- StocksGeniusMastery

- Posts

- 💥 Nvidia’s 78% Run: Could a 2026 Stock Split Be Coming?

💥 Nvidia’s 78% Run: Could a 2026 Stock Split Be Coming?

What Investors Must Know Before Hitting the Buy Button

Hi Fellow Investors,

Nvidia (NASDAQ: NVDA) has surged roughly 78% over the past 18 months, reigniting speculation about whether the AI powerhouse could split its stock again in 2026.

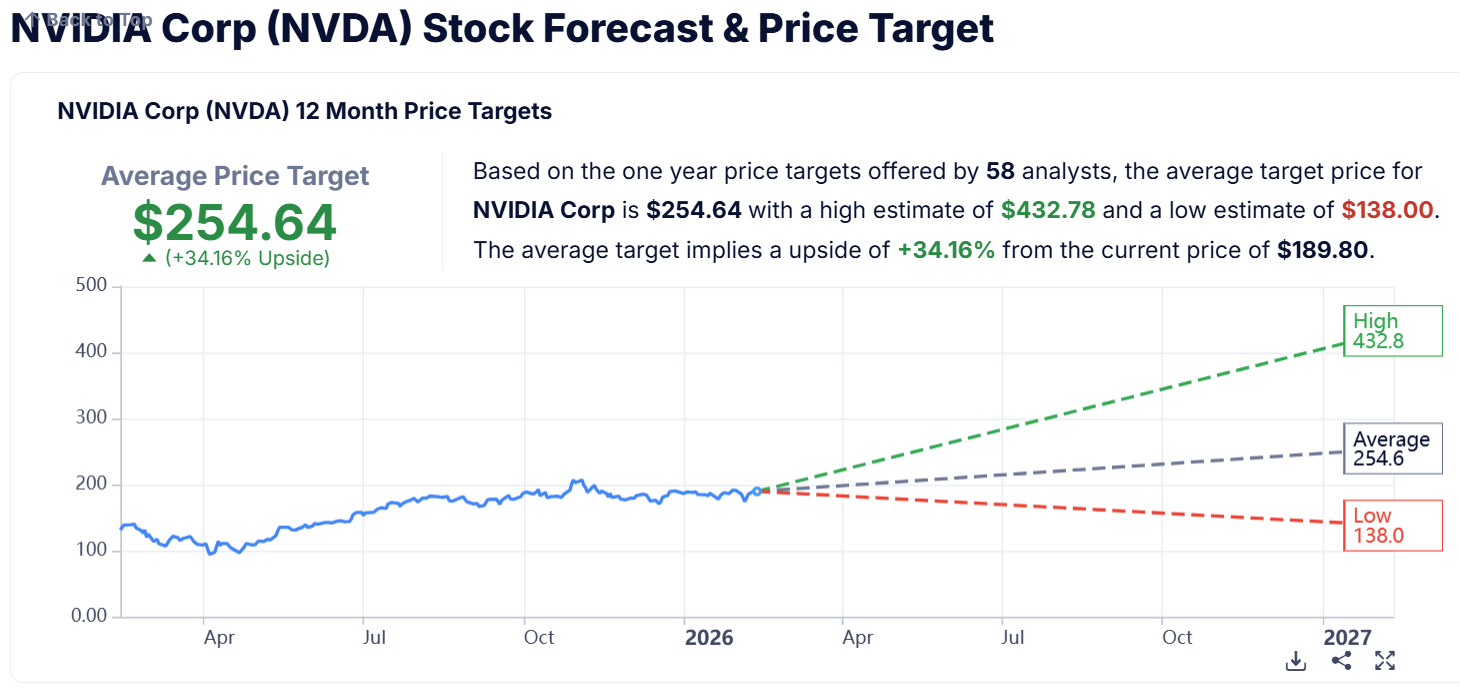

With shares trading near $189 and trading below historical valuation averages, investors are weighing whether the real opportunity lies in fundamentals rather than a potential split announcement.

Key Points:

Nvidia shares have climbed 78% in 18 months, fueling 2026 stock-split speculation.

The AI leader has split its stock six times, most recently a 10-for-1 split in 2024.

Despite premium pricing, NVDA trades below its five-year average P/E, offering relative valuation appeal.

TODAY’S SPONSOR

Attio is the AI CRM for modern teams.

Connect your email and calendar, and Attio instantly builds your CRM. Every contact, every company, every conversation, all organized in one place.

Then Ask Attio anything:

Prep for meetings in seconds with full context from across your business

Know what’s happening across your entire pipeline instantly

Spot deals going sideways before they do

No more digging and no more data entry. Just answers.

A Proven Stock-Split Veteran — But Timing Is Everything

Nvidia is no stranger to stock splits, having executed six since its 1999 IPO.

The most recent 10-for-1 split in 2024 followed a surge that pushed shares near $1,200 pre-split.

Historically, management has opted to split when prices climb to levels that may limit accessibility for retail investors.

At approximately $189 per share, the current price simply does not create that same accessibility barrier.

Momentum alone does not trigger a split; valuation optics and investor psychology often play larger roles.

For now, the numbers suggest patience rather than anticipation.

Why a Stock Split Doesn’t Change the Investment Equation

Forward stock splits often create excitement, but they do not alter intrinsic value.

Owning more shares after a split is financially equivalent to holding fewer shares at a higher price.

The company’s market capitalization and underlying fundamentals remain unchanged.

Savvy investors understand that splits are cosmetic, not economic events.

The real driver of long-term wealth creation lies in earnings growth and cash flow expansion.

For Nvidia, that story remains firmly intact.

AI Dominance and Cash Flow Power Drive the Real Opportunity

Nvidia continues to stand at the epicenter of the artificial intelligence revolution.

Demand for high-performance AI chips and data center solutions has translated into extraordinary financial performance.

Through the first nine months of 2025, free cash flow reached $61.7 billion, marking a 36.4% year-over-year increase.

Such capital generation strengthens its balance sheet and expands strategic flexibility.

Trading at 42.5 times trailing earnings, the stock appears expensive at first glance.

However, compared to its five-year average P/E of 65, shares are currently priced at a meaningful discount relative to historical norms.

Strengths

Dominant AI chip leadership creates powerful pricing power and sustained demand momentum.

Massive free cash flow generation provides strategic flexibility for innovation, acquisitions, and shareholder returns.

Strong gross margins near 70% highlight operational efficiency rarely matched in the semiconductor sector.

Weaknesses

Premium valuation leaves little room for execution missteps during cyclical semiconductor downturns.

Heavy reliance on AI infrastructure spending exposes revenue to shifts in enterprise and hyperscaler budgets.

Competitive pressures from custom silicon and emerging rivals could compress margins over time.

Potential

Expanding AI adoption across industries could drive another multi-year revenue supercycle.

Continued innovation in next-generation GPUs and AI platforms may unlock new high-margin growth streams.

Relative valuation compression compared to historical averages presents an attractive long-term entry point for disciplined investors.

TODAY’S SPONSOR

AI is all the rage, but are you using it to your advantage?

Successful AI transformation starts with deeply understanding your organization’s most critical use cases. We recommend this practical guide from You.com that walks through a proven framework to identify, prioritize, and document high-value AI opportunities. Learn more with this AI Use Case Discovery Guide.

Conclusion

Nvidia’s recent rally has reignited stock-split speculation, but current pricing makes a near-term split unlikely.

The more compelling story lies in its unmatched AI leadership and accelerating cash flow strength.

Investors focused on fundamentals rather than headlines may find today’s valuation particularly compelling.

Final Thought

Stock splits capture attention, but earnings power builds wealth.

The real question is not whether Nvidia will split again — but whether investors are positioned before its next growth wave unfolds.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply