- StocksGeniusMastery

- Posts

- 💥Is Nvidia Still a Buy After Its Early 2025 Boom? Wall Street’s Verdict Is Overwhelming.

💥Is Nvidia Still a Buy After Its Early 2025 Boom? Wall Street’s Verdict Is Overwhelming.

New forecasts reveal a compelling entry point for long-term AI-focused portfolios.

Hi Fellow Investors,

Nvidia (NASDAQ: NVDA) continues to dominate the AI hardware landscape as its stock delivers another standout year.

The latest rally has pushed investors to question whether this is still an attractive entry point.

Wall Street’s newest projections shed light on what may be coming next.

Key Points:

Nvidia’s Q3 delivered massive revenue acceleration across its AI-driven data center business.

Analysts expect continued hypergrowth into 2026 and 2027 despite short-term market skepticism.

Wall Street’s price targets suggest Nvidia may still be undervalued relative to future earnings momentum.riven rivals.

TODAY’S SPONSOR

Startups who switch to Intercom can save up to $12,000/year

Startups who read beehiiv can receive a 90% discount on Intercom's AI-first customer service platform, plus Fin—the #1 AI agent for customer service—free for a full year.

That's like having a full-time human support agent at no cost.

What’s included?

6 Advanced Seats

Fin Copilot for free

300 Fin Resolutions per month

Who’s eligible?

Intercom’s program is for high-growth, high-potential companies that are:

Up to series A (including A)

Currently not an Intercom customer

Up to 15 employees

Nvidia’s Rapid 2025 Rally Has Investors Asking the Right Questions

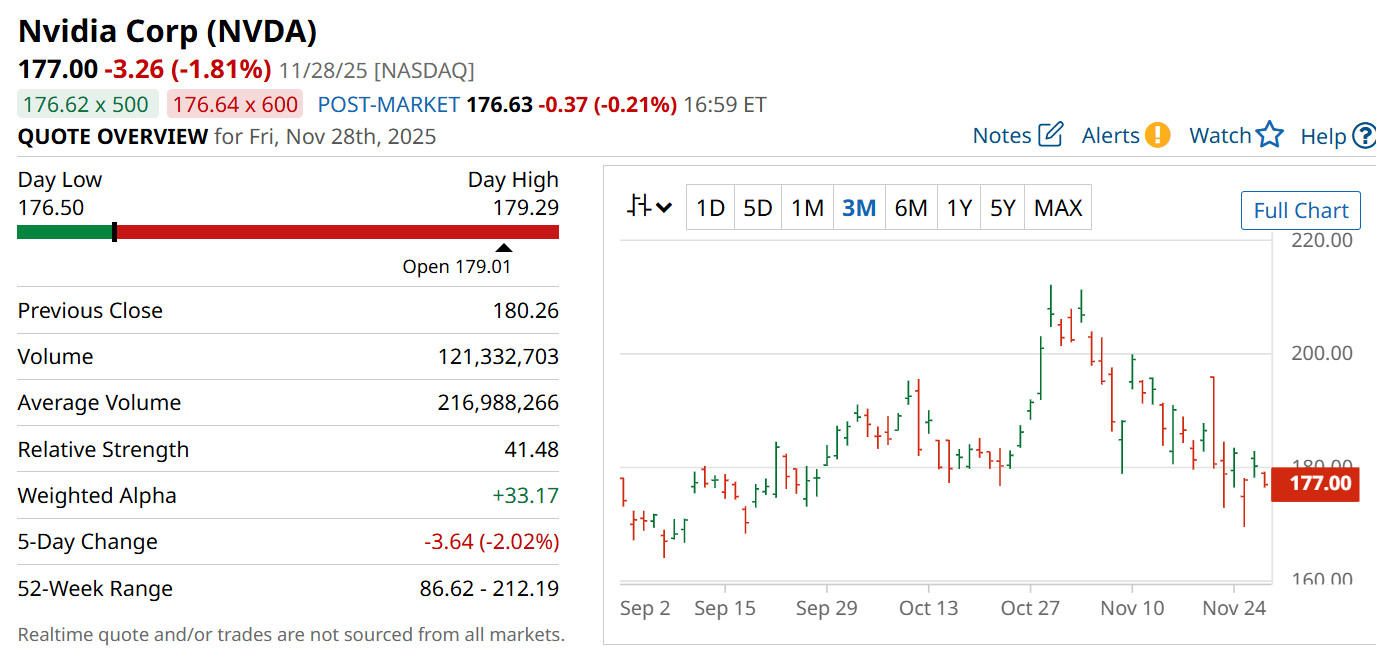

Nvidia’s stock has climbed roughly 30% in 2025, even after cooling off from its peak.

This pullback occurred despite the company continuing to post extraordinary AI-driven results.

Broader weakness across AI-related equities caused many firms to sell off regardless of fundamentals.

Investors faced renewed uncertainty as questions emerged around the cost and payoff timeline of hyperscaler AI buildouts.

But Nvidia’s historical rarity of meaningful pullbacks is forcing investors to consider whether this dip is a fleeting opportunity.

With Wall Street leaning heavily bullish, the answer may be clearer than the market’s reaction suggests.

Analysts Are Sending a Strongly Bullish Signal on Nvidia’s Future

Nvidia currently trades near the $180 level, but analysts see far more upside ahead.

Among 63 analysts tracked, the consensus price target sits near $250 — a strong premium to today’s valuation.

A striking 58 analysts rate the stock a buy or strong buy, leaving almost no room for bearish sentiment.

This near-unanimous confidence highlights Wall Street’s expectation of significant AI-driven expansion.

And with Nvidia’s visibility into next year’s chip demand, analysts expect a powerful multi-year growth cycle.

The data is unmistakable: professional sentiment strongly favors long-term ownership.

Nvidia’s Q3 Results Highlight Why AI Demand Shows No Signs of Slowing

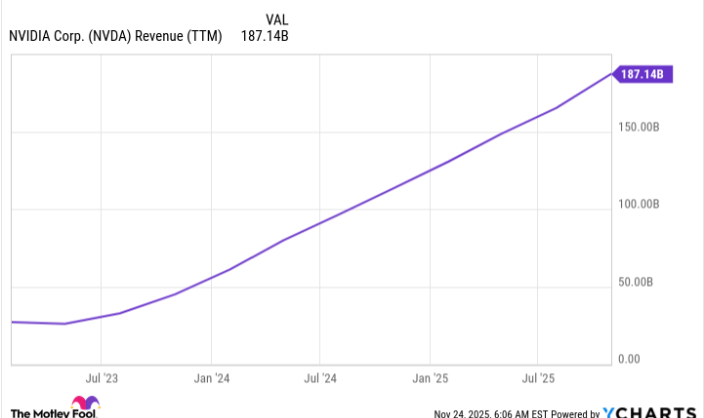

The company’s Q3 revenue surged 62% year over year to an astonishing $57 billion.

Its AI-centric data center segment expanded even faster, rising 66% to $51.2 billion.

This demonstrates Nvidia’s unrivaled grip on the world’s most valuable compute market.

Management noted that cloud providers have already sold out supply of next-generation hardware.

Looking ahead, Nvidia expects $500 billion in combined Blackwell and Rubin chip sales between 2025 and 2026.

Such levels imply that 2026 revenue could potentially double — an extraordinary feat for the world’s largest company.

Forecasts Suggest Nvidia’s Growth Trajectory May Be Even Higher Than Expected

Wall Street’s FY 2027 revenue estimates stand around $313 billion.

But current order flows and management’s commentary suggest those projections may be conservative.

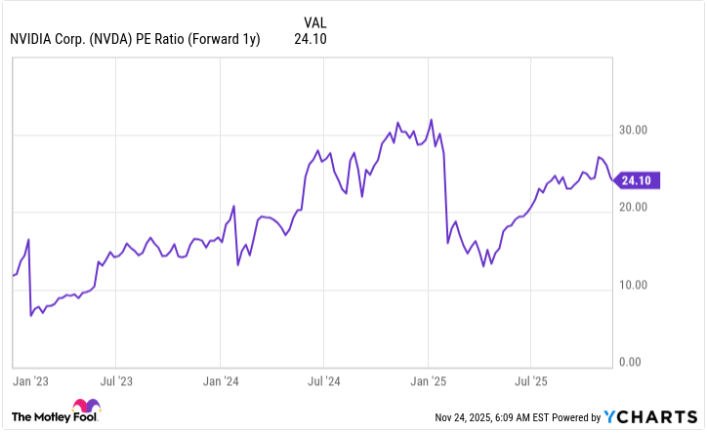

Despite this explosive backdrop, Nvidia trades for just 24 times next year’s earnings — cheaper than Microsoft and Apple.

Investors appear hesitant to fully price in the continuation of hyperscaler AI spending.

Yet tech leaders consistently reiterate that underbuilding AI infrastructure poses greater risks than overspending.

If these demand patterns hold, Nvidia remains positioned as the core beneficiary of the AI computing boom.

Strengths

Nvidia maintains total dominance in AI compute hardware, enabling pricing power and massive demand visibility.

Explosive growth in Blackwell and Rubin architectures sets the stage for multi-year revenue acceleration.

Strong analyst consensus and robust profitability create a favorable long-term risk-reward profile.

Weaknesses

Nvidia’s valuation, while cheaper than peers, still depends on aggressive hyperscaler spending to remain justified.

The company’s revenue remains heavily concentrated in data center customers with cyclical investment cycles.

Any slowdown in AI infrastructure funding could create notable short-term volatility.

Potential

Demand for next-generation AI models could drive record-breaking chip sales through 2026 and beyond.

Expected revenue expansion may push Nvidia into an entirely new valuation range if forecasts prove conservative.

Continued dominance in AI accelerators positions Nvidia as the primary engine of the global AI economy.

TODAY’S SPONSOR

Revolutionize Learning with AI-Powered Video Guides

Upgrade your organization training with engaging, interactive video content powered by Guidde.

Here’s what you’ll love about it:

1️⃣ Fast & Simple Creation: AI transforms text into video in moments.

2️⃣ Easily Editable: Update videos as fast as your processes evolve.

3️⃣ Language-Ready: Reach every learner with guides in their native tongue.

Bring your training materials to life.

The best part? The browser extension is 100% free.

Conclusion

Nvidia’s latest results and forward outlook demonstrate unmistakable long-term strength.

With Wall Street aligning almost unanimously behind the stock, the recent cooling-off period may be a rare opening.

For investors seeking exposure to the AI supercycle, Nvidia remains one of the market’s most compelling opportunities.

Final Thought

Every major technological shift has a defining company — and Nvidia may be that company for the AI era.

The real question is whether investors choose to act before the next major leg higher arrives.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply