- StocksGeniusMastery

- Posts

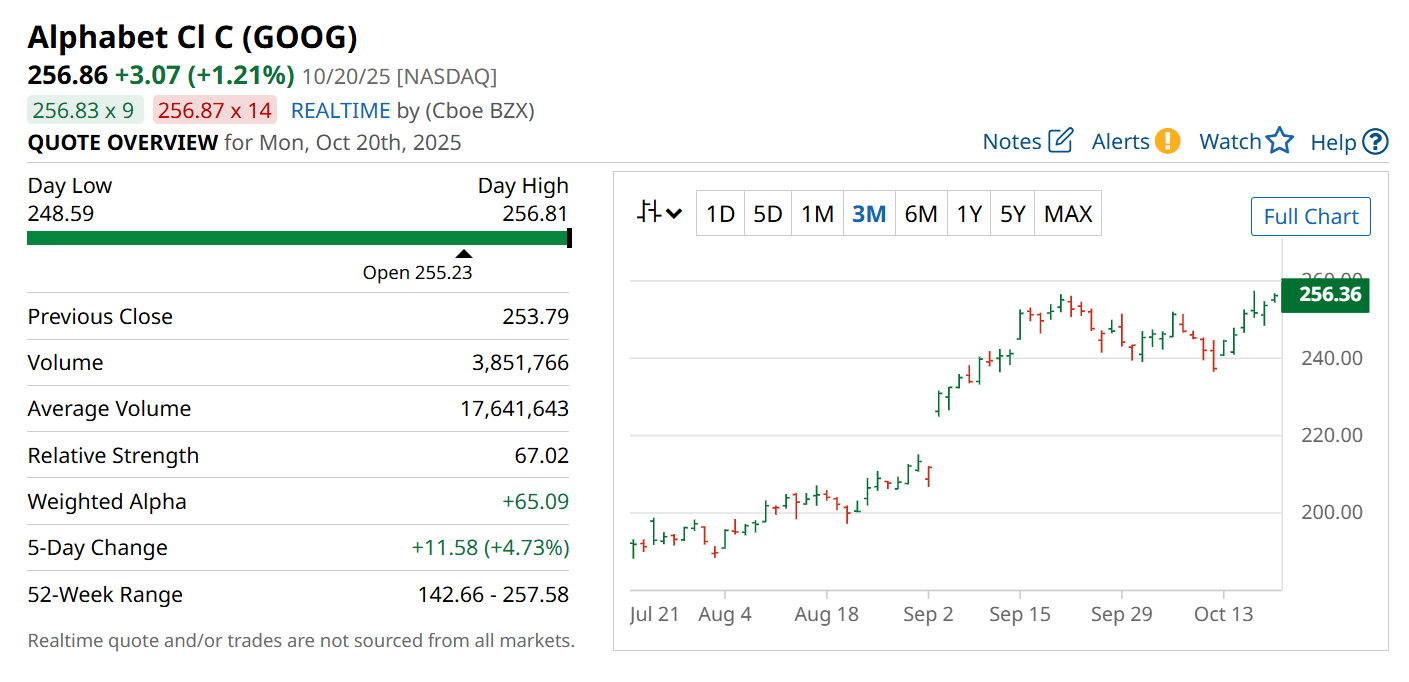

- 💥One AI Giant Wall Street Is Still Undervaluing

💥One AI Giant Wall Street Is Still Undervaluing

Alphabet’s Gemini engine and cloud growth could make GOOGL the breakout tech stock of 2026.

Hi Fellow Investors,

Alphabet (NASDAQ: GOOGL) continues to redefine the limits of artificial intelligence.

The company’s Gemini models are reshaping how users search, create, and connect across devices.

And with its cloud business booming and stock valuation still modest, Alphabet may be one of the best AI stocks to own for the next year — and beyond.

Key Points:

Alphabet’s AI moat in search and data remains unmatched globally.

Cloud revenue is soaring with record profitability and expansion.

GOOGL stock trades at an attractive valuation relative to its AI peers.

TODAY’S SPONSOR

How can AI power your income?

Ready to transform artificial intelligence from a buzzword into your personal revenue generator

HubSpot’s groundbreaking guide "200+ AI-Powered Income Ideas" is your gateway to financial innovation in the digital age.

Inside you'll discover:

A curated collection of 200+ profitable opportunities spanning content creation, e-commerce, gaming, and emerging digital markets—each vetted for real-world potential

Step-by-step implementation guides designed for beginners, making AI accessible regardless of your technical background

Cutting-edge strategies aligned with current market trends, ensuring your ventures stay ahead of the curve

Download your guide today and unlock a future where artificial intelligence powers your success. Your next income stream is waiting.

Alphabet’s Unshakable Lead in AI Search

Alphabet’s dominance in search continues to anchor its AI advantage.

Its ecosystem spans Chrome, Android, and YouTube — each capturing over 70% market share in their domains.

That unparalleled reach makes Google the world’s default search engine, reinforced by a lucrative deal with Apple to remain the go-to option on iPhones and iPads.

Now, the integration of its Gemini AI models is transforming search from reactive answers to predictive insight.

With multimodal features like Circle to Search, Lens, and AI Overviews, Alphabet is redefining how billions access information.

And thanks to AI Mode and the fast-growing Gemini app, Alphabet is quickly blending traditional search with conversational AI — all backed by unmatched behavioral data and ad reach.

Cloud Momentum Accelerates with AI at the Core

Alphabet’s fastest-growing segment is Google Cloud — and it’s delivering record results.

Last quarter, revenue jumped 32% to $13.6 billion, while operating income more than doubled to $2.8 billion.

The company even boosted its capital expenditure target from $75 billion to $85 billion to fuel new data center growth.

Its competitive edge lies in full-stack integration — owning the AI models, silicon chips, software, and global fiber network.

That vertical control enables superior performance and lower latency, giving Alphabet a durable cost advantage.

The pending acquisition of cybersecurity leader Wiz could also expand Google Cloud’s dominance in secure enterprise AI solutions.

Emerging Bets Add Explosive Optionality

Beyond search and cloud, Alphabet is planting the seeds for the next wave of innovation.

Its Waymo robotaxi unit is already operational in multiple U.S. cities, signaling that autonomous mobility may soon become mainstream.

Meanwhile, its quantum computing division — powered by the Willow chip — is making real breakthroughs in error correction, potentially positioning Alphabet at the forefront of quantum AI.

Together, these bets offer massive optionality for long-term investors looking beyond the next earnings quarter.

Strengths

Dominant position in search and data creates a moat competitors can’t replicate.

Rapidly growing cloud division generating consistent profitability.

Deep AI expertise with Gemini models and proprietary AI chips driving next-gen innovation.

Weaknesses

Heavy capital expenditures required to sustain growth in AI and cloud infrastructure.

Regulatory risks in the U.S. and Europe remain persistent headwinds.

Competitive pressures from OpenAI, Anthropic, and Amazon in enterprise AI markets.

Potential

Expansion of AI-driven search features could unlock massive new ad revenue streams.

Waymo and quantum computing initiatives provide long-term growth catalysts.

Valuation under 24x forward earnings gives Alphabet room for significant multiple expansion as earnings rise.

TODAY’S SPONSOR

Tax automation that clears your desk and your mind

Tax leaders are juggling shifting regulations, growing complexity, and leaner teams. In this on-demand webinar, discover how automation reduces manual work, increases accuracy, and frees your team to focus on strategy instead of spreadsheets. You will see how Longview Tax helps you streamline compliance, gain real-time insights, and turn your department into a true strategic asset.

Conclusion

Alphabet stands at the intersection of search, AI, and cloud — three of the most powerful forces shaping the digital economy.

With dominant platforms, rising profitability, and a reasonable valuation, GOOGL may be one of the smartest AI investments heading into 2026.

Investors seeking exposure to AI’s long-term growth engine should take a close look now.

Final Thought

AI isn’t just the next big trend — it’s the next economic revolution.

Will Alphabet’s Gemini lead this transformation, or will a new disruptor emerge to challenge its crown?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply