- StocksGeniusMastery

- Posts

- 💥Taiwan Semiconductor: The Silent Giant Behind the AI Boom

💥Taiwan Semiconductor: The Silent Giant Behind the AI Boom

Wall Street is missing this $700 billion AI titan. But savvy investors won’t overlook it for long.

Hello Fellow Investors!

Taiwan Semiconductor Manufacturing (NYSE: TSM) may not command the spotlight like Big Tech giants, but it's the invisible force behind nearly every major technological leap.

From iPhones to AI supercomputers, TSMC quietly transforms the world’s most advanced chip designs into reality.

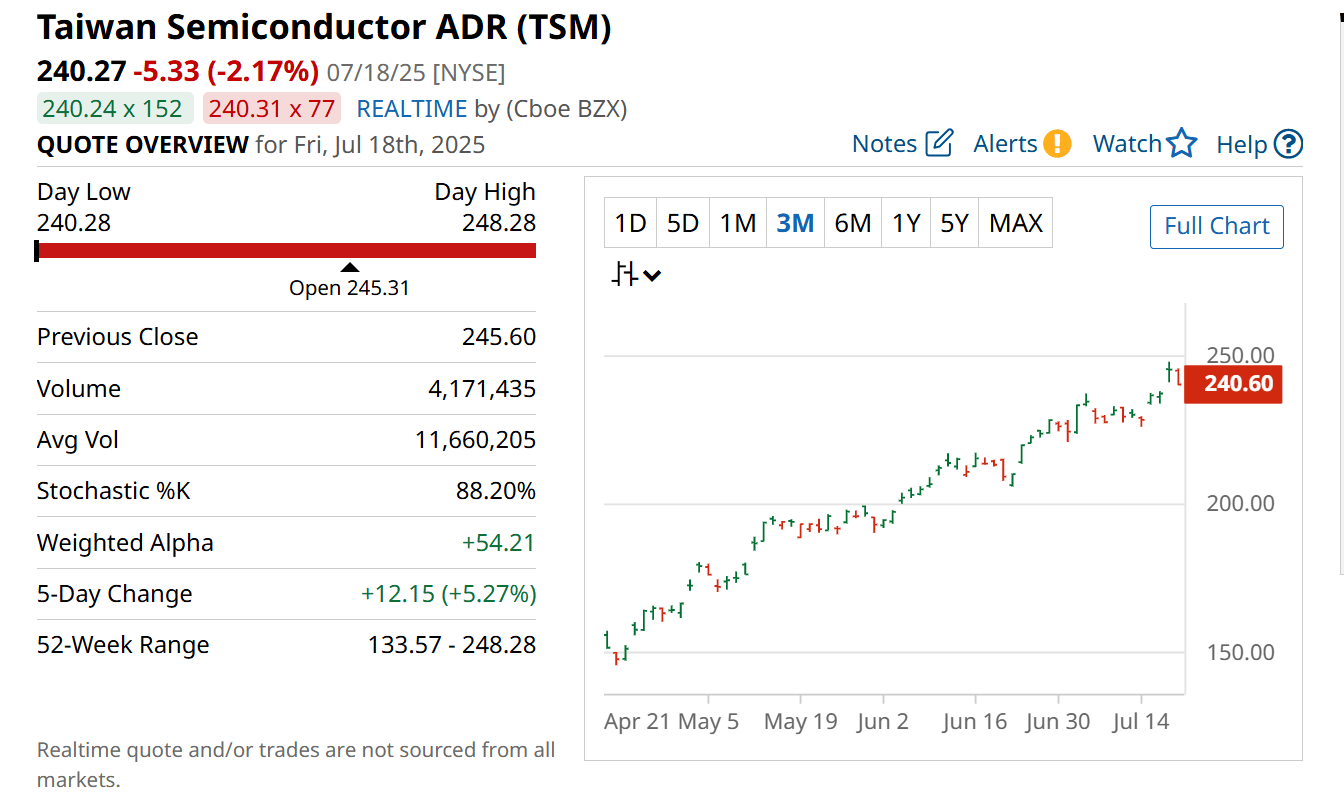

Over the past five years, TSMC has outpaced the S&P 500 by a wide margin—rallying more than 250% as it became the backbone of the global semiconductor supply chain.

And with artificial intelligence demand exploding, its growth trajectory could only be getting started.

TSMC isn't just a supporting player in the AI boom—it’s the one company every AI giant depends on.

As demand for faster, smaller, and more efficient chips accelerates, TSMC's dominance in cutting-edge fabrication is shaping up to be its most powerful growth engine yet.

Key Points:

Taiwan Semiconductor dominates the global chip foundry industry, producing 90% of the world's most advanced chips.

Its unmatched ability to manufacture high-performance chips makes it the cornerstone of the AI revolution.

TSMC forecasts AI revenue to surge at a 40%+ CAGR through 2029, powering its next leg of explosive growth.

TODAY’S SPONSOR

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

TSMC’s AI Rocket Is Just Launching

While headlines often focus on flashy AI developers, Taiwan Semiconductor Manufacturing silently powers the backbone of their success.

As data centers balloon to support artificial intelligence, demand for TSMC’s industry-leading fabrication services has surged.

The company’s advanced nodes are not only mission-critical to AI training and deployment—they're virtually irreplaceable.

Management projects its AI chip segment will double revenue this year and grow at a 40–50% CAGR through 2029.

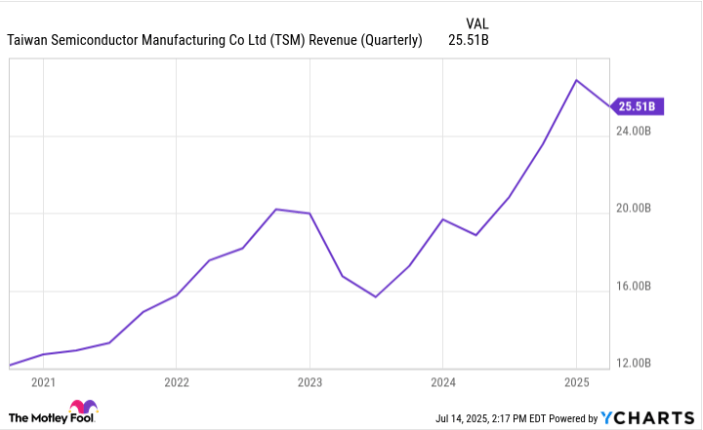

With revenue already doubling in the past five years, TSMC’s role in the AI pipeline is just beginning to show its true potential.

Why Nvidia, AMD, and Big Tech Can’t Function Without TSMC

As the AI arms race accelerates, chip designers like Nvidia and AMD depend on one player to bring their visions to life: TSMC.

The more AI systems grow, the more data centers need chips—and only TSMC can deliver the precision, speed, and efficiency required.

This iron grip on the supply chain is what sets the company apart. In an industry where scale, cost, and complexity create high barriers to entry, TSMC has already won the next five years.

No foundry comes close to matching its yield, scale, or technology roadmap.

Strengths:

Industry Leadership: TSMC holds over 50% global market share in foundry services, far outpacing competitors.

AI Tailwind: Its cutting-edge process nodes are essential for AI accelerators and high-performance computing.

Strong Financial Growth: Revenue and net income have more than doubled over the past five years, fueled by strategic capex.

Weaknesses:

Supply Chain Complexity: Reliance on a global supply chain means disruptions can ripple through operations quickly.

Currency Fluctuations: A strong Taiwanese dollar can hurt export competitiveness and profit margins.

Regulatory Scrutiny: Growing international presence could invite regulatory or political challenges abroad.

Potential:

AI Chip Boom: AI training demands will fuel sustained demand for TSMC’s 3nm and future 2nm processes.

Global Expansion: New fabs in Arizona and Japan diversify risk and increase capacity to meet global demand.

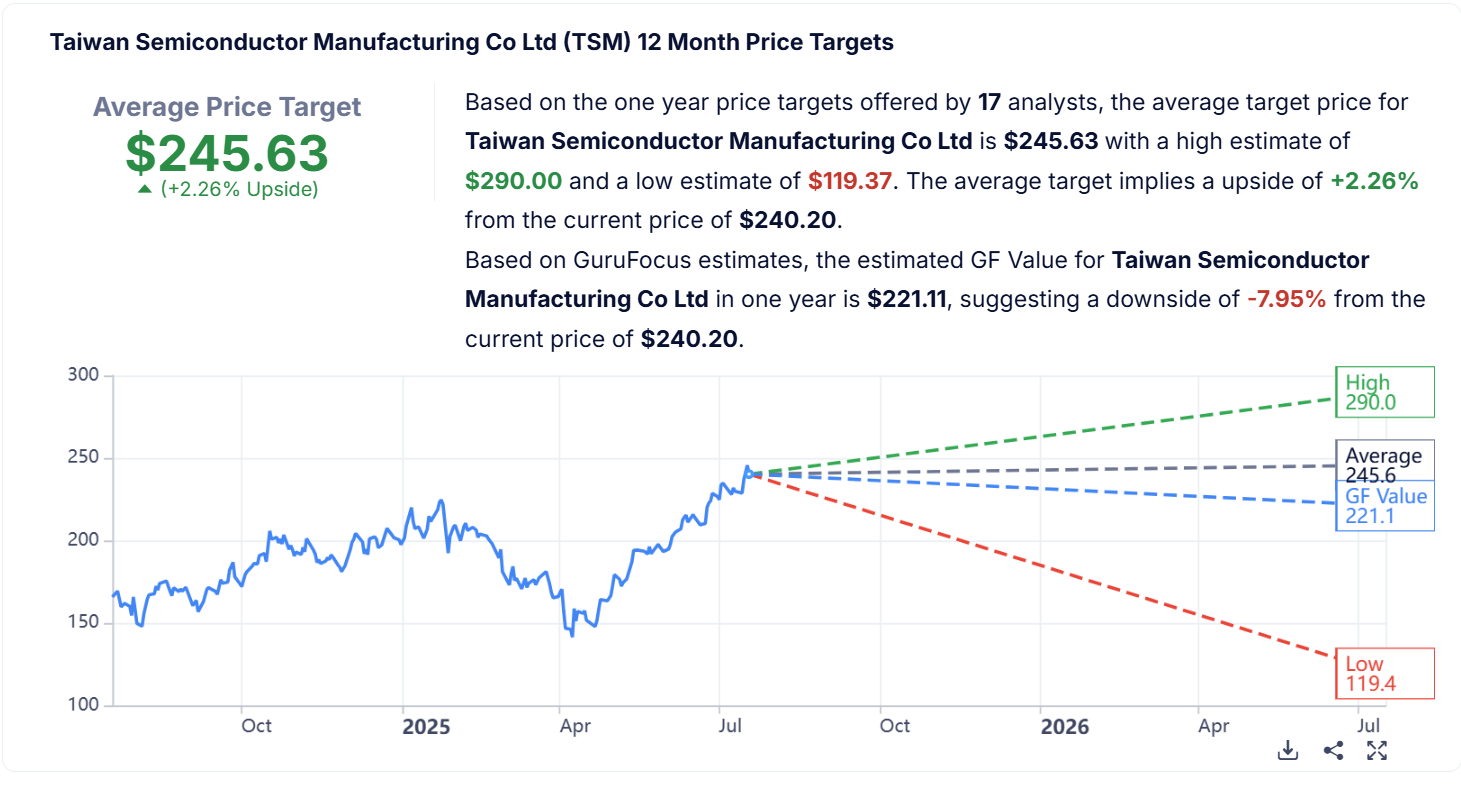

Market Cap Growth: With accelerating AI revenues, TSMC could challenge the $1 trillion market cap milestone by 2028.

TODAY’S SPONSOR

Start learning AI in 2025

Keeping up with AI is hard – we get it!

That’s why over 1M professionals read Superhuman AI to stay ahead.

Get daily AI news, tools, and tutorials

Learn new AI skills you can use at work in 3 mins a day

Become 10X more productive

Conclusion

While the market chases flashy AI stocks, the real value may lie in the foundry enabling them all.

TSMC is not just riding the AI wave—it’s the wave’s architect.

With massive upside potential, this overlooked titan could be one of the best-performing semiconductor stocks of the decade.

Final Thought

If Nvidia is the brain of AI, TSMC is the beating heart.

The question isn’t whether it will grow—but how many portfolios will benefit from its rise. Will yours be one of them?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply