- StocksGeniusMastery

- Posts

- 💥 Is Nvidia Still a Buy After a Historic Run?

💥 Is Nvidia Still a Buy After a Historic Run?

Why AI Agents Could Push NVDA Much Higher in the Next 12 Months

Hi Fellow Investors,

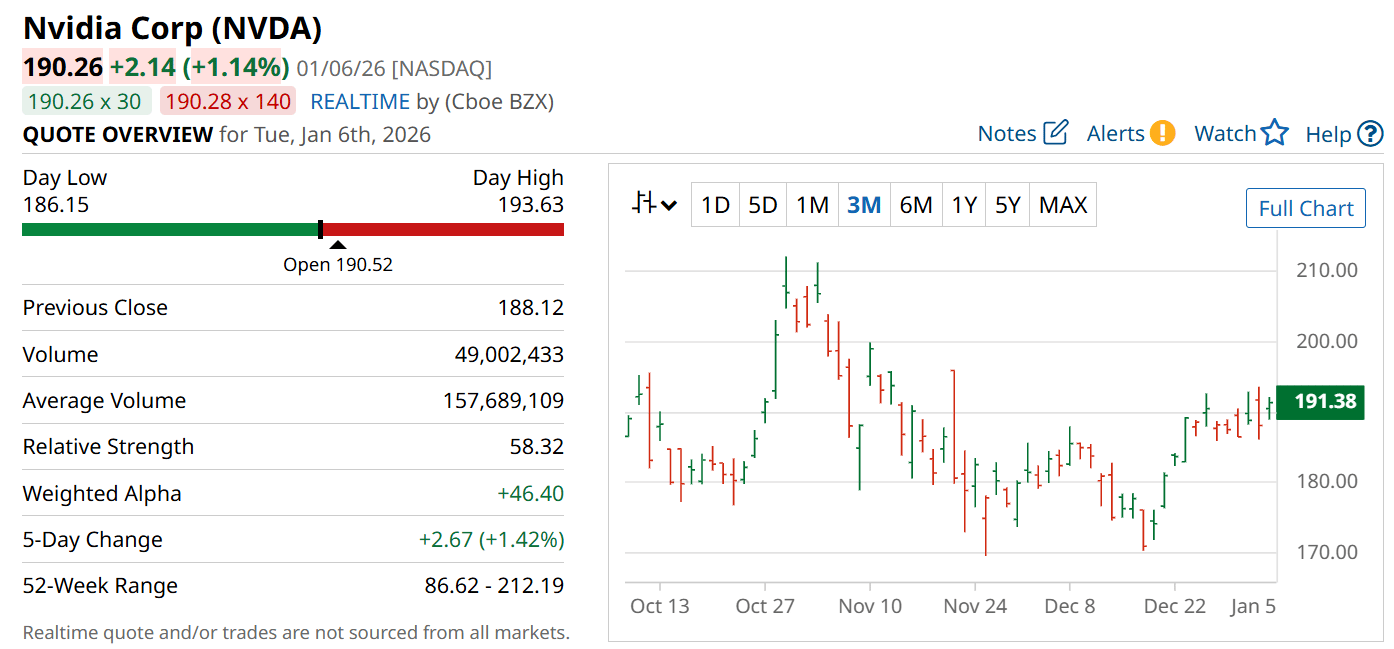

Nvidia (NASDAQ: NVDA) enters 2026 after one of the most dominant multi-year runs in market history.

The stock’s valuation suggests Wall Street is bracing for slower AI spending despite explosive demand signals.

A new wave of agentic AI could quietly reset Nvidia’s growth trajectory once again.

Key Points:

Nvidia trades near 25 times forward earnings despite record AI demand and constrained supply.

Wall Street fears an AI infrastructure slowdown and rising competition in advanced chips.

Agentic AI workloads could drive a new surge in high-end GPU and system demand.

TODAY’S SPONSOR

How much could AI save your support team?

Peak season is here. Most retail and ecommerce teams face the same problem: volume spikes, but headcount doesn't.

Instead of hiring temporary staff or burning out your team, there’s a smarter move. Let AI handle the predictable stuff, like answering FAQs, routing tickets, and processing returns, so your people focus on what they do best: building loyalty.

Gladly’s ROI calculator shows exactly what this looks like for your business: how many tickets AI could resolve, how much that costs, and what that means for your bottom line. Real numbers. Your data.

Why Nvidia’s Valuation Tells a Different Story

Nvidia’s share price surged dramatically over the last three years, yet the valuation entering 2026 appears restrained relative to growth.

The stock trades around 25 times forward earnings and roughly 46 times trailing earnings.

This pricing reflects skepticism around how long AI infrastructure spending can sustain its current pace.

Investors are increasingly concerned hyperscalers may moderate capital expenditures.

That caution has capped Nvidia’s multiple despite accelerating revenue forecasts.

This disconnect sets the stage for potential upside if demand remains resilient.

Wall Street’s Biggest Fear May Be Overstated

The primary risk embedded in Nvidia’s valuation is a slowdown in AI infrastructure investment.

Concerns also include rising competition from custom silicon and rival chip designers.

However, cloud providers continue to report demand for compute capacity exceeding supply.

Nvidia is effectively selling every GPU it can manufacture.

Supply constraints remain the limiting factor rather than end-market demand.

This dynamic supports sustained pricing power and margin strength.

Agentic AI Could Be Nvidia’s Next Growth Engine

Agentic AI represents a significant evolution beyond traditional chatbots.

These systems can plan, reason, and execute complex tasks autonomously.

Such models require exponentially more compute, sometimes up to 1,000 times more than basic conversational AI.

This shift directly benefits Nvidia’s highest-end hardware platforms.

The NVLink 72 rack system is optimized for precisely these workloads.

As agentic AI adoption accelerates, infrastructure demand could rise sharply.

The Path to $300 May Be Closer Than It Appears

Analysts project Nvidia’s revenue to grow roughly 50% in the coming year.

Earnings per share are expected to rise more than 60% as operating leverage expands.

If the stock simply maintains its current trailing multiple, shares could exceed $300.

That scenario implies more than 50% upside from recent price levels.

Importantly, this outlook does not assume multiple expansion.

It assumes execution continues at today’s pace.

Strengths

Nvidia dominates AI acceleration with an unmatched ecosystem spanning hardware, software, and systems.

Demand continues to exceed supply, reinforcing pricing power and long-term customer lock-in.

Agentic AI creates a structural tailwind that competitors struggle to replicate at scale.

Weaknesses

Valuation sensitivity remains high if AI spending expectations weaken materially.

Large customers continue exploring in-house silicon alternatives to reduce long-term costs.

Heavy reliance on data-center growth ties performance to cloud capital expenditure cycles.

Potential

Agentic AI adoption could materially expand total addressable market beyond current forecasts.

Sustained earnings growth may force Wall Street to re-rate the stock higher.

Continued supply tightness could extend Nvidia’s competitive moat well into the next decade.

TODAY’S SPONSOR

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 25 sales have delivered net annualized returns like 14.6%, 17.6%, and 17.8%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

Conclusion

Nvidia’s historic rally has not eliminated its forward opportunity.

Agentic AI introduces a new layer of demand that may not yet be fully reflected in forecasts.

For investors focused on long-term AI infrastructure leadership, Nvidia remains a compelling contender.

Final Thought

The greatest risk to Nvidia may not be competition or valuation.

It may be underestimating how transformative the next phase of AI truly becomes.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply