- StocksGeniusMastery

- Posts

- 👉🏻Tariff Concerns Addressed By Taiwan Semiconductor

👉🏻Tariff Concerns Addressed By Taiwan Semiconductor

TSMC just dropped a tariff bombshell that could flip the entire market narrative.

Hello Fellow Investors!

While global markets brace for impact from new tariffs, Taiwan Semiconductor (NYSE: TSM) just delivered a surprising twist that could calm investor nerves.

Despite the noise, the company’s leadership is sending a crystal-clear message: business remains as strong as ever.

With reciprocal tariffs looming on the horizon, many expected chipmakers to sound the alarm—but TSMC’s CEO says customer demand hasn’t budged an inch.

That confidence could be a bullish signal in disguise.

As others panic, Taiwan Semiconductor may be quietly positioning itself as the ultimate safe harbor in a turbulent trade environment.

The question now: are investors ready to catch the next big wave?

Key Points:

TSMC reports no change in customer behavior despite looming tariffs.

Taiwan Semiconductor remains a mission-critical supplier for global tech giants.

This resilience suggests the market may be overestimating tariff risks in the chip sector.

TODAY’S SPONSOR

The Future of AI in Marketing. Your Shortcut to Smarter, Faster Marketing.

Unlock a focused set of AI strategies built to streamline your work and maximize impact. This guide delivers the practical tactics and tools marketers need to start seeing results right away:

7 high-impact AI strategies to accelerate your marketing performance

Practical use cases for content creation, lead gen, and personalization

Expert insights into how top marketers are using AI today

A framework to evaluate and implement AI tools efficiently

Stay ahead of the curve with these top strategies AI helped develop for marketers, built for real-world results.

TSMC Defies Tariff Fears with Strategic Advantage

While investors brace for the Aug. 1 tariff storm, Taiwan Semiconductor (TSMC) is delivering a clear message—its business remains untouched.

Semiconductors are currently exempt from the new reciprocal tariffs, and TSMC’s critical role in the global chip supply chain gives it unique insulation from the fallout.

Unlike other industries that face direct pricing shocks, chips remain largely protected, keeping demand steady across the board.

With key players like Nvidia and Apple relying on TSMC’s advanced nodes, alternatives are scarce, giving TSMC unmatched leverage.

And with U.S. fab expansions in motion, even that small tariff exposure is shrinking fast. TSMC isn’t just surviving the trade war—it’s strategically dodging it.

TSMC's Valuation Signals a Rare Opportunity for Investors

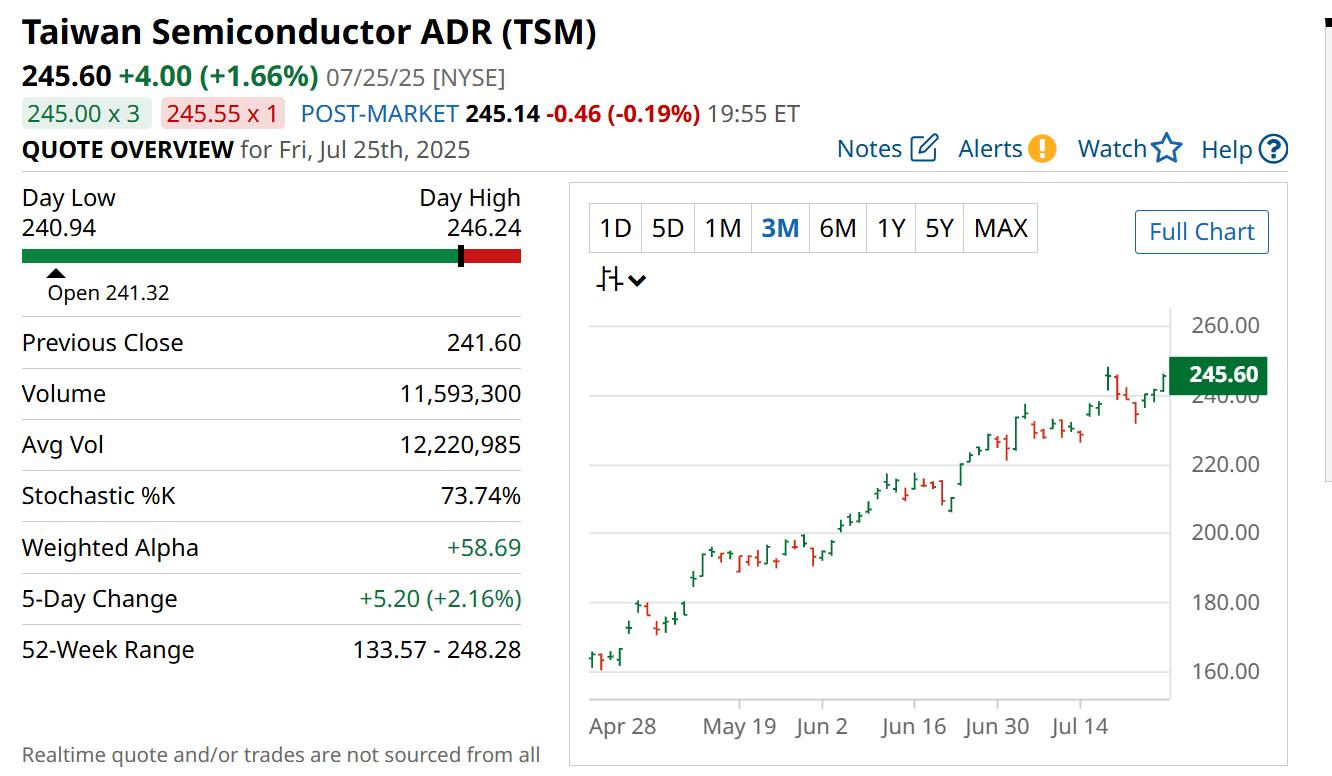

Taiwan Semiconductor’s financial outlook is shaping up to be one of the most compelling in the semiconductor world.

Management forecasts AI-related revenues to soar at a staggering 45% CAGR through 2030, while total revenue is projected to grow nearly 20% annually.

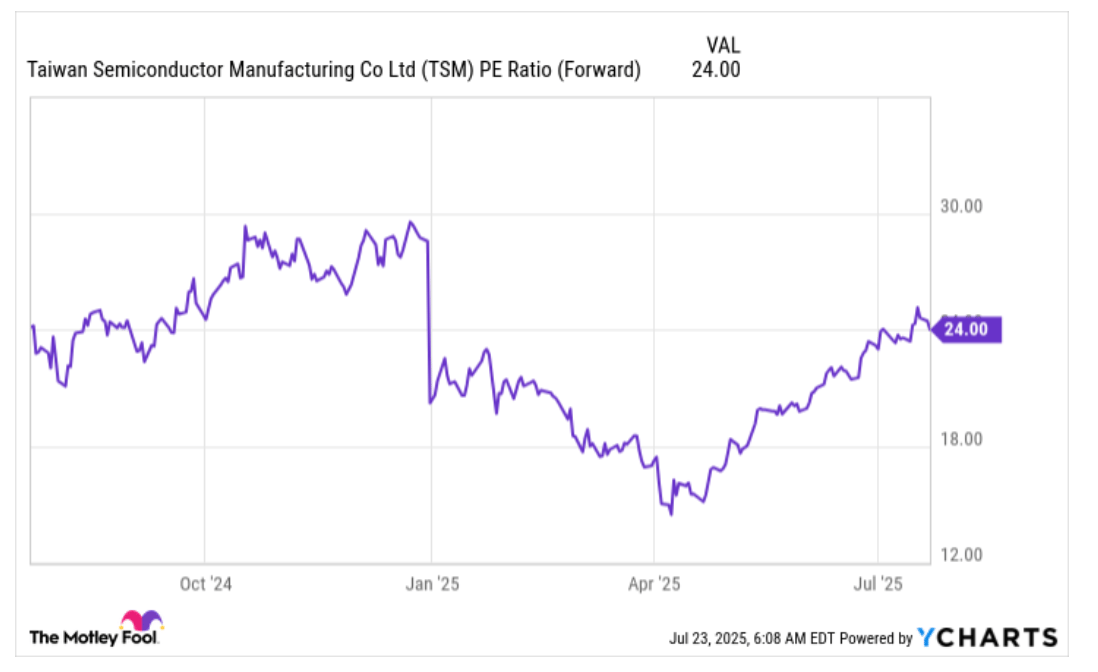

Yet, the stock trades at just 24 times forward earnings—roughly in line with the S&P 500, despite clearly outpacing it in growth.

This disconnect between valuation and growth potential makes TSMC a powerful buy signal for long-term investors.

With expanding U.S. operations reducing geopolitical risks and its position as a non-negotiable partner for tech giants, TSMC looks undervalued at current levels.

The window to capitalize on this imbalance may not stay open for long.

Strengths:

Global Technological Leadership: TSMC leads the world in advanced chip manufacturing, servicing elite clients like Nvidia and Apple with unmatched precision.

Tariff-Proof Supply Chain: With current semiconductor exemptions and U.S. fabs under construction, TSMC is shielded from near-term tariff risks.

Explosive AI Growth Pipeline: Management expects AI-driven revenues to grow at 45% CAGR—solidifying TSMC’s relevance in the next wave of tech innovation.

Weaknesses:

Geopolitical Exposure: Its Taiwan-based operations leave it vulnerable to regional tensions and U.S.–China relations.

High Capital Requirements: TSMC must consistently spend billions on cutting-edge fab development, which can pressure margins.

Customer Concentration: Heavy reliance on a handful of clients like Apple and Nvidia could pose risks if demand softens or shifts.

Potential:

U.S. Manufacturing Expansion: The Arizona chip plant initiative could unlock domestic contracts and reduce geopolitical risk premiums.

Broader Industry Domination: As competitors struggle with yields and delays, TSMC is poised to absorb more market share.

AI and Edge Computing Tailwinds: As AI adoption accelerates globally, demand for TSMC’s advanced nodes is expected to explode, creating sustained tailwinds.

TODAY’S SPONSOR

The best marketing ideas come from marketers who live it. That’s what The Marketing Millennials delivers: real insights, fresh takes, and no fluff. Written by Daniel Murray, a marketer who knows what works, this newsletter cuts through the noise so you can stop guessing and start winning. Subscribe and level up your marketing game.

Conclusion

Taiwan Semiconductor is quietly rewriting the narrative on tariffs and trade risk. While the rest of the market scrambles to assess fallout, TSMC is executing with clarity, speed, and dominance.

Its combination of unbeatable technological edge, robust long-term growth, and tariff immunity makes it one of the most compelling semiconductor plays today.

Investors looking for a high-conviction, future-proof stock in an uncertain macro environment shouldn’t ignore this sleeping giant.

Final Thought

If a company can shrug off global trade wars and still post market-beating growth, what does that say about its long-term upside—and how long will investors wait to act on it?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply