- StocksGeniusMastery

- Posts

- 💥 ServiceNow Stock Slides Despite Blockbuster AI Metrics

💥 ServiceNow Stock Slides Despite Blockbuster AI Metrics

Why a Market Sell-Off Could Be the Opportunity Long-Term Investors Are Waiting For

Hi Fellow Investors,

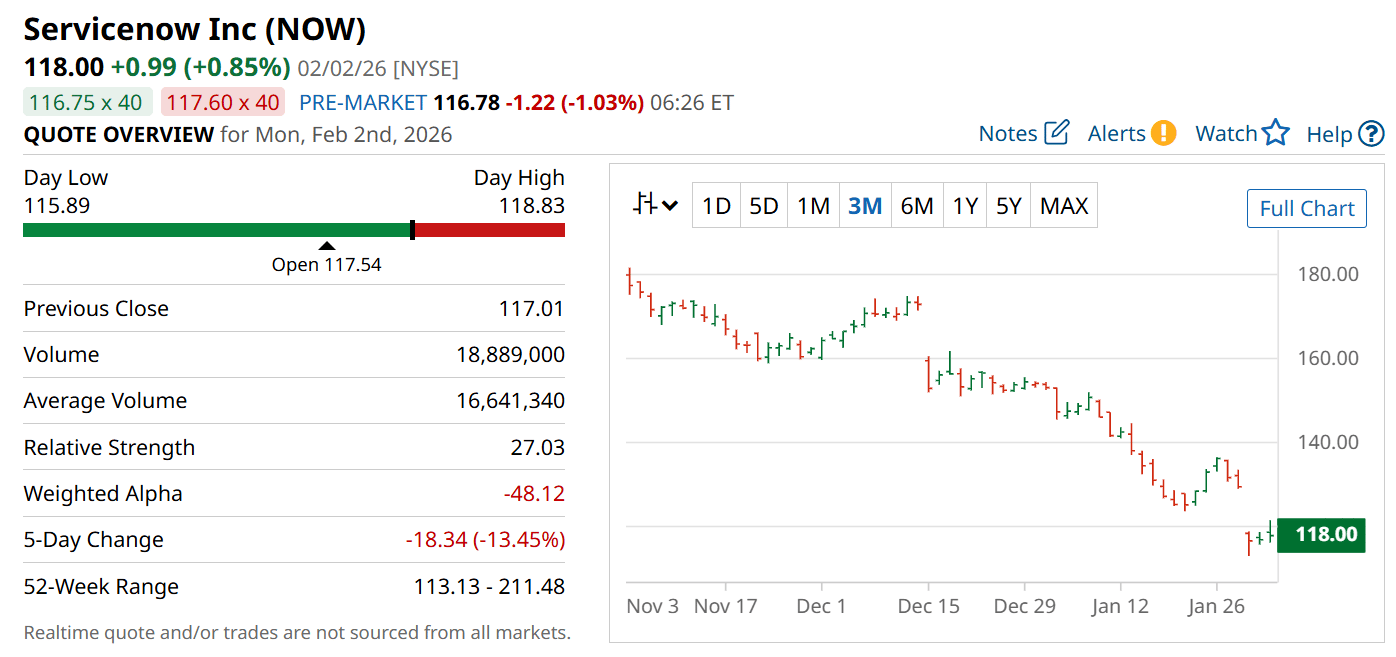

ServiceNow (NYSE: NOW) shares declined despite posting strong earnings and issuing upbeat guidance.

Market sentiment toward SaaS stocks remains cautious as investors debate how AI will reshape enterprise software.

Beneath the surface, ServiceNow’s fundamentals suggest the sell-off may be overdone.

Key Points:

ServiceNow delivered double-digit revenue and earnings growth, yet shares moved lower on broader SaaS pessimism.

AI-driven products like Now Assist are scaling rapidly and strengthening long-term growth visibility.

The stock’s valuation has reset to levels that look compelling relative to growth prospects.

TODAY’S SPONSOR

Investor-ready updates, by voice

High-stakes communications need precision. Wispr Flow turns speech into polished, publishable writing you can paste into investor updates, earnings notes, board recaps, and executive summaries. Speak constraints, numbers, and context and Flow will remove filler, fix punctuation, format lists, and preserve tone so your messages are clear and confident. Use saved templates for recurring financial formats and create consistent reports with less editing. Works across Mac, Windows, and iPhone. Try Wispr Flow for finance.

AI Strategy Gains Traction as Revenue Accelerates

ServiceNow continues to execute on its transition toward an AI-first enterprise platform.

The company’s generative AI suite, Now Assist, has already reached $600 million in annual contract value.

Management expects that figure to surpass $1 billion by the end of 2026.

Strategic acquisitions in AI-driven cybersecurity are expanding the platform’s relevance across enterprise workflows.

These initiatives position ServiceNow as a central orchestration layer for agentic AI adoption.

Quarterly Results Highlight Durable SaaS Strength

Fourth-quarter revenue climbed 20.5% year over year to $3.57 billion.

Adjusted earnings per share surged 26%, exceeding consensus expectations.

Subscription revenue growth remained robust, rising 21% year over year.

Professional services growth complemented the core subscription business.

Margins and scale continue to reinforce ServiceNow’s premium SaaS profile.

Backlog Growth Signals Strong Forward Visibility

Remaining performance obligations increased 26.5% to $28.2 billion.

Current RPO growth of 25% points to sustained near-term demand.

These metrics underscore customer confidence in long-term platform adoption.

Large enterprise clients continue to expand usage across multiple workflows.

This backlog strength provides a buffer against short-term market volatility.

Guidance Confirms Confidence in 2026 Outlook

Management forecast first-quarter subscription revenue growth of 21.5%.

Full-year guidance implies another year of 20%+ subscription expansion.

CEO commentary emphasized that AI enhances, rather than replaces, enterprise orchestration.

ServiceNow’s structured data environment makes it an ideal foundation for AI agents.

Operational performance remains solid even as investor sentiment weakens.

Strengths

Rapid AI monetization through Now Assist demonstrates strong product-market fit and pricing power.

Expanding backlog and RPO growth provide clear visibility into future revenue streams.

Unified workflows and enterprise-scale data position the platform as an AI orchestration leader.

Weaknesses

SaaS sector sentiment remains fragile, pressuring valuation regardless of execution.

Premium enterprise focus can expose results to delayed large-customer spending cycles.

Ongoing acquisitions introduce integration and execution risk in the near term.

Potential

AI-driven upsell opportunities could materially lift average contract values over time.

Valuation compression has created an entry point rarely seen for this growth profile.

Becoming the control layer for agentic AI could unlock a new multi-year growth phase.

TODAY’S SPONSOR

Payroll errors cost more than you think

While many businesses are solving problems at lightspeed, their payroll systems seem to stay stuck in the past. Deel's free Payroll Toolkit shows you what's actually changing in payroll this year, which problems hit first, and how to fix them before they cost you. Because new compliance rules, AI automation, and multi-country remote teams are all colliding at once.

Check out the free Deel Payroll Toolkit today and get a step-by-step roadmap to modernize operations, reduce manual work, and build a payroll strategy that scales with confidence.

Conclusion

ServiceNow’s business momentum remains intact despite recent share price weakness.

AI adoption is accelerating, backlog growth is strong, and guidance supports sustained expansion.

For long-term investors, the current dip may represent a high-quality buying opportunity.

Final Thought

Markets often punish uncertainty before rewarding execution.

When fundamentals and valuation align, patience can become a powerful advantage.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply