- StocksGeniusMastery

- Posts

- 💥 The Market May Be Missing This Company’s AI Endgame

💥 The Market May Be Missing This Company’s AI Endgame

Why a social media titan may be quietly building an AI empire investors are overlooking.

Hi Fellow Investors,

Markets often associate artificial intelligence leadership with chips and cloud platforms.

But one dominant tech company is pursuing AI leadership from a very different angle.

This overlooked strategy could reshape how investors value the business long term.

Key Points:

Many investors continue to view this company primarily as a social media advertising business rather than an emerging AI powerhouse.

Massive capital investments in AI infrastructure are positioning the company for long-term technological leadership.

Deeper user engagement and smarter advertising tools could meaningfully expand revenue over time.

TODAY’S SPONSOR

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Meta Platforms (NASDAQ: META) operates some of the most widely used digital platforms on the planet.

Billions of people engage daily across its ecosystem, giving the company extraordinary reach and data depth.

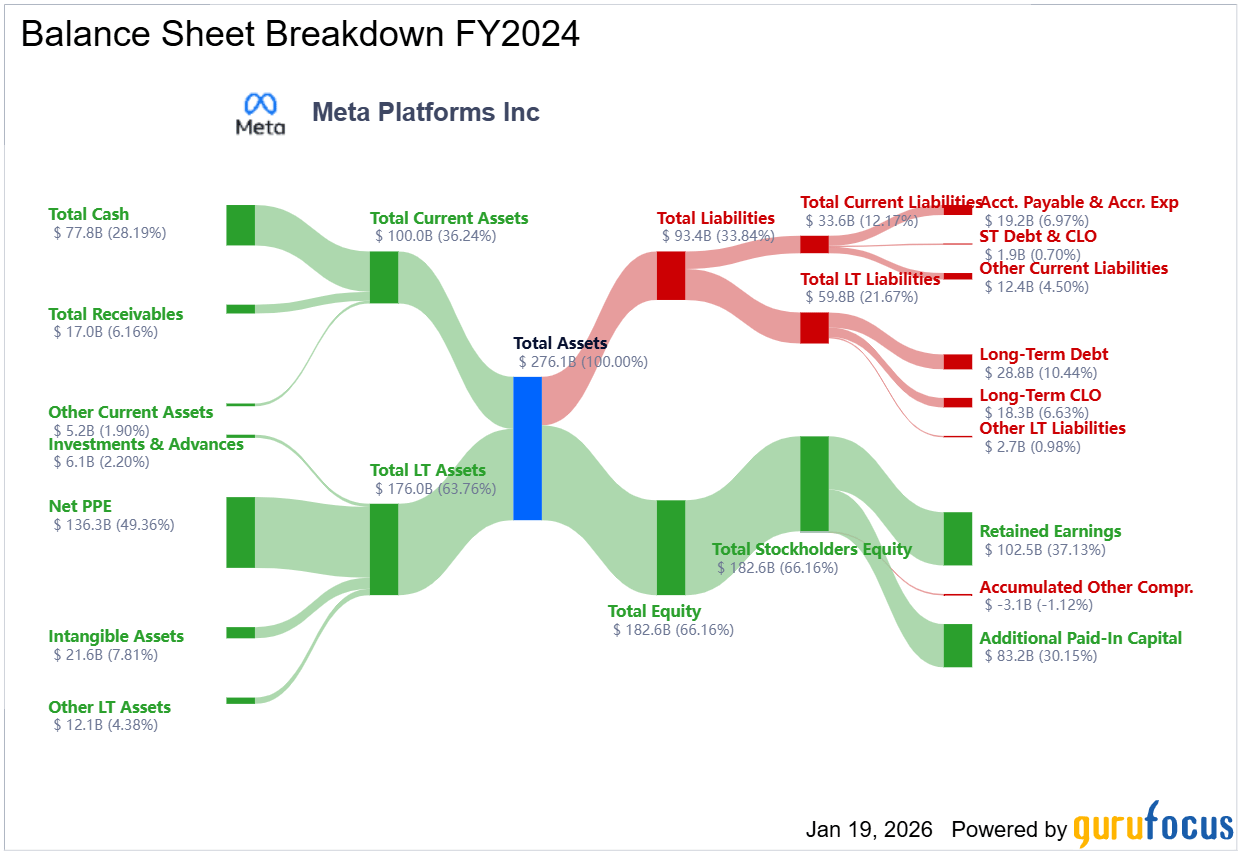

Advertising remains the core revenue driver, delivering strong cash flows and industry-leading margins.

This scale provides a powerful foundation for future innovation.

However, focusing only on social media significantly understates what the business is becoming.

An AI Strategy Built for Long-Term Advantage

Unlike AI leaders such as Nvidia or cloud providers like Amazon, Meta’s AI strategy is internally focused.

The company designs custom AI chips and operates massive data centers to support its own workloads.

Its open-source large language model, Llama, demonstrates serious commitment to AI research leadership.

Capital spending continues to rise sharply as infrastructure scales.

Management has already warned that AI expansion will keep pressure on spending well into 2026.

Turning AI Investment Into Revenue Growth

Meta’s AI initiatives are designed to increase time spent across its platforms.

More engagement typically leads to higher advertising demand and improved monetization efficiency.

AI-powered tools aim to help advertisers rapidly create and optimize high-performing campaigns.

This could significantly improve advertiser returns and encourage higher ad budgets.

Over time, AI research may unlock entirely new revenue streams beyond advertising.

Strengths

Unmatched global user scale provides a powerful data advantage for training and refining AI models.

Heavy AI investment signals long-term commitment to technological leadership rather than short-term optimization.

Advertising cash flows remain strong enough to fund aggressive innovation without external dependence.

Weaknesses

Elevated capital expenditures may weigh on margins in the near and medium term.

AI monetization benefits may take several years to fully materialize at scale.

Regulatory, privacy, and political scrutiny continue to create uncertainty.

Potential

AI-driven ad optimization could meaningfully increase revenue per user over time.

Proprietary AI infrastructure reduces reliance on third-party chip and cloud providers.

New AI-powered products may diversify revenue and expand total addressable markets.

TODAY’S SPONSOR

Leadership Can’t Be Automated

AI can help you move faster, but real leadership still requires human judgment.

The free resource 5 Traits AI Can’t Replace explains the traits leaders must protect in an AI-driven world and why BELAY Executive Assistants are built to support them.

Conclusion

Meta’s AI strategy is often overlooked because it operates behind familiar consumer platforms.

Investors who recognize the depth of this transformation may see a very different company emerging.

Long-term returns could reward those who look beyond traditional labels.

Final Thought

How many investors are still valuing this business based on yesterday’s identity instead of tomorrow’s capabilities?

Sometimes the most misunderstood stocks carry the greatest long-term potential.

Can I ask a small favor from you if you find the content useful to you? Spread the wealth by sharing my FREE Newsletter with fellow stock investors and friends and help to check out my sponsor advertisement and that will keep me writing more stocks newsletters!

Of course, you should always do your own research and due diligence before investing in any stock. You should also diversify your portfolio and balance your risk and reward too!

~ Final Thought: "Fortune Favors the Bold: Embrace Opportunity Property, Execute Strategy, and Reap the Rewards of Investing Wisely.”🌱

What's Your Take on Our Newsletter? 🌟We're eager to hear your thoughts so we can make our newsletter even more amazing for you! |

Disclaimer: The content provided on this blog is for educational and informational purposes only and is not intended as financial, investment, tax, or legal advice. Investing in the stock market involves risks, including the loss of principal. The views, thoughts, and opinions expressed in this blog are solely those of the author and do not reflect the views of any company, organization, or other group. Readers are encouraged to perform their own research and due diligence before making any financial decisions and actions based on the content. Neither the author nor the publisher is liable for any losses or damages arising from the use of the advice or information contained herein.

Reply