- StocksGeniusMastery

- Posts

- The Next Tech Titans: 3 Stocks Poised to Outshine Apple in the Coming Decade

The Next Tech Titans: 3 Stocks Poised to Outshine Apple in the Coming Decade

These powerhouse companies are gearing up to surpass Apple and redefine market leadership

The Next Tech Titans: 3 Stocks Poised to Outshine Apple in the Coming Decade

Nvidia (NASDAQ) recently achieved a historic milestone by surpassing Apple (NASDAQ) in market cap, becoming the world's second-largest company. This remarkable feat by the maker of GeForce gaming GPUs highlights the rapid shifts in market leadership, with Nvidia potentially on track to claim the top spot soon.

While Nvidia's momentum shows no signs of slowing, investors should pay attention to other fast-rising companies poised to challenge Apple's dominance. As the tech landscape evolves, several large-cap tech firms are capitalizing on advancements in artificial intelligence (AI), presenting substantial growth opportunities.

Apple still faces significant hurdles in the AI arena, with other tech giants making more aggressive moves to monetize this transformative technology. Here are three contenders that have the potential to surpass Apple in market cap within the next decade.

Meta Platforms (META):

With Zuckerberg’s ambitious AI investments, Meta Platforms is on the brink of a growth surge that could see it leapfrog Apple in the tech hierarchy.Tesla (TSLA):

Elon Musk’s visionary pursuit of autonomous vehicle technology has the potential to drive Tesla stock to unprecedented highs, challenging even the mightiest of tech giants.Taiwan Semiconductor (TSM):

As the backbone of the AI chip industry, Taiwan Semiconductor’s cutting-edge advancements and market dominance position it as a strong contender to surpass Apple.

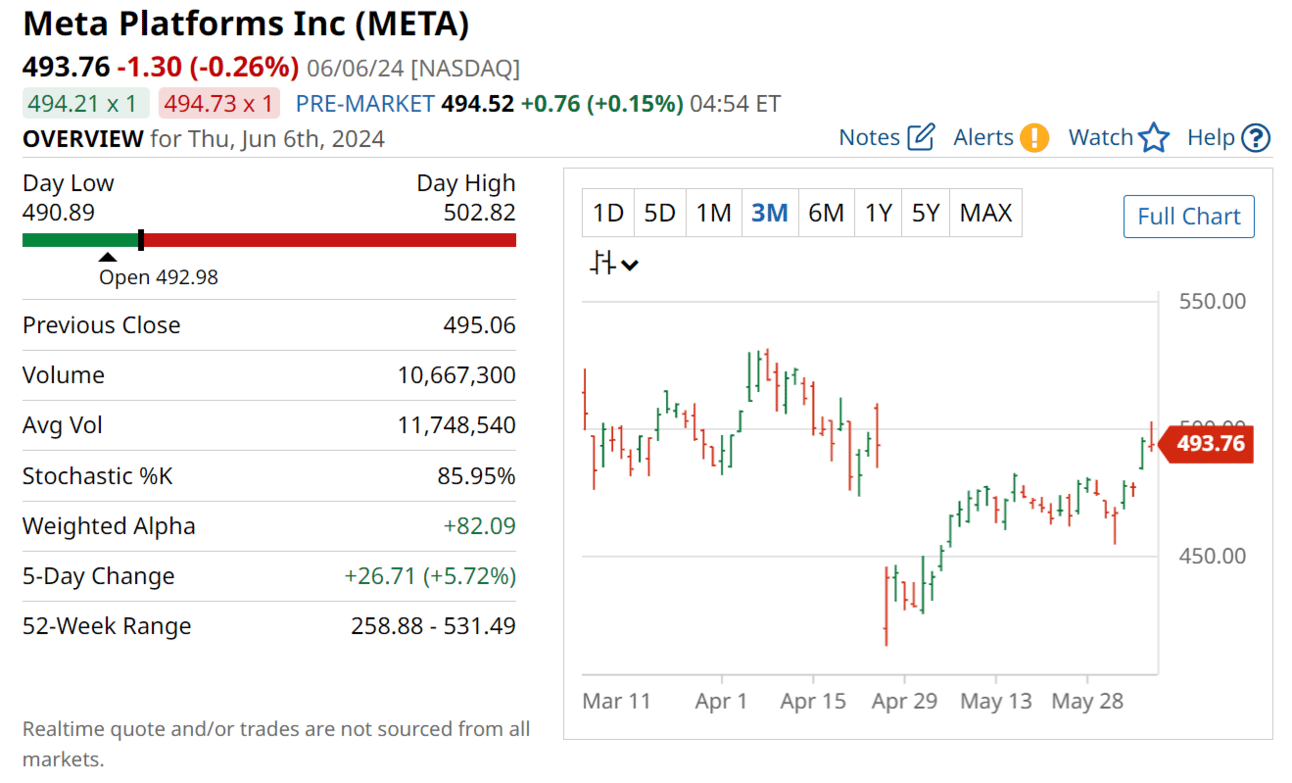

Meta Platforms (NASDAQ: META):

Meta Platforms is rapidly evolving from a social media powerhouse into a metaverse pioneer, with a significant focus on AI technology. This transformation is fueled by substantial investments in AI, with 2024 capital expenditures projected to reach up to $40 billion. Such aggressive spending is aimed at building a platform that could eventually surpass the influence of smartphones and PCs.

Strengths:

Aggressive AI investment: Committing $40 billion in 2024 to advance AI capabilities.

Metaverse vision: Leading the charge in developing next-generation virtual worlds.

Strong market cap growth: Current market cap of $1.25 trillion with significant momentum.

Weaknesses:

High expenditure: Massive capital outlay could strain financial resources.

Uncertain metaverse future: The long-term success of the metaverse is still speculative.

Regulatory challenges: Ongoing scrutiny and potential regulatory hurdles.

Potential:

Joining the $3 trillion club: Realistic shot at reaching a $3 trillion market cap by 2034.

AI-driven growth: High double-digit growth expected as AI tech advances.

Platform leadership: Potential to create a dominant platform succeeding current tech giants.

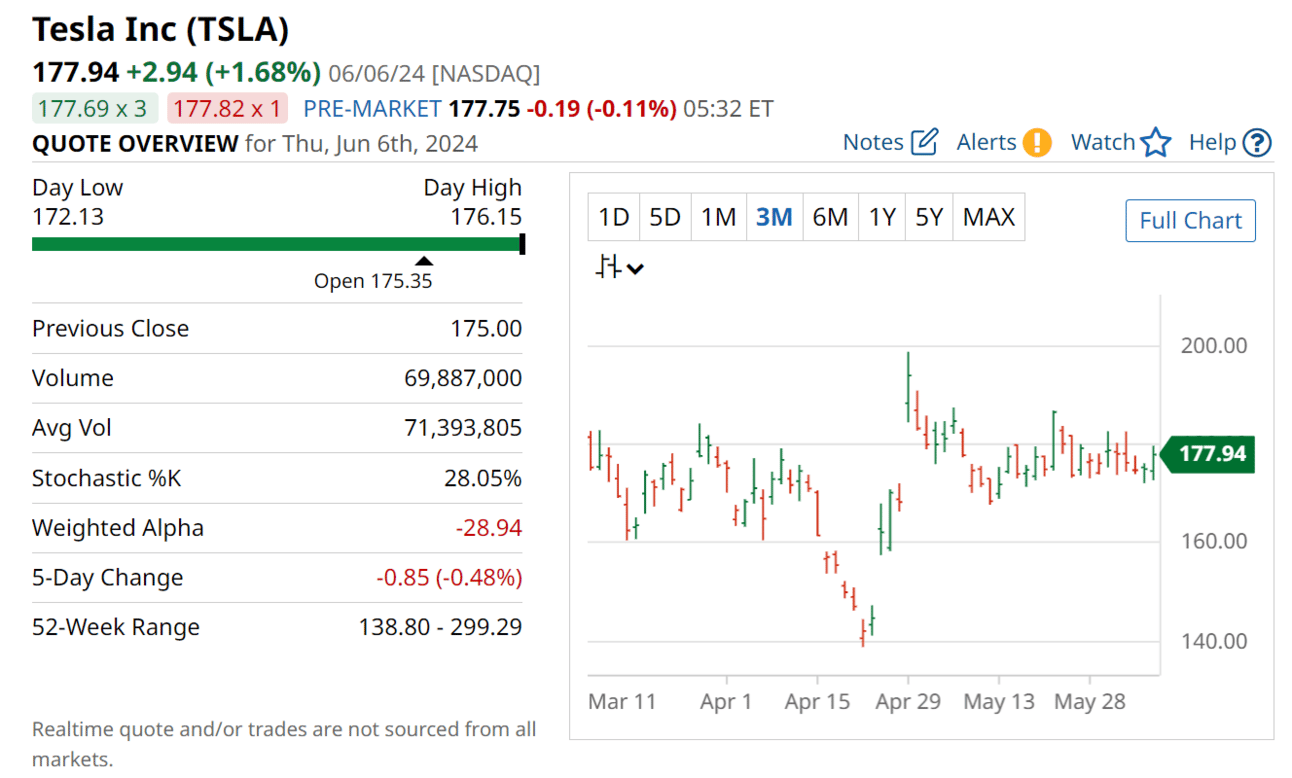

Tesla (NASDAQ: TSLA):

Tesla (TSLA):

Tesla, once poised to overtake Apple with its peak valuation in late 2021, has since seen its value decline. However, the company remains a formidable contender, especially with the potential breakthrough in robotaxi technology. If Elon Musk can bring next-gen robotaxis to market, Tesla could soar to new heights, rivaling the most valuable companies in the world.

Strengths:

Innovative edge: Leading in electric vehicle and autonomous technology.

Brand loyalty: Strong global brand recognition and customer base.

R&D focus: Continuous investment in cutting-edge technologies.

Weaknesses:

Market volatility: Significant drop in valuation since 2021 peak.

Competitive landscape: Increasing competition from hybrid and fully electric vehicles.

Consumer spending trends: Economic pressures affecting big-ticket purchases.

Potential:

Robotaxi revolution: Major wildcard that could propel Tesla back to all-time highs.

Technological advancements: Continued leadership in EV and autonomous tech.

Market recovery: Potential for significant rebound with successful new innovations.

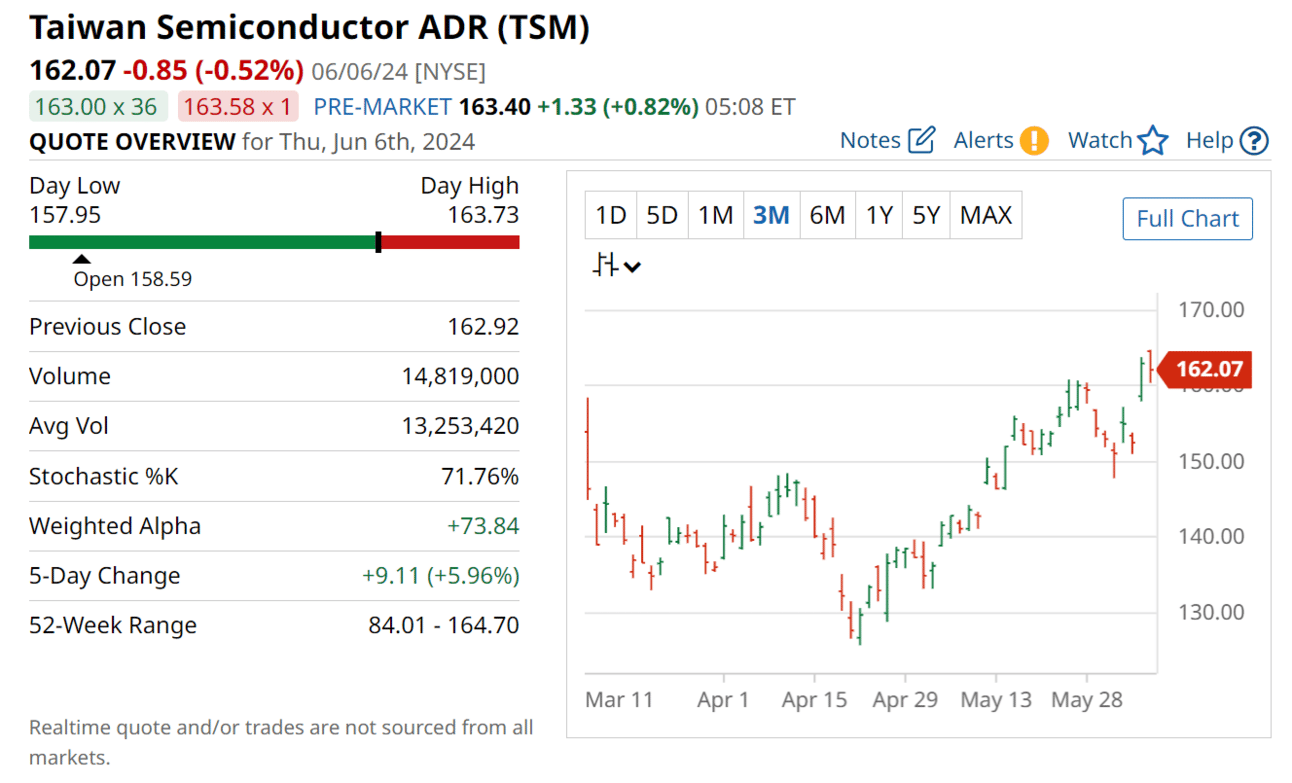

Taiwan Semiconductor (NYSE: TSM)

Taiwan Semiconductor dominates the semiconductor foundry market, crucial in the AI chip boom. The company's preparations for advanced 2nm and 1.4nm chips position it well for future growth. Despite its current valuation, TSM stock is poised for an explosive move that could see it compete with the tech industry's biggest players.

Strengths:

Industry leader: Dominant position in semiconductor manufacturing.

Advanced technology: Leading the way with cutting-edge chip developments.

Robust demand: High demand for AI chips driving growth.

Weaknesses:

High capital requirements: Significant investment needed for advanced manufacturing.

Geopolitical risks: Exposure to geopolitical tensions affecting supply chains.

Valuation pressure: High expectations reflected in stock price.

Potential:

Explosive growth: Positioned for significant market cap increase.

Next-gen chips: Pioneering advanced chip technology to meet AI demand.

Strategic positioning: Potential to join the ranks of the world's most valuable companies.

Summary

Meta Platforms is betting big on AI and the metaverse, aiming for a $3 trillion market cap by 2034. Tesla's innovative edge and potential robotaxi revolution could see it reclaim its peak valuation and more. Taiwan Semiconductor's leadership in the semiconductor industry positions it for explosive growth in the AI era.

Conclusion:

These emerging giants are well-positioned to surpass Apple in the next decade. With aggressive investments, groundbreaking innovations, and strategic market positioning, Meta Platforms, Tesla, and Taiwan Semiconductor are leading the charge towards becoming the world's most valuable companies.

Final Thought:

As these companies push the boundaries of technology and market dominance, which one will ultimately redefine the future of tech and emerge as the new leader? The race is on, and the next decade will reveal the true titans of industry.

Are you loving the content you’re devouring right now? Spread the wealth by sharing with fellow stock investors and friends! Dive deeper into our exclusive analyses and stay ahead of the curve with our tailored content delivered directly to your Inbox. Let's forge a community of savvy, thriving investors. Let’s strive towards financial freedom together!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity, Execute Strategy, and Reap the Rewards of Investing Wisely.” 🌱

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply