- StocksGeniusMastery

- Posts

- 💥The Best "Magnificent Seven" Stock to Buy Now Before It Skyrockets

💥The Best "Magnificent Seven" Stock to Buy Now Before It Skyrockets

Wall Street’s elite tech giants are surging—but one stands out as the ultimate AI-era winner in 2025.

Hello Fellow Investors!

The "Magnificent Seven" have reshaped global markets, dominating headlines and portfolios alike.

Yet beneath the hype, one stock is clearly separating itself from the rest—on innovation, on value, and on future upside.

While others chase momentum, this powerhouse quietly builds a fortress of recurring revenue, AI leadership, and unmatched balance sheet strength.

Now trading at a surprisingly modest valuation, this stock offers investors a rare chance to buy a market leader before its next breakout move.

Key Points:

AI at the Core: This tech titan is leading the charge in generative AI, cloud computing, and custom silicon design.

Financial Strength: Armed with billions in free cash flow and minimal debt, it’s one of the most financially resilient companies in the world.

Valuation Advantage: Despite its dominance, the stock trades at a discount to peers, making it a compelling buy right now.

TODAY’S SPONSOR

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

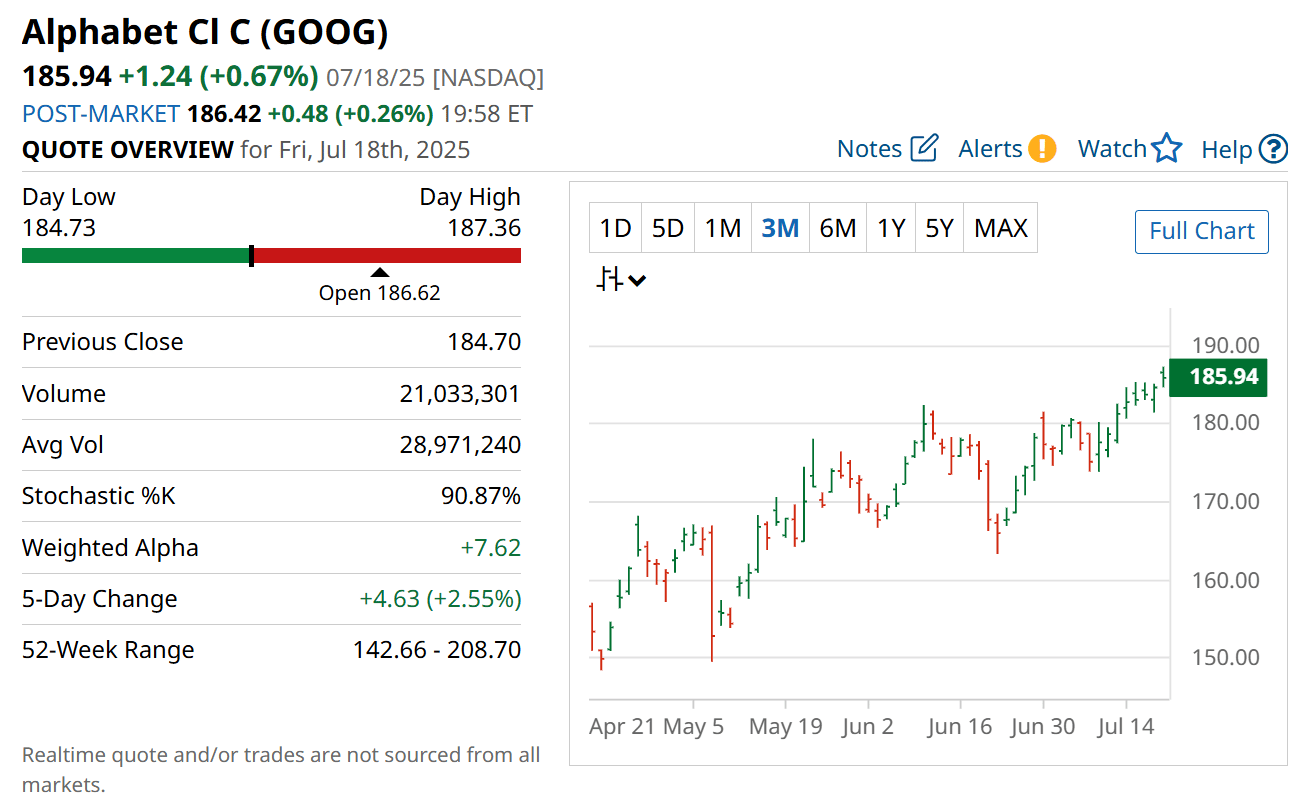

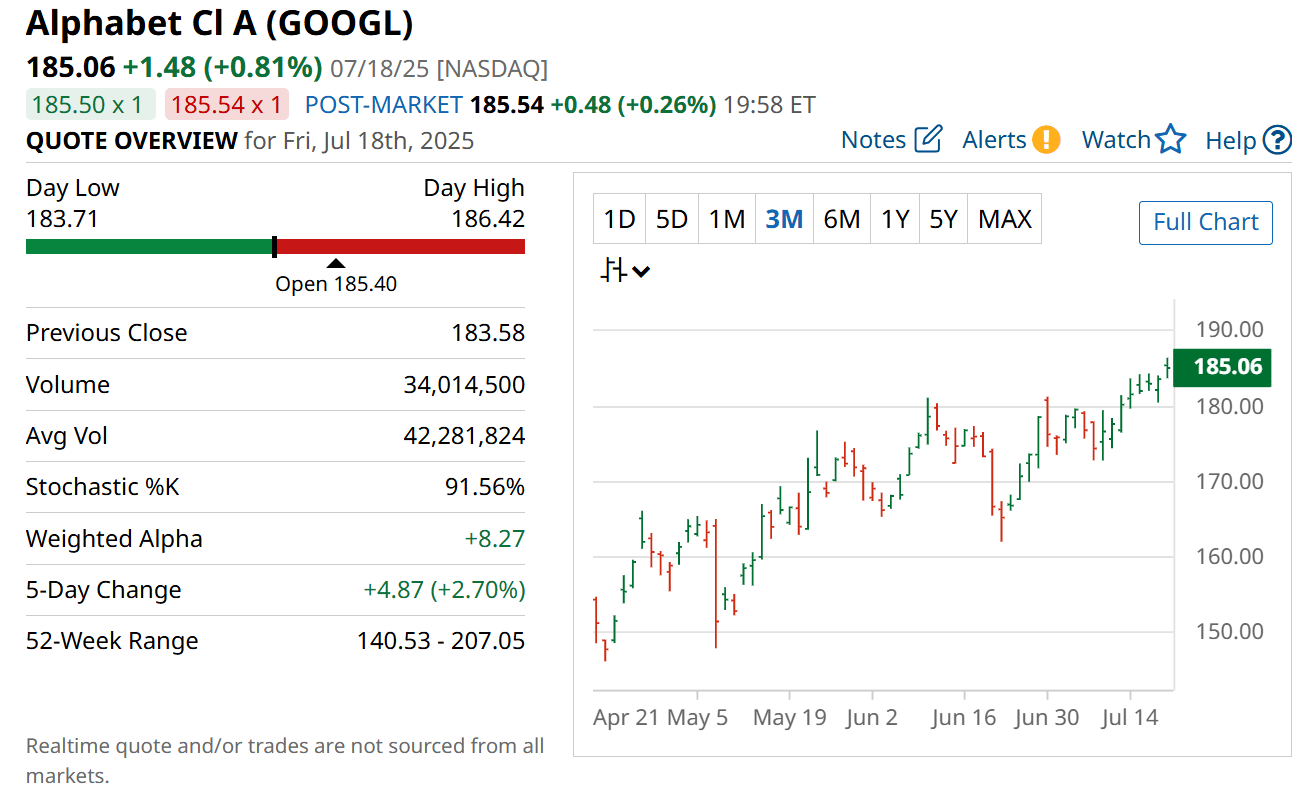

Why This Tech Giant Could Be the Most Undervalued AI Winner of 2025

While artificial intelligence has shaken the search engine landscape, one Silicon Valley powerhouse continues to dominate both users’ attention and advertisers’ dollars.

Its flagship product still brings in tens of billions in revenue per quarter, and new AI integrations are accelerating user engagement rather than hurting it.

Backed by a massive ecosystem used by billions globally, this company can deploy new AI tools instantly across platforms that serve nearly half the planet.

More than just consumer-facing dominance, it’s also rising as an enterprise AI force through its cloud offerings and proprietary chip development.

Its custom TPUs now deliver massive boosts in performance and efficiency, solidifying its infrastructure moat.

With nearly $100 billion in cash and a staggering $75 billion investment planned for infrastructure this year alone, this tech titan isn’t playing defense—it’s gearing up for an AI-first future.

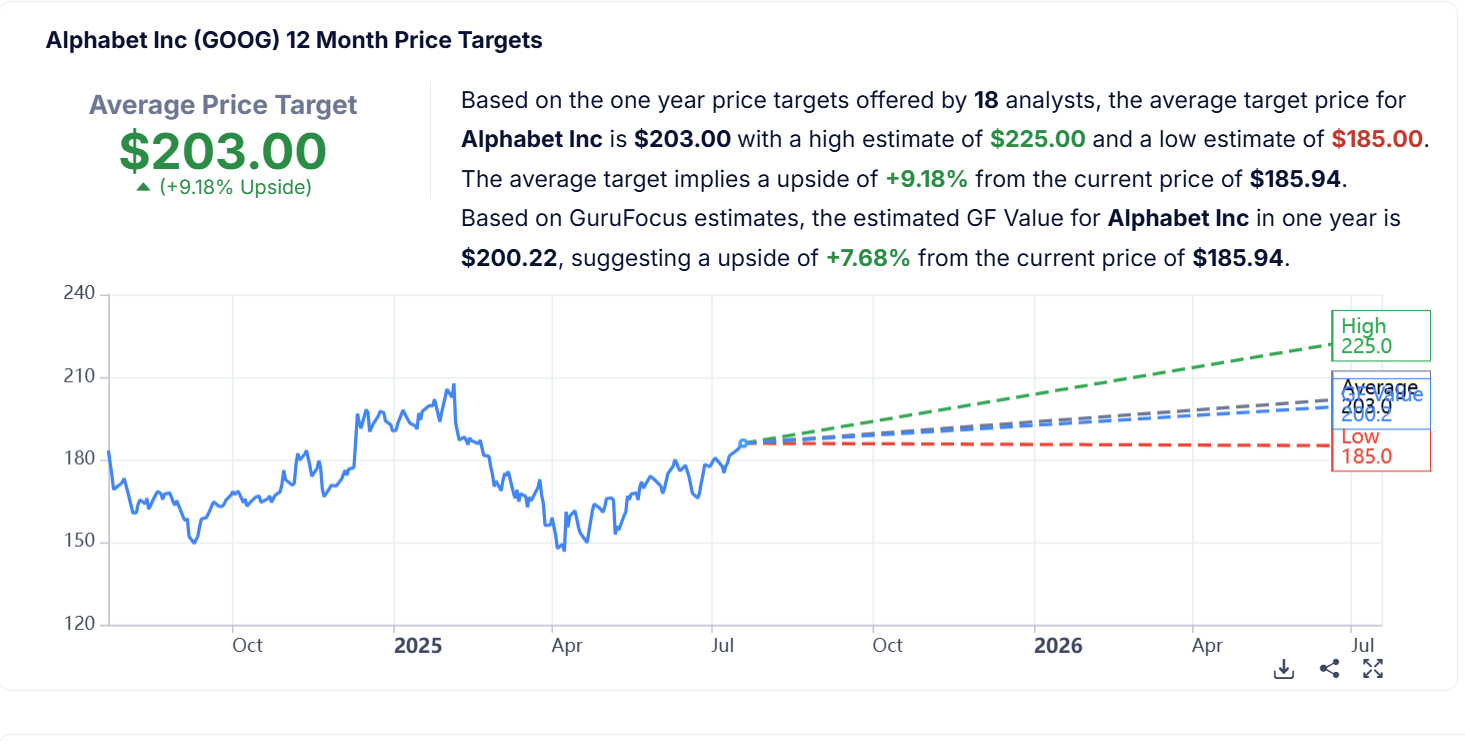

Amid trillion-dollar valuations and headline-hogging megacaps, it’s easy to assume there are no deals left on the table.

But one Magnificent Seven stock defies that assumption. Despite its scale and global dominance, this company trades at a valuation lower than the S&P 500 average—an unheard-of opportunity for a business of its caliber.

Its stock commands a modest 20.3x earnings multiple, even as it generates $350 billion in annual revenue and remains a leader in both advertising and AI.

This disconnect between fundamentals and valuation makes it arguably the most overlooked bargain among the tech elite.

Investors seeking long-term compounding at a reasonable price shouldn’t ignore this opportunity—it’s a rare case of quality and value aligning.

Strengths

Massive User Reach: Its ecosystem spans over 15 products with 500M+ users, and 6 with over 2 billion, providing an unmatched distribution channel for AI features.

AI Infrastructure Leadership: Developing custom chips and cloud-based generative AI platforms, this company controls both the tools and the deployment.

Strong Financial Backbone: With $95 billion in liquidity and $75 billion in capex planned, it has the financial muscle to invest aggressively in innovation.

Weaknesses

Ad Revenue Dependency: A significant portion of its revenue still hinges on advertising, which can be cyclical and vulnerable to market downturns.

Regulatory Pressures: Increasing scrutiny from antitrust regulators globally could impact growth and acquisitions.

AI Competition: The rise of AI-first search challengers like ChatGPT introduces long-term risk to its dominance in search.

Potential

AI Monetization: Continued integration of AI into search, video, and cloud opens new monetization channels across both consumer and enterprise segments.

Cloud Expansion: Growth in Google Cloud—especially via Vertex AI—positions the company to be a mission-critical partner in enterprise digital transformation.

Global Streaming Domination: YouTube’s expanding lead in streaming engagement presents a major upside catalyst for both ad revenue and premium subscriptions.

TODAY’S SPONSOR

Start learning AI in 2025

Keeping up with AI is hard – we get it!

That’s why over 1M professionals read Superhuman AI to stay ahead.

Get daily AI news, tools, and tutorials

Learn new AI skills you can use at work in 3 mins a day

Become 10X more productive

Conclusion

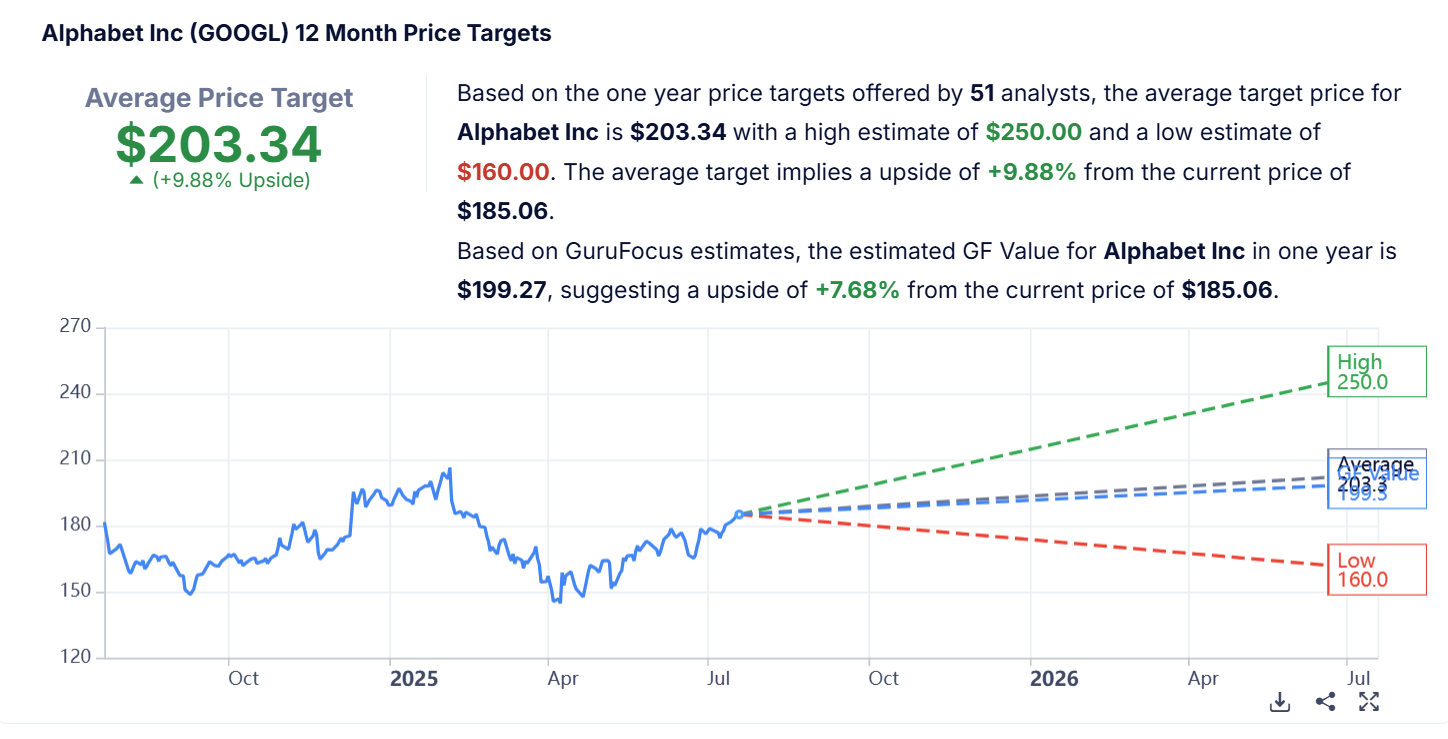

Alphabet stands alone as a rare blend of technological leadership, global scale, and undervalued opportunity.

While others in the Magnificent Seven boast hype, this stock backs it up with real profits, expanding moats, and AI-fueled tailwinds.

With its low P/E ratio, enterprise cloud traction, and explosive YouTube potential, Alphabet offers the kind of asymmetric risk-reward that savvy investors dream about.

For those searching for the best stock to own in the AI decade—this may very well be it.

Final Thought

If a $2.2 trillion company can still be considered a bargain, what does that say about the upside that lies ahead?

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply