- StocksGeniusMastery

- Posts

- 💥 Microsoft’s 2026 Stock Forecast: Solid Growth, No Valuation Boost

💥 Microsoft’s 2026 Stock Forecast: Solid Growth, No Valuation Boost

Why steady AI execution and premium valuation may still reward long-term investors

Hi Fellow Investors,

Microsoft enters 2026 after another strong but market-matching year.

The company’s AI strategy emphasizes platform neutrality rather than model dominance.

Wall Street expectations suggest steady growth — but little valuation upside.

Key Points:

Microsoft’s AI-neutral Azure platform continues to gain share with faster growth than peers.

Copilot adoption is improving but still must prove long-term user value.

A premium valuation means stock gains will likely mirror earnings growth.

TODAY’S SPONSOR

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Azure’s AI Neutrality Is Microsoft’s Quiet Advantage

Microsoft (NASDAQ: MSFT) plays a different role in the artificial intelligence ecosystem than many competitors.

Rather than betting on a single breakthrough model, the company positions itself as an infrastructure and platform provider.

Azure’s cloud business benefits regardless of which AI model developers ultimately favor.

This neutrality allows customers to deploy OpenAI, Anthropic, xAI, or cost-efficient alternatives without friction.

As AI usage scales globally, Microsoft captures value from compute, storage, and enterprise integration.

Azure Growth Continues to Outpace the Competition

Azure remains the second-largest cloud provider, but its growth trajectory is closing the gap.

In the first quarter of fiscal 2026, Azure revenue grew 40% year over year.

That growth rate doubled the pace of Amazon Web Services during the same period.

Enterprise customers continue shifting workloads toward Azure’s AI-optimized infrastructure.

This momentum positions Microsoft as a long-term beneficiary of enterprise AI adoption.

Predictable Growth Sets the Framework for 2026

Wall Street forecasts Microsoft to deliver 16% revenue growth in fiscal 2026.

Consensus estimates point to an additional 15% growth rate in fiscal 2027.

These projections align closely with Microsoft’s historical performance.

The company’s consistency makes earnings growth relatively easy to model.

However, predictability also limits the potential for surprise-driven multiple expansion.

Valuation Is the Limiting Factor for Stock Performance

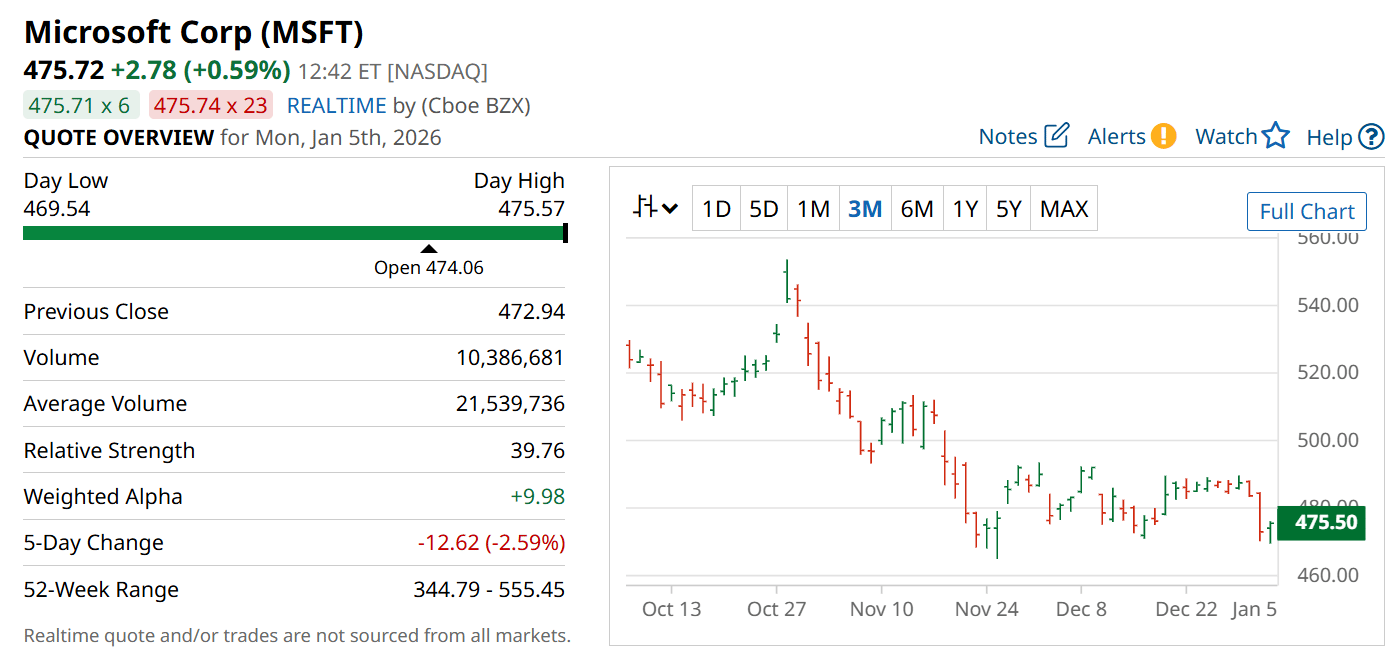

Microsoft already trades at roughly 30 times forward earnings.

That multiple reflects optimism around AI, cloud dominance, and enterprise resilience.

Assuming earnings grow at 15% and the valuation multiple remains unchanged, the math is straightforward.

Under those conditions, Microsoft stock could approach $560 by the end of 2026.

That outcome would represent solid absolute returns, but not necessarily market-beating performance.

Strengths

Azure’s rapid growth positions Microsoft as a core infrastructure winner in the AI era.

A diversified business model reduces reliance on any single product or technology trend.

Strong enterprise relationships provide durable recurring revenue and pricing power.

Weaknesses

Premium valuation limits upside if growth merely meets expectations.

Copilot adoption still needs to prove sustained, long-term value creation.

Stock performance may lag in years when broader markets surge aggressively.

Potential

Continued AI workload migration could push Azure growth higher than forecasts.

Deeper Copilot integration may unlock new monetization across Microsoft’s ecosystem.

Any acceleration in enterprise AI spending could lift earnings beyond consensus estimates.

TODAY’S SPONSOR

What investment is rudimentary for billionaires but ‘revolutionary’ for 70,571+ investors entering 2026?

Imagine this. You open your phone to an alert. It says, “you spent $236,000,000 more this month than you did last month.”

If you were the top bidder at Sotheby’s fall auctions, it could be reality.

Sounds crazy, right? But when the ultra-wealthy spend staggering amounts on blue-chip art, it’s not just for decoration.

The scarcity of these treasured artworks has helped drive their prices, in exceptional cases, to thin-air heights, without moving in lockstep with other asset classes.

The contemporary and post war segments have even outpaced the S&P 500 overall since 1995.*

Now, over 70,000 people have invested $1.2 billion+ across 500 iconic artworks featuring Banksy, Basquiat, Picasso, and more.

How? You don’t need Medici money to invest in multimillion dollar artworks with Masterworks.

Thousands of members have gotten annualized net returns like 14.6%, 17.6%, and 17.8% from 26 sales to date.

*Based on Masterworks data. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd

Conclusion

Microsoft remains one of the market’s most reliable large-cap growth stories.

Steady earnings expansion suggests the stock could reach approximately $560 by the end of 2026.

While upside may be measured, long-term investors continue to benefit from durability and scale.

Final Thought

In a market obsessed with AI breakthroughs, Microsoft’s quiet consistency may be its greatest strength.

Sometimes the most predictable path still leads to the most dependable returns.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply