- StocksGeniusMastery

- Posts

- 💥Nvidia's Future: 5-Year Stock Forecast!

💥Nvidia's Future: 5-Year Stock Forecast!

Can the AI King Keep Dominating Through 2030?

Hello Fellow Investors!

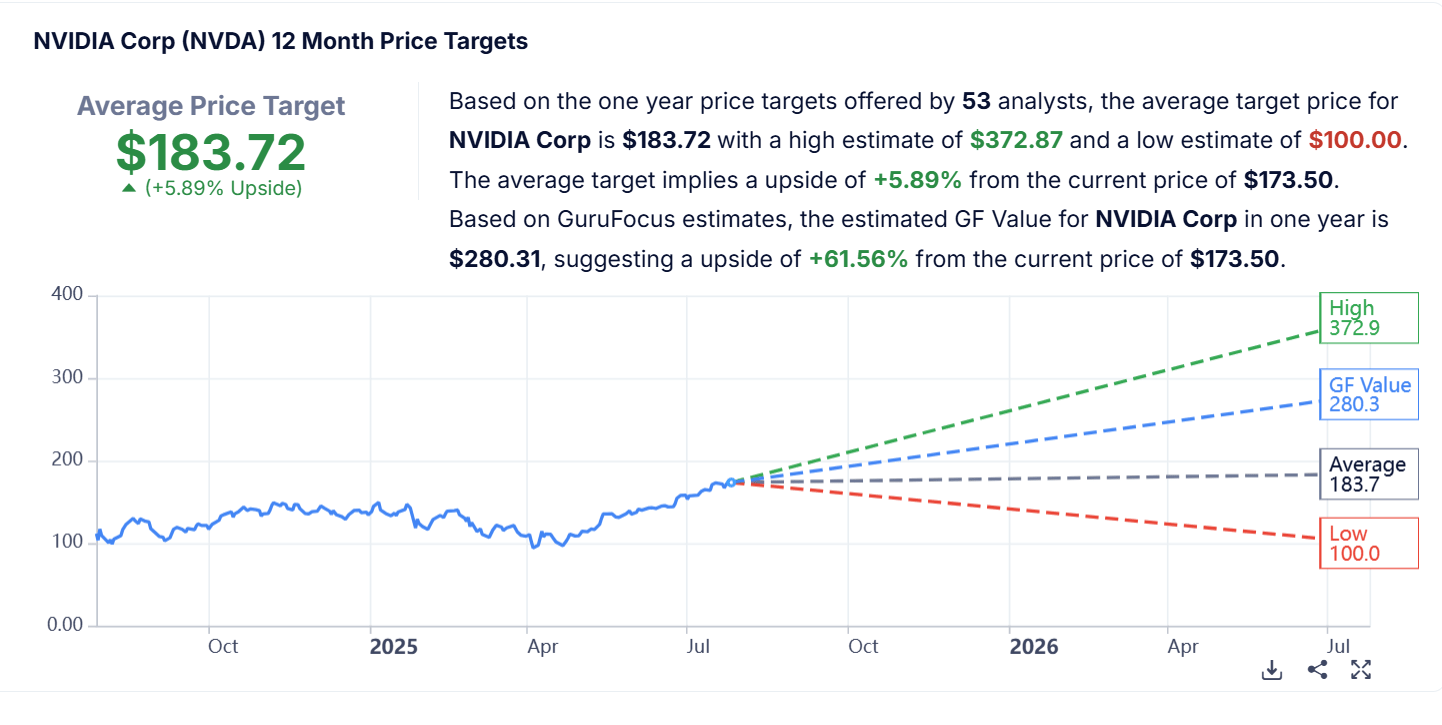

Nvidia (NASDAQ: NVDA) has already turned early believers into millionaires, but the AI revolution it's powering may just be getting started.

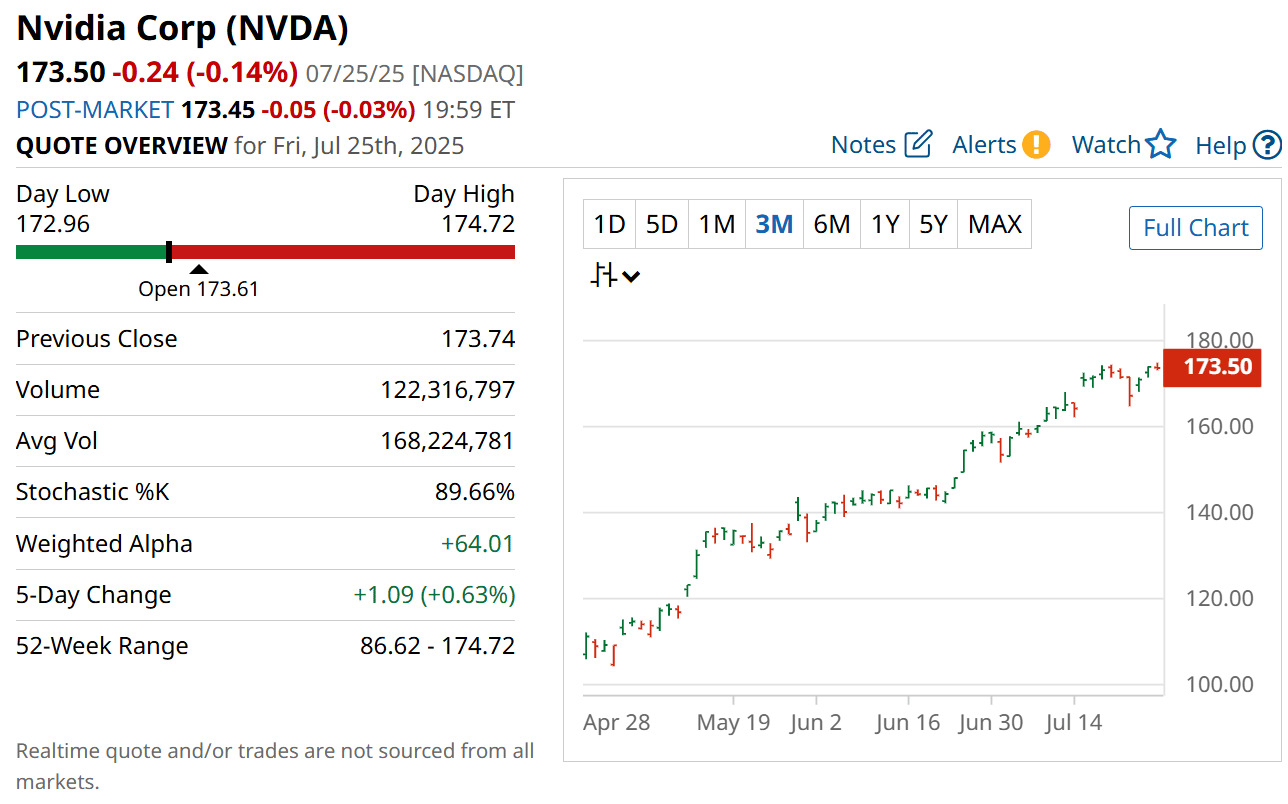

With explosive growth driven by dominance in AI chips, the company transformed a modest investment into a 16x return in just five years.

Now sitting atop the global market with a $4 trillion valuation, skeptics question how much higher Nvidia can realistically climb.

After all, duplicating its past performance would imply a market cap that rivals half the entire global economy—a scenario many find implausible.

Yet dismissing Nvidia’s future potential could be a costly mistake.

With massive tailwinds in data centers, robotics, and autonomous AI infrastructure, the road to 2030 may still hold explosive upside for the world’s most important chipmaker.

Key Points:

Nvidia’s explosive 1,500% rally over the past five years may only be the beginning of a much larger AI-fueled supercycle.

Even with a $4 trillion market cap, Nvidia's leadership in AI chips, data centers, and enterprise software could still drive outsized gains.

The market may be underestimating Nvidia’s ability to expand into trillion-dollar opportunities across autonomous tech, robotics, and cloud AI infrastructure.

TODAY’S SPONSOR

Create How-to Videos in Seconds with AI

Stop wasting time on repetitive explanations. Guidde’s AI creates stunning video guides in seconds—11x faster.

Turn boring docs into visual masterpieces

Save hours with AI-powered automation

Share or embed your guide anywhere

How it works: Click capture on the browser extension, and Guidde auto-generates step-by-step video guides with visuals, voiceover, and a call to action.

AI Megatrend Still in Its Early Innings

Despite achieving a $4 trillion valuation and dominating the AI chip market, Nvidia’s growth engine remains far from maxed out.

Global data center investments are projected to surpass $6.7 trillion by 2030, with a majority funneled into AI-specific infrastructure.

Nvidia’s iron grip on the AI GPU market—owning 92% market share—positions it as the most powerful player to capture this windfall.

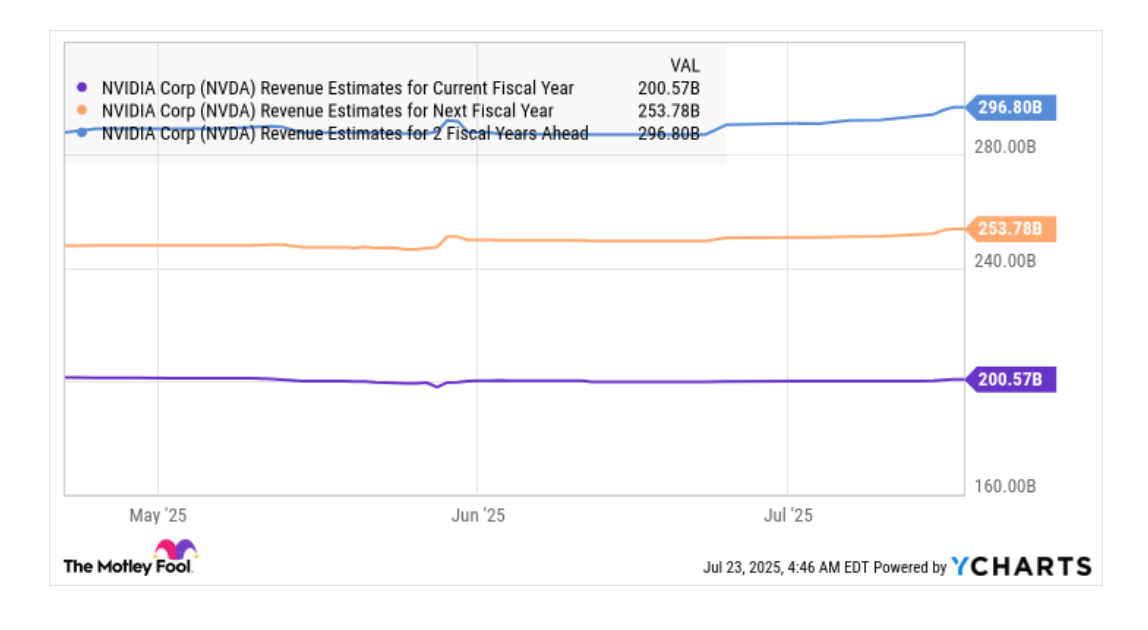

Even if GPU market share declines, Nvidia is still forecast to tap into over $1.2 trillion in AI accelerator revenues.

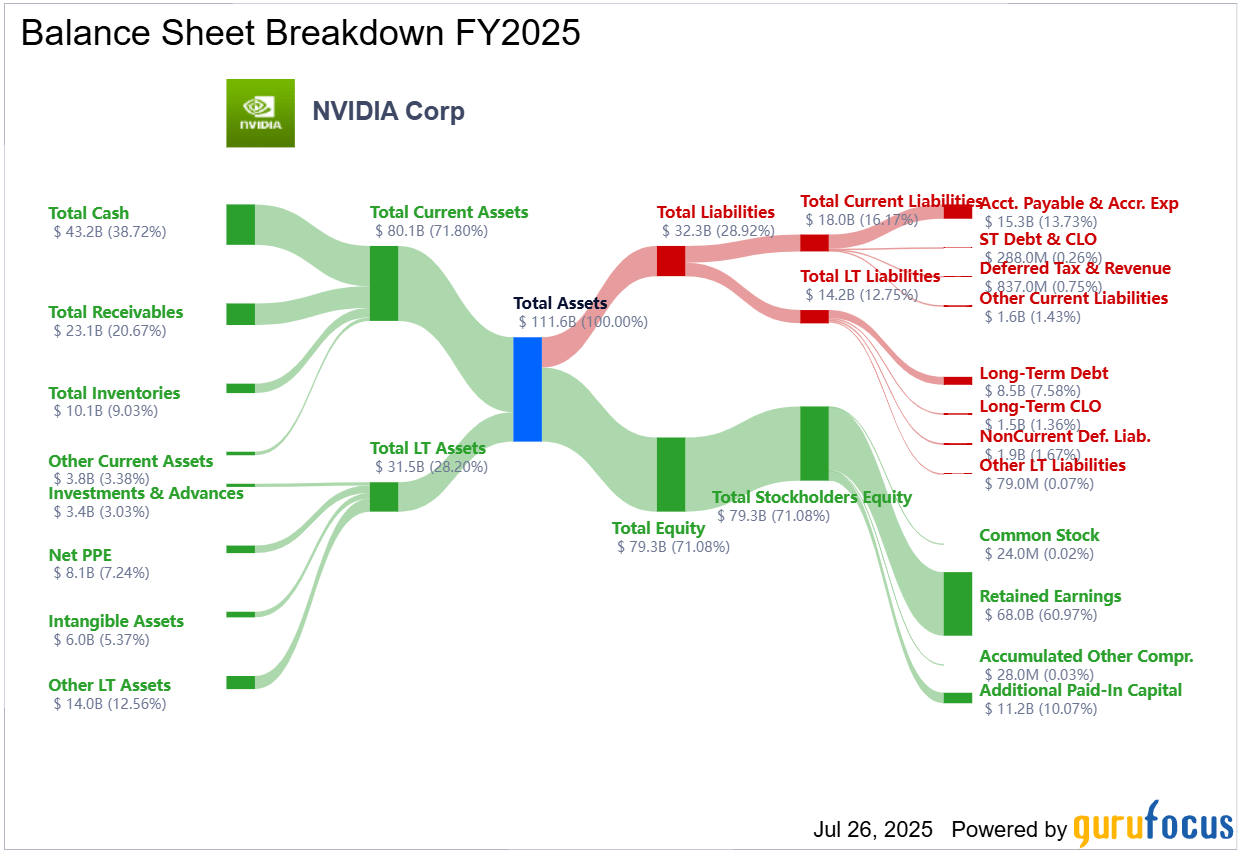

Backed by a deep war chest of $43 billion and preferred access to TSMC’s most advanced chip packaging capacity, Nvidia is armed to dominate the AI race throughout the rest of the decade.

Built for Hypergrowth—And It Knows It

Nvidia isn’t just positioned to win—it’s planning to.

Even under conservative assumptions, if its AI GPU market share drops to 50%, the company’s data center revenue could still triple to $600 billion by 2030.

Given that data centers already generate nearly 90% of Nvidia’s current revenue, this growth isn't speculative—it’s foundational.

If the stock traded at just half its historical average sales multiple, Nvidia’s valuation could soar to $7.2 trillion—an 80% gain from today’s level.

And that estimate doesn't even factor in its growth across automotive AI, robotics, or enterprise software. This isn’t just confidence—it’s calculated execution.

Strengths

AI Market Dominance: Nvidia commands 92% of the AI GPU market, giving it unrivaled pricing power and scale.

Deep Capital Reserves: With over $43 billion in net cash, the company can secure supply chains, outspend rivals, and accelerate R&D.

Preferred Manufacturing Access: TSMC has reportedly allocated 70% of its advanced chip packaging to Nvidia for 2025, cementing Nvidia’s supply chain edge.

Weaknesses

High Expectations Priced In: With a $4 trillion market cap, even moderate missteps could trigger significant stock pullbacks.

Customer Concentration Risk: A large portion of Nvidia's revenue is tied to a few hyperscalers, increasing reliance on continued AI infrastructure investment.

Competition Gaining Ground: AMD and custom AI chipmakers are investing heavily to close the performance and pricing gap.

Potential

Multi-Trillion Dollar AI TAM: The AI data center opportunity alone could exceed $5 trillion by 2030, with Nvidia poised to be the primary beneficiary.

Expansion Into New Verticals: Nvidia is making moves into automotive AI, robotics, and software, which could unlock entirely new revenue streams.

Enterprise AI Ecosystem: With tools like CUDA and Omniverse, Nvidia is building a sticky platform that integrates software and hardware for AI developers globally.

TODAY’S SPONSOR

Marketing ideas for marketers who hate boring

The best marketing ideas come from marketers who live it. That’s what The Marketing Millennials delivers: real insights, fresh takes, and no fluff. Written by Daniel Murray, a marketer who knows what works, this newsletter cuts through the noise so you can stop guessing and start winning. Subscribe and level up your marketing game.

Conclusion

Nvidia is not just riding the AI wave—it’s steering the entire ship.

Its technological lead, robust cash reserves, and ironclad supply chain dominance make it one of the few companies with the potential to shape the next digital era.

Even at today’s lofty valuation, Nvidia remains one of the few megacap tech stocks with a credible path to double in size.

For investors seeking exposure to the AI boom, this may still be the best horse to bet on.

Final Thought

If Nvidia was the undisputed kingmaker of the past five years, the next five may crown it the first true AI superpower—are you ready to ride that wave or risk watching it from the sidelines?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply