- StocksGeniusMastery

- Posts

- 💥Meta Platforms’ Hidden Catalyst: The AI Boom That Could Trigger a Stock Split

💥Meta Platforms’ Hidden Catalyst: The AI Boom That Could Trigger a Stock Split

The only “Magnificent Seven” member yet to split may finally be gearing up for a game-changing move.

Hi Fellow Investors,

Meta Platforms (NASDAQ: META) is quietly preparing for what could be one of the most significant stock events of the decade.

The company’s artificial intelligence transformation is accelerating growth and deepening its ecosystem.

And that could send its share price soaring toward a long-awaited stock split by 2030.

Key Points:

Meta remains the only “Magnificent Seven” member yet to split its stock.

AI-driven ad tools and product innovations are fueling Meta’s next growth phase.

With rising revenue and an expanding ecosystem, a stock split could be on the horizon by 2030.

TODAY’S SPONSOR

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

A Rare Holdout in the Magnificent Seven

Meta Platforms has never split its stock — a unique trait among tech giants.

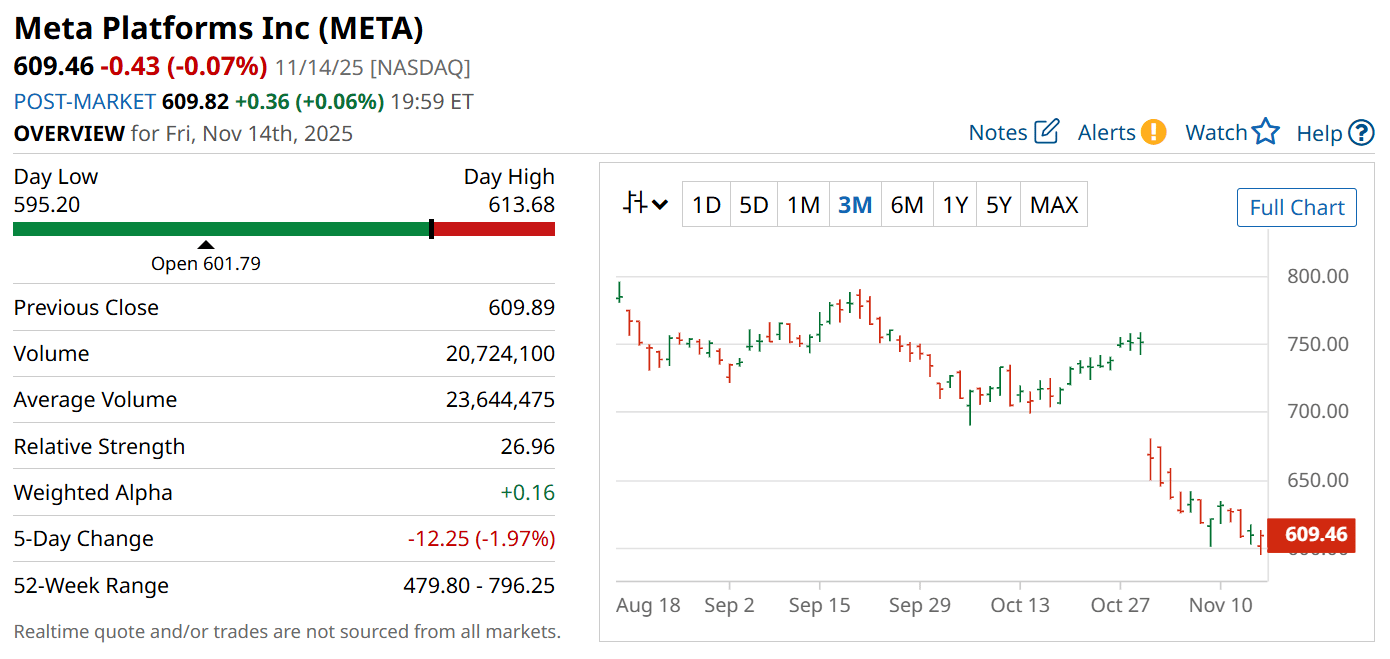

Since debuting at $38 per share in 2012, the company’s stock has soared more than fifteenfold, briefly peaking near $800.

Stock splits typically aim to make shares more accessible to retail investors and attract fresh momentum.

With Meta’s share price now back above $600, investor chatter around a potential split is building again.

And as Meta continues to dominate digital advertising and expand into AI-driven tools, the rationale for a future split grows even stronger.

Post-Earnings Dip or Opportunity in Disguise?

Following its latest earnings release, Meta’s shares dipped after a higher-than-expected tax charge and a surge in capital expenditures.

But beneath the headline numbers, business performance remains exceptional.

Revenue climbed 26% year over year to $51.2 billion — a powerful signal of underlying demand.

Without the one-time tax hit, earnings per share would have jumped more than 20%.

Daily active users across Facebook, Instagram, and WhatsApp reached a record 3.54 billion, showcasing massive global reach.

Far from a red flag, Meta’s post-earnings dip looks more like a buying window for patient investors.

AI: Meta’s Ultimate Growth Engine

Meta Platforms’ true growth catalyst lies in artificial intelligence.

The company’s AI-driven content recommendations are driving record engagement across its platforms.

New AI advertising tools are helping marketers refine their targeting and boost ROI — directly fueling Meta’s top line.

Management’s goal to fully automate ad creation by 2026 could transform digital marketing and unlock billions in new revenue.

This AI-first approach isn’t just improving efficiency; it’s reshaping Meta’s entire business model.

The Future of Interaction: AI Glasses and Beyond

CEO Mark Zuckerberg is betting that AI glasses will be the next major computing interface.

He calls them the “ideal form factor” for human-AI interaction.

Unlike chatbots, smart glasses can see and hear, allowing AI to interpret the world in real time.

If Meta executes on this vision, its Reality Labs division could shift from a long-term bet to a major profit center by the end of the decade.

That, combined with steady digital ad growth, could push Meta’s stock beyond $1,000 — and make a split almost inevitable.

Strengths

Meta’s AI-driven ad tools and recommendation algorithms are boosting engagement and advertiser ROI.

The company’s unmatched user base of 3.5+ billion provides a durable competitive moat.

With $1.5 trillion in market cap and soaring revenue, Meta remains one of the strongest AI plays on the market.

Weaknesses

Heavy capital spending on AI infrastructure could pressure short-term margins.

Regulatory scrutiny around data privacy and competition remains a recurring challenge.

Reality Labs continues to post large losses, delaying profitability for emerging technologies.

Potential

A future stock split could unlock renewed retail investor demand and market enthusiasm.

AI glasses and full ad automation may establish new high-margin revenue streams.

Meta’s growing AI ecosystem positions it as a long-term winner in both tech innovation and shareholder returns.

TODAY’S SPONSOR

Your annual insurance check, now headache-free

When did you last review your insurance rates? Life changes, driving records improve, and insurers update pricing constantly. You might be missing big savings by not checking. Use EverQuote as your yearly insurance reset—compare trusted carriers quickly, confirm your coverage, and ensure you’re getting the best price with zero hassle.

Conclusion

Meta Platforms is evolving from a social media empire into an AI powerhouse.

Its expanding ecosystem, cutting-edge ad technology, and strong financial momentum make a future stock split not just possible — but probable.

For investors seeking exposure to the AI revolution, Meta remains a powerful buy-and-hold candidate through 2030.

Final Thought

If Meta’s AI ambitions truly redefine how billions connect and communicate, a stock split might be the least exciting thing about this company’s future.

Could today’s $600 stock be tomorrow’s $1,000 juggernaut?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply