- StocksGeniusMastery

- Posts

- 💥 Tesla’s Valuation vs. Reality in 2026

💥 Tesla’s Valuation vs. Reality in 2026

Why AI Dreams Are Colliding With EV Market Headwinds

Hi Fellow Investors,

Fresh 2025 data is reshaping the outlook for one of the market’s most closely watched stocks.

The numbers reveal growing pressure on Tesla’s core business despite continued excitement around future technologies.

Investors heading into 2026 face a pivotal moment that could redefine long-term expectations.

Key Points:

Tesla’s global vehicle deliveries declined again in 2025, signaling ongoing weakness in its core automotive business.

BYD has overtaken Tesla in global full-electric vehicle sales, accelerating its international expansion.

Tesla’s premium valuation increasingly depends on execution in AI, robotics, and autonomous driving.

TODAY’S SPONSOR

How much could AI save your support team?

Peak season is here. Most retail and ecommerce teams face the same problem: volume spikes, but headcount doesn't.

Instead of hiring temporary staff or burning out your team, there’s a smarter move. Let AI handle the predictable stuff, like answering FAQs, routing tickets, and processing returns, so your people focus on what they do best: building loyalty.

Gladly’s ROI calculator shows exactly what this looks like for your business: how many tickets AI could resolve, how much that costs, and what that means for your bottom line. Real numbers. Your data.

Tesla’s Core Business Faces Mounting Pressure

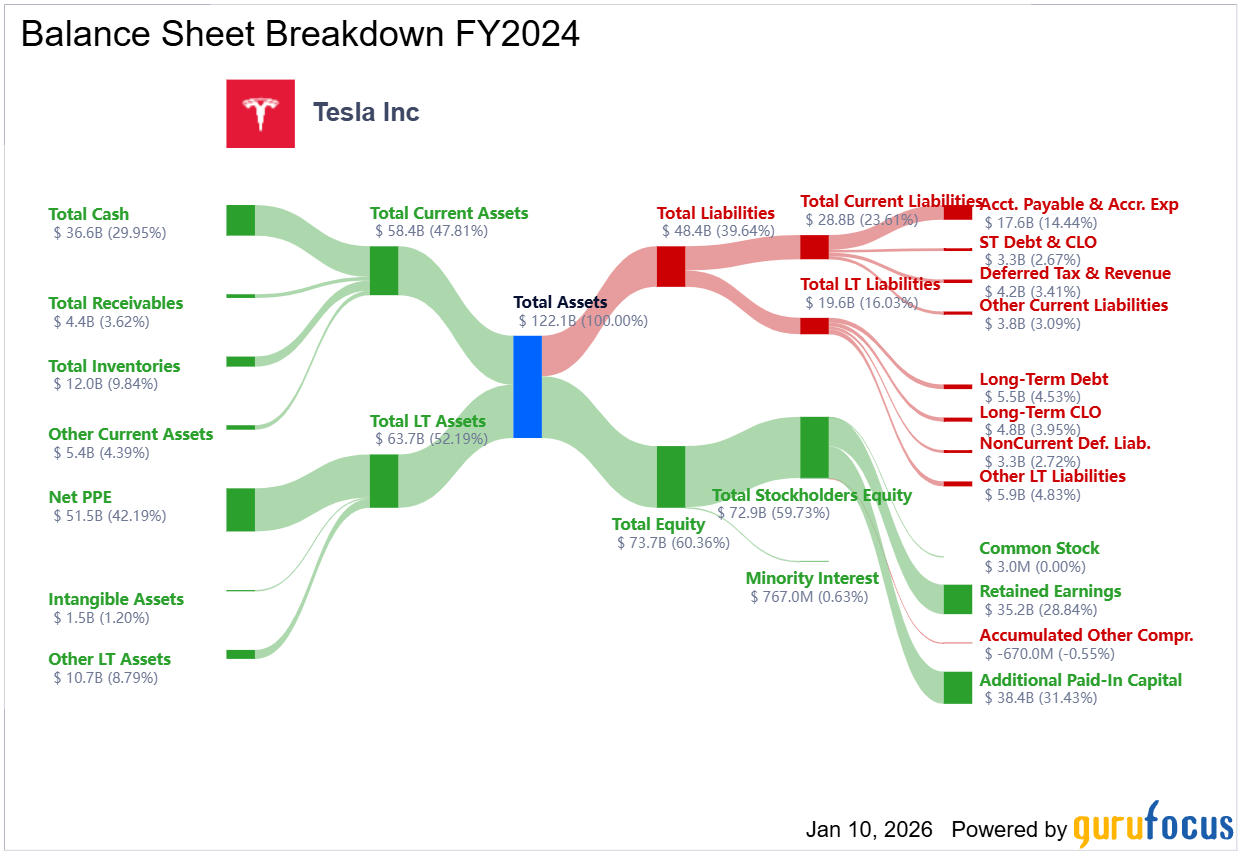

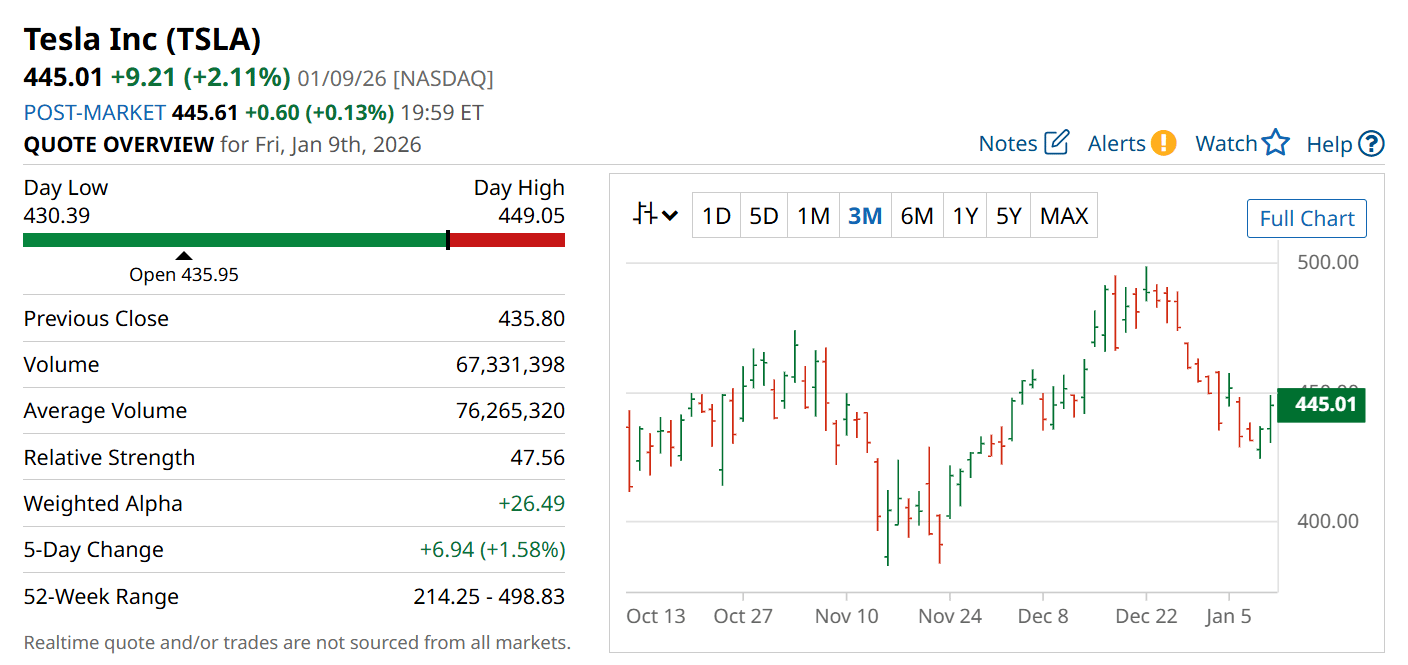

Tesla (NASDAQ: TSLA) entered 2026 with its core automotive segment under visible strain.

Global deliveries fell roughly 9% in 2025 to about 1.6 million vehicles, marking the second straight year of declining sales.

This slowdown reflects an aging product lineup and intensifying competition across major EV markets.

While demand headwinds were expected, the persistence of declining volumes is now shaping investor sentiment.

The gap between Tesla’s valuation and its near-term fundamentals is becoming harder to ignore.

BYD’s Global Momentum Shifts the EV Landscape

BYD has moved decisively ahead in the global EV race.

The company sold more than 2.2 million full-electric vehicles in 2025, representing a sharp year-over-year increase.

When plug-in hybrids are included, BYD’s total vehicle sales reached roughly 4.5 million units.

Overseas deliveries surpassed one million vehicles for the first time, highlighting accelerating international traction.

This growth comes as Chinese automakers face margin pressure at home, pushing them to compete aggressively abroad.

Valuation Stretches as Execution Risks Rise

Tesla’s market capitalization near $1.5 trillion continues to dwarf traditional automakers.

That valuation stands more than ten times larger than the combined market caps of Ford Motor Company and General Motors.

Investors are clearly pricing in success across AI, robotics, battery storage, and autonomous driving.

However, Tesla still trades at a price-to-earnings ratio above 300, leaving little room for missteps.

Any delays or setbacks in these future-focused initiatives could significantly challenge investor confidence.

2026 Emerges as a Defining Transition Year

Leadership optimism continues to highlight transformative potential beyond vehicle sales.

Elon Musk has acknowledged that the company could face rough quarters through mid-2026.

Analysts remain focused on the pace of autonomous driving, robotaxi development, and robotics commercialization.

Execution across these initiatives will determine whether Tesla can justify its premium valuation.

The coming year may ultimately define whether Tesla is viewed as a carmaker or a diversified technology platform.

Strengths

Tesla retains one of the strongest global EV brands, supported by scale, software integration, and manufacturing expertise.

The company’s leadership in autonomous driving data collection provides long-term optionality if regulatory hurdles are cleared.

Expanding energy storage and AI initiatives offer potential revenue diversification beyond vehicle sales.

Weaknesses

Declining vehicle deliveries highlight growing competitive pressure and an aging product lineup.

The current valuation leaves little margin for error if growth initiatives face delays or regulatory pushback.

Legal and reputational challenges continue to weigh on investor perception and near-term momentum.

Potential

Successful commercialization of robotaxis could unlock a high-margin, recurring revenue model.

Robotics and AI breakthroughs may reposition Tesla as a leading technology platform rather than a pure automaker.

International manufacturing and localization could help stabilize vehicle demand over the long term.

TODAY’S SPONSOR

Modernize Out Of Home with AdQuick

AdQuick unlocks the benefits of Out Of Home (OOH) advertising in a way no one else has. Approaching the problem with eyes to performance, created for marketers and creatives with the engineering excellence you’ve come to expect for the internet.

You can learn more at www.AdQuick.com

Conclusion

Tesla enters 2026 facing a clear divergence between present fundamentals and future ambition.

The company’s ability to execute beyond vehicle manufacturing will determine whether its valuation remains justified.

Investors should weigh long-term technological upside against near-term operational and competitive risks.

Final Thought

Is Tesla on the verge of redefining its business model, or is the market underestimating the challenges ahead?

The answer in 2026 may reshape how investors value innovation versus execution in the EV sector.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply