- StocksGeniusMastery

- Posts

- 💥Netflix Just Bought Warner Bros. Discovery — Here’s the Real Reason Investors Should Pay Attention

💥Netflix Just Bought Warner Bros. Discovery — Here’s the Real Reason Investors Should Pay Attention

The streaming giant is taking a historic swing at content dominance.

Hi Fellow Investors,

Netflix (NASDAQ: NFLX) just shocked the streaming world with a transformative $72 billion acquisition of Warner Bros. Discovery’s (NASDAQ: WBD) entertainment assets.

This move signals a dramatic shift from Netflix’s traditional reliance on internally developed content.

The implications for investors are significant as the company takes on unprecedented debt to fund the deal.

Key Points:

Netflix is acquiring HBO Max and Warner Bros. film studios in a $72 billion cash-and-stock deal.

The acquisition expands Netflix’s ecosystem with premium franchises like Harry Potter, Game of Thrones, and Friends.

The company is taking on more than $50 billion in additional debt to finance the transaction.

TODAY’S SPONSOR

How High-Net-Worth Families Invest Beyond the Balance Sheet

Every year, Long Angle surveys its private member community — entrepreneurs, executives, and investors with portfolios from $5M to $100M — to understand how they allocate their time, money, and trust.

The 2025 High-Net-Worth Professional Services Report reveals what today’s wealthy families value most, what disappoints them, and where satisfaction truly comes from.

From wealth management to wellness, from private schools to personal trainers — this study uncovers how the top 1% make choices that reflect their real priorities. You’ll see which services bring the greatest satisfaction, which feel merely transactional, and how spending patterns reveal what matters most to affluent households.

Benchmark your household’s service spending against peers with $5–25M portfolios.

Learn why emotional well-being often outranks financial optimization.

See which services families are most likely to change — and which they’ll never give up.

Understand generational differences shaping how the wealthy live, work, and parent.

See how your spending, satisfaction, and priorities compare to your peers. Download the report here.

A Historic Expansion of Netflix’s Content Empire

Netflix is stepping into new territory by purchasing major content assets rather than simply producing or licensing them.

The HBO Max platform and Warner Bros. film studio provide Netflix with global franchises that instantly elevate its catalog.

This strategic move aims to attract subscribers through iconic brands already proven to drive audience engagement.

It also signals that Netflix intends to control a significantly larger share of the entertainment value chain.

For investors, the scale of content entering Netflix’s ecosystem could create new competitive advantages and pricing power.

A Complex Cash-and-Stock Deal That Redefines Industry M&A

The acquisition structure is designed to offer Warner Bros. Discovery shareholders a mix of liquidity and exposure to Netflix’s future.

Shareholders will receive $23.50 in cash and $4.50 in Netflix stock for each share of Warner Bros. Discovery.

This values the acquired assets at $27.75 per share, reflecting confidence in long-term content monetization.

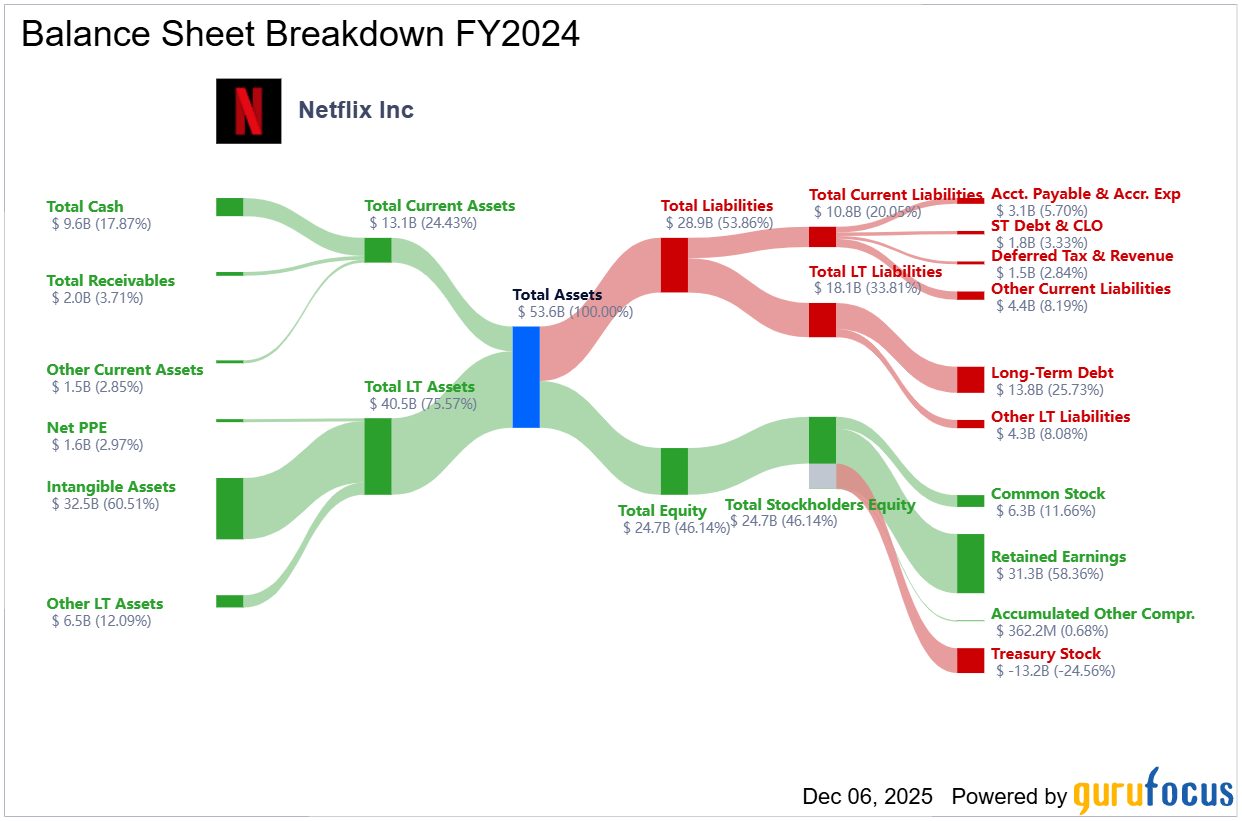

Netflix will assume $10.7 billion of existing debt tied to Warner Bros. Discovery’s balance sheet.

The financial engineering behind this deal highlights Netflix’s willingness to stretch its capital structure to secure premium assets.

Netflix Takes On Massive New Debt to Fund Its Streaming Ambition

To complete the acquisition, Netflix is adding more than $50 billion of new debt on top of the debt it inherits.

This represents a substantial leverage increase and marks a strategic shift away from the company’s historically disciplined balance sheet.

Management is effectively betting that iconic IP and expanded content pipelines will drive subscriber and revenue growth.

The streaming giant appears focused on reinforcing its global dominance at a time when competition is intensifying.

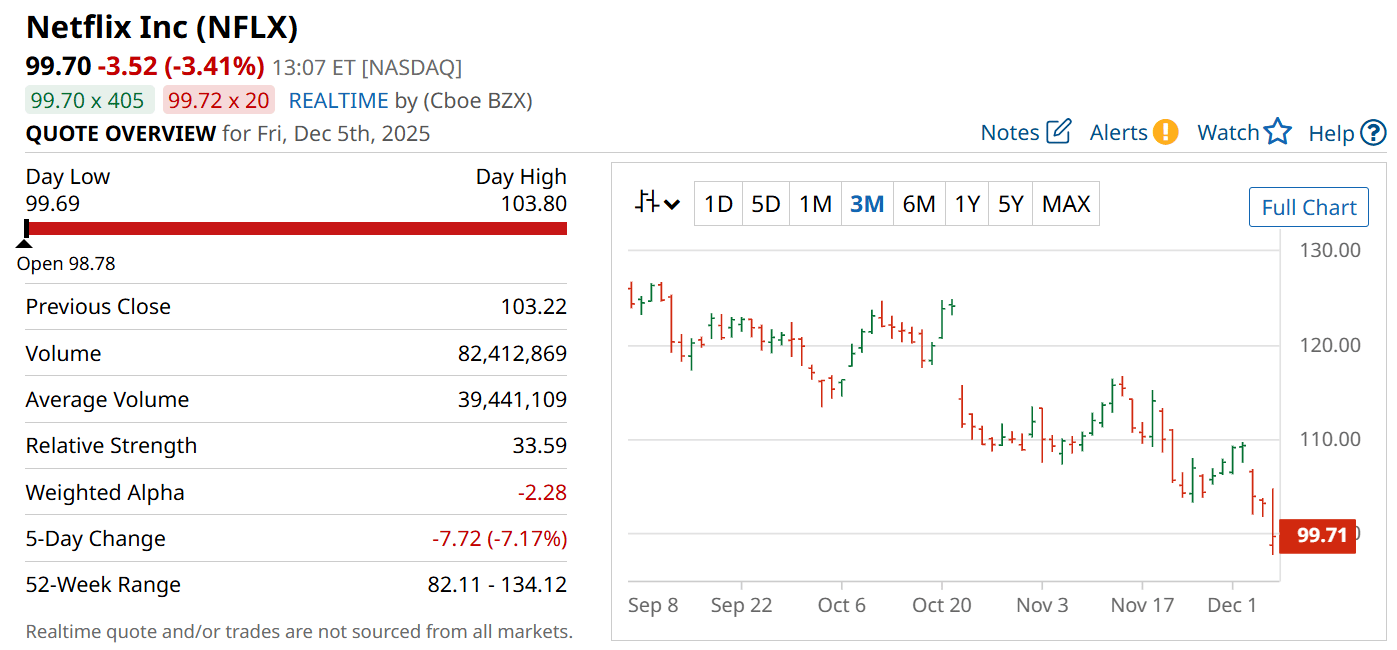

Investors will need to evaluate whether projected long-term returns justify this aggressive financing approach.

What Investors Should Consider Now

Warner Bros. Discovery shares rose following the announcement but remain below the acquisition price due to regulatory uncertainty.

Shareholders must weigh whether the remaining upside is worth holding through a potentially lengthy approval process.

They also must decide if becoming Netflix shareholders aligns with their long-term strategy.

For Netflix investors, the key question is whether the value of these iconic content assets outweighs the massive debt burden.

This acquisition could reshape Netflix’s growth trajectory for years to come.

Strengths

The acquisition instantly boosts Netflix’s library with globally recognized franchises that drive subscriber engagement.

Integrating HBO Max and Warner Bros. studios strengthens Netflix’s competitive moat across both streaming and theatrical entertainment.

The expanded content ecosystem provides pricing leverage and long-term monetization potential across multiple platforms.

Weaknesses

The company’s debt load will surge, creating financial risk if subscriber or revenue growth underperforms expectations.

Regulatory hurdles could delay or complicate the closing of the transaction, introducing uncertainty for investors.

Integration challenges across film, TV, and streaming units may strain operational efficiency.

Potential

If executed effectively, Netflix could dominate premium content streaming on an unprecedented scale.

Cross-platform monetization of blockbuster franchises could unlock new recurring revenue streams.

Long-term synergies may position Netflix as a diversified entertainment powerhouse with global pricing power.

TODAY’S SPONSOR

Turn AI into Your Income Engine

Ready to transform artificial intelligence from a buzzword into your personal revenue generator

HubSpot’s groundbreaking guide "200+ AI-Powered Income Ideas" is your gateway to financial innovation in the digital age.

Inside you'll discover:

A curated collection of 200+ profitable opportunities spanning content creation, e-commerce, gaming, and emerging digital markets—each vetted for real-world potential

Step-by-step implementation guides designed for beginners, making AI accessible regardless of your technical background

Cutting-edge strategies aligned with current market trends, ensuring your ventures stay ahead of the curve

Download your guide today and unlock a future where artificial intelligence powers your success. Your next income stream is waiting.

Conclusion

This acquisition marks one of the most ambitious strategic expansions in Netflix’s history.

Investors now face the critical question of whether the long-term power of premium content outweighs the near-term risks of higher leverage.

If successful, the deal could redefine the hierarchy of global entertainment.

Final Thought

Every major industry shift begins with a bold decision, and Netflix just made one of its biggest yet.

The next chapter of streaming may hinge on whether this gamble becomes its ultimate competitive advantage.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply