- StocksGeniusMastery

- Posts

- 💥Tesla Faces Its Biggest Threat Yet — and It’s Not BYD This Time

💥Tesla Faces Its Biggest Threat Yet — and It’s Not BYD This Time

From smartphones to supercars, Xiaomi’s innovation engine is turning into Tesla’s biggest challenge yet.

Hi Fellow Investors,

Tesla (NASDAQ: TSLA) once reigned supreme in the electric vehicle revolution.

But a new challenger is rising fast from China’s tech heartland.

Xiaomi (OTC: XIACF) — the smartphone and smart home powerhouse — is shaking the global EV landscape with aggressive pricing, higher range, and a connected ecosystem Tesla can’t easily match.

This could be the most formidable threat Tesla has faced yet.

Key Points:

Tesla’s profitability continues to weaken amid global price cuts and fierce Chinese competition.

Xiaomi’s new YU7 and SU7 EV models are smashing sales expectations and redefining market standards.

China’s EV consumers are favoring pricing and convenience over Tesla’s brand prestige and autonomy.

TODAY’S SPONSOR

AI-native CRM

“When I first opened Attio, I instantly got the feeling this was the next generation of CRM.”

— Margaret Shen, Head of GTM at Modal

Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up.

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Xiaomi’s Bold EV Breakthrough

Once known for budget smartphones, Xiaomi has transformed into one of China’s fastest-growing electric vehicle makers.

Its first sedan, the SU7, outsold Tesla’s Model 3 in December 2024 — an early sign of what was coming.

Then came the YU7, a direct competitor to the Model Y, priced nearly $10,000 cheaper and boasting a claimed range of 835 kilometers, surpassing Tesla’s redesigned Model Y.

In just 18 hours, Xiaomi secured almost 240,000 firm orders, stunning industry analysts and putting Tesla’s market position in China under severe pressure.

China’s EV market is intensely price-sensitive, and Xiaomi has mastered this battlefield through its seamless human-vehicle-home ecosystem — something Tesla lacks.

Xiaomi’s Ecosystem Advantage

Xiaomi’s strength doesn’t just come from price or range — it comes from integration.

With 731 million monthly active users across smartphones, wearables, and smart homes, Xiaomi’s EVs become the final piece of a fully connected lifestyle puzzle.

The company’s EV app seamlessly syncs with users’ existing Xiaomi devices, giving owners unified control of homes, vehicles, and personal tech.

That “stickiness” builds customer loyalty that Tesla can’t easily replicate.

Financially, Xiaomi is also surging.

Revenue climbed 30.5% year over year in Q2 2025, with net profit up 75%, giving it ample firepower to expand R&D and production capacity.

Its R&D budget grew 41%, funding cutting-edge AI initiatives and even a 3-nanometer chip (XRING O1) — signaling ambitions far beyond EVs.

Tesla’s Shifting Strategy Amid Growing Pressure

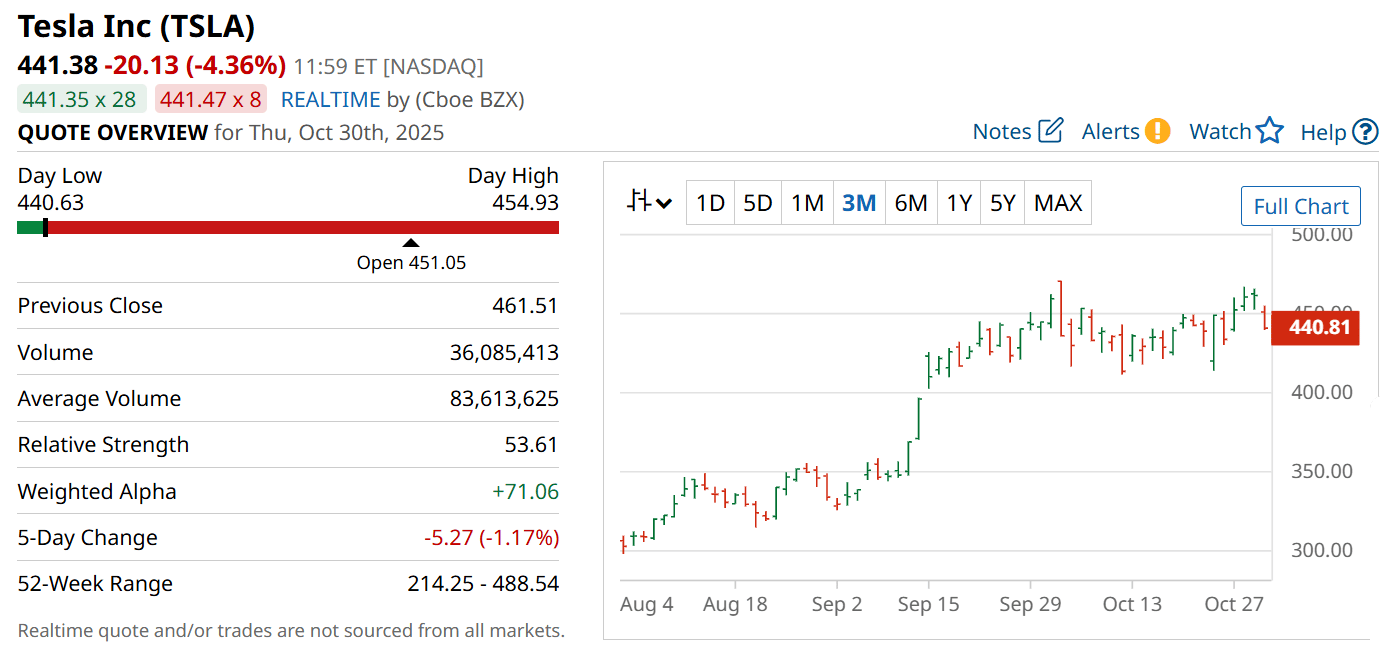

Tesla remains a global EV powerhouse, delivering nearly 497,000 vehicles in the latest quarter — but cracks are showing.

Production has slowed, and profits are shrinking due to ongoing price cuts aimed at maintaining sales momentum.

Operating margin has fallen to 5.8%, a stark reminder that price wars come at a cost.

To preserve margins, Tesla has been trimming vehicle features and battery sizes, a move that risks weakening its premium brand perception.

In China, Tesla’s market share has slipped to 4.4%, down from 16% in 2020 — a dramatic erosion that underscores the severity of local competition.

Even with promising traction in energy storage and AI-driven robotaxis, Tesla’s near-term challenge remains clear: surviving China’s aggressive EV battlefield led by Xiaomi.

Strengths

Tesla’s global brand recognition and advanced AI-autonomy initiatives remain unmatched.

Expanding energy storage division offers long-term diversification beyond vehicles.

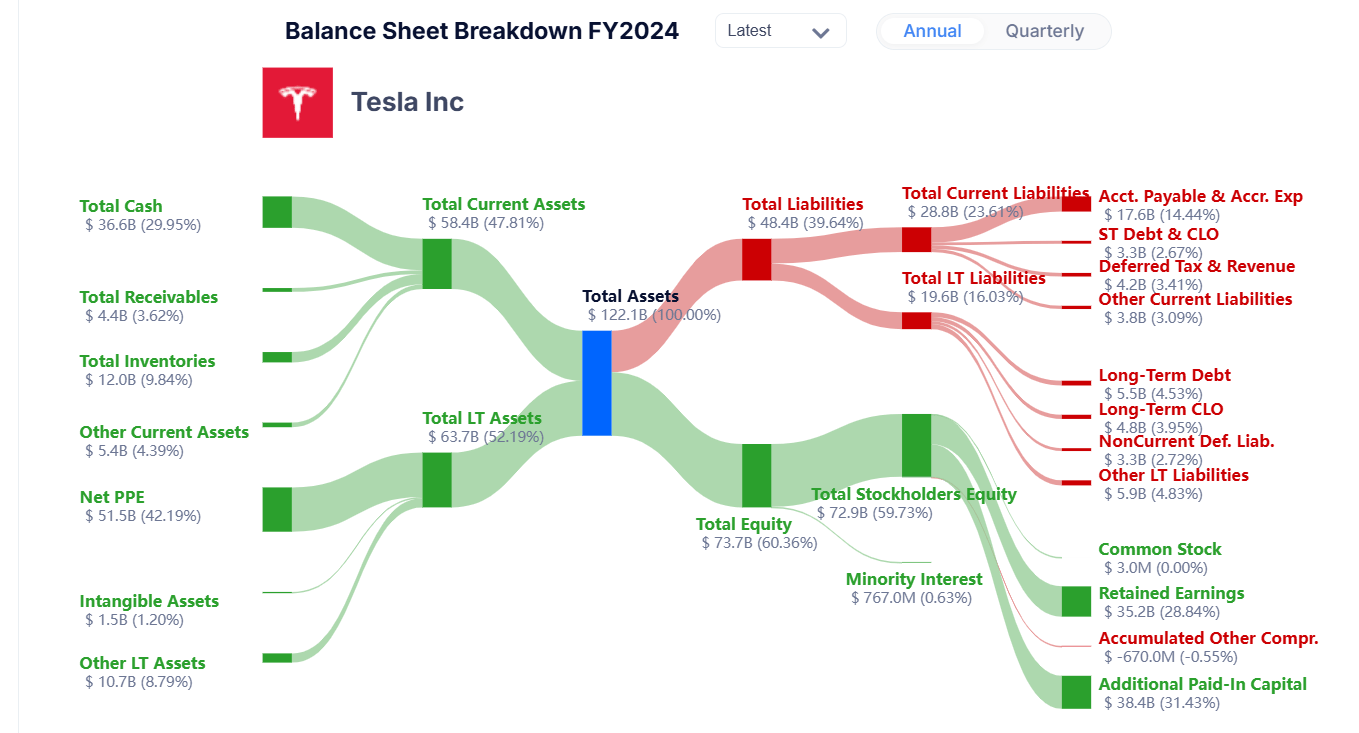

Strong cash reserves and R&D pipeline enable resilience amid price wars.

Weaknesses

Profit margins are under heavy strain due to aggressive price cuts.

Declining market share in China threatens overall growth momentum.

Reduced premium features risk diluting Tesla’s high-end brand image.

Potential

Continued robotaxi expansion across the U.S. could unlock new recurring revenue streams.

Breakthroughs in battery cost reductions may restore margin growth by 2026.

Strategic partnerships or localized pricing models could help Tesla regain competitiveness in Asia.

TODAY’S SPONSOR

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for HNW entrepreneurs and executives ($5M-$100M net worth). No membership fees.

Connect with self-made peers in confidential discussions and live meetups.

With $100M+ invested annually, secure preferential terms unavailable to individual investors.

Conclusion

Xiaomi’s rapid EV ascent signals a powerful shift in the global auto hierarchy.

Tesla is no longer battling just traditional automakers — it’s facing AI-powered tech conglomerates with ecosystems spanning every aspect of consumers’ lives.

While Tesla still leads in innovation and global influence, Xiaomi’s momentum in China could reshape the EV narrative faster than expected.

Investors should watch this rivalry closely — it could define the next era of electric mobility.

Final Thought

When a smartphone company can outsell the world’s top EV maker on its home turf, it’s not just competition — it’s a revolution in motion.

Is this the moment Tesla finally meets its match?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply