel's free Payroll Toolkit shows you what's actually changing in payroll this year, which problems hit first, and how to fix them before they cost you. Because new compliance rules, AI automation, and multi-country remote teams are all colliding at once.

Check out the free Deel Payroll Toolkit today and get a step-by-step roadmap to modernize operations, reduce manual work, and build a payroll strategy that scales with confidence.

Solid Results Mask a Market Confidence Problem

Netflix closed out 2025 with its fastest revenue growth in more than a year.

Revenue climbed nearly 18% to $12.1 billion, beating expectations and confirming resilient demand across its platform.

Operating margins expanded meaningfully to 24.5%, reflecting disciplined cost control and higher monetization.

Advertising momentum continued to build, validating management’s multi-tier strategy.

From a pure performance standpoint, the quarter reinforced Netflix’s position as the most profitable major streamer.

Guidance Signals Slower Growth Ahead

Looking into 2026, management guided for revenue growth in the low-teens range.

While that pace remains impressive for a company of Netflix’s size, it marks a deceleration from recent levels.

The company expects advertising revenue to double, signaling confidence in a key growth lever.

Operating margin targets of over 30% suggest earnings power is still expanding rapidly.

However, markets reacted negatively to the implication that peak growth may now be in the past.

Acquisition Fears and Valuation Reset

Investor sentiment has also been shaken by Netflix’s planned acquisition of Warner Bros. Discovery.

Concerns around execution risk and capital allocation have overshadowed otherwise strong fundamentals.

The decision to pause share buybacks to preserve cash amplified near-term uncertainty.

As a result, the stock has fallen roughly 40% from its peak, compressing valuation multiples.

At current levels, Netflix trades closer to the broader market despite superior margins and scale.

Strengths

Industry-leading profitability sets Netflix apart from loss-making streaming competitors.

A fast-growing advertising tier opens a powerful new revenue stream with minimal incremental cost.

Global scale and original content depth create durable competitive advantages.

Weaknesses

Slowing revenue growth challenges the narrative of perpetual high expansion.

The Warner Bros. Discovery deal introduces integration and execution risk.

Investor confidence has weakened following abrupt strategic shifts.

Potential

Margin expansion could drive earnings growth faster than revenue growth.

Advertising success may unlock a re-rating of the business model.

A stabilized acquisition strategy could quickly restore market confidence.

TODAY’S SPONSOR

We’re running a super short survey to see if our newsletter ads are being noticed. It takes about 20 seconds and there's just a few easy questions.

Your feedback helps us make smarter, better ads.

Conclusion

Netflix remains one of the strongest cash-generating platforms in global media.

The recent sell-off reflects uncertainty, not operational collapse.

For long-term investors, the current valuation presents a compelling risk-reward setup.

Final Thought

When elite businesses fall out of favor, the biggest gains often follow clarity.

The key question is whether Netflix’s strategy restores confidence before patience runs out.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply