- StocksGeniusMastery

- Posts

- 💥Nvidia vs. The Field: Why the World’s Biggest Company Faces Its Toughest Year Yet

💥Nvidia vs. The Field: Why the World’s Biggest Company Faces Its Toughest Year Yet

Even trillion-dollar leaders stumble — can Nvidia stay ahead of the AI chip revolution?

Hi Fellow Investors,

Nvidia (NASDAQ: NVDA) became the world’s largest company thanks to its dominance in AI chips.

But that dominance is now under threat.

With Broadcom (NASDAQ: AVGO) and Advanced Micro Devices (NASDAQ: AMD) gaining traction, analysts say Nvidia’s golden streak may be slowing.

Let’s break down what’s really happening — and where Nvidia’s stock could be one year from now.

Key Points:

Nvidia’s AI chip growth may cool as Broadcom and AMD win large contracts.

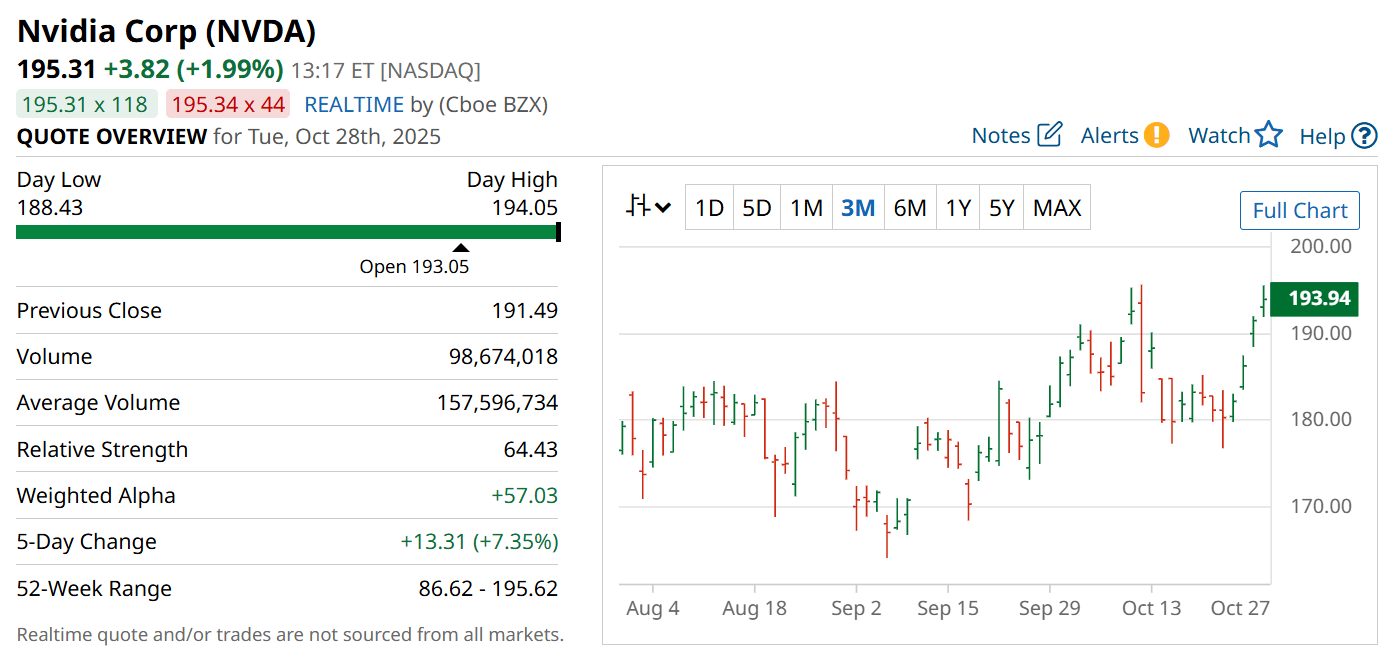

Analysts project just 19% upside in Nvidia shares over the next 12 months.

Despite challenges, new initiatives in AI infrastructure could spark a rebound.

TODAY’S SPONSOR

Startups who switch to Intercom can save up to $12,000/year

Startups who read beehiiv can receive a 90% discount on Intercom's AI-first customer service platform, plus Fin—the #1 AI agent for customer service—free for a full year.

That's like having a full-time human support agent at no cost.

What’s included?

6 Advanced Seats

Fin Copilot for free

300 Fin Resolutions per month

Who’s eligible?

Intercom’s program is for high-growth, high-potential companies that are:

Up to series A (including A)

Currently not an Intercom customer

Up to 15 employees

Nvidia’s Growth Machine Faces New Rivals

For years, Nvidia powered the artificial intelligence revolution, becoming the most valuable company in history with a market cap near $4.7 trillion.

Its AI-focused data center business drove more than $81 billion in revenue during the first half of fiscal 2026 — a figure unmatched by any semiconductor rival.

But now, that dominance is being tested.

Broadcom recently secured a massive OpenAI contract, potentially adding $100 billion in new revenue through 2029.

AMD, meanwhile, is deploying 6 gigawatts of AI chips for OpenAI — a multibillion-dollar opportunity that could finally help it close the performance gap with Nvidia.

As hyperscalers diversify their AI hardware suppliers, Nvidia’s once iron grip on the market is showing cracks.

Competition Could Weigh on Nvidia’s Stock in 2026

Wall Street analysts expect Nvidia’s revenue to climb 33% in fiscal 2027, compared with 58% growth this year.

That slowdown matters — especially when the stock trades at a lofty price-to-sales ratio of 28, far above the Nasdaq Composite average of 5.4.

The median 12-month price target of $215 implies just 19% upside, signaling that investors may see smaller gains in the coming year.

Simply put, Nvidia’s valuation has caught up with its performance.

Unless new growth drivers emerge, the world’s most valuable chipmaker could face a rare year of underperformance.

Why Nvidia Could Still Surprise Wall Street

Despite these headwinds, Nvidia isn’t standing still.

It recently committed $5 billion to Intel (NASDAQ: INTC), positioning itself to pair GPUs with Intel’s market-leading server CPUs for accelerated computing.

The company also leads a booming new segment: sovereign AI infrastructure, helping nations build their own large-scale AI systems.

Nvidia expects this business to more than double to $20 billion this year and projects 10x growth in Europe next year.

Its automotive and gaming divisions — often overlooked — also represent multibillion-dollar opportunities, including a $300 billion addressable market for AI-driven vehicles.

Taken together, these catalysts could help Nvidia beat expectations again, just as it has done many times before.

Strengths

Unmatched leadership in AI chips and accelerated computing technology.

Expanding partnerships, including Intel collaboration for hybrid AI systems.

Dominant position in sovereign AI infrastructure with global government contracts.

Weaknesses

Slowing revenue growth amid intensifying competition from Broadcom and AMD.

High valuation multiples leave limited room for error or negative surprises.

Heavy dependence on data center revenue concentration raises long-term risk.

Potential

Sovereign AI and automotive expansion could drive unexpected upside in 2026.

GPU-CPU integration with Intel could open new computing markets.

Continued AI infrastructure investment (estimated at $3–$4 trillion through 2030) may fuel sustained demand for Nvidia hardware.

TODAY’S SPONSOR

AI-native CRM

“When I first opened Attio, I instantly got the feeling this was the next generation of CRM.”

— Margaret Shen, Head of GTM at Modal

Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up.

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Conclusion

Nvidia remains the undisputed leader of the AI chip revolution — but the battle is getting fierce.

While Wall Street expects modest gains, the company’s expansion into sovereign AI, automotive systems, and strategic partnerships could power another breakout year.

Investors who stay the course may still capture long-term upside from Nvidia’s technological and strategic advantages.

Final Thought

Even market kings must fight to keep their crowns.

Will Nvidia’s next year prove it’s still the undisputed ruler of AI — or mark the first cracks in its trillion-dollar empire?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply