- StocksGeniusMastery

- Posts

- 💥Tesla’s AI Dreams Collide With Harsh Reality: Why the Stock Is Sliding Again

💥Tesla’s AI Dreams Collide With Harsh Reality: Why the Stock Is Sliding Again

TSLA investors face a wake-up call as growth excitement meets profit pressure.

Hi Fellow Investors,

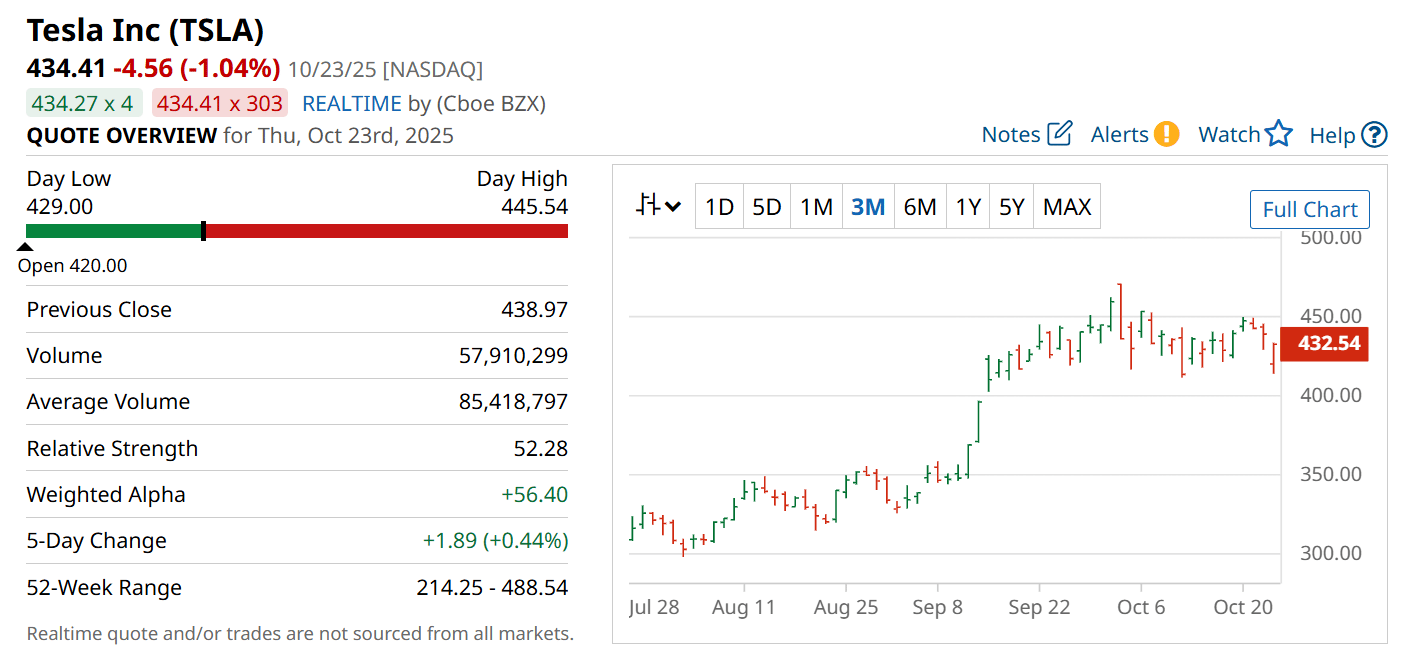

Tesla (NASDAQ: TSLA) just delivered its Q3 earnings — and Wall Street wasn’t impressed.

Revenue growth finally returned after three sluggish quarters.

But profits fell sharply, and investors are reacting fast.

Let’s break down what’s happening and what could come next for the world’s most-watched automaker.

Key Points:

Tesla’s Q3 revenue rose 12% year over year — its first growth in three quarters.

Operating income dropped 40%, missing Wall Street’s expectations.

Elon Musk is shifting focus to AI, robotics, and energy storage — but investors remain skeptical.

TODAY’S SPONSOR

Turn customer feedback into evidence that moves your product roadmap faster

For PMs who need buy-in fast: Enterpret turns raw feedback into crisp, evidence-backed stories.

Explore any topic across Zendesk, reviews, NPS, and social; quantify how many users are affected and why; and package insights with verbatim quotes stakeholders remember.

Product teams at companies like Canva, Notion and Perplexity use Enterpret to manage spikes, stack-rank work, and track sentiment after launches—so you can show impact, not just ship lists.

Replace hunches with data that drives planning, sprint priorities, and incident triage.

Tesla’s Growth Story Returns — But Profits Don’t

Tesla’s revenue growth should have been a victory headline.

After three straight quarters of declines, sales jumped 12% compared to last year.

But beneath the surface, operating income plunged 40% year over year to $1.6 billion — far short of Wall Street’s $1.8 billion estimate.

The stock immediately sold off, dropping nearly 6% before trimming some losses.

By late morning, shares were still down more than 3%, reflecting a sharp investor reset after a brief optimism burst.

Musk’s Vision Goes Beyond Cars — But Investors Want Results

On the earnings call, CEO Elon Musk barely talked about electric vehicles.

Instead, he painted a futuristic vision of AI dominance, robotics, and energy storage expansion.

He highlighted a 44% surge in Tesla’s energy generation and storage business — a bright spot in an otherwise mixed report.

Musk said large-scale battery storage could “double U.S. energy output” without building new power plants — a bold claim that captured attention.

Yet, the market seemed to care more about today’s margins than tomorrow’s megaprojects.

Tesla’s AI5 Chip and “Robot Army” — Musk’s Next Frontier

Musk spent much of the call describing Tesla’s next-generation AI5 chip, the foundation for a future fleet of fully autonomous vehicles.

He even mentioned a “robot army” — an ambitious plan to make AI-driven robots a core business pillar.

This is classic Tesla storytelling: painting a bold technological future while current fundamentals disappoint.

Bulls see these moves as visionary groundwork for the next trillion-dollar phase of Tesla’s empire.

Skeptics, however, argue it’s a distraction from sliding profitability and intensifying EV competition.

Strengths

Tesla maintains dominant brand equity in EVs, AI, and robotics, attracting unmatched retail investor enthusiasm.

The 44% jump in energy storage sales shows real growth beyond vehicles, expanding Tesla’s total addressable market.

Musk’s AI5 chip could become the linchpin of Tesla’s autonomous vehicle ecosystem, a potential long-term game changer.

Weaknesses

Operating income decline of 40% signals mounting cost pressures and potential demand challenges.

Musk’s futuristic narratives may distract investors from near-term execution and profitability metrics.

Heavy reliance on government incentives could distort true organic demand in key EV markets.

Potential

Continued momentum in the energy and AI divisions could transform Tesla into a diversified tech-energy hybrid.

Successful rollout of the AI5 chip and autonomous driving fleet could redefine Tesla’s valuation multiples.

Long-term investors may find buying opportunities if near-term volatility persists amid innovation-driven growth.

TODAY’S SPONSOR

Turn AI into Your Income Engine

Ready to transform artificial intelligence from a buzzword into your personal revenue generator

HubSpot’s groundbreaking guide "200+ AI-Powered Income Ideas" is your gateway to financial innovation in the digital age.

Inside you'll discover:

A curated collection of 200+ profitable opportunities spanning content creation, e-commerce, gaming, and emerging digital markets—each vetted for real-world potential

Step-by-step implementation guides designed for beginners, making AI accessible regardless of your technical background

Cutting-edge strategies aligned with current market trends, ensuring your ventures stay ahead of the curve

Download your guide today and unlock a future where artificial intelligence powers your success. Your next income stream is waiting.

Conclusion

Tesla’s stock drop isn’t just about earnings — it’s about investor patience.

Wall Street wants profits today, but Musk is selling a future built on AI, energy, and robotics.

If Tesla executes on even part of that vision, today’s sell-off could look like a fleeting moment in a much larger transformation story.

Final Thought

Is Tesla being punished for thinking too far ahead — or are investors finally demanding substance over vision?

The next few quarters will answer whether AI dreams can truly power real-world profits.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply