- StocksGeniusMastery

- Posts

- 💥Nvidia's Hidden Value: Surprising Insight Inside

💥Nvidia's Hidden Value: Surprising Insight Inside

Wall Street is missing one key metric that makes Nvidia stock look wildly undervalued.

Hello Fellow Investors!

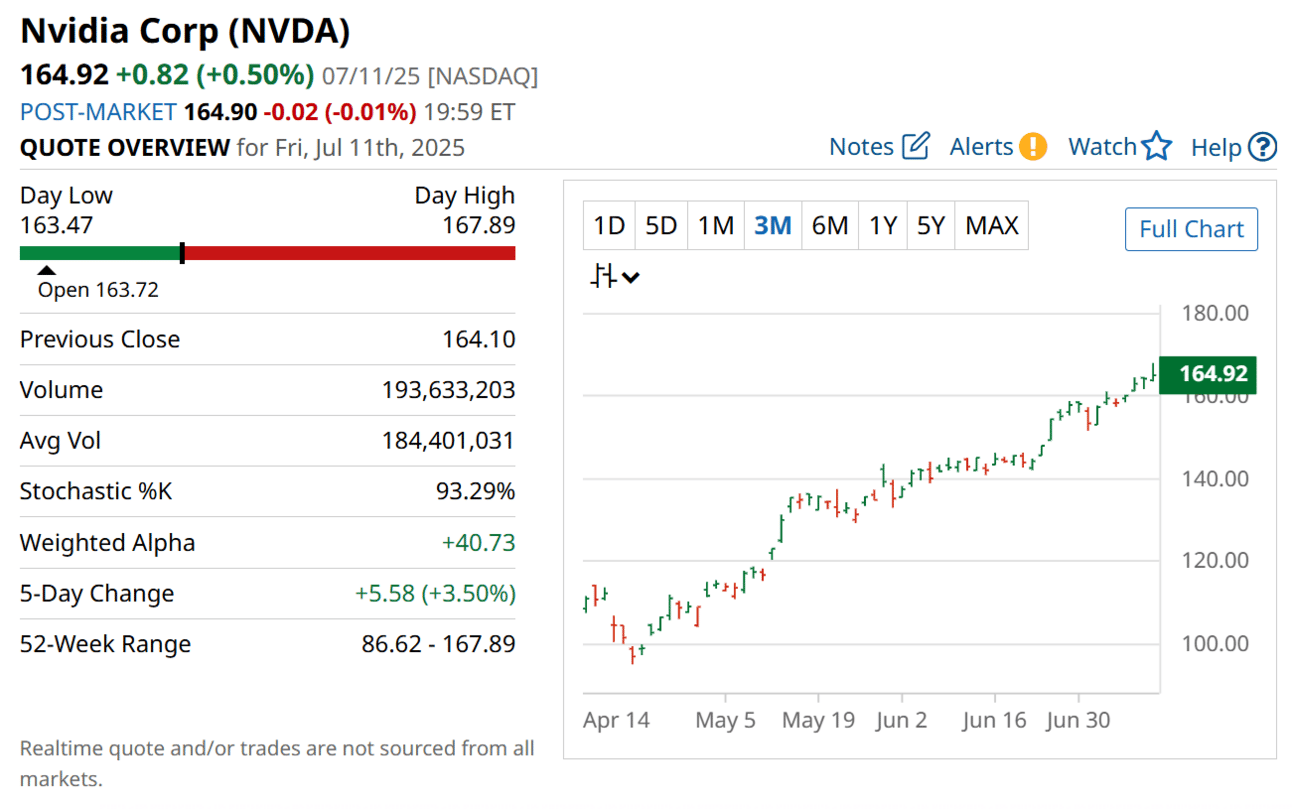

Nvidia (NASDAQ: NVDA) has been the poster child of the AI revolution, with its stock rocketing nearly 1,500% over the past five years.

But even after this meteoric rise, Nvidia may still be one of the cheapest AI plays on the market.

Wall Street's obsession with raw price has blinded many to the real story—Nvidia’s earnings are compounding at breakneck speed.

When future profits are taken into account, the stock trades at a valuation that would make even value investors take a second look.

Forget the sticker price. Nvidia's fundamentals reveal a stealth bargain hiding in plain sight - one that could power the next leg of explosive growth.

Key Points:

Nvidia’s earnings growth is accelerating faster than its stock price.

Adjusted for forward growth, Nvidia’s P/E ratio looks surprisingly low.

Even after a 1,500% run, this AI leader still trades like a value stock.

TODAY’S SPONSOR

Create How-to Videos in Seconds with AI

Stop wasting time on repetitive explanations. Guidde’s AI creates stunning video guides in seconds—11x faster.

Turn boring docs into visual masterpieces

Save hours with AI-powered automation

Share or embed your guide anywhere

How it works: Click capture on the browser extension, and Guidde auto-generates step-by-step video guides with visuals, voiceover, and a call to action.

The AI Supercycle Is Only Just Beginning

The artificial intelligence boom isn’t a moment—it’s a multi-decade transformation, and Nvidia sits at the heart of it.

With the AI market forecasted to explode from $190 billion in 2023 to nearly $5 trillion by 2033, Nvidia's dominance in GPU hardware and AI infrastructure places it years ahead of its competitors.

Its unmatched 90% market share in AI GPUs and the stickiness of its CUDA software platform mean customers aren’t just choosing Nvidia—they’re locked into its ecosystem.

Demand for its new Blackwell chips is already booked out over 12 months, and every cloud titan, from Amazon to Microsoft, is racing to secure supply.

While rivals scramble to catch up, Nvidia’s technological lead and pricing power make it the go-to engine of the AI economy—setting the stage for sustained, above-market growth for decades.

Valuation Misleads—Long-Term Value Unfolds Over Time

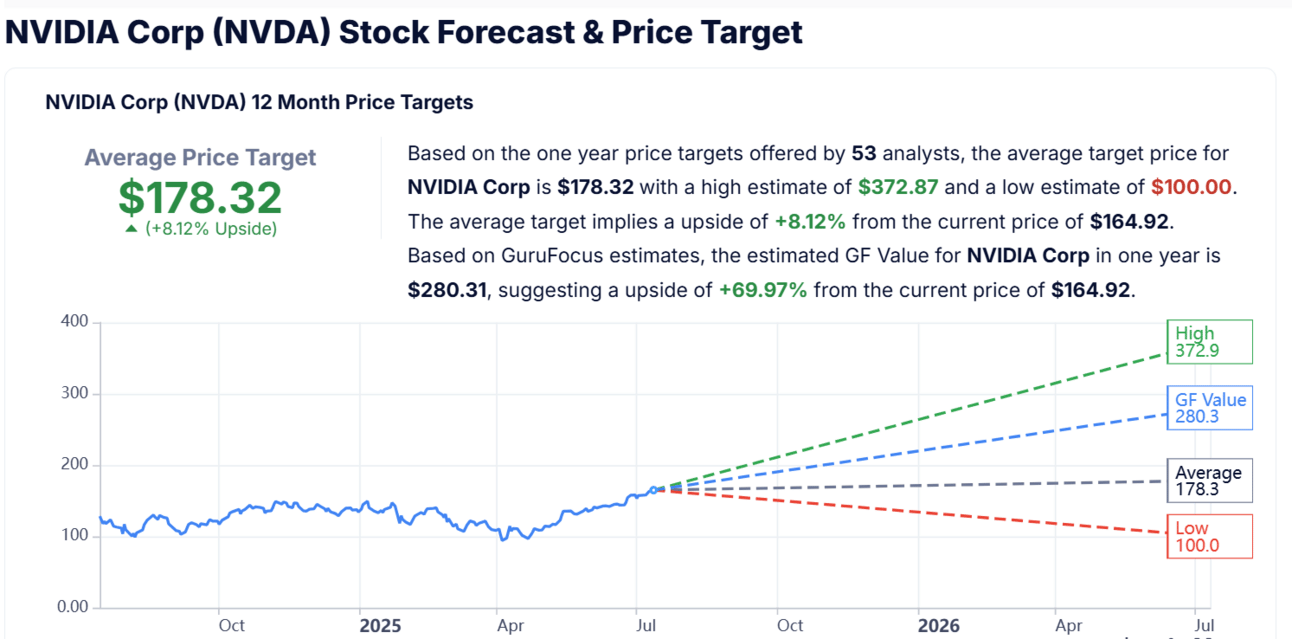

At first glance, Nvidia may look expensive—but for patient investors, it's a rare gem hiding in plain sight.

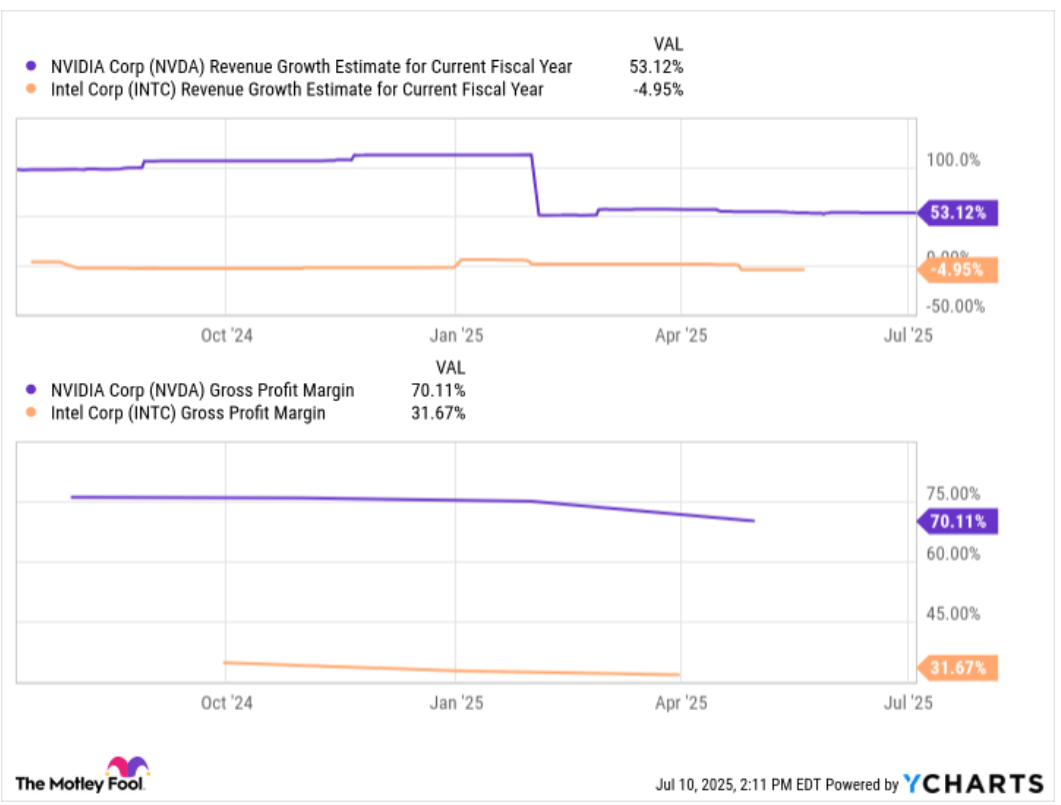

The stock trades at a premium based on current earnings, yet forward-looking metrics paint a very different picture.

With projected earnings growth above 30% annually, the forward P/E drops from 38 in 2026 to just 22 by 2028—levels typically seen in much slower-growth sectors.

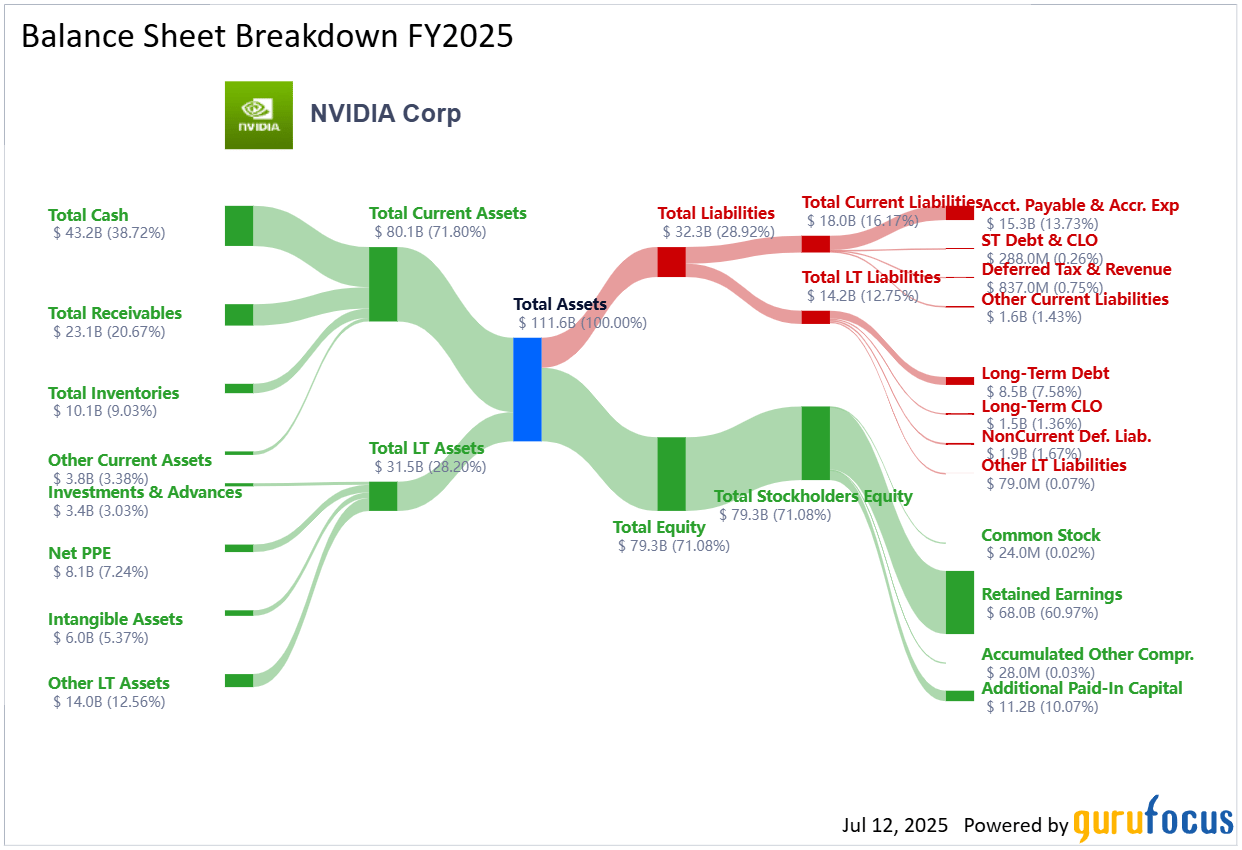

This accelerating earnings power, fueled by near-monopolistic margins and unmatched AI demand, reshapes how Nvidia’s valuation should be viewed.

Investors who can zoom out beyond the next quarter and anchor their strategy on multi-year gains will find Nvidia’s current price point not a warning sign—but a long-term buying opportunity.

Strengths

Dominant Market Position: Nvidia controls over 90% of the AI GPU market, backed by unparalleled hardware performance.

Sticky Software Ecosystem: The CUDA platform locks in developers, making switching costs prohibitively high for enterprise clients.

Unmatched Demand: Blackwell chips are sold out for over a year, underscoring extreme demand from hyperscalers and cloud providers.

Weaknesses

Premium Valuation: Current P/E and price-to-sales ratios are high, requiring sustained future growth to justify.

Competitive Pressure: Rivals like AMD and Intel are investing heavily to close the gap in AI hardware.

Supply Constraints: Overwhelming demand may create bottlenecks, limiting Nvidia’s ability to fully capture near-term growth.

Potential

Expansion into Inference Chips: Nvidia is poised to disrupt not only AI training but also inference, a market worth billions.

Global Infrastructure Dependence: Major AI infrastructure projects worldwide are increasingly reliant on Nvidia’s ecosystem.

New Product Cycles: Continuous innovation, like the rollout of Blackwell and next-gen chips, can refresh growth every few years.

TODAY’S SPONSOR

The Future of AI in Marketing. Your Shortcut to Smarter, Faster Marketing.

This guide distills 10 AI strategies from industry leaders that are transforming marketing.

Learn how HubSpot's engineering team achieved 15-20% productivity gains with AI

Learn how AI-driven emails achieved 94% higher conversion rates

Discover 7 ways to enhance your marketing strategy with AI.

Conclusion

For investors who think they’ve missed the boat on Nvidia, the reality is quite the opposite.

The market has underappreciated the true long-term compounding potential behind its AI dominance.

This is a stock that rewards conviction, not caution.

Those who are bold enough to hold through market noise may end up holding one of the century’s greatest compounders.

Final Thought

What if the best time to buy Nvidia wasn’t five years ago—but right now, before the next wave of AI disruption hits full throttle?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply