- StocksGeniusMastery

- Posts

- 💥 Microsoft Is Bleeding on Wall Street — But Its AI Backlog Tells a Different Story

💥 Microsoft Is Bleeding on Wall Street — But Its AI Backlog Tells a Different Story

Azure momentum and OpenAI exposure set the stage for long-term upside.

Hi Fellow Investors,

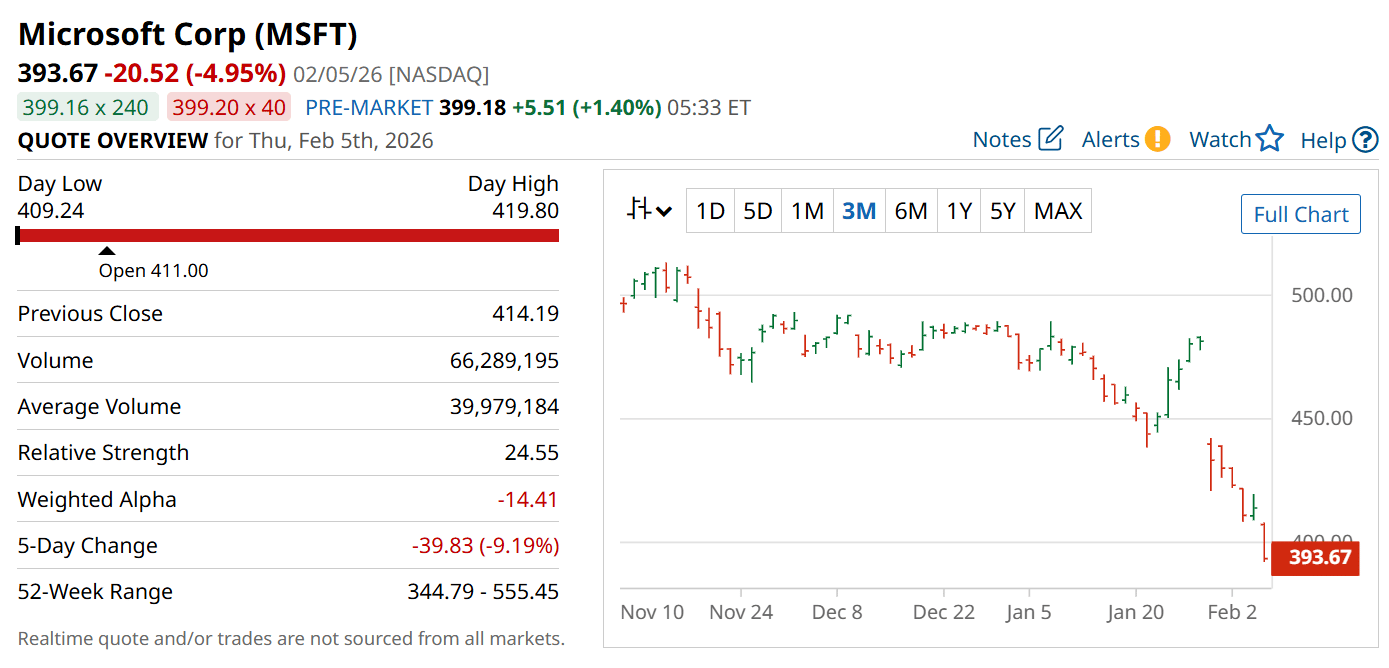

Microsoft (NASDAQ: MSFT) has entered 2026 under heavy pressure despite reporting strong operating results.

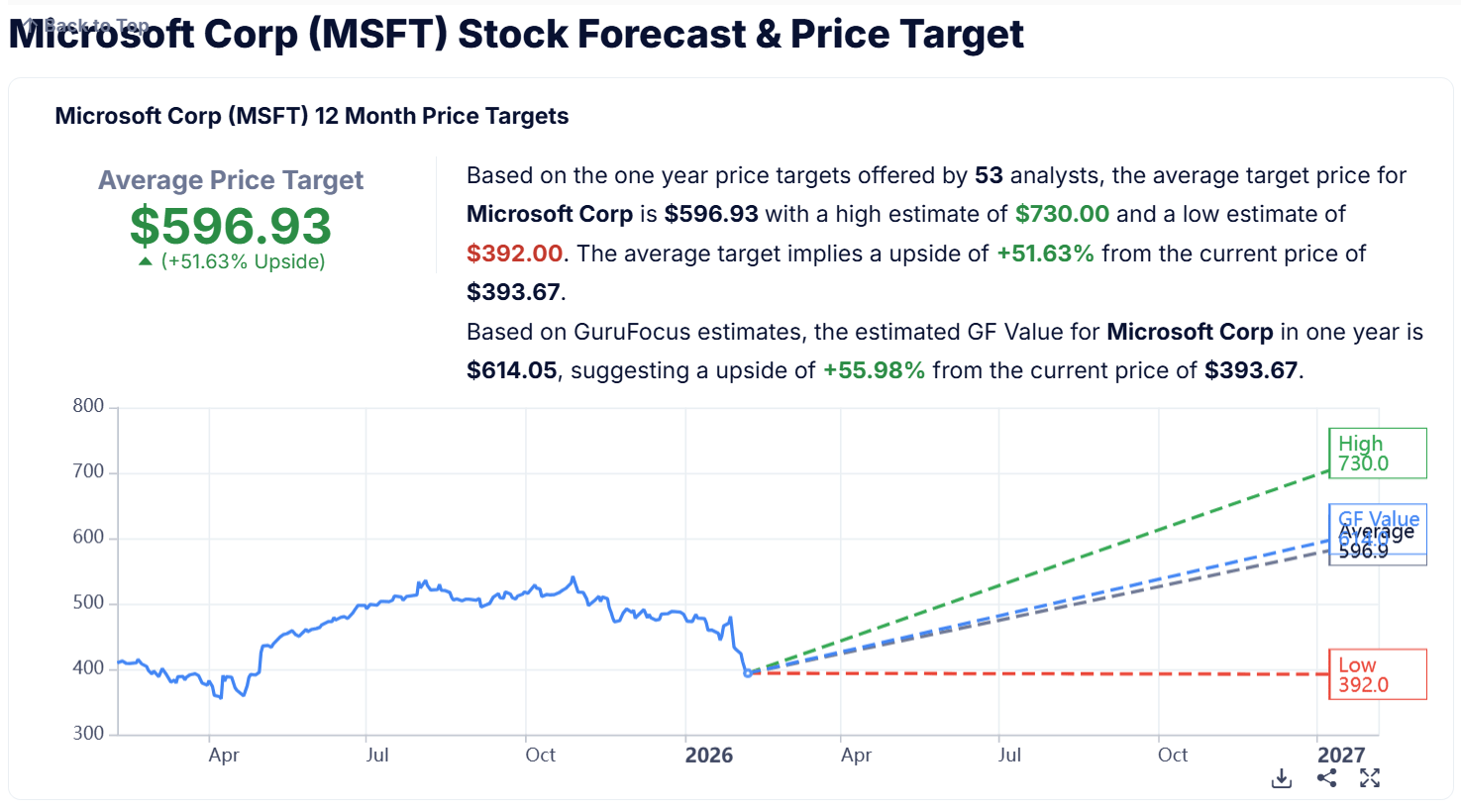

The stock’s sharp pullback has sparked debate over whether AI-driven growth justifies today’s massive spending cycle.

Investors are now weighing near-term margin risk against long-term cloud and AI dominance.

Key Points:

Microsoft delivered another quarter of double-digit revenue and operating income growth despite market pessimism.

Commercial backlog surged 110% year over year, with OpenAI accounting for nearly half of future commitments.

Capital expenditures are rising sharply, signaling margin pressure during an aggressive AI infrastructure buildout.

TODAY’S SPONSOR

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Microsoft’s Core Business Momentum Remains Intact

The recent sell-off reflects valuation concerns rather than operational weakness.

Fiscal second-quarter revenue grew 17% year over year, demonstrating continued enterprise demand.

Operating income climbed even faster, highlighting strong execution despite heavy investment.

Productivity and Business Processes revenue rose 16%, driven by Microsoft 365, LinkedIn, and Dynamics.

Growth remains diversified across enterprise software and cloud-based services.

This resilience reinforces Microsoft’s position as a foundational technology provider.

Azure and Cloud Services Are Accelerating Rapidly

The Intelligent Cloud segment delivered 29% year-over-year revenue growth.

Azure and other cloud services expanded at a striking 39% annual rate.

AI-driven workloads are becoming a major catalyst for enterprise cloud adoption.

Customers are committing to long-term contracts to secure AI computing capacity.

This demand strength is reshaping Microsoft’s revenue visibility.

Cloud growth continues to outperform most large-cap peers.

A Record Backlog Signals Future Revenue Power

Microsoft’s commercial remaining performance obligations reached $625 billion.

This represents a staggering 110% increase compared to last year.

Management expects roughly $156 billion to convert into revenue within 12 months.

OpenAI alone accounts for approximately 45% of the total backlog.

This level of contracted demand is rare at Microsoft’s scale.

The backlog underscores long-term confidence in Microsoft’s AI platform.

Capital expenditures surged 66% year over year to $37.5 billion in fiscal Q2.

Spending is heavily concentrated in GPUs, CPUs, and AI data center infrastructure.

These investments are essential but highly capital intensive.

Rising depreciation will eventually pressure operating margins.

This marks the beginning of a prolonged investment cycle rather than a short-term spike.

Investors must accept near-term margin volatility in exchange for long-term positioning.

Strengths

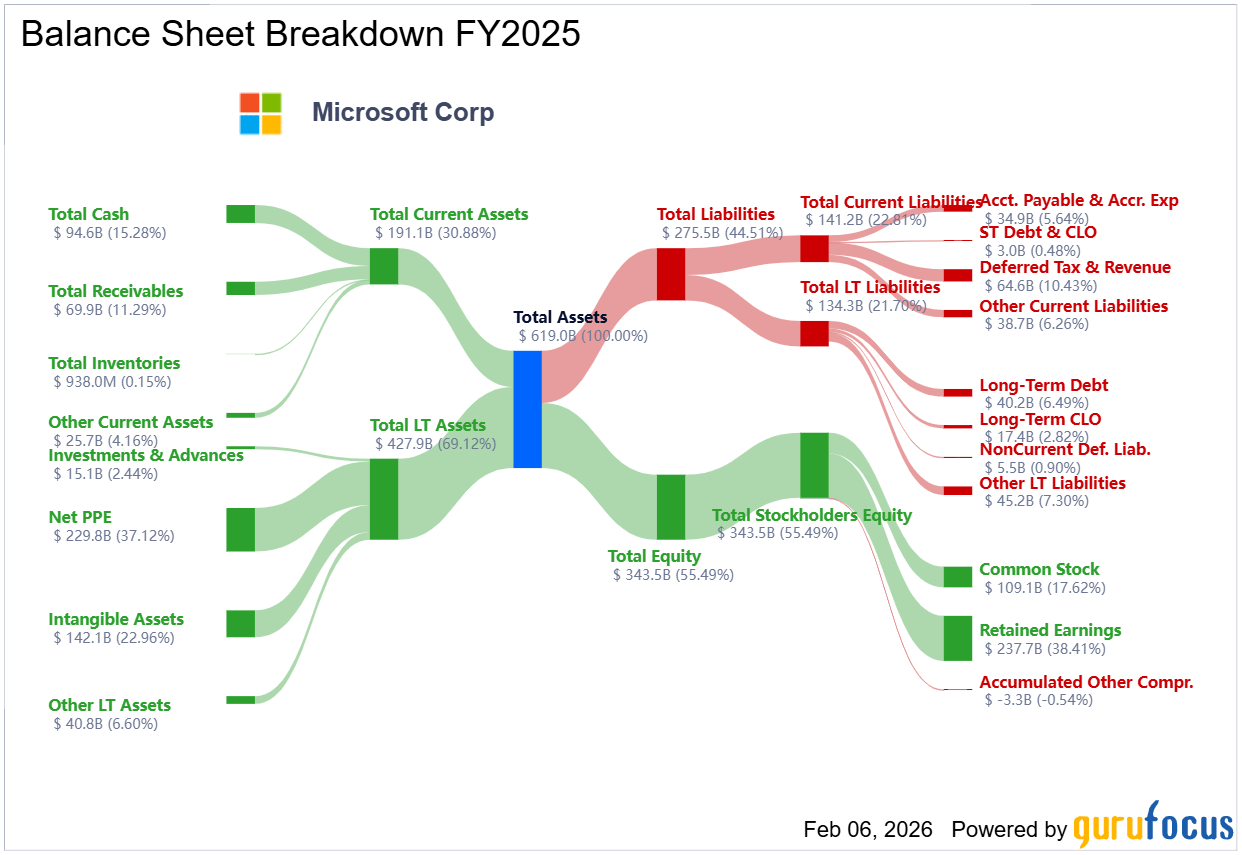

Massive and diversified revenue streams provide resilience during market downturns.

Azure’s accelerating growth positions Microsoft as a core AI infrastructure provider.

A record commercial backlog offers exceptional long-term revenue visibility.

Weaknesses

Capital expenditures are rising at an aggressive pace, pressuring free cash flow.

Margin compression risk is increasing as depreciation expenses scale.

Consumer-facing segments show slower or negative growth trends.

Potential

Successful monetization of AI workloads could unlock multi-year earnings expansion.

OpenAI partnerships deepen Microsoft’s competitive moat in generative AI.

Long-term cloud contracts may smooth earnings volatility once investment peaks.

TODAY’S SPONSOR

Turn AI into Your Income Engine

Ready to transform artificial intelligence from a buzzword into your personal revenue generator

HubSpot’s groundbreaking guide "200+ AI-Powered Income Ideas" is your gateway to financial innovation in the digital age.

Inside you'll discover:

A curated collection of 200+ profitable opportunities spanning content creation, e-commerce, gaming, and emerging digital markets—each vetted for real-world potential

Step-by-step implementation guides designed for beginners, making AI accessible regardless of your technical background

Cutting-edge strategies aligned with current market trends, ensuring your ventures stay ahead of the curve

Download your guide today and unlock a future where artificial intelligence powers your success. Your next income stream is waiting.

Conclusion

Microsoft’s fundamentals remain strong despite the stock’s sharp decline.

The current valuation reflects caution around capital intensity rather than business deterioration.

For long-term investors, patience may be rewarded as AI investments mature.

Final Thought

Market pullbacks often test conviction more than fundamentals.

When industry leadership meets short-term fear, opportunity tends to follow.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply