- StocksGeniusMastery

- Posts

- 💥Is Now the Time to Invest in Microsoft Before July 30?

💥Is Now the Time to Invest in Microsoft Before July 30?

Microsoft’s AI Momentum Is Accelerating – But Is the Stock Too Hot to Touch Ahead of Earnings?

Hello Fellow Investors!

Microsoft (NASDAQ: MSFT) isn't just riding the AI wave — it’s building it.

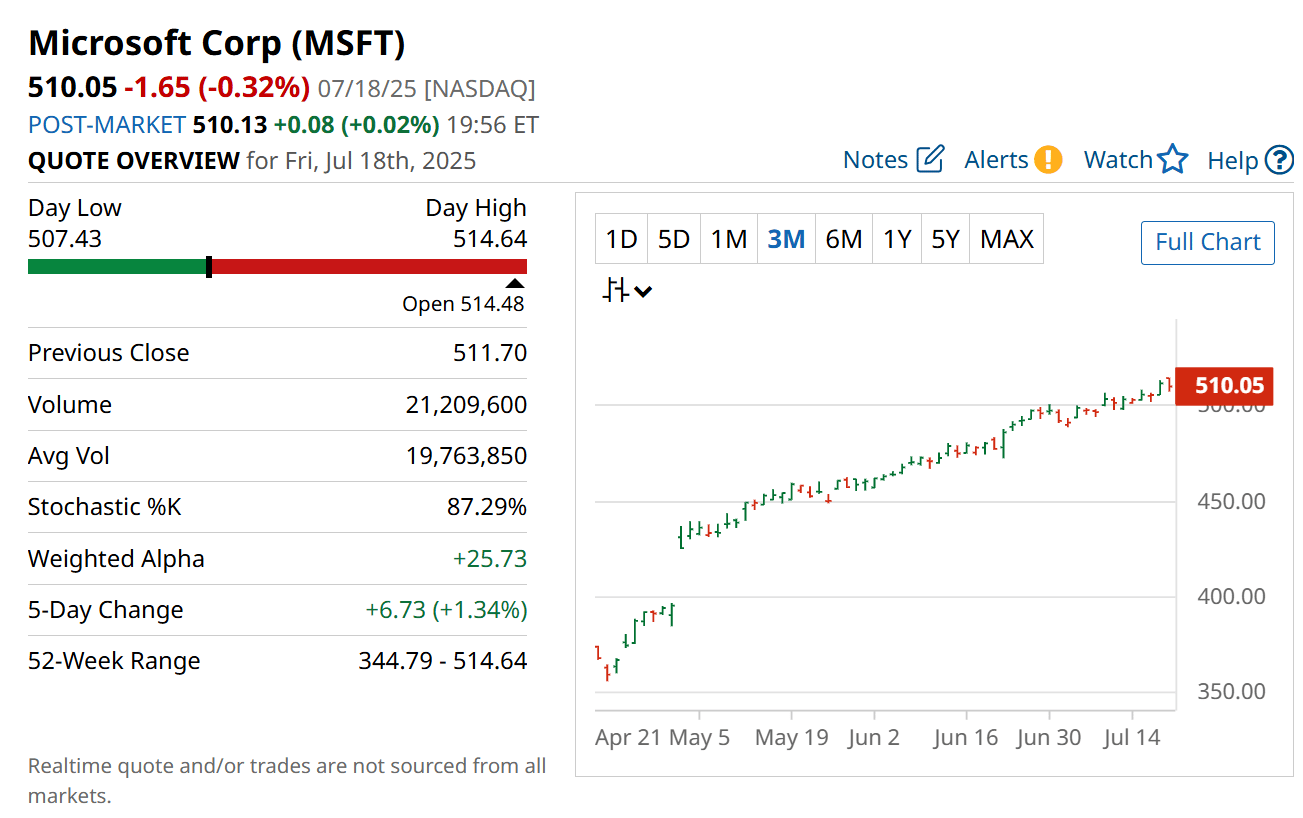

With shares already up 20% this year, the tech titan is outperforming the broader market by a wide margin.

All eyes are now on Microsoft’s upcoming earnings report on July 30, which could deliver the next jolt in the AI-fueled rally.

Any hint of stronger-than-expected cloud or AI growth could send shares soaring.

For investors seeking exposure to the next generation of AI infrastructure leaders, Microsoft offers both scale and innovation — but timing your entry could make all the difference.

Key Points:

Microsoft’s AI and Azure cloud business is quickly becoming the engine of its long-term growth.

The July 30 earnings report could spark a major move if AI momentum beats expectations.

Despite strong fundamentals, the stock trades at a premium — making timing critical for new investors.

TODAY’S SPONSOR

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

Cloud Powerhouse: Azure’s Role in Microsoft’s Next Growth Chapter

Microsoft has quietly evolved into one of the most dominant forces in the AI-driven cloud revolution.

While productivity tools like Word and Excel remain household staples, the real growth engine lies in its Intelligent Cloud segment — fueled by the explosive rise of Azure.

In the latest quarter, Azure's revenue jumped a staggering 33%, far outpacing the growth in Microsoft’s other business units.

Azure’s secret weapon? It acts as a platform that hosts a diverse range of cutting-edge generative AI models — from OpenAI’s ChatGPT to Meta’s Llama and Elon Musk’s Grok.

This “AI supermarket” strategy allows Microsoft to capitalize on the entire AI ecosystem without being tied to a single model.

With the global cloud market expected to more than triple by 2030, Azure is perfectly positioned to ride this $2.4 trillion wave.

Microsoft’s upcoming July 30 earnings report will likely spotlight this unstoppable momentum — and could be a defining moment for investors.

Priced for Perfection — But Is It Too Rich to Chase Right Now?

Microsoft’s 20% surge this year reflects high expectations — and its stock valuation shows it.

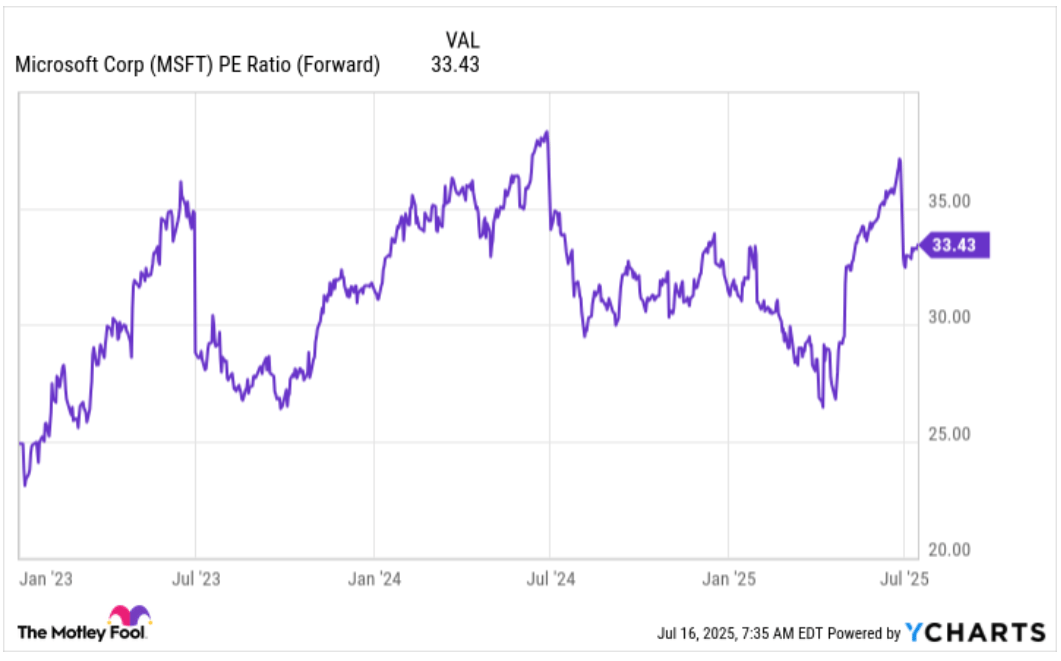

Currently trading at over 33 times forward earnings, Microsoft sits at the premium end of the tech sector.

While the company deserves a quality multiple thanks to its fortress-like balance sheet and AI-driven tailwinds, the pace of earnings growth hasn’t quite caught up to justify its lofty valuation.

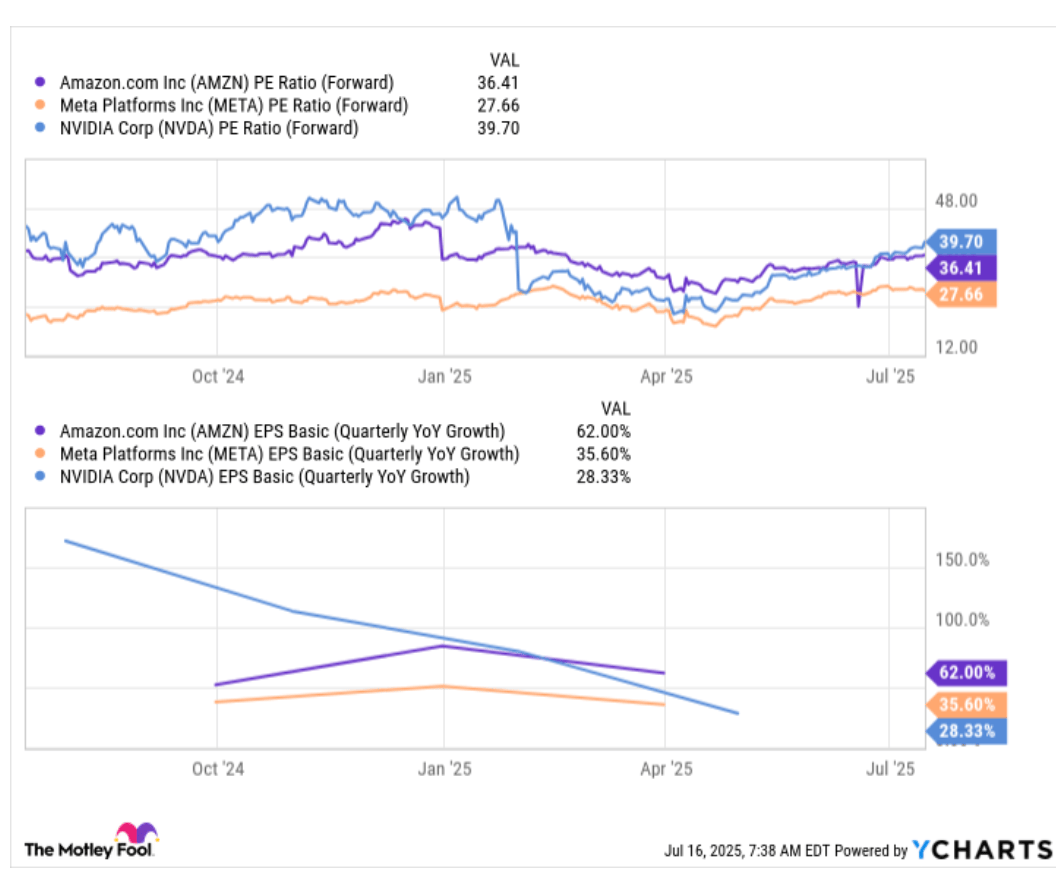

Compared to peers in its valuation range, some of which are growing earnings faster, Microsoft appears richly priced.

This doesn’t mean it’s not a strong long-term buy — only that caution may be warranted in the short term.

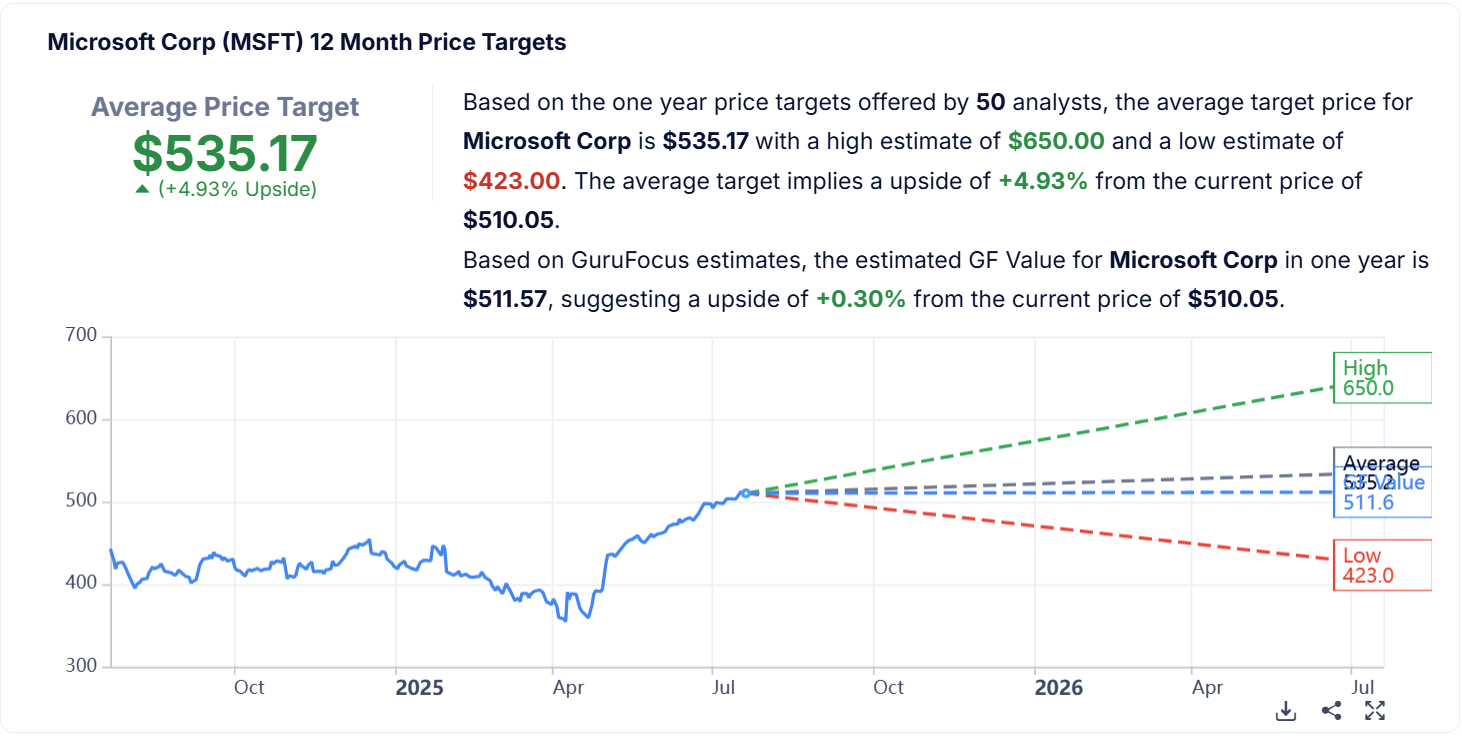

Investors hoping to capitalize on Microsoft’s AI boom may want to monitor how management frames its guidance on July 30.

A beat-and-raise could spark another rally. But any stumble could open a rare buying window at a discount.

Strengths

AI-Driven Cloud Leadership: Azure's 33% revenue growth and diverse AI offerings position Microsoft at the forefront of the next digital era.

Diverse Revenue Streams: Beyond cloud, Microsoft leverages growth in gaming, LinkedIn, and productivity tools for consistent performance.

Strategic AI Partnerships: The OpenAI collaboration and integration of top-tier models reinforce Microsoft’s role as a key AI infrastructure provider.

Weaknesses

High Valuation Premium: The stock trades at over 33x forward earnings, leaving little margin for error.

Earnings Growth Lag vs. Peers: While impressive, Microsoft’s EPS growth trails some competitors with similar valuations.

Dependence on Azure Momentum: A slowdown in cloud or AI adoption could disproportionately impact overall revenue growth.

Potential

Multi-Trillion-Dollar Cloud Expansion: Azure stands to gain massively from the global cloud market’s projected $2.4 trillion valuation by 2030.

AI Monetization at Scale: As enterprise AI adoption accelerates, Microsoft is poised to capture recurring revenue from AI workloads on Azure.

Platform Ecosystem Dominance: With Windows, Office, Azure, and Teams tightly integrated, Microsoft can continue scaling its ecosystem across consumer and enterprise markets.

TODAY’S SPONSOR

Start learning AI in 2025

Keeping up with AI is hard – we get it!

That’s why over 1M professionals read Superhuman AI to stay ahead.

Get daily AI news, tools, and tutorials

Learn new AI skills you can use at work in 3 mins a day

Become 10X more productive

Conclusion

Microsoft stands at the intersection of innovation and scale — a rare combination in today’s tech landscape.

Its powerful Azure engine, bolstered by a smart AI strategy and wide adoption, makes it a compelling long-term play.

Yet, with the stock trading at a premium and a pivotal earnings report looming, the best opportunities may come to those who wait for a market overreaction or short-term dip.

Investors seeking exposure to the AI megatrend should keep Microsoft high on their radar — the July 30 report could be the catalyst that sets the next leg of this rally in motion.

Final Thought

Will Microsoft's July 30 earnings mark the start of a new AI-driven bull run — or serve as a reminder that even tech giants must justify their price?

The answer could define where smart money moves next.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply