- StocksGeniusMastery

- Posts

- 💥 Nvidia’s Comeback Setup: Why $300 Might Be Closer Than You Think

💥 Nvidia’s Comeback Setup: Why $300 Might Be Closer Than You Think

With earnings set to surge, Wall Street may be underestimating what’s next.

Hi Fellow Investors,

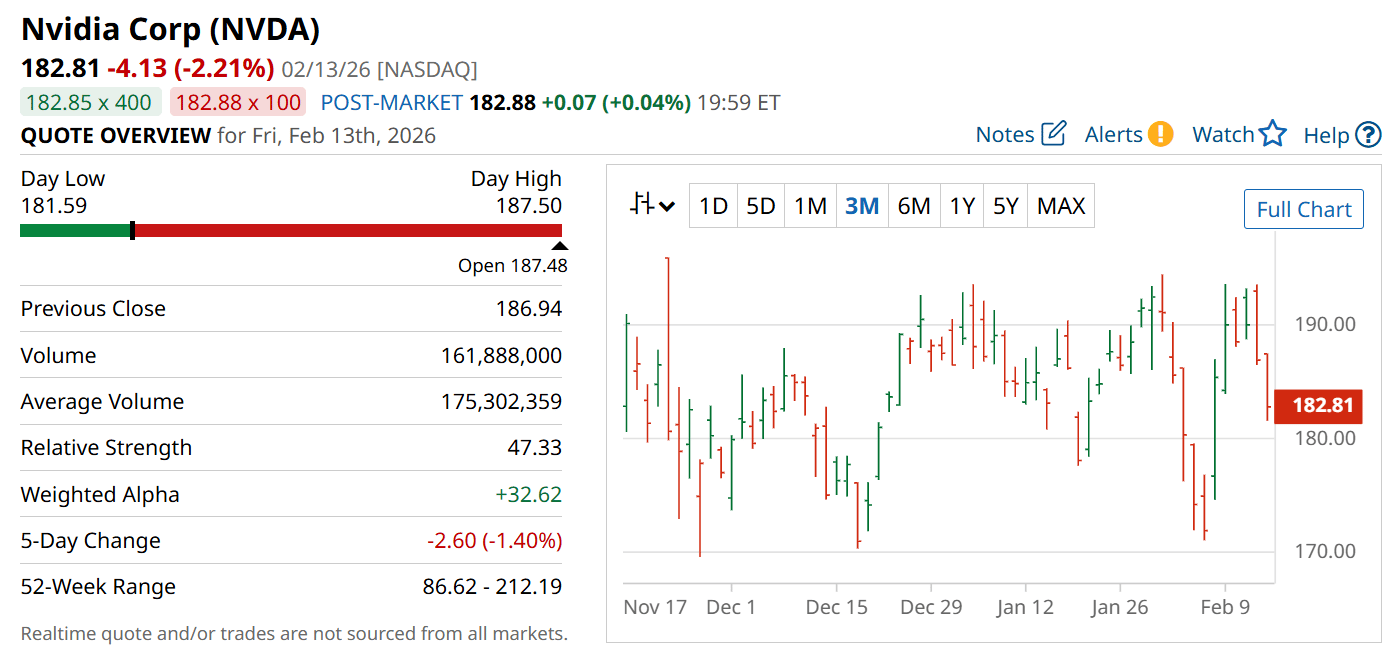

Nvidia (NASDAQ: NVDA) has faced pressure over the past six months despite dominating the AI chip market.

Shares have traded sideways even as the broader semiconductor index surged.

Investors are now questioning whether Nvidia can regain momentum and push toward $300.

Key Points:

Gross margin expansion in fiscal 2027 could meaningfully accelerate earnings growth.

The upcoming Vera Rubin processor launch may trigger another demand surge.

If Nvidia earns close to $10 per share by fiscal 2028, a $300 stock price becomes mathematically plausible.

TODAY’S SPONSOR

Still searching for the right CRM?

Attio is the AI CRM that builds itself and adapts to how you work. With powerful AI automations and research agents, Attio transforms your GTM motion into a data-driven engine, from intelligent pipeline tracking to product-led growth.

Instead of clicking through records and reports manually, simply ask questions in natural language. Powered by Universal Context—a unified intelligence layer native to Attio—Ask Attio searches, updates, and creates with AI across your entire customer ecosystem.

Teams like Granola, Taskrabbit, and Snackpass didn't realize how much they needed a new CRM. Until they tried Attio.

Margin Recovery Could Reignite Earnings Acceleration

Nvidia’s earnings for the first nine months of fiscal 2026 climbed roughly 50% year over year.

Full-year earnings are expected to rise nearly 57%, reflecting sustained AI demand.

However, margins were pressured earlier in the year due to the ramp-up of Blackwell processors.

Management prioritized production scale to meet extraordinary customer demand.

As production matures, cost efficiencies are expected to improve materially.

Gross margin guidance in the mid-70% range for fiscal 2027 signals potential operating leverage ahead.

Vera Rubin Could Spark the Next Growth Wave

Nvidia is preparing to launch its next-generation Vera Rubin processors later this year.

These chips are expected to deliver exponential performance improvements over Blackwell.

AI infrastructure demand remains robust, with a growing order backlog supporting visibility.

Analysts currently project earnings growth of 65% in fiscal 2027, followed by another strong increase the following year.

Given Nvidia’s history of exceeding expectations during AI cycles, upside surprises remain possible.

A fresh innovation cycle often catalyzes both revenue growth and valuation expansion.

The Math Behind a $300 Stock Price

Analysts estimate earnings could approach $9.90 per share by fiscal 2028.

If Nvidia trades at 30 times earnings — slightly below the Nasdaq-100 average — the stock would approach $300.

Given Nvidia’s leadership position and strong competitive moat, a premium multiple is not unrealistic.

At current levels near $183, that implies substantial upside potential.

The key variable remains execution and sustained AI demand across hyperscalers and enterprise customers.

If growth persists and margins expand, $300 shifts from aspiration to achievable scenario.

Strengths

Dominant position in AI GPUs with a rapidly expanding global customer base.

Expected margin expansion into the mid-70% range enhances earnings leverage.

Next-generation processor launches provide fresh catalysts for demand acceleration.

Weaknesses

Valuation remains sensitive to any slowdown in AI spending.

Production ramps can temporarily pressure margins.

Heavy reliance on hyperscaler capital expenditure cycles introduces volatility risk.

Potential

Fiscal 2027 earnings growth of 65% could drive meaningful multiple expansion.

Vera Rubin adoption may unlock another wave of AI infrastructure upgrades.

Earnings approaching $10 per share could justify a $300 valuation or higher.

TODAY’S SPONSOR

Stop typing prompt essays

Dictate full-context prompts and paste clean, structured input into ChatGPT or Claude. Wispr Flow preserves your nuance so AI gives better answers the first time. Try Wispr Flow for AI.

Conclusion

Nvidia’s recent consolidation reflects operational scaling rather than structural weakness.

Margin recovery and next-generation innovation create a credible path toward higher earnings.

If forecasts materialize, a move toward $300 is well within reach over the next two years.

Final Thought

Market leaders rarely rise in straight lines.

Could Nvidia’s current pause simply be the setup for its next powerful breakout?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply